Are you ready to elevate your financial game with advanced tax strategies? In today's ever-changing tax landscape, having a solid plan is essential to maximizing your savings and securing your future. This article will break down innovative techniques that can help you minimize your tax liability while enhancing your overall financial health. So, let's dive in and explore how these strategies can benefit youâkeep reading to unlock valuable insights!

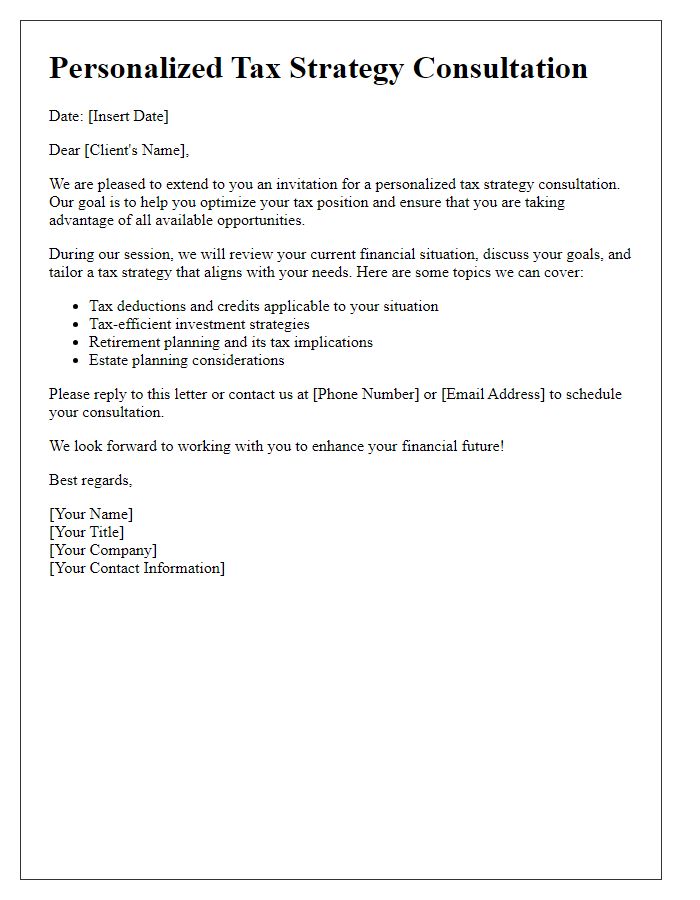

Personalization and customization

The advanced tax strategy session offers tailored insights into maximizing financial efficiency for high-net-worth individuals and business owners. Attendees can expect specialized recommendations on tax-efficient investment vehicles such as municipal bonds (offering tax-free interest) and retirement accounts like the Roth IRA (providing tax-free withdrawals). A detailed analysis of state tax implications, particularly for residents of high-tax states like California (where income tax can reach up to 13.3%), will be provided. Participants will explore strategies for entity structuring, including the benefits of forming LLCs or S-corporations to minimize liabilities and optimize deductions. Additionally, insights into recent tax code changes, such as adjustments from the Tax Cuts and Jobs Act of 2017, will be discussed to ensure compliance and strategic alignment with current regulations. Personalization elements will focus on individual financial goals, risk tolerance, and specific industry nuances to enhance each participant's financial outcomes.

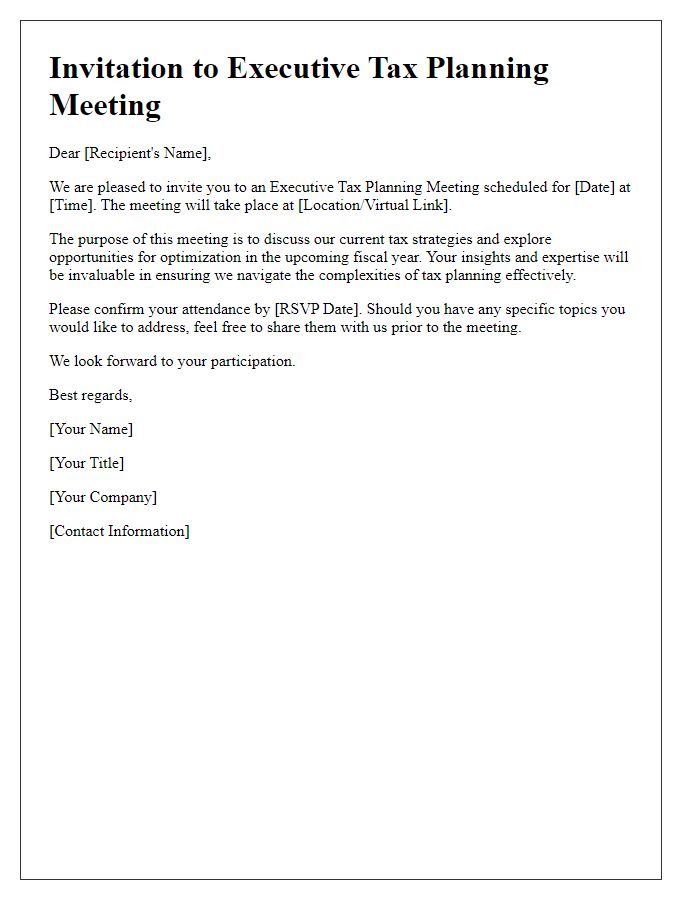

Clear objectives and goals

Advanced tax strategy sessions focus on optimizing financial outcomes through strategic planning and implementation. These sessions aim to identify tax savings opportunities, assess compliance with current regulations, and evaluate the benefits of specific tax incentives such as credits and deductions. Participants discuss intricate financial scenarios involving multiple entities, such as partnerships, corporations, or individuals, to devise tailored approaches that minimize tax liabilities. Additionally, these sessions highlight the importance of staying updated on legislative changes, including the recent tax reforms from 2021 regarded by many experts as pivotal. Key performance indicators established during these meetings often include projections for tax savings percentages, compliance timelines, and the impact of various strategies on overall financial health. Advanced technology tools and software may be utilized to analyze complex data and streamline the decision-making process.

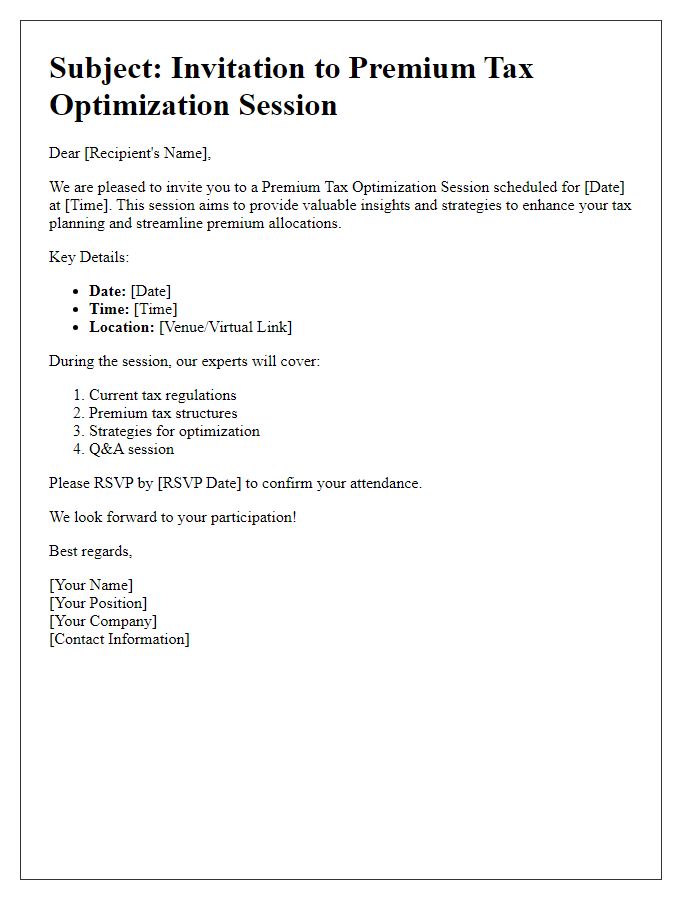

Schedule and logistics details

The advanced tax strategy session is scheduled for October 15, 2023, at the downtown conference center located at 1200 Main Street, Suite 300, Springfield. Participants can expect a comprehensive agenda tailored to address current tax law changes and optimizations. Registration opens at 8:30 AM, with the session commencing promptly at 9:00 AM and concluding at 4:00 PM. A catered lunch will be provided, featuring dietary options for various preferences. Attendees are encouraged to bring financial statements and relevant documents for interactive discussions. Parking facilities are available on-site, and public transit options include the Metro Line 3, with a station located one block away.

Value proposition and benefits

A comprehensive advanced tax strategy session offers significant value to individuals and businesses aiming to optimize their tax obligations. Expertise in various tax codes, including IRS regulations and state-specific laws, ensures clients leverage available deductions and credits effectively. Tailored strategies can lead to substantial savings, often exceeding thousands of dollars annually, depending on individual financial situations and revenue streams. Clients gain insights into sophisticated techniques such as income shifting, asset protection through trusts, and investment tax optimization. Additionally, such sessions provide access to current industry trends and legislative changes that may influence future tax planning, reinforcing proactive rather than reactive tax management. Ultimately, this strategic approach not only enhances financial health but also fosters peace of mind regarding compliance and financial forecasting.

Call-to-action and contact information

The implementation of advanced tax strategies plays a crucial role in maximizing financial efficiency and minimizing tax liabilities for individuals and businesses. Effective planning can lead to significant savings, often involving strategies like income splitting, tax deferral (postponing tax payments to future years), and the utilization of tax credits that align with current tax laws and regulations. Engaging with tax professionals who specialize in advanced strategies can provide tailored solutions that consider the complexities of each unique financial situation, ensuring compliance with the latest IRS guidelines and state tax requirements. Potential participants in these sessions should consider booking consultations, which may include detailed assessments of previous tax returns, exploring eligible deductions, and discussing future financial goals to develop a comprehensive tax strategy.

Comments