If you've recently filed an insurance claim, you might be wondering what happens next or how your insurer acknowledges your request. It's important to understand that a well-crafted acknowledgment letter can set the tone for a positive claims process moving forward. By recognizing your submission promptly, the insurance company reassures you that they value your time and concerns. Curious to learn more about the specifics of crafting an effective acknowledgment letter? Keep reading!

Claim Reference Number

Acknowledging an insurance claim involves confirming receipt of the claim submitted by a policyholder. The claim reference number serves as a unique identifier for tracking and managing the claim throughout the process. Upon receipt of the claim submission, the insurance company reviews the details pertaining to the incident reported, ensuring all necessary documentation is attached, such as police reports, medical bills, or estimates for repairs. The acknowledgment serves not only as a confirmation but also outlines the next steps in the evaluation process, including timelines for review completion and potential communication with the policyholder for additional information. Maintaining clear communication is essential for policyholder trust and satisfaction during this critical period.

Date of Submission

The acknowledgement of an insurance claim is crucial for maintaining clear communication between the claimants and insurance providers. Upon receipt of a claim submission, typically filed within 30 days of the incident, the insurance company generates an official acknowledgement letter. This document usually includes important details such as the date of submission, the policyholder's name, claim number, and type of coverage provided. The acknowledgement serves to confirm that the claim has been received and is currently under review, giving the policyholder peace of mind. Insurance companies aim to process claims promptly, often within a 14-day period following the acknowledgement, to ensure customer satisfaction and adhere to compliance regulations.

Claimant's Personal Information

Acknowledgment of an insurance claim signals the first step in the claims process for the claimant, who may be an individual or business seeking compensation following a loss. The claimant's personal information typically includes essential details such as full name, contact number, address, policy number, and the nature of the claim, such as property damage or healthcare expenses. This information ensures the insurance company can accurately identify the policyholder and the specific policy involved. Timely acknowledgment (usually within 10 business days) reassures the claimant that their submission is being reviewed and processed, leading to a smoother claims resolution experience.

Policy Details

The acknowledgment of an insurance claim signifies a crucial step in the claims process, providing assurance to policyholders that their request is being reviewed. The policy details, which may include the policy number, insured individual's name, and coverage type, are essential components that help streamline communication. Claim numbers assigned by the insurer allow for easier tracking of the claim's progress. Typically, claims may result from various events, ranging from vehicle accidents to property damage, each necessitating specific documentation such as police reports, photographs, or repair estimates. Timely acknowledgment is critical, as it sets the tone for efficient processing and can significantly impact the overall customer experience. Insurance companies often strive to acknowledge claims within a few business days to maintain trust and transparency in their services.

Next Steps and Timelines

Acknowledging insurance claims involves understanding various components that facilitate clarity and efficiency. The initial notification date, which signifies when the insurance claim was filed, plays a crucial role in determining processing timelines. Typically, insurance companies like Geico or State Farm set a standard processing period, often around 30 days, to review submitted documents and assess claims. The required documentation, which may include police reports (in case of accidents), medical invoices for healthcare-related claims, and photographs of damages, must be submitted promptly. Claims adjusters, responsible for evaluating the details of each claim, often contact claimants within this period to gather additional information. Following the review, policyholders receive a formal decision letter, detailing approval or denial, alongside the specific reason if the claim is denied. Understanding these elements helps individuals navigate the claims process effectively, ensuring timely resolutions.

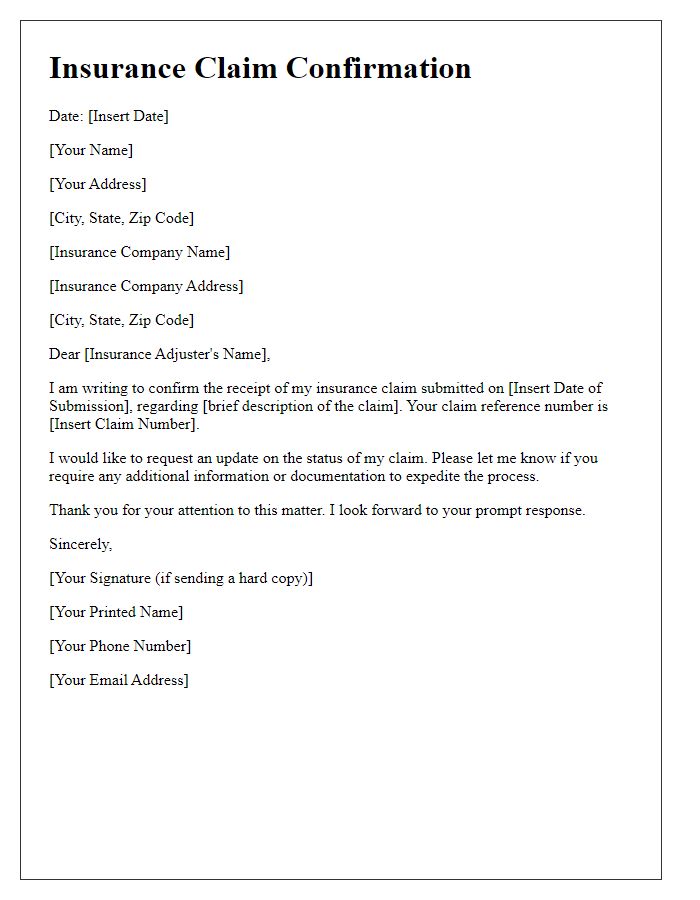

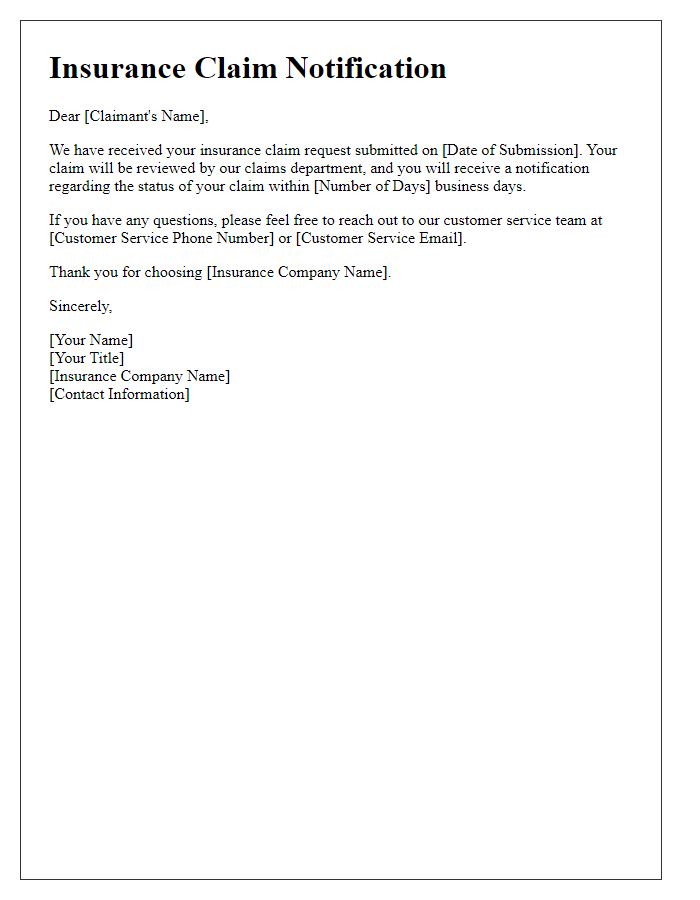

Letter Template For Acknowledging Insurance Claim Filed Samples

Letter template of receipt acknowledgment for insurance claim application

Letter template of validation for your recent insurance claim submission

Letter template of recognition for the initiation of your insurance claim

Comments