Are you feeling overwhelmed by unexpected convenience fees and considering disputing them? You're not alone; many people find themselves in similar situations and seek clarity on how to navigate this process. In this article, we'll break down the essential steps for writing a letter to cancel a convenience fee dispute, ensuring you approach it with confidence and clarity. So, grab a cup of coffee and let's dive into the details that will help you resolve this issue smoothly!

Customer Information

Convenience fees are additional charges that businesses apply for the privilege of using certain payment methods, often associated with online transactions. Disputing these charges may lead to complications, requiring a clear understanding of relevant timelines and data. For instance, consumer protection regulations like the Fair Credit Billing Act provide guidelines on disputing billing errors such as unauthorized convenience fees within 60 days after the billing statement. Documenting customer information accurately, including account numbers and transaction details, is crucial for resolving the dispute effectively. Businesses often track the volume and frequency of these convenience fees across transactions, reflecting their impact on customer satisfaction and retention rates.

Account Details

The cancellation of a convenience fee dispute involves several important account details. The account number, often a unique identifier for customers, typically contains 10 to 12 digits and should be accurately referenced. The transaction date, crucial for verifying the specific charge, usually falls within the past billing cycle or specific event timeframe. Additionally, the dispute amount, which is the exact fee being contested, must be clearly stated to prevent any discrepancies. Contact information, including phone number and email address, may be needed for further communication regarding the dispute resolution process. Finally, documentation such as receipts or transaction history can support the dispute cancellation process, providing evidence necessary for approval.

Dispute Details

Convenience fees are additional charges imposed for certain payment methods, often encountered during online transactions. These fees can vary by merchant, sometimes ranging from 2% to 5% of the total purchase price. Disputes regarding convenience fees typically arise when customers believe these charges are excessive or not clearly communicated. Effective resolution of such disputes is crucial, especially for businesses that rely on customer satisfaction for retention. Recording details such as transaction dates (e.g., May 1, 2023), amounts, and the nature of the fee in question enables clearer communication and potential reimbursement discussions. Clear documentation can facilitate smoother interactions with financial institutions or merchants involved in the dispute.

Resolution Request

A convenience fee dispute resolution request arises from charges incurred during online transactions. Customers often face additional fees, typically ranging from $2 to $5, for using credit cards when making payments. Such fees are often implemented by service providers, like utility companies or ticketing platforms, to cover processing costs. A request for resolution might typically include specific transaction details, including the date, time, and reference number. Consumers seeking cancellation of these fees should articulate their concerns clearly, citing consumer protection regulations, such as the Fair Credit Billing Act. Directing the request to the customer service department of the respective company, with documentation attached, can facilitate a more prompt resolution.

Contact Information

Canceling a convenience fee dispute can involve important details about the service provider, fee structure, and personal information. The convenience fee, often a percentage of the total transaction amount, is typically charged by companies for processing payments electronically. Consumers disputing these fees should accurately document the charge date, amount, and transaction context. Providing contact information such as a phone number and email address is essential for further correspondence with the service provider or the payment platform. It is crucial to keep records of all communications and responses, ensuring a clear dispute resolution process.

Letter Template For Canceling Convenience Fee Dispute Samples

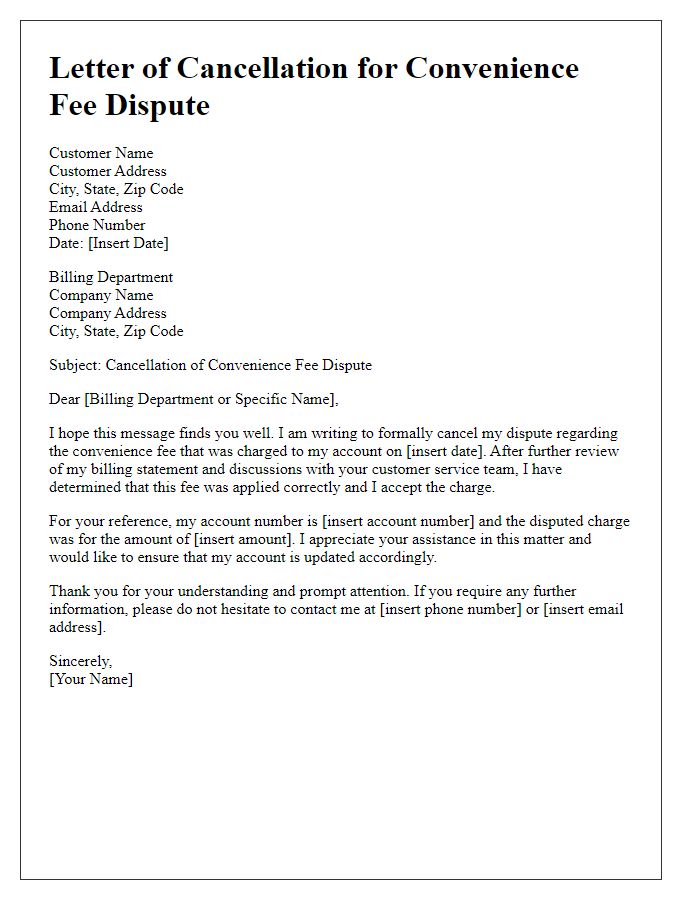

Letter template of convenience fee dispute cancellation for a credit card transaction.

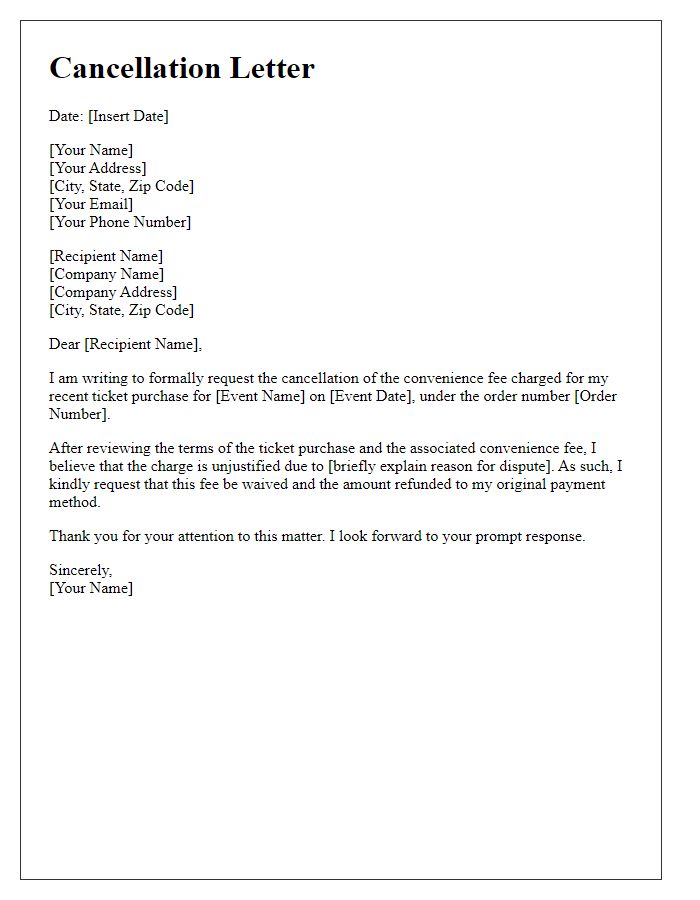

Letter template of cancellation request for a convenience fee dispute related to services rendered.

Letter template of convenience fee dispute cancellation for online subscription.

Letter template of cancellation notice for an erroneous convenience fee charge.

Letter template of convenience fee dispute cancellation for a billing error.

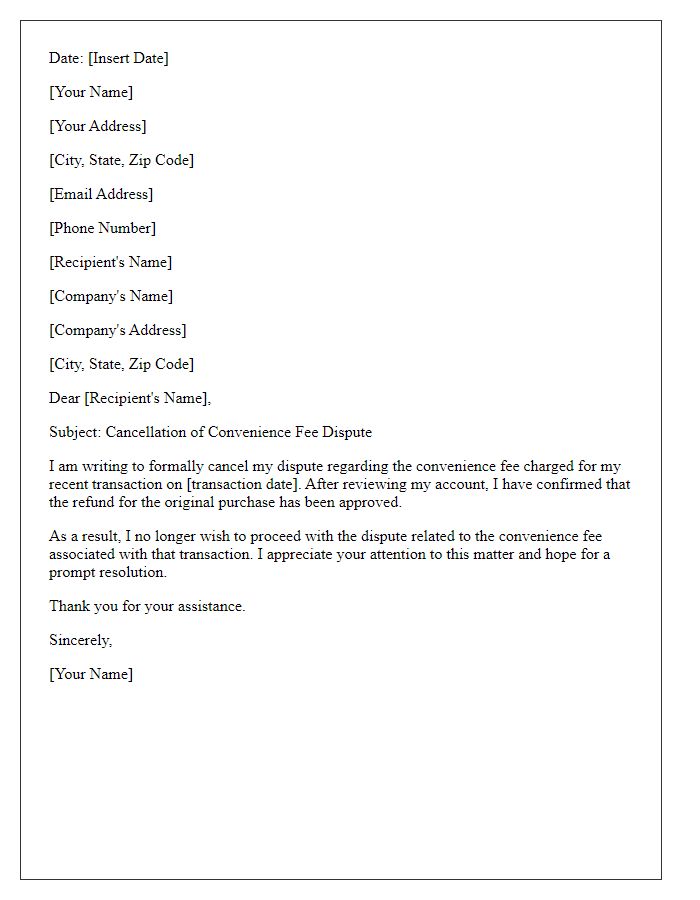

Letter template of cancellation of convenience fee dispute due to refund approval.

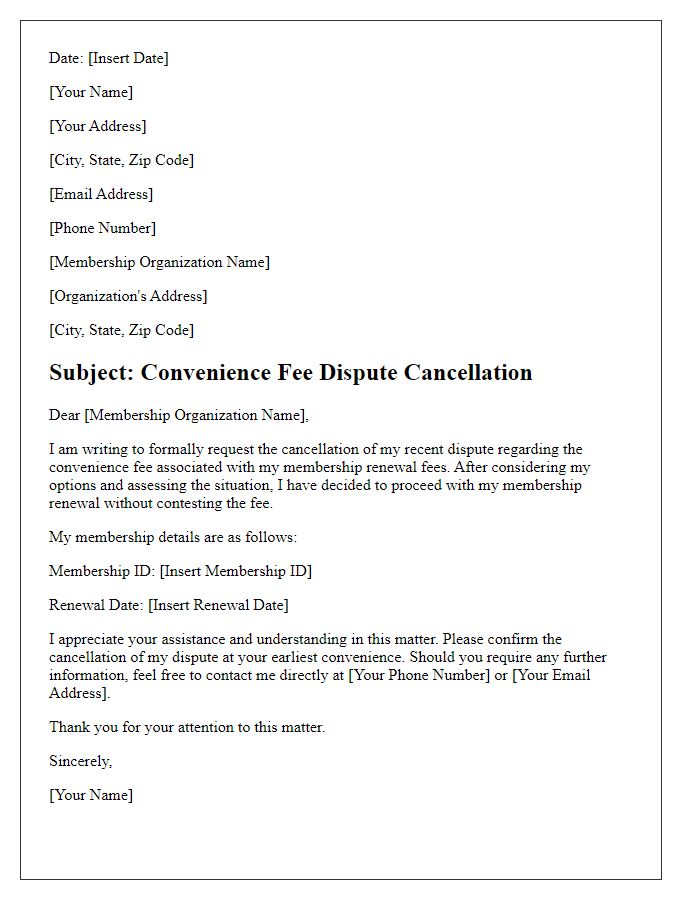

Letter template of convenience fee dispute cancellation for membership renewal fees.

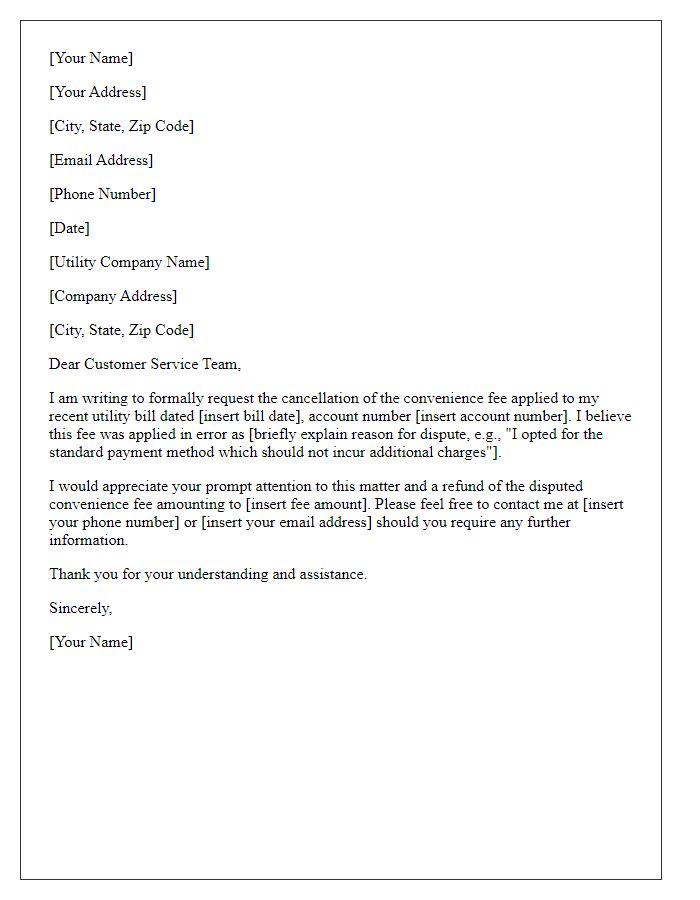

Letter template of cancellation request for a disputed convenience fee on utilities.

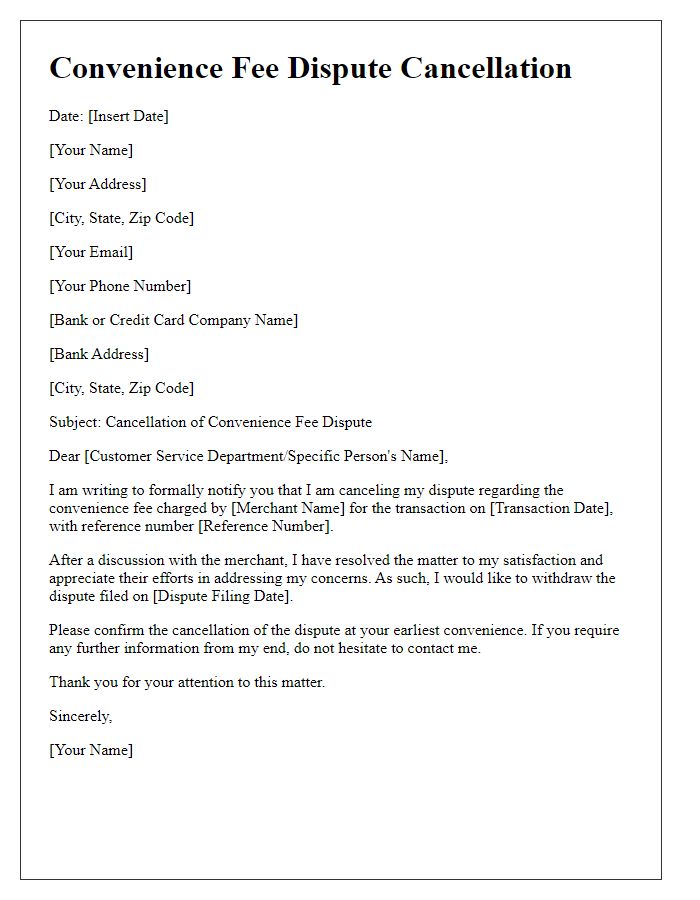

Letter template of convenience fee dispute cancellation after resolution with the merchant.

Comments