Have you ever received an invoice that just didn't quite add up? It can be confusing and frustrating when there's a discrepancy, especially when you're trying to keep your finances in order. In this article, we'll explore the essential steps to take when addressing vendor invoice discrepancies and how to communicate effectively to resolve any issues. Let's dive deeper into this topic and ensure you're prepared to tackle any billing challenges that come your way!

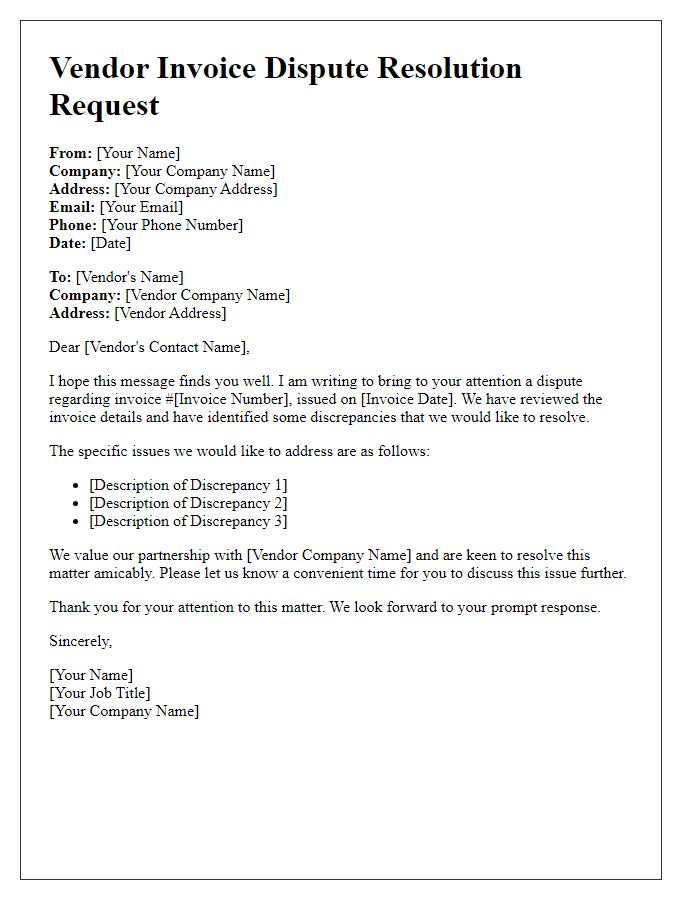

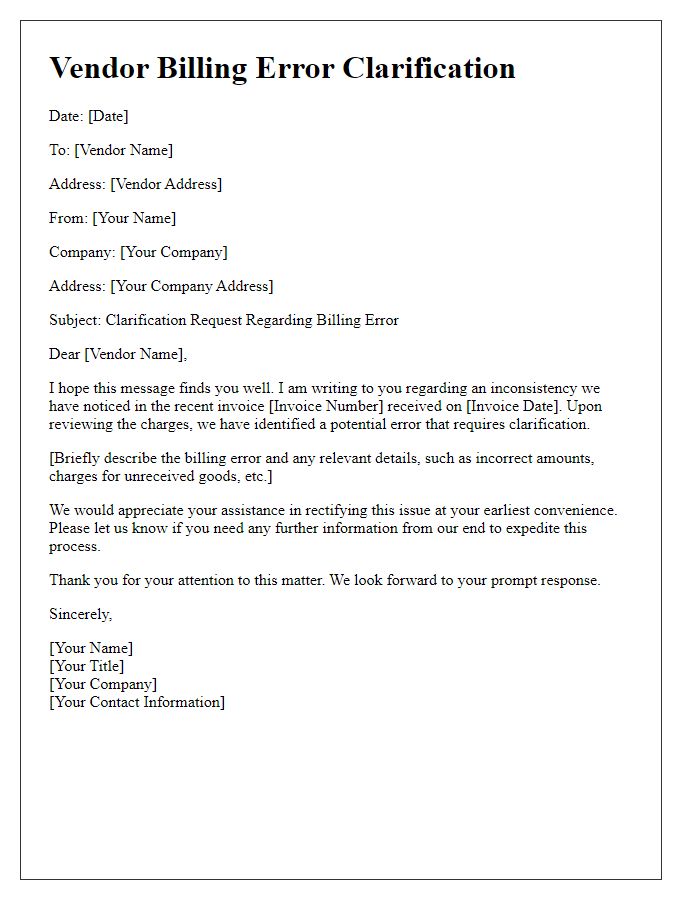

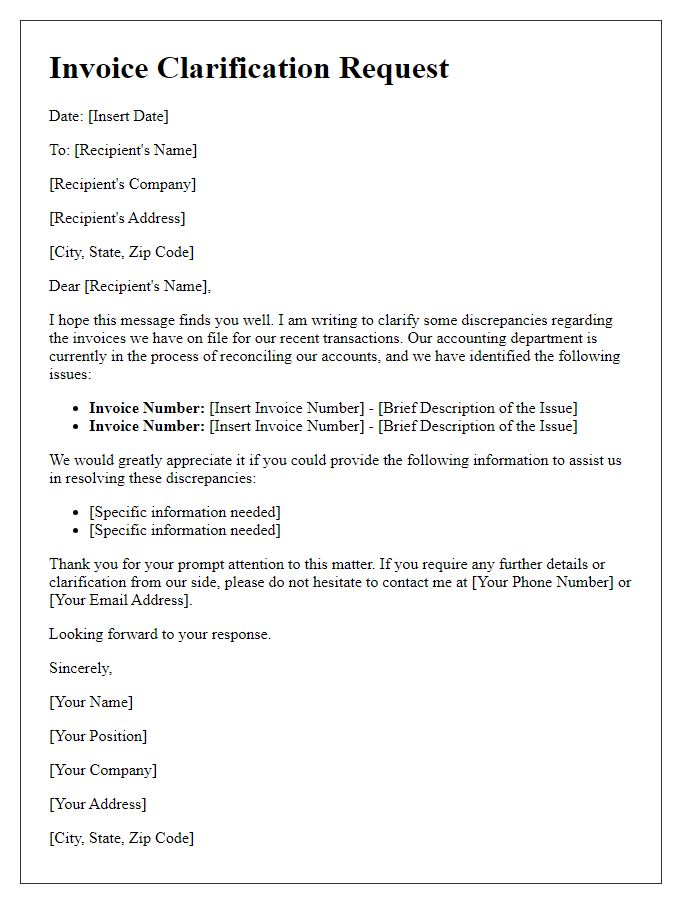

Vendor's contact details

The vendor's contact details encompass essential information such as the business name, address, phone number, and email, vital for effective communication regarding invoice discrepancies. Accurate details enhance clarity, ensuring prompt resolutions. For instance, a vendor located in New York City (with a ZIP code of 10001) might possess a specific phone number like (212) 555-0199 and an email address in a standardized format (e.g., contact@vendorcompany.com). These particulars facilitate clear correspondence, allowing the accounts payable team to address any inconsistencies efficiently, thus maintaining a productive vendor relationship. Accurate vendor contact details contribute significantly to streamlining financial operations within the business.

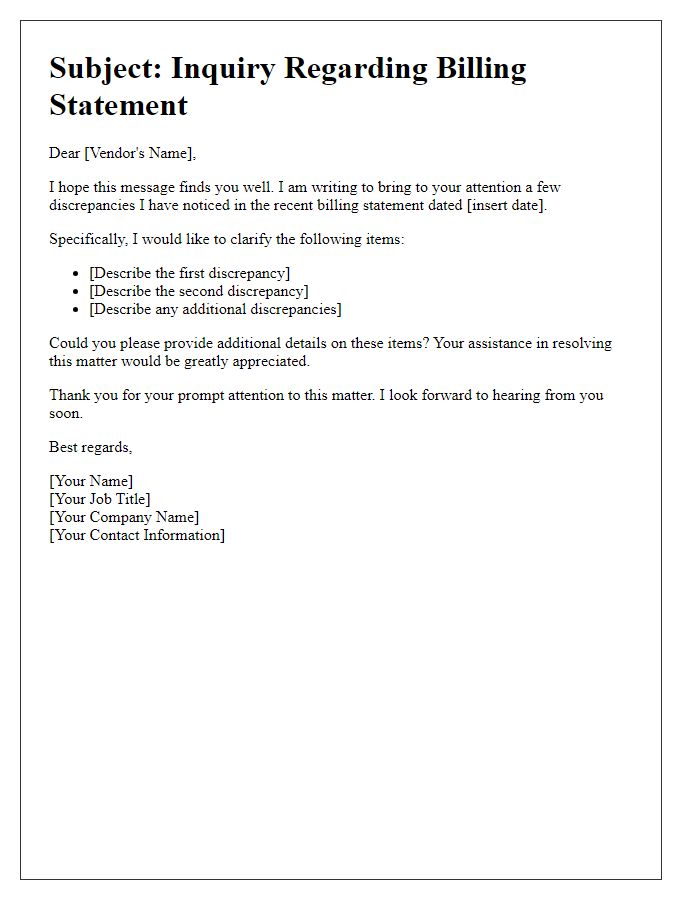

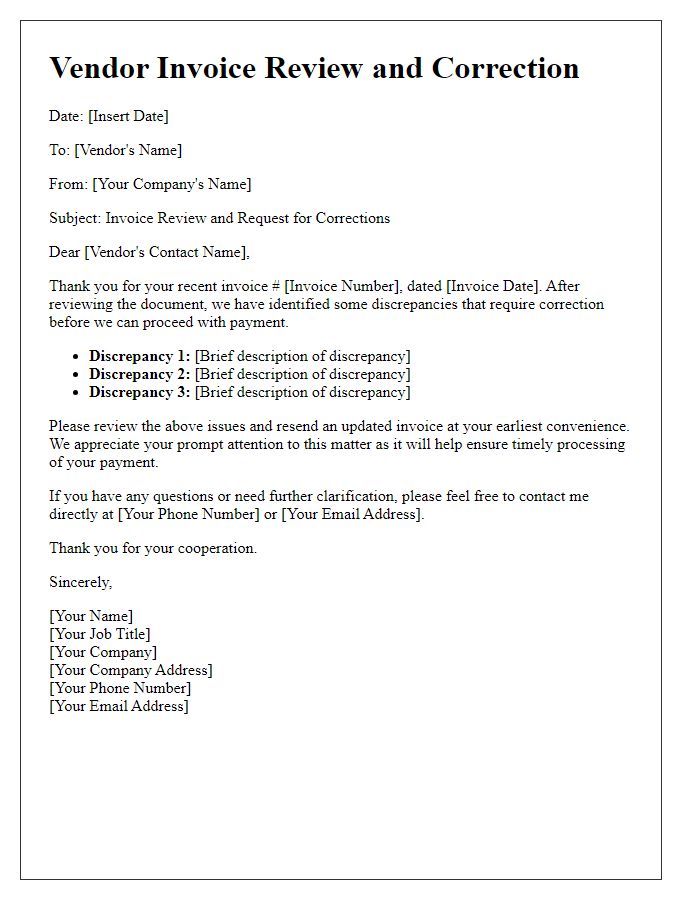

Invoice details and reference number

Discrepancies in vendor invoices often arise due to errors in line items, quantities, or total amounts, which can lead to confusion during payment processing. For instance, invoice number 12345 from Supplier ABC, dated September 15, 2023, indicates a quantity of 100 units at a rate of $10 per unit, totaling $1,000. However, the purchase order number PO6789 specifies only 80 units were ordered. This mismatch in quantities requires immediate clarification to ensure accurate financial records. Prompt resolution of such discrepancies is essential for maintaining positive vendor relationships and ensuring timely payments.

Specific discrepancy description

Discrepancies in vendor invoices, such as incorrect item quantities or pricing errors, can cause significant issues in accounting processes. For instance, an invoice for 150 units priced at $20 each should total $3,000, but if the vendor mistakenly lists the total as $3,200 due to an error in unit price or quantity, it creates a need for clarification. Accurate records should be cross-referenced against purchase orders and delivery receipts. Addressing these discrepancies requires detailed documentation to ensure proper resolution, maintain good vendor relationships, and ensure accurate financial reporting. Prompt communication, including invoice number, date, and specific line items affected, can facilitate a quicker resolution process.

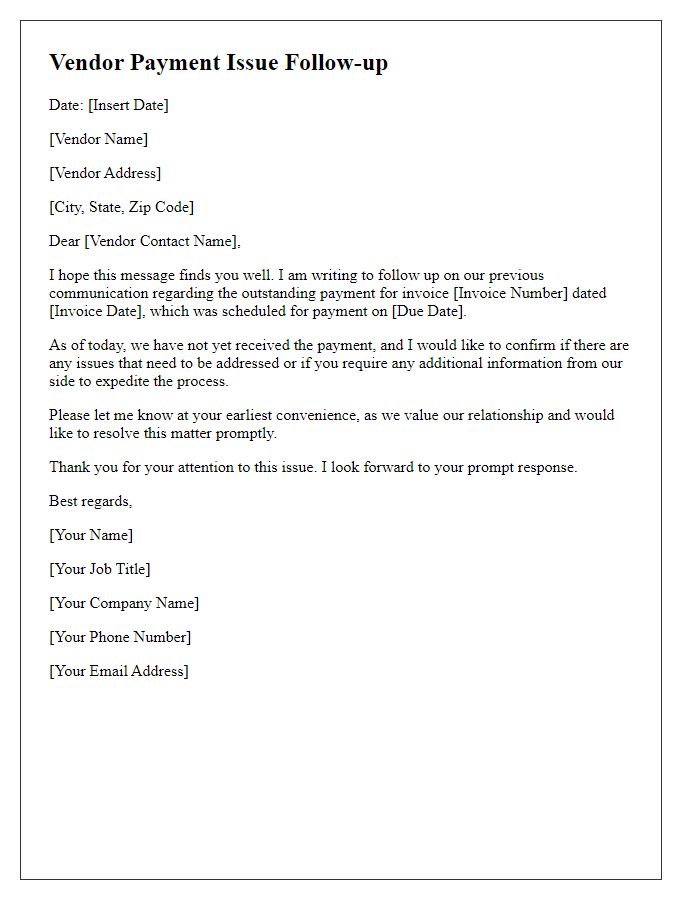

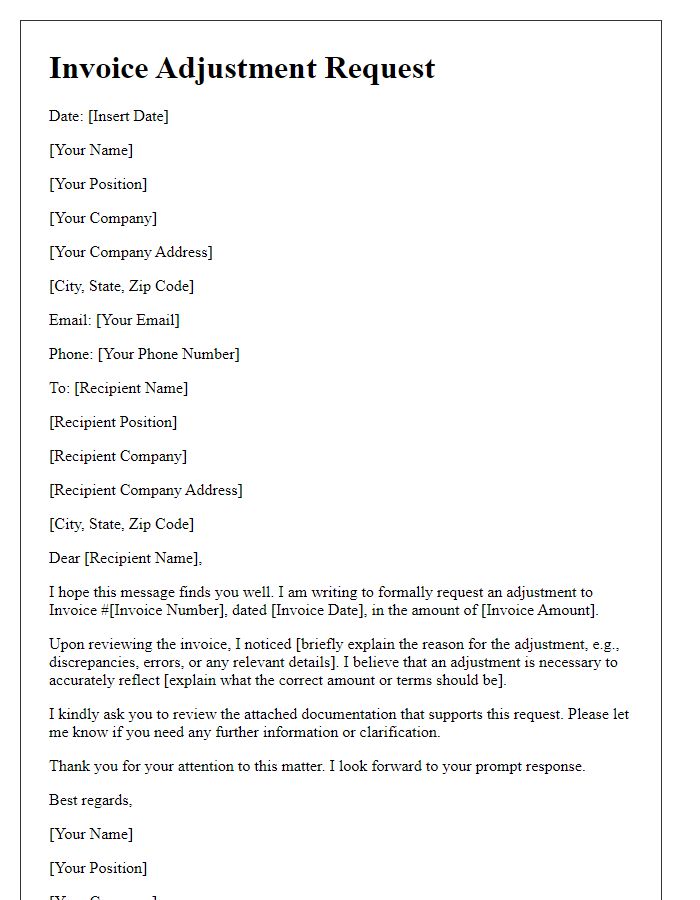

Requested action or resolution

A vendor invoice discrepancy often arises during the billing process, leading to inaccuracies that can impact financial reporting for both parties. For instance, an invoiced amount of $5,000 for delivered goods may differ from the quoted amount of $4,800 agreed upon in the procurement contract. This discrepancy might stem from incorrect quantities billed, pricing errors, or additional charges for services not previously discussed. Prompt resolution of such issues is essential for maintaining clear financial records and ensuring timely payments. Communication between accounting departments can facilitate a review of relevant documents, including purchase orders and delivery receipts, to clarify the discrepancies and agree on a revised invoice amount.

Contact information for follow-up

Vendor invoice discrepancies often occur due to miscommunication regarding payment terms, pricing, or quantities. Maintaining organized records of invoices is essential to identify any discrepancies promptly. For clarification, contact information should include a direct line or email address for the vendor's accounting department, such as invoices@companyname.com. It's crucial to document specific invoice numbers, amounts, and the corresponding dates (e.g., invoice #1234, dated July 15, 2023) when reaching out. Providing a detailed summary of the issue will facilitate quicker resolution. Effective communication is vital in ensuring accurate bookkeeping and maintaining vendor relationships.

Comments