In today's fast-paced e-commerce landscape, managing finances can be challenging for business owners. That's why our dedicated accounting services are designed to help you streamline your financial processes and make informed decisions. With a focus on accuracy and efficiency, we tailor our solutions to meet the unique needs of your e-commerce business. Curious to learn how we can elevate your financial management? Read on to discover more!

Personalized Salutation

E-commerce platforms such as Shopify and WooCommerce require meticulous accounting practices due to their unique financial transactions. Accurate bookkeeping (an essential process involving tracking income and expenses) ensures compliance with IRS regulations. Revenue from online sales often includes various payment processors like PayPal or Stripe, affecting cash flow management. Understanding sales tax obligations (varying by state; for instance, 7.25% in California) is crucial. Implementing efficient inventory management systems provides insights into product performance, aiding profitability analysis. A dedicated accounting service can offer tailored financial strategies to maximize growth opportunities within the competitive e-commerce landscape.

Clear Service Offerings

E-commerce accounting services provide essential financial oversight for online businesses, enhancing operational efficiency. These services typically include bookkeeping (recording financial transactions), tax preparation (ensuring compliance with federal and state regulations), financial reporting (providing insights into revenue and expenses), and inventory management (tracking stock levels and costs). Additionally, specialized e-commerce platforms like Shopify or Amazon require tailored solutions to manage sales tax (government levies on goods and services) and payment reconciliations (matching transaction records with bank statements). Accurate financial analysis can also assist in cash flow management (monitoring inflow and outflow of funds), which is crucial for sustaining growth in a competitive market. Seamless integration of accounting software (such as QuickBooks or Xero) helps streamline processes and improve financial visibility.

Pricing Structure

E-commerce businesses often require comprehensive accounting services to manage financial transactions effectively. The pricing structure for these services can vary widely based on factors such as business size, transaction volume, and specific needs. For instance, a small online retailer generating $50,000 annually may require basic bookkeeping services at a rate of $300 per month, while a larger enterprise with sales exceeding $1 million may need advanced reporting and analytics services priced around $1,200 monthly. Additionally, specialized services such as tax preparation during peak seasons, particularly around April 15th in the United States, may incur additional fees. Clear communication about the pricing model, including hourly rates for consultation, fixed monthly fees, and charges for additional services, can help e-commerce businesses budget effectively and ensure transparency in their financial operations.

Value Proposition

E-commerce accounting services play a crucial role in helping online businesses manage their financial operations effectively. These services encompass tasks such as bookkeeping, tax compliance, and financial reporting tailored to the unique challenges faced by e-commerce platforms such as Shopify, Amazon, or eBay. Accurate tracking of sales data, inventory management, and expense reporting is vital given that e-commerce businesses can experience high transaction volumes, often exceeding thousands per month. Implementing advanced accounting software can streamline these processes, ensuring real-time access to financial information, thereby enhancing decision-making. With specialized knowledge in e-commerce tax regulations, these services ensure compliance with laws such as the Streamlined Sales and Use Tax Agreement, which varies by state, preventing costly penalties. Additionally, tailored financial insights can drive growth strategies and enhance profitability in a competitive online marketplace. These comprehensive services ultimately lead to improved cash flow management, allowing business owners to focus on scaling their operations and enhancing customer experience.

Call-to-Action

Professional e-commerce accounting services can significantly enhance financial management for online businesses. Accurate bookkeeping ensures compliance with tax regulations, reducing the risk of audits and penalties. Understanding metrics like gross merchandise value (GMV) and net profit margin is crucial for maintaining profitability. Services tailored to platforms such as Shopify or Amazon provide insights into inventory turnover rates and sales trends. Leveraging software like QuickBooks or Xero can streamline invoicing and expense tracking, giving business owners more time to focus on growth. Engaging with experts in e-commerce accounting can lead to improved financial reporting and strategic planning, ultimately supporting long-term success in the competitive online marketplace.

Letter Template For E-Commerce Accounting Services Proposal Samples

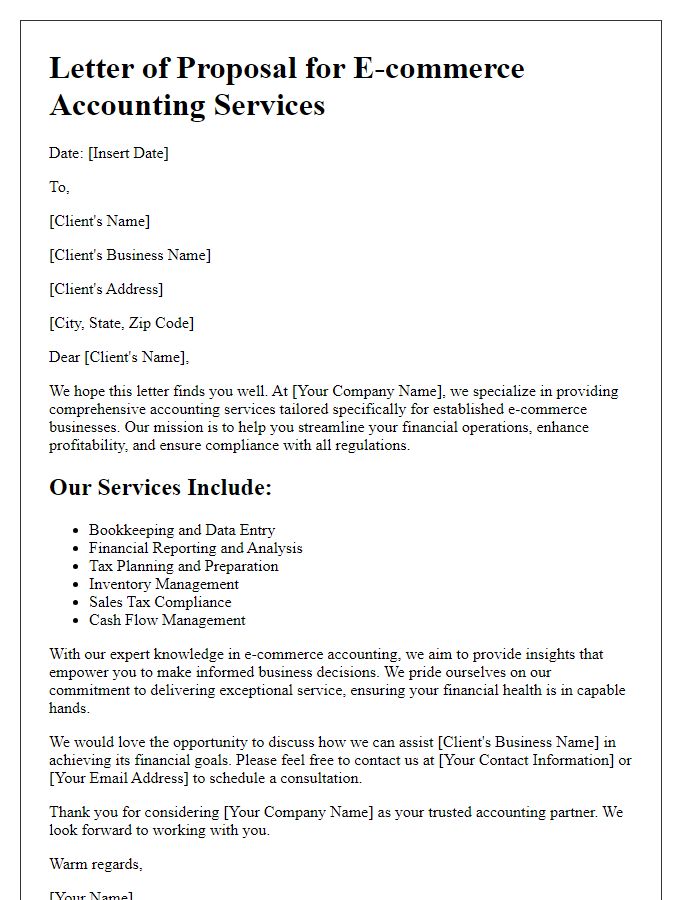

Letter template of e-commerce accounting services for established businesses

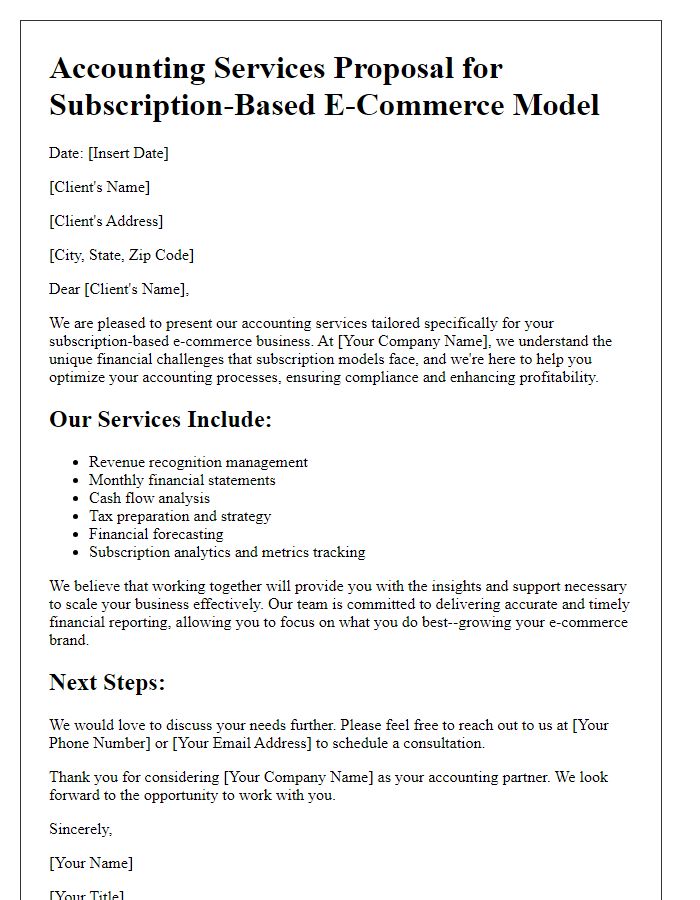

Letter template of e-commerce accounting services for subscription-based models

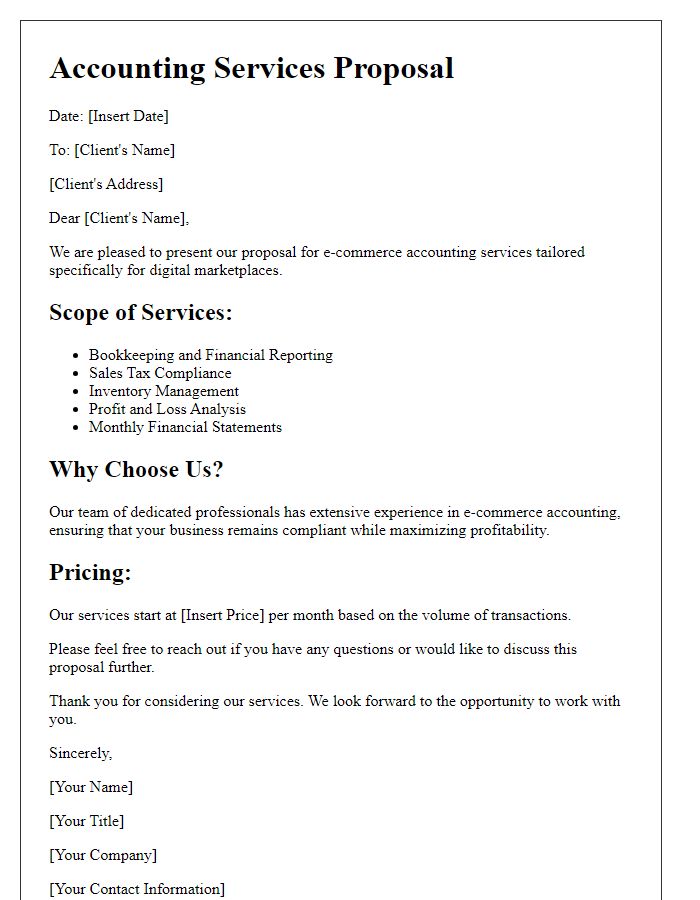

Letter template of e-commerce accounting services for digital marketplaces

Comments