Hey there! If you've ever found yourself nervously staring at an overdue invoice, you're not alone. Managing payments can be tricky, and sometimes gentle reminders are necessary to keep everything on track. In this article, we'll explore an effective letter template to help you notify clients about overdue invoices while maintaining a positive relationship. So, let's dive in and discover how to communicate this important message with ease!

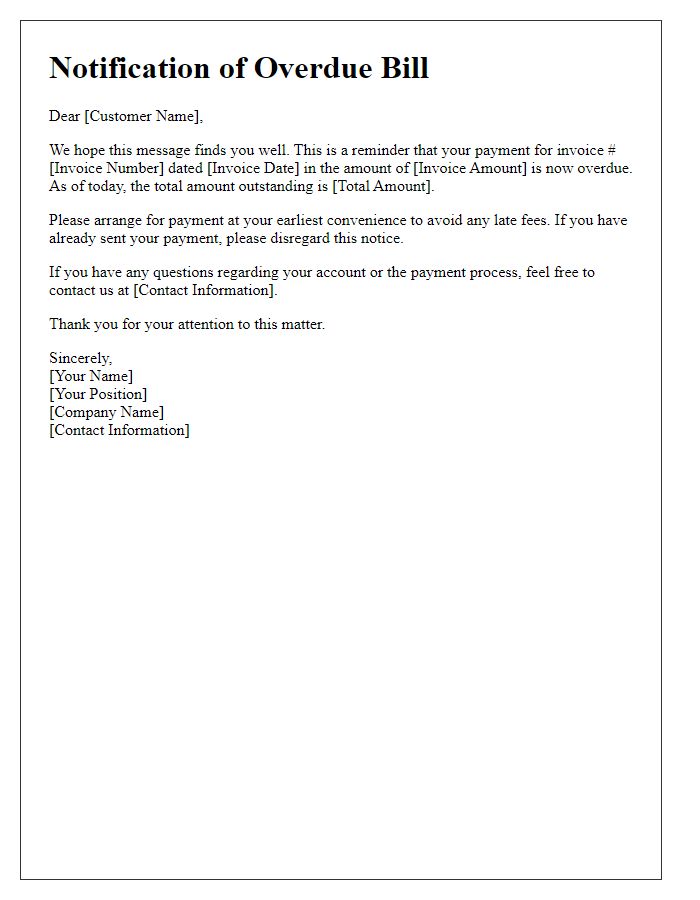

Clear Subject Line

Timely follow-up on overdue invoices is essential for maintaining healthy cash flow in a business. An overdue invoice notification should include essential details such as the invoice number (for tracking), the original due date (often 30 days from the invoice date), and the total outstanding amount (which can impact budgeting). Clarity is crucial, so using a concise subject line like "Invoice #12345 Overdue Notice" helps recipients immediately recognize the purpose of the email. Including your company's contact information allows the recipient to reach out for any questions or clarifications. Reminding clients about payment terms (such as discounts for early payment or penalties for late payment) can also be effective in prompting prompt responses.

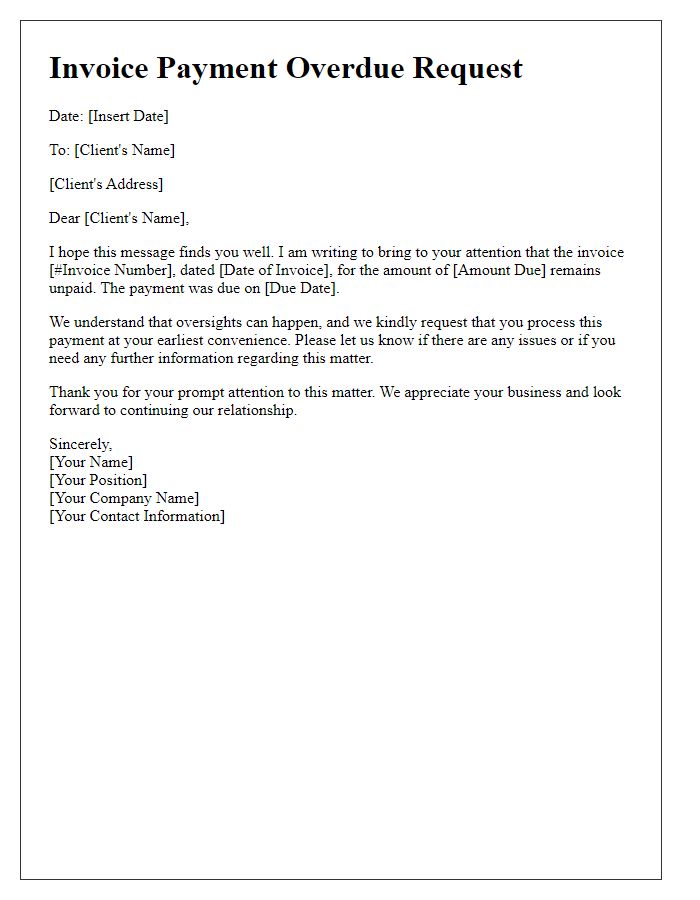

Friendly Tone

Overdue invoices can create financial strain for businesses, especially small enterprises struggling with cash flow management. A friendly notification alerting clients to overdue amounts is important for maintaining positive relationships while ensuring timely payments. It is essential to mention the invoice number, original due date, and total outstanding amount, typically ranging from 30 to 90 days past due. Additionally, acknowledging the potential for oversight and emphasizing the willingness to assist with any issues related to payment demonstrates understanding and professionalism. A gentle reminder can encourage prompt action, ultimately improving financial stability for both the service provider and the client.

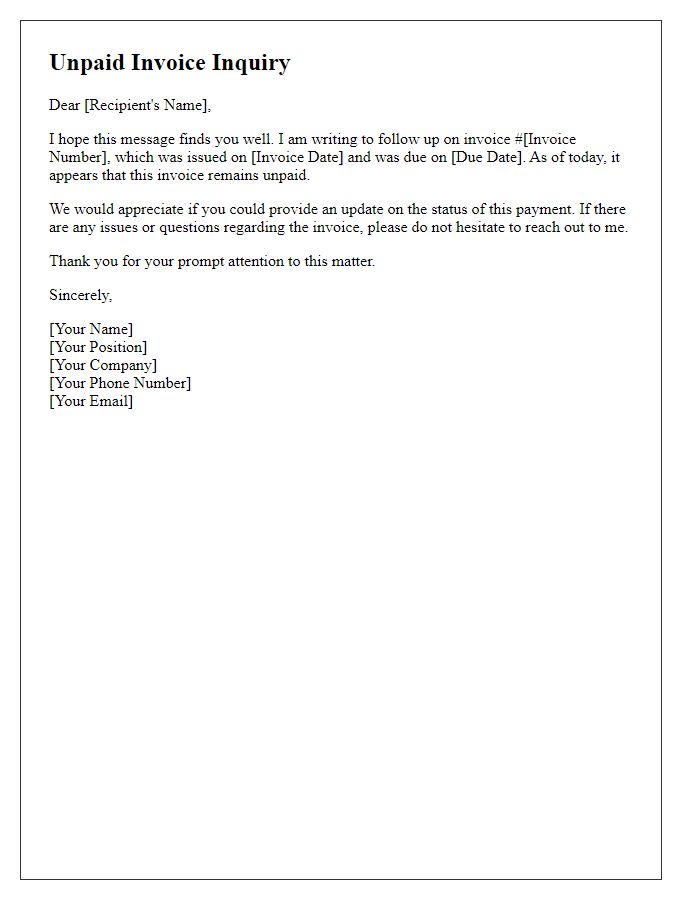

Specific Invoice Details

An overdue invoice notification highlights important details concerning outstanding payments for businesses. Invoice number, such as 12345, can represent specific transactions related to products or services rendered. Due date, like February 15, 2023, signifies the payment deadline that has lapsed. Total amount owed, for example, $2,500.00, captures the financial obligation of the client. Client name, such as ABC Corporation, identifies the recipient responsible for settling the invoice. Sending such notifications can include a reminder about late fees, which often accrue at a rate of 1.5% per month on overdue balances, emphasizing the importance of timely payments to maintain business relationships.

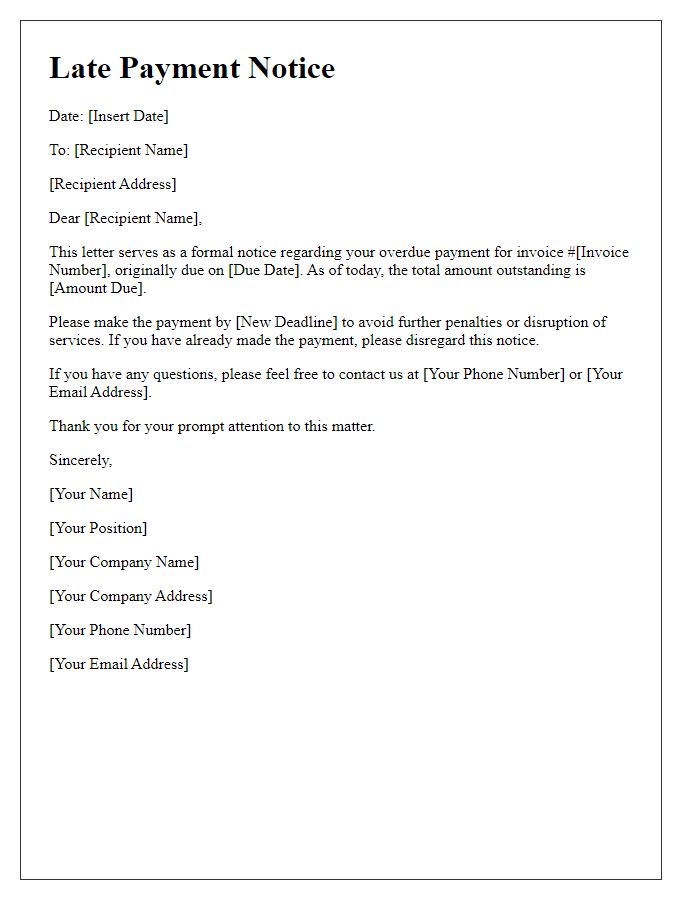

Payment Options

Overdue invoices can lead to cash flow issues for businesses, especially for small enterprises. An overdue invoice occurs when a customer fails to pay within the agreed timeframe, typically 30, 60, or 90 days past the due date. The outstanding balance can accrue late fees, usually around 1.5% per month, which increases the total payable amount. Effective communication methods include reminder emails or phone calls, detailing payment options such as credit card, bank transfer, or digital services like PayPal. Maintaining a professional tone while clearly stating the necessary steps for payment can improve the chances of recovery. Additionally, providing a revised payment deadline can encourage prompt action and foster positive client relations, essential for sustaining ongoing business partnerships.

Contact Information

An overdue invoice notification serves as a crucial reminder for clients regarding outstanding payments. This notification typically includes essential contact information such as the company's name, which may range from small businesses to large corporations, along with an address that could include a city like San Francisco or a state such as California. Phone numbers, often with area codes, provide a direct line for clients to inquire about the invoice, while email addresses facilitate quick electronic communication. Detailed invoice numbers, such as INV-12345, and due dates, which may have passed by several weeks, also usually accompany this information to ensure clarity in the transaction history. Timely follow-ups can help maintain positive client relationships and increase the likelihood of payment.

Comments