Are you considering applying for a business loan but unsure where to start? Crafting a compelling letter can significantly impact your chances of approval. In this article, we'll guide you through a simple yet effective template that highlights your business goals and financial needs. So, let's dive in and explore how to effectively present your case to potential lenders!

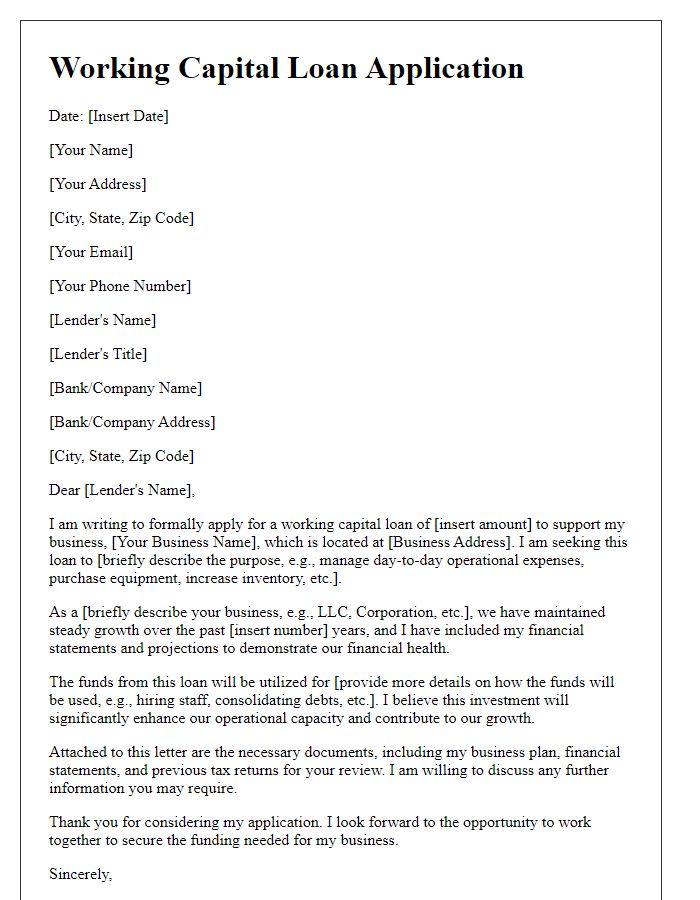

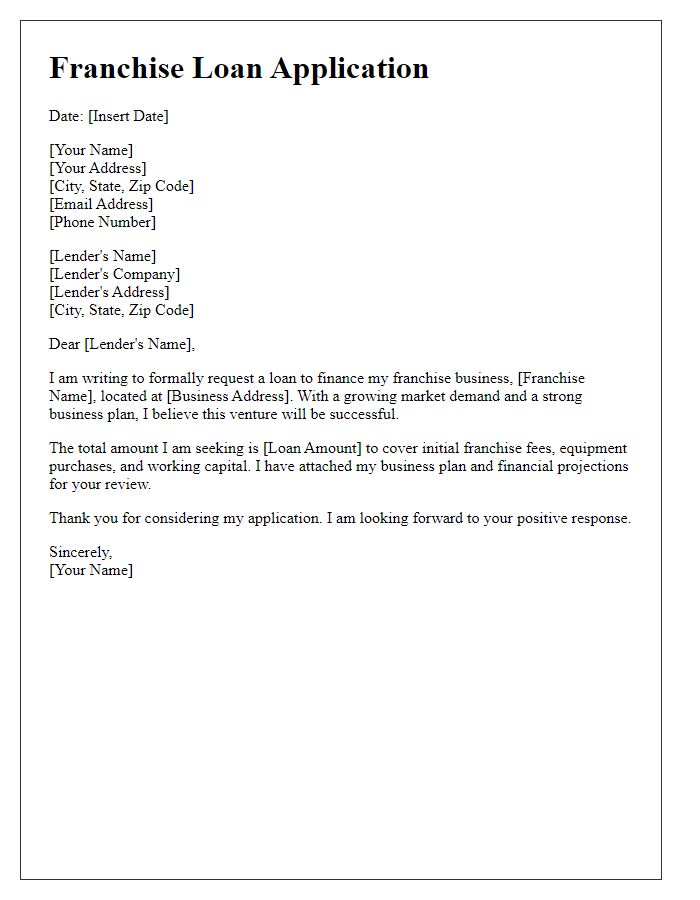

Applicant's Business Information

The applicant's business information encompasses essential details that provide insights into the establishment's operations and financial status. Business name plays a crucial role in identification; for example, "Green Tech Innovations Inc." implies a focus on sustainable technology solutions. Business address including road number, city, and state, such as "123 Eco Street, San Francisco, California," facilitates location assessment and analysis of market reach. Established date, indicating how long the company has operated, for instance, "founded in 2015," demonstrates stability and experience in the market. Business structure category, such as sole proprietorship or corporation, affects liability and tax implications, influencing funding decisions. Number of employees, like "25 full-time staff," reflects operational capacity. Annual revenue figures, perhaps "generated $2 million in 2022," illustrate financial health and project feasibility. Business description summarizing products or services offered, such as "innovative recycling solutions and biodegradable materials," highlights market niche and unique selling propositions, crucial for lenders' consideration.

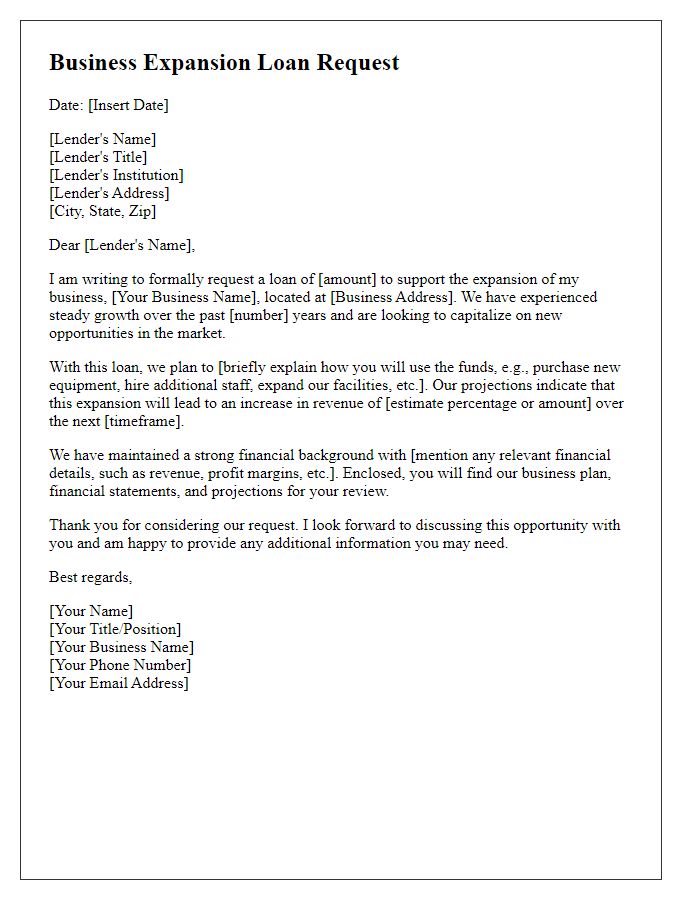

Purpose of the Loan

A business loan application often highlights the purpose of the loan, serving as a crucial aspect for lenders. Common purposes may include purchasing equipment, expanding operations, or covering working capital needs. For instance, acquiring a commercial-grade 3D printer for a small manufacturing business can enhance production capabilities and efficiency. Additionally, renovating a retail space (like a downtown boutique in Austin, Texas) could attract more customers, potentially increasing monthly sales. Another purpose might involve financing inventory purchases during peak seasons, which can optimize stock levels and improve cash flow. Clearly outlining the intended use of funds helps demonstrate the business's commitment to growth and financial responsibility.

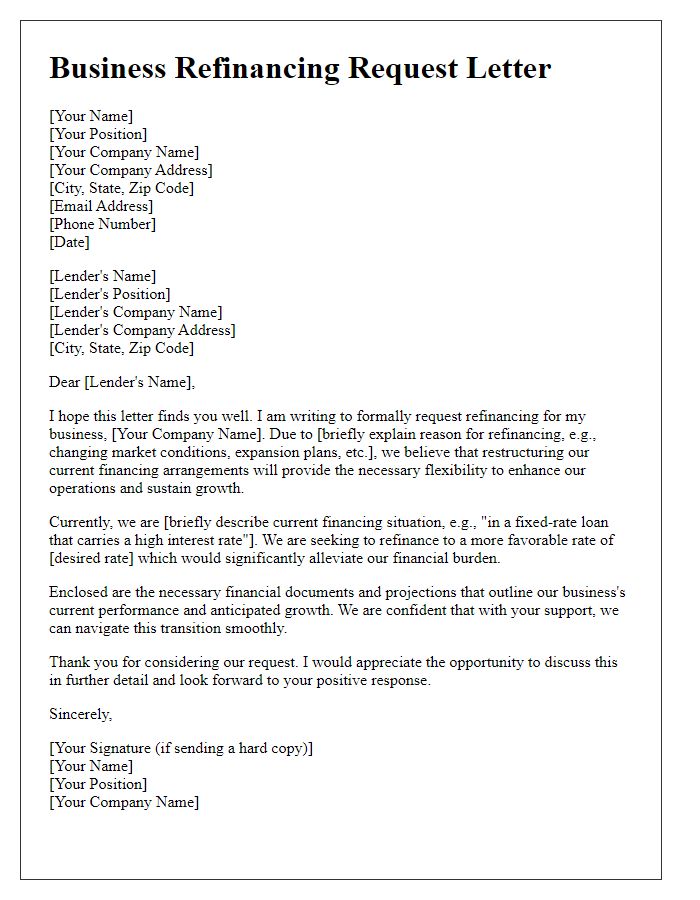

Financial Statements and Projections

Comprehensive financial statements and projections are crucial for demonstrating an organization's fiscal responsibility and potential growth, especially when applying for a business loan. These documents typically include detailed balance sheets that show assets, liabilities, and equity for a specific period, such as the fiscal year 2022, along with income statements reflecting revenue streams and expenses. Cash flow statements indicate the liquidity status and management of funds over time, revealing the net cash inflows and outflows. Additionally, projections for the next three to five years, with assumptions based on market trends and internal analyses, help illustrate expected revenue growth of approximately 10% annually, alongside anticipated operating expenses. Accurate financial modeling showcases the business's potential to repay the loan and sustain operations, thereby increasing the likelihood of loan approval from financial institutions.

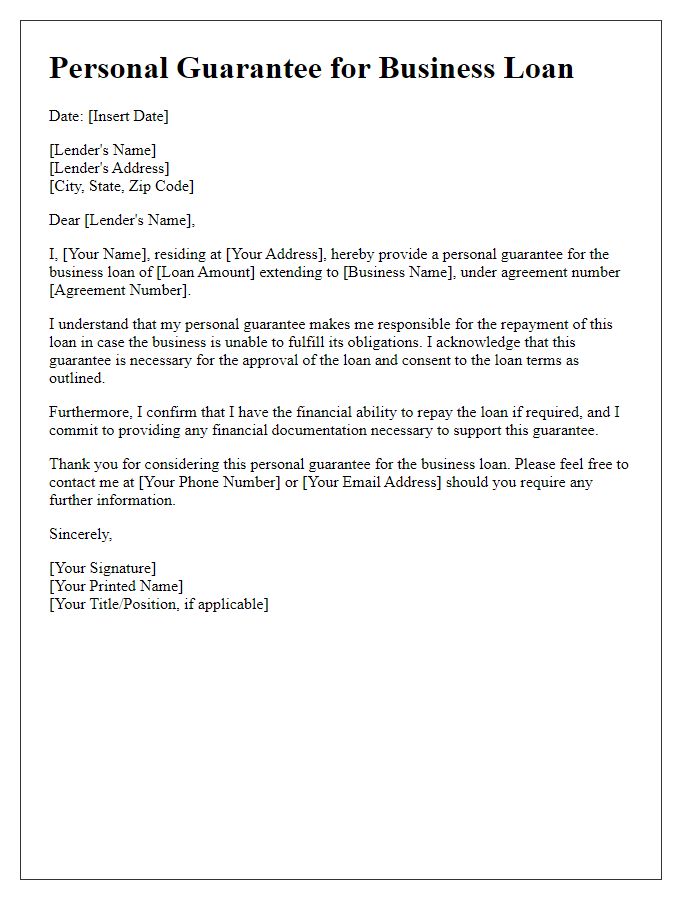

Credit History and Collateral

A strong credit history is vital for securing business loans, as lenders evaluate past borrowing behaviors and repayment patterns. A credit score, typically ranging from 300 to 850, indicates financial reliability; scores above 700 are often considered favorable. Collateral refers to assets pledged as security for a loan, reducing lender risk. Common types of collateral include real estate (commercial properties in prime locations), equipment (machinery essential for production processes), and inventory (goods held for resale), each contributing to overall business valuation. Certain lenders, such as banks and credit unions, may require specific collateral types to mitigate risks associated with loan defaults. Understanding these components significantly enhances the chances of loan approval.

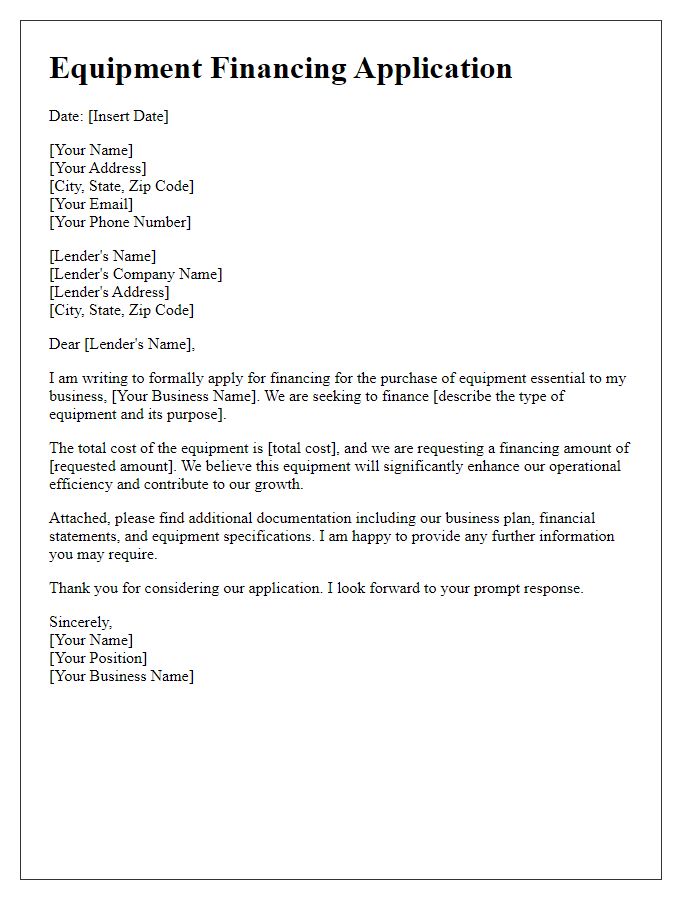

Loan Amount and Terms Requested

A business loan application typically requires a clear statement of the loan amount needed and the specific terms requested. For instance, when seeking a loan of $150,000 to expand a small cafe in downtown Seattle (noted for its vibrant tourism and local economy), a business owner may specify a repayment term of five years at an interest rate of 6%. This structured request should detail the purpose of the loan, such as purchasing new equipment, remodeling the space, or increasing inventory to meet demand during peak tourist seasons. Having clear figures and intended uses helps to create a compelling case for lenders, demonstrating both the necessity and projected return on investment for the business endeavor.

Comments