Are you feeling overwhelmed by your financial obligations and uncertain about how to approach your creditor for a payment plan? You're not alone in this experience, and it's essential to know that there are ways to negotiate your way to a more manageable solution. Crafting a well-structured letter can make all the difference in setting the right tone for your discussion. Curious to find out how to create an effective payment plan negotiation letter? Read on!

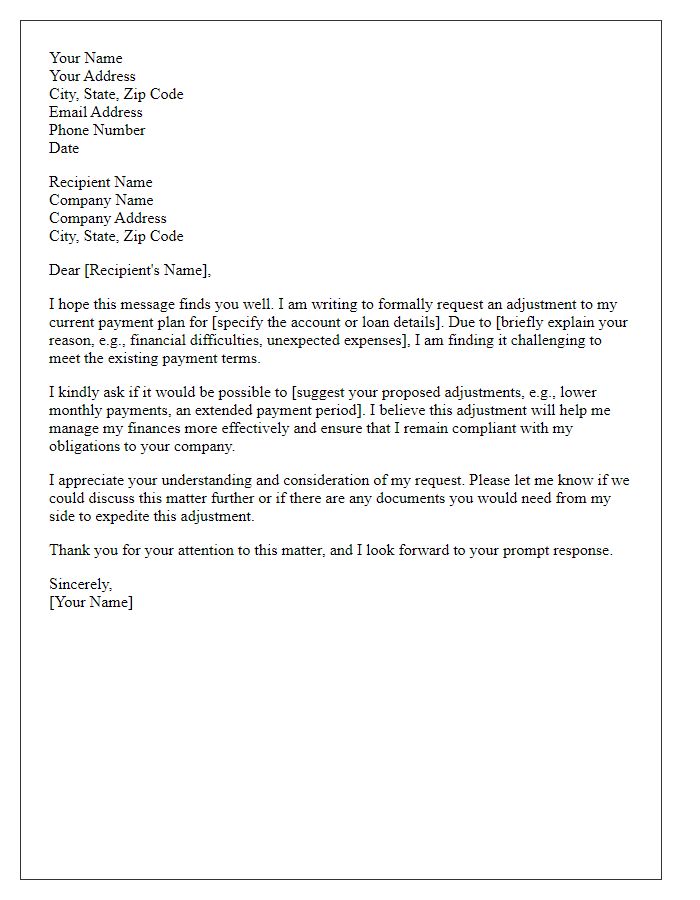

Polite Opening and Establishment of Context

In a challenging financial landscape, individuals may seek to negotiate a payment plan with service providers to alleviate monetary burdens. Establishing a polite tone can foster a cooperative atmosphere for discussions. Highlighting specific circumstances such as unexpected medical expenses, job loss, or a global event like the 2020 COVID-19 pandemic can provide context for the request. Mentioning specific account details, like account number and outstanding balance, ensures clarity. Emphasizing willingness to collaborate on a solution demonstrates commitment. A respectful approach lays the groundwork for a constructive dialogue with the service provider.

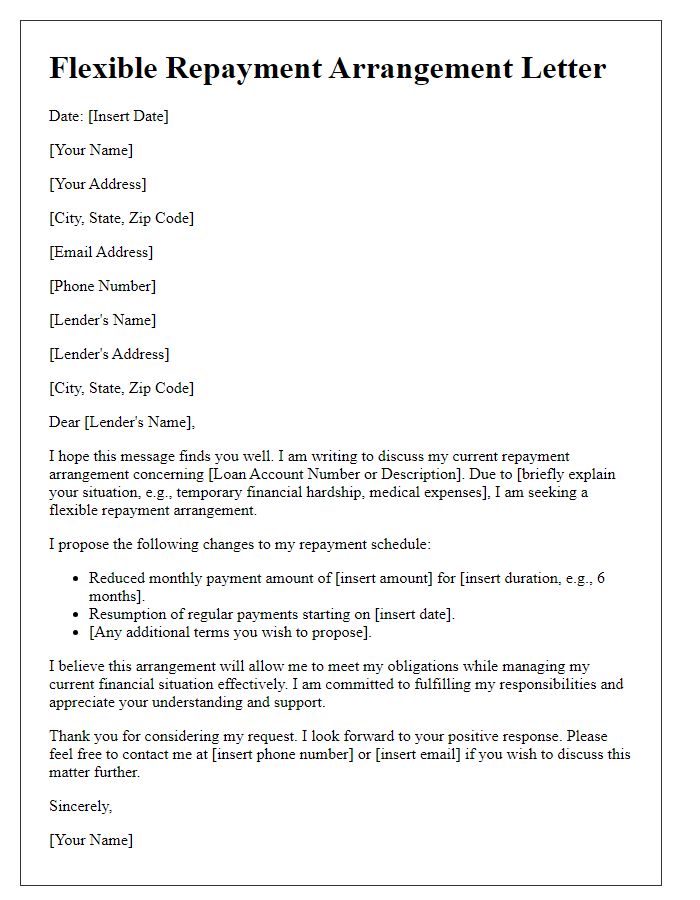

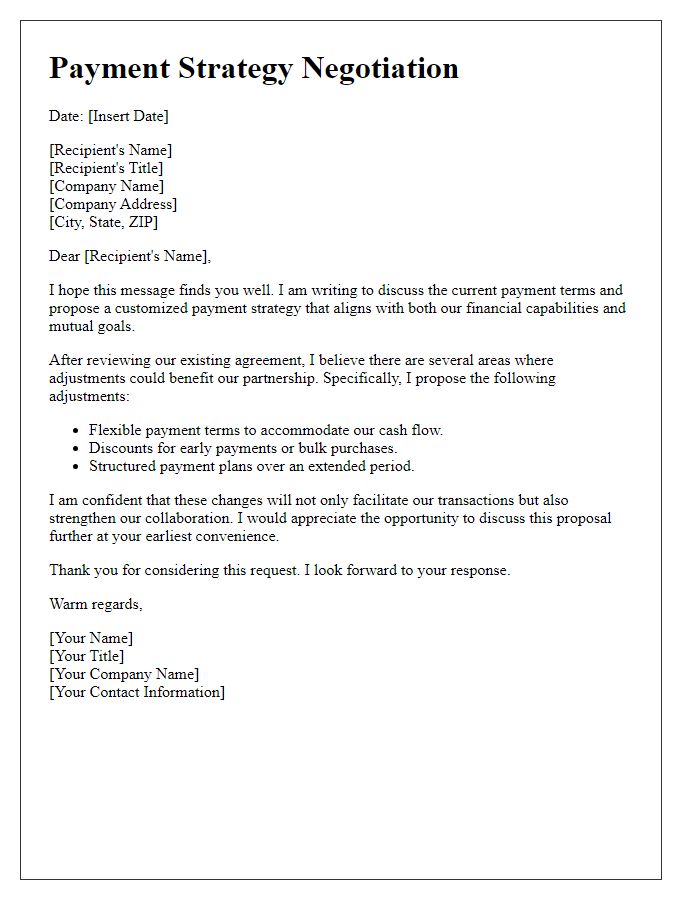

Explanation of Financial Situation

Individuals facing financial difficulties often encounter challenges in meeting their obligations. Unforeseen circumstances such as job loss, medical emergencies, or unexpected repairs to vehicles can lead to a cash flow crisis. For example, a person may experience a reduction in income by 30% due to layoffs within their industry, leading to difficulties in paying monthly expenses like rent (which averages $1,500 in urban areas), utilities, and loan repayments. This situation necessitates the establishment of a feasible payment plan with creditors, allowing manageable installments over time rather than overwhelming lump sum payments that can exacerbate financial strain. A clear outline of the individual's current financial obligations and discrepancies in income can facilitate productive negotiations, potentially resulting in temporary reductions in monthly payments or extended repayment periods.

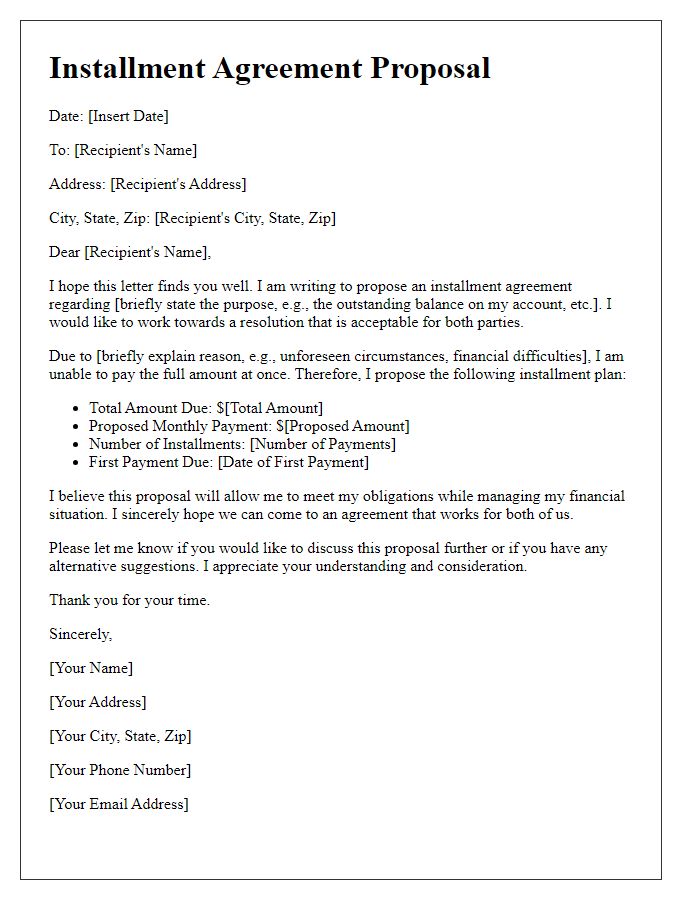

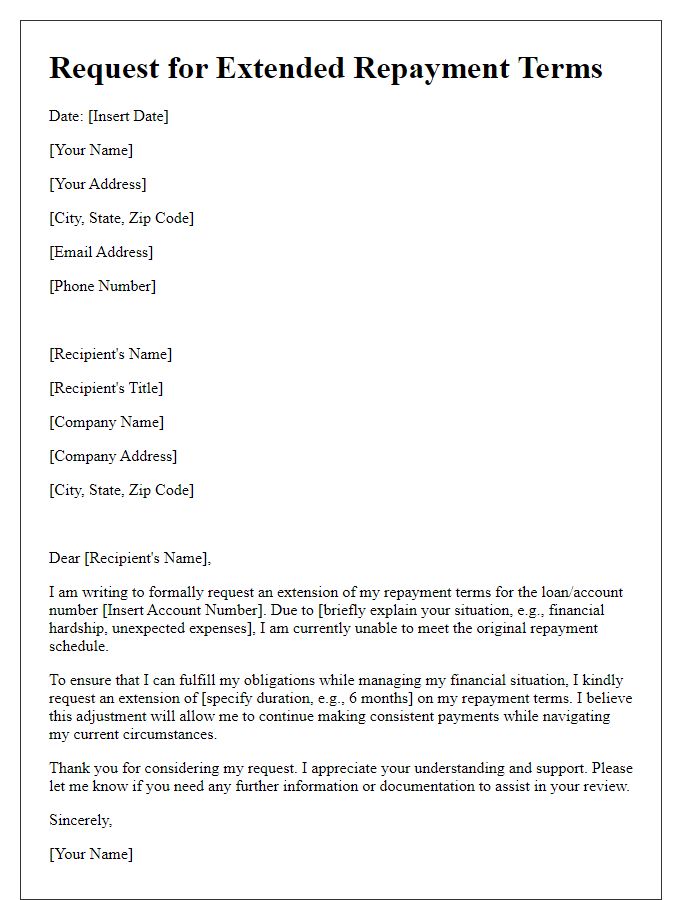

Proposal of Revised Payment Terms

The proposal of revised payment terms aims to address financial challenges experienced by a business. By extending the payment period, businesses may ease cash flow burdens and maintain operational stability during economic uncertainty. For instance, a company facing cash flow issues could suggest a six-month extension on payment schedules instead of the standard three-month period, allowing more time to allocate resources effectively. Additionally, the proposal could include reduced monthly installments, making contributions more manageable, thus supporting both parties' objectives. Clear communication regarding the new terms may also strengthen relationships with suppliers, ensuring long-term partnerships are preserved while navigating financial difficulties.

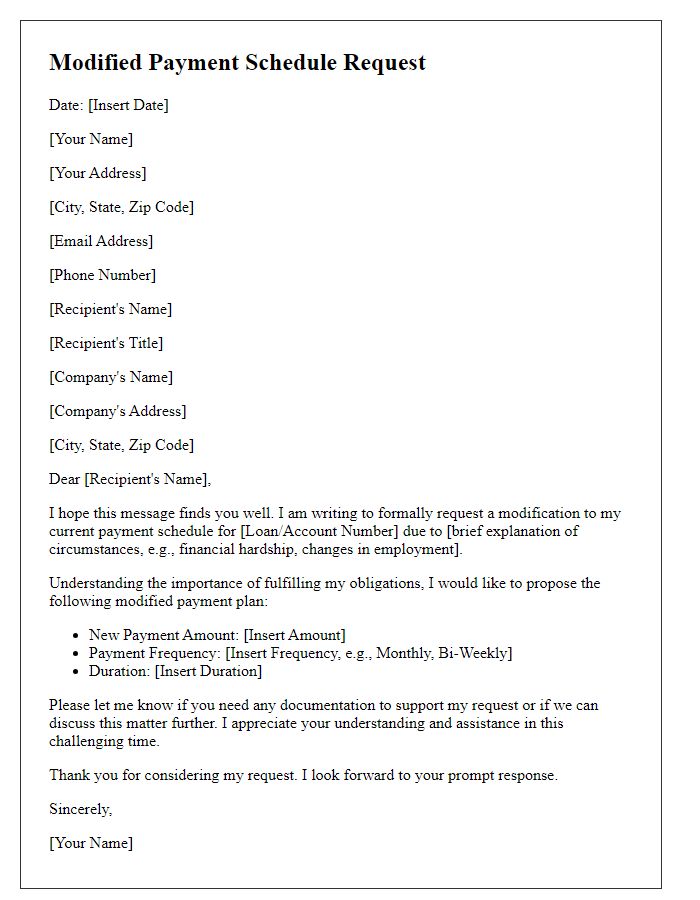

Assurance of Commitment to Pay

Assurance of commitment to pay is crucial in negotiating a payment plan. Clearly outlined commitments to each payment date ensures accountability and transparency. For example, a plan might specify monthly payments of $200 over six months, totaling $1,200, for outstanding medical bills from XYZ Hospital. Additionally, including a start date, such as December 1, 2023, and an end date of May 1, 2024, helps both parties track progress. Communication channels established in the agreement can facilitate adjustments if financial circumstances change. This structured approach fosters trust between the borrower and lender, setting a solid foundation for future financial interactions.

Request for Confirmation and Next Steps

Negotiating a payment plan often involves addressing a current financial situation, discussing a commitment to fulfill obligations, and proposing manageable solutions. A comprehensive approach includes outlining the specific amount owed, detailing proposed payment intervals, and specifying the mode of payment (such as bank transfer or check). Key factors to consider include the total debt amount, interest rates (if applicable), and any legal stipulations that might influence the negotiation process. For effective communication, confirmation of agreed terms and understanding the necessary next steps (such as signing a formal agreement) is crucial to ensure both parties maintain clarity and commitment throughout the payment schedule.

Comments