Are you finding yourself in a situation where you need to extend your loan agreement? You're not alone, as many individuals face similar challenges and seek ways to manage their financial obligations more effectively. Crafting the right letter to request this extension is crucial for conveying your needs and maintaining a positive relationship with your lender. Keep reading to discover tips and a template to help you navigate this process smoothly!

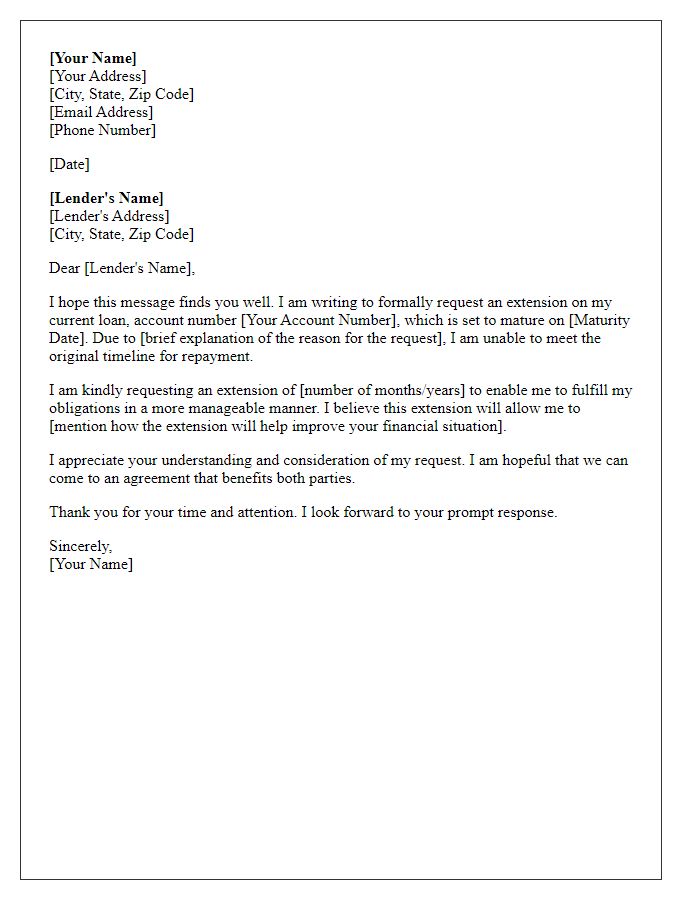

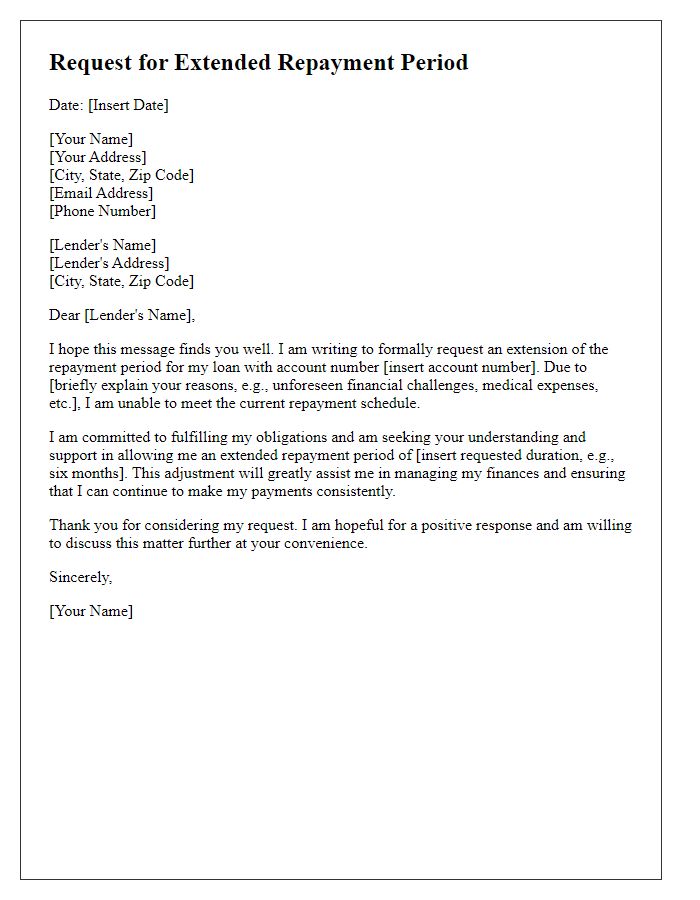

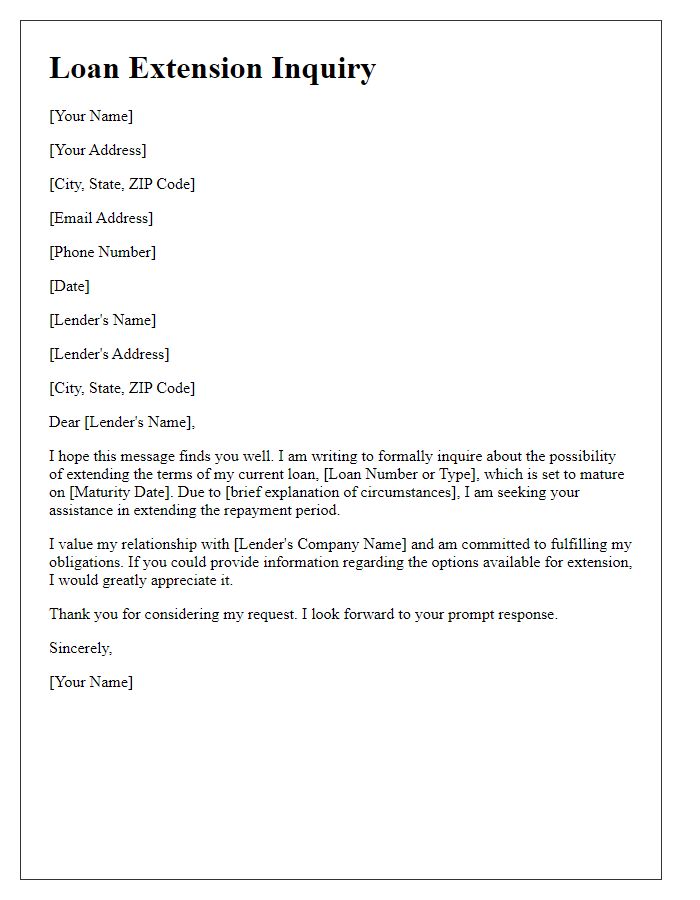

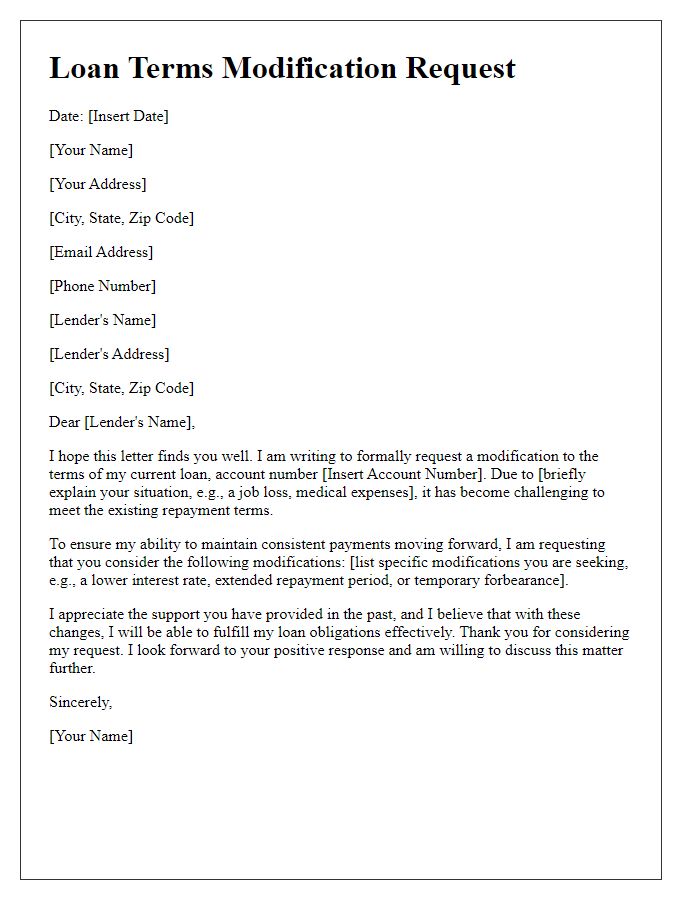

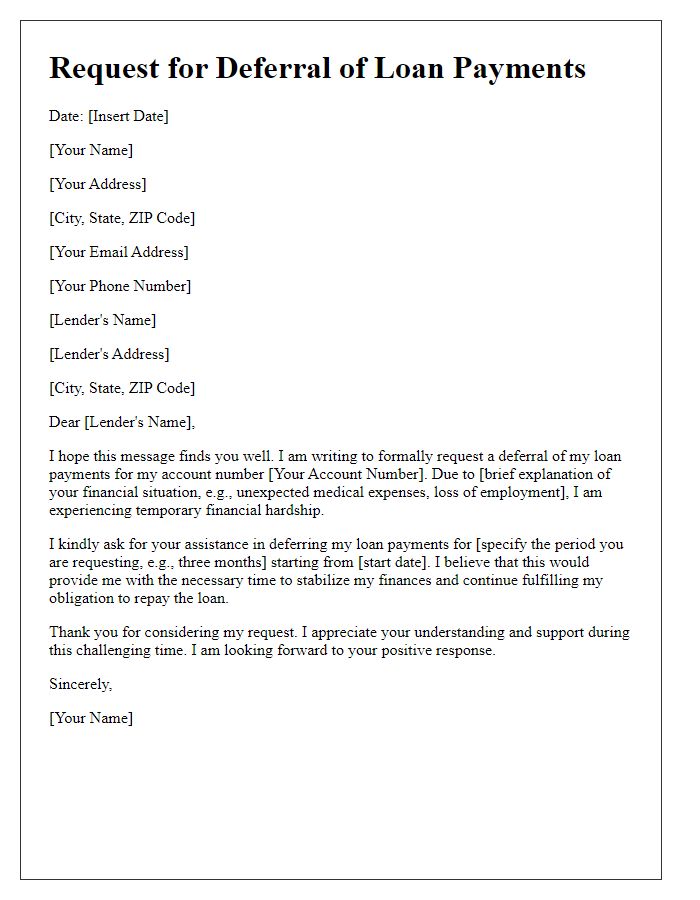

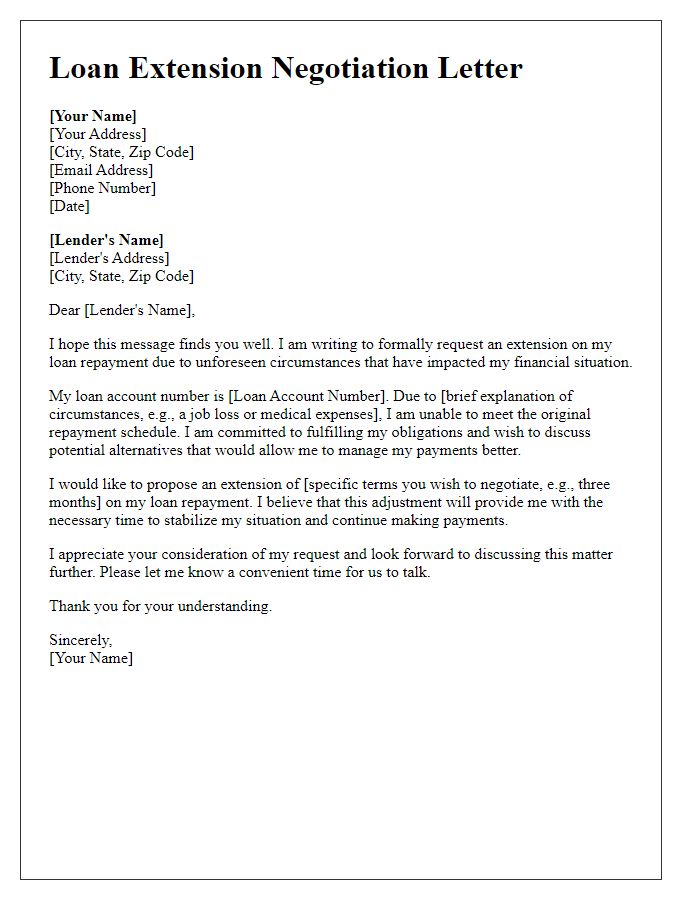

Applicant's Personal and Contact Information

A loan agreement extension request form should include essential details regarding the applicant's personal and contact information. This includes the applicant's full name, which serves as the formal identifier; address, providing a physical location that validates residency; phone number, allowing for direct communication with the lender; and email address, offering an additional contact method that can facilitate efficient correspondence. The collection of this information ensures proper identification of the applicant and aids in the loan management process, making it easier for financial institutions to review and respond to requests.

Loan Details and Current Status

Loan agreements often require careful management, especially regarding extension requests. Current loan balance might be $20,000, with a monthly payment of $500 due for the next 12 months. Borrower may face unforeseen circumstances, like job loss or medical expenses, impacting repayment ability. Original loan terms could be set in place by a lender, such as a local bank in Springfield, with an interest rate of 5% per annum. A formal extension request should include a detailed explanation of the current financial situation, proposed new terms, and gratitude for the lender's consideration, ensuring transparency and maintaining a positive relationship.

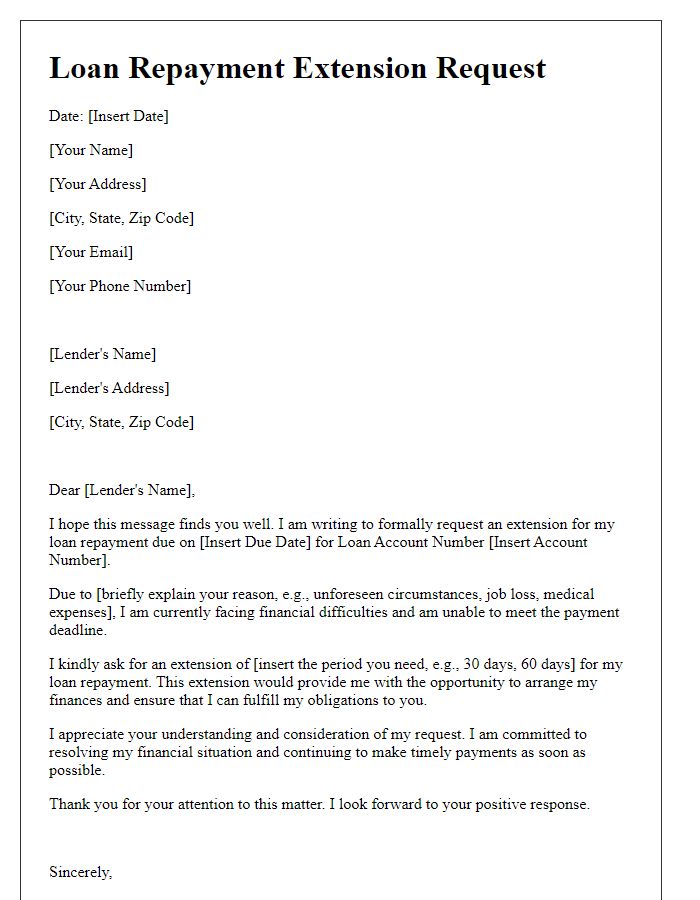

Reason for Extension Request

A loan agreement extension request due to unforeseen financial challenges can provide relief to borrowers. Factors such as job loss, medical expenses, or economic downturns can disrupt cash flow, making timely payments difficult. For instance, an unexpected medical emergency resulting in high medical bills may necessitate additional time to meet loan obligations. Moreover, ongoing economic uncertainties, like inflation rates rising to 6.2% as noted in various reports, can significantly impact personal finances. Borrowers often seek extensions to avoid late fees and maintain credit scores, ensuring responsible financial management during challenging times. Each extension request is evaluated based on individual circumstances and lender policies, highlighting the importance of clear communication during the process.

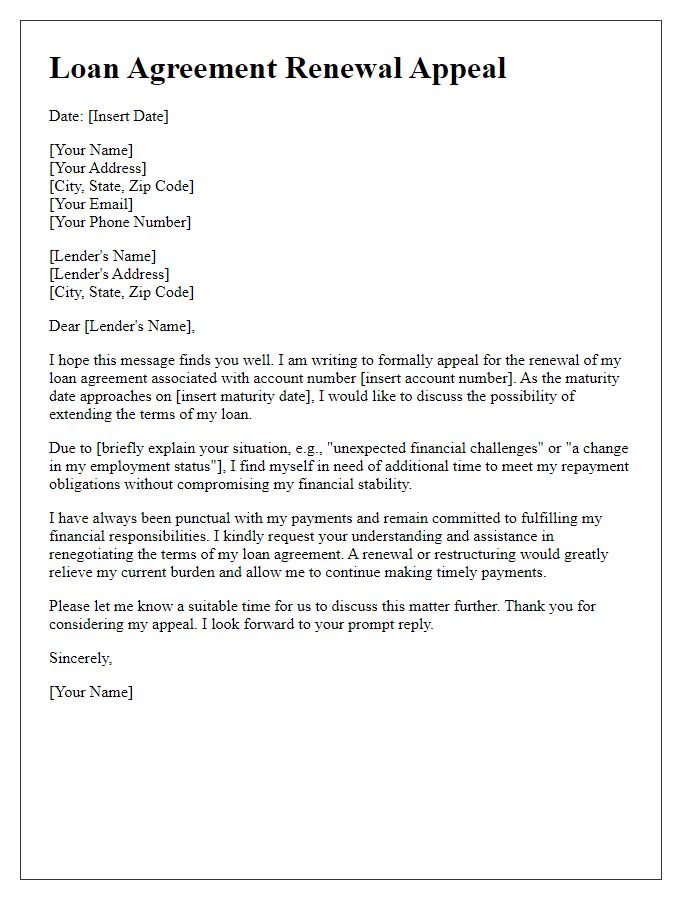

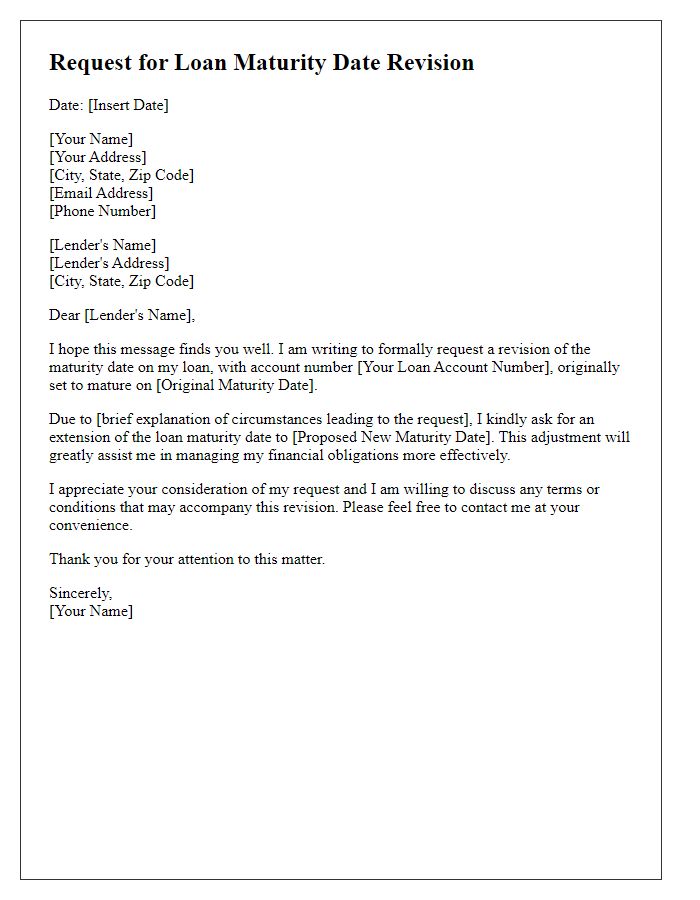

Proposed New Terms or Extension Period

A loan agreement extension request is a formal communication aimed at modifying the existing terms of a financial contract. The proposed new terms often include specific details, such as the desired length of the extension, which can range from a few months to several years, depending on the borrower's circumstances and the lender's policies. Additionally, the borrower might suggest a modification of the interest rate, with percentages potentially changing based on current market conditions or the borrower's credit history. Including relevant dates, such as the original loan due date and the proposed new maturity date, helps clarify intentions. Mentioning the loan type, such as a personal loan, auto loan, or mortgage, adds context. Furthermore, outlining the reasons for the extension request, such as financial hardship or unforeseen circumstances like medical emergencies or job loss, strengthens the rationale. Including a clear plan for repayment can also demonstrate the borrower's commitment to fulfilling the loan obligations despite the request for an extension.

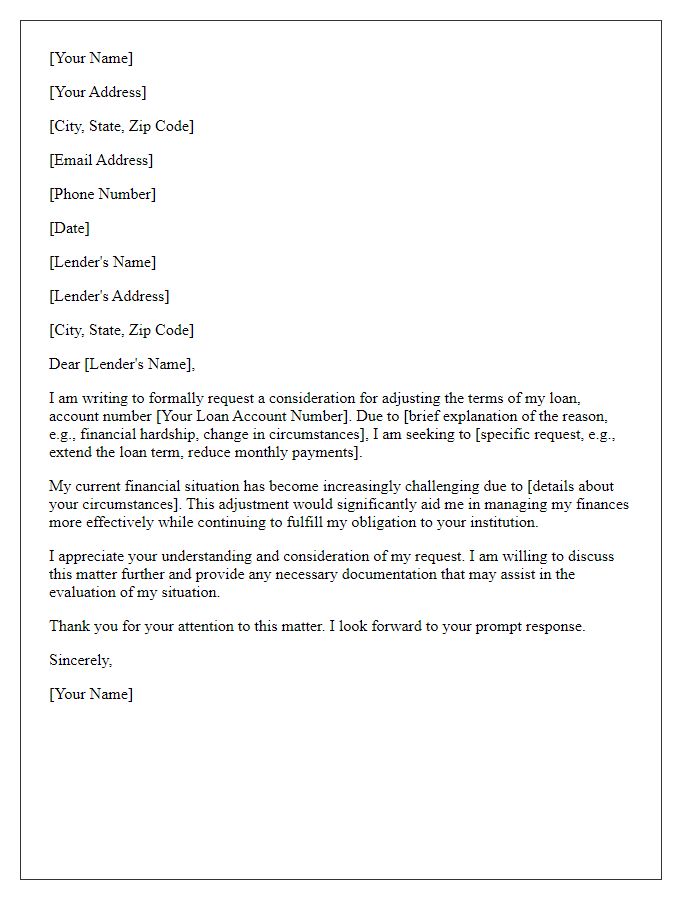

Expression of Appreciation and Future Obligations

A loan agreement extension request involves legal and financial nuances that can significantly impact both parties involved. Borrowers often face unforeseen circumstances such as job loss, medical emergencies, or economic downturns, resulting in the necessity to extend loan terms. By formally requesting an extension, borrowers convey gratitude towards lenders for their support, emphasizing a commitment to fulfill future obligations. Providing details such as original loan amount, current balance, due dates, and proposed new terms enhances the clarity of the request. Clear communication about the ability to meet adjusted repayment schedules demonstrates responsibility and fosters trust between borrowers and lenders. Such requests may occur in various contexts, including home mortgage agreements or personal loans, contingent on the terms set forth initially.

Comments