Have you ever found yourself staring at an overdue payment notice, feeling a mixture of confusion and concern? Acknowledging such notifications can be a daunting task, but it's also an opportunity to communicate effectively and resolve the situation amicably. Your response can pave the way for better financial relationships and understanding with your creditors. If you'd like to explore a comprehensive template for crafting your acknowledgment letter, keep reading!

Polite and Professional Tone

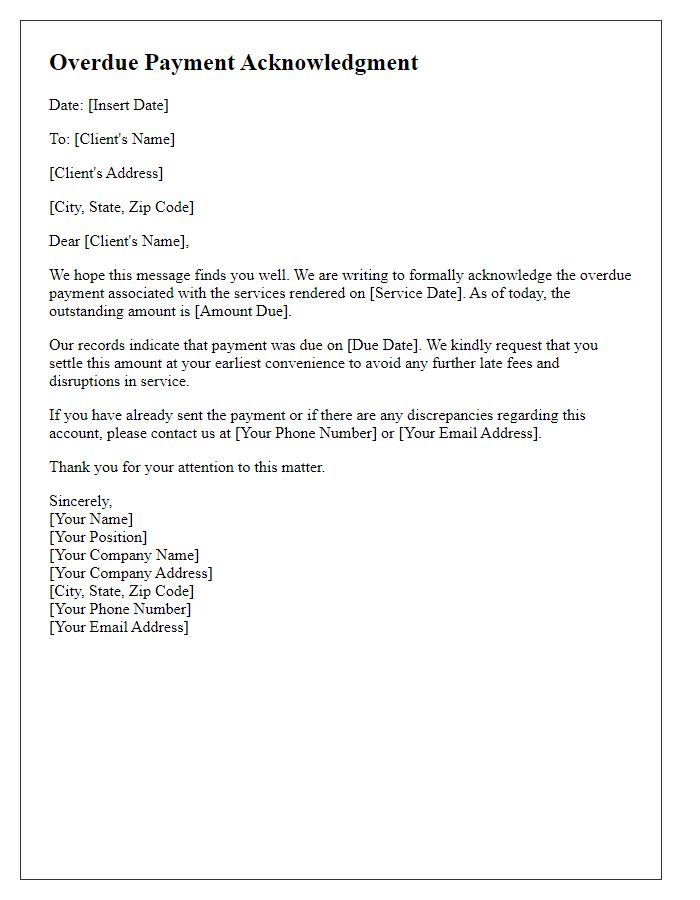

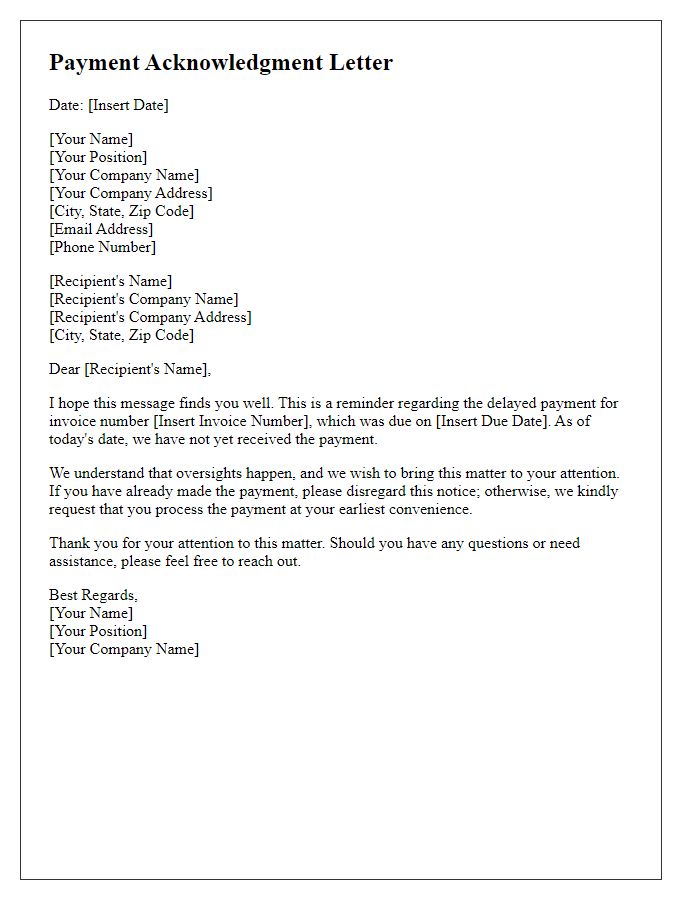

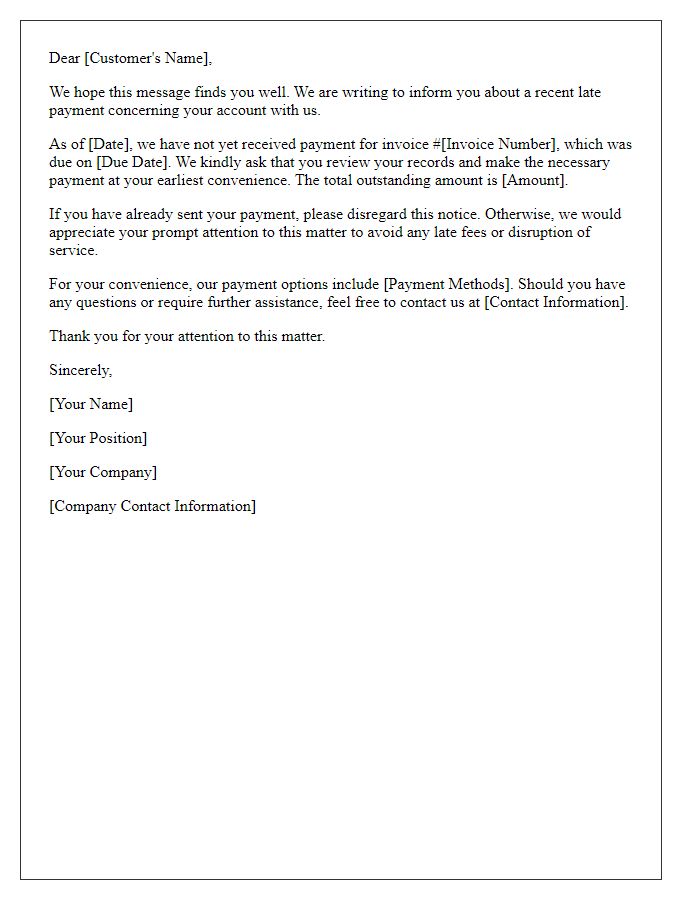

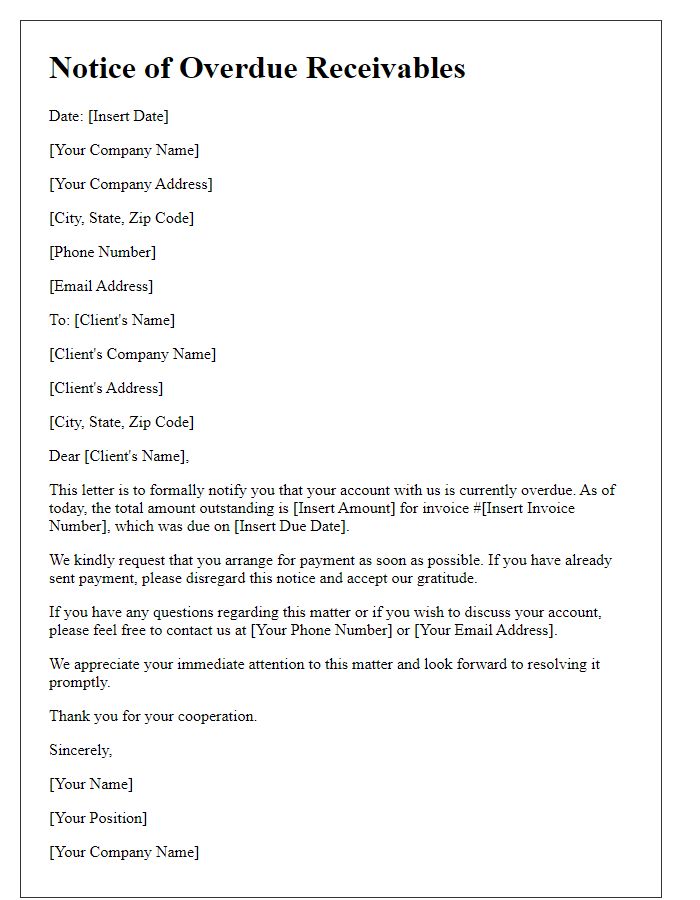

Acknowledge overdue payment notices from clients respectfully. Regular payment terms specify due dates, typically within 30 days post-invoice issuance. Prompt communication is essential for maintaining client relationships, including reminders for payments such as invoices. A gentle reminder can encourage resolution, ensuring business cash flow management remains stable. Professionalism in tone helps maintain trust and resolve issues amicably, allowing continued collaboration. Use tools like email or formal letters to convey the message clearly, outlining specific amounts due and the original payment dates.

Clear Reference to the Invoice

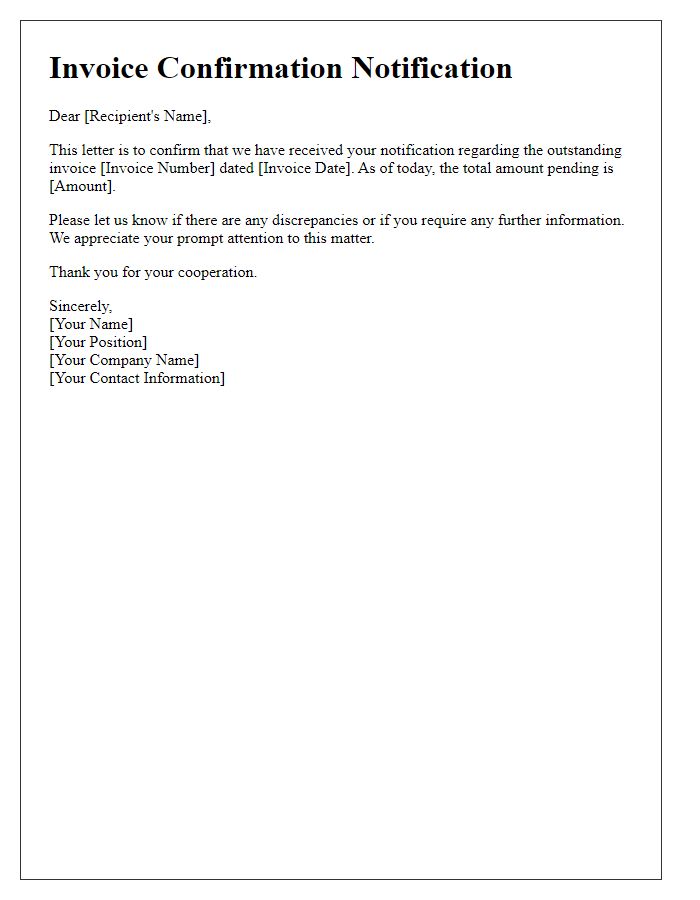

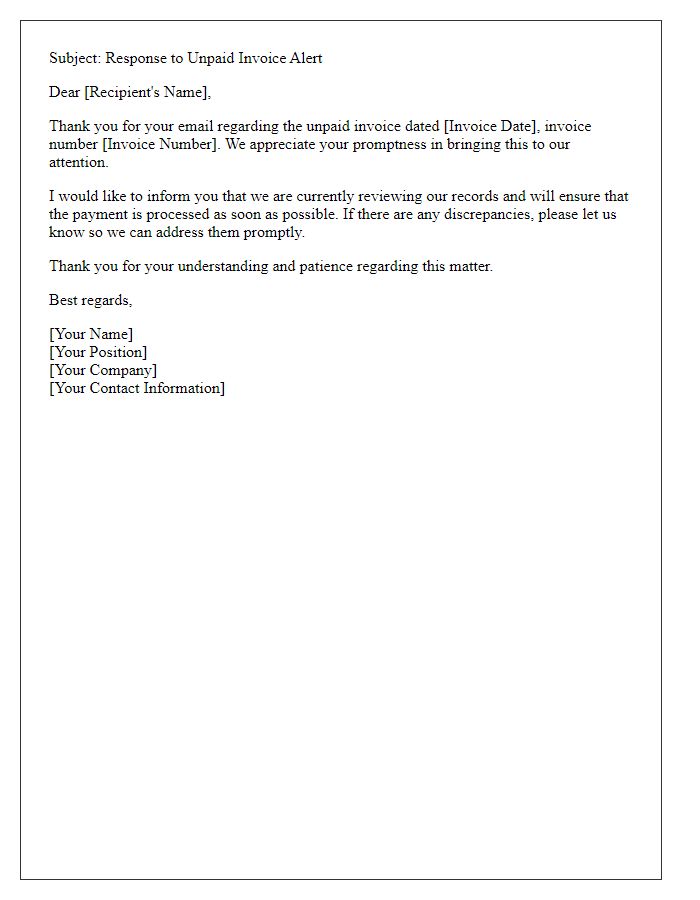

Acknowledging an overdue payment notice is essential for maintaining good relationships with vendors and ensuring prompt payments. Invoices, typically numbered for easy reference, often have specific due dates, and identifying these helps clarify the situation. For instance, an invoice dated September 15, 2023, with a due date of September 30, 2023, indicates a missed payment timeline. Additionally, including the total amount due, say $1,500, provides further context to the matter. Acknowledgment of receipt of the overdue notice, which may have been sent on October 10, 2023, conveys the recipient's commitment to resolving the issue, ensuring both parties can proceed toward a practical solution.

Reiteration of Payment Terms

In the realm of financial management, acknowledging overdue payment notices is essential for maintaining positive relationships with clients. Specific terms, such as the agreed payment schedule, typically outlined in contracts, establish clear expectations. For instance, payments are usually expected within 30 days of invoicing. Consistent reminders regarding outstanding balances can reinforce the importance of adhering to these timelines. Legal implications, including late fees, can result from prolonged delays in payment, often specified in the contract, leading to potential disputes. Efficient communication through formal notices is crucial for clarifying any misunderstandings and ensuring compliance with payment obligations.

Offer of Assistance or Payment Plans

Many businesses face challenges related to overdue payments from clients, leading to financial strain and operational difficulties. Companies such as small enterprises or freelance professionals often rely on timely payments to maintain cash flow. An overdue payment notice can serve as a reminder that the payment due date, typically within 30 days of the invoice date, has passed. Offering assistance or payment plans can be a beneficial strategy, creating flexibility for clients experiencing financial difficulties in locations such as New York or San Francisco. Payment plans may involve structured installments over a set period, allowing clients to manage their finances while ensuring that the owed amount, often several hundred or thousands of dollars, is settled eventually. Engaging in open communication fosters positive relationships and demonstrates understanding of clients' situations.

Contact Information for Follow-up

Acknowledging overdue payment notices is crucial for maintaining positive client relationships. Timely responses can lead to effective communication and resolution of outstanding balances. When addressing overdue payments, businesses often highlight specific details such as the invoice number, amount due, and payment terms, which typically include a grace period of 30 days. Contact information, including phone numbers and email addresses, should be clear and accessible for follow-up inquiries. It's beneficial to provide assurance regarding the company's willingness to discuss payment arrangements, demonstrating a commitment to customer service and cooperation.

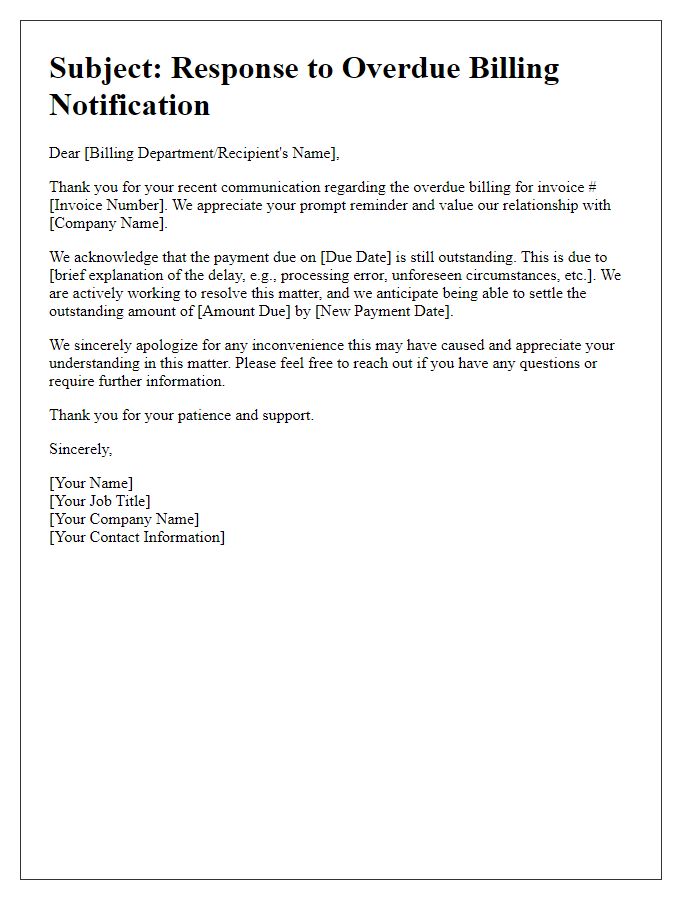

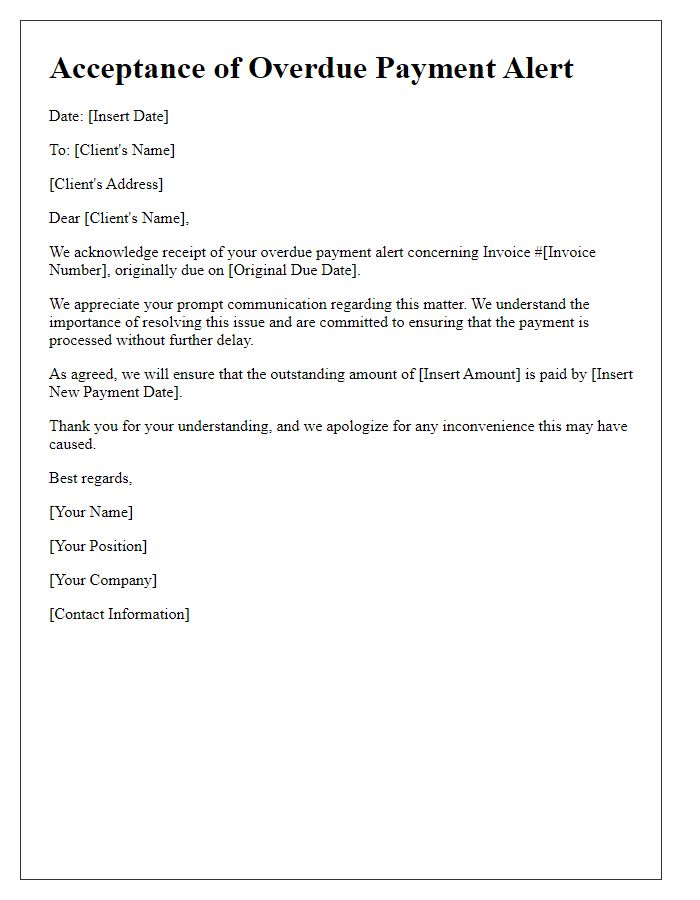

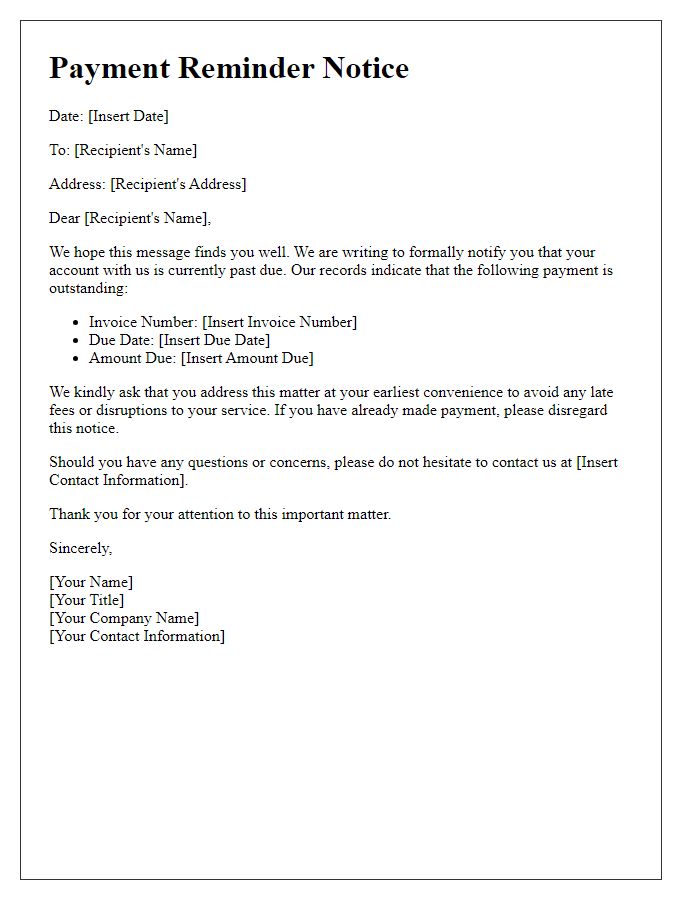

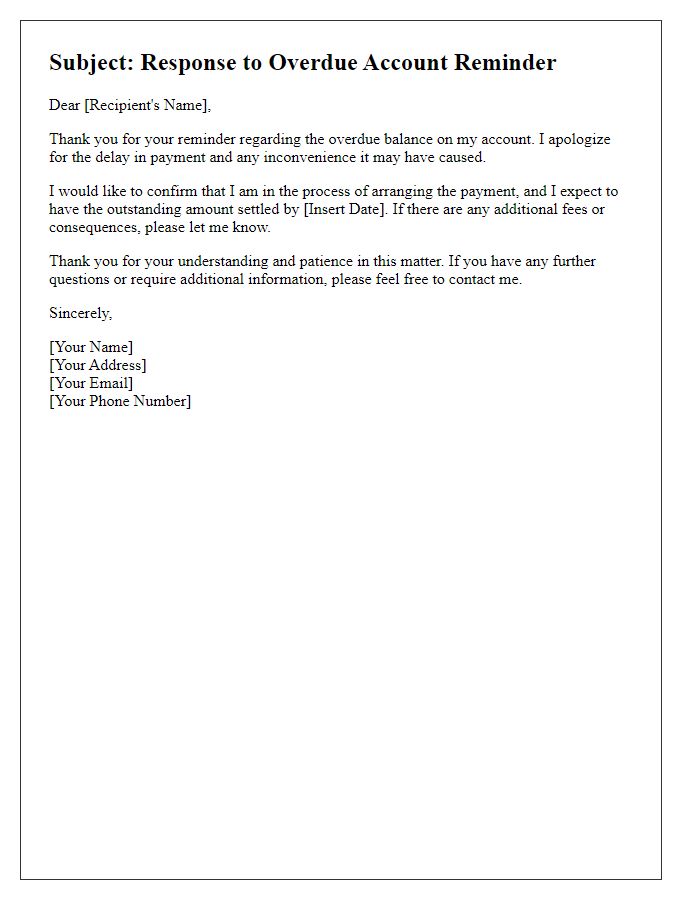

Letter Template For Acknowledging Overdue Payment Notice Samples

Letter template of overdue payment acknowledgment for services rendered.

Comments