Are you navigating the often complex world of vendor invoice approvals? It can be a daunting task, but having the right template at your fingertips can streamline the process significantly. In this article, we'll explore an easy-to-follow letter template that not only simplifies your workflow but also ensures clarity and transparency with your vendors. Keep reading to discover tips and tricks for crafting an effective invoice approval letter!

Vendor Information

Vendor information is crucial for processing invoices efficiently. Essential details include the vendor's legal name, registered with the local business authority, and the unique tax identification number (TIN) used for tax purposes. The physical address should include street, city, state, and zip code, ensuring accurate correspondence and delivery. Contact information such as a phone number and email address provides direct communication channels for any inquiries or issues related to the invoice. Payment terms should specify conditions, such as net 30 days, highlighting the timeframe for clearing payments. Additionally, including the vendor's banking information is vital for electronic fund transfers, delineating account number and routing number for precise transactions.

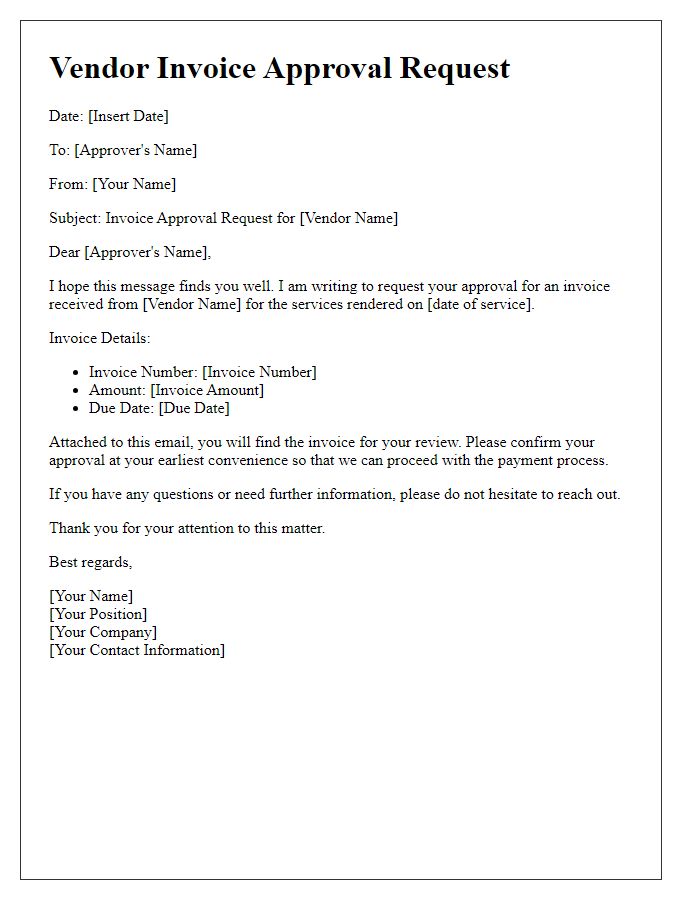

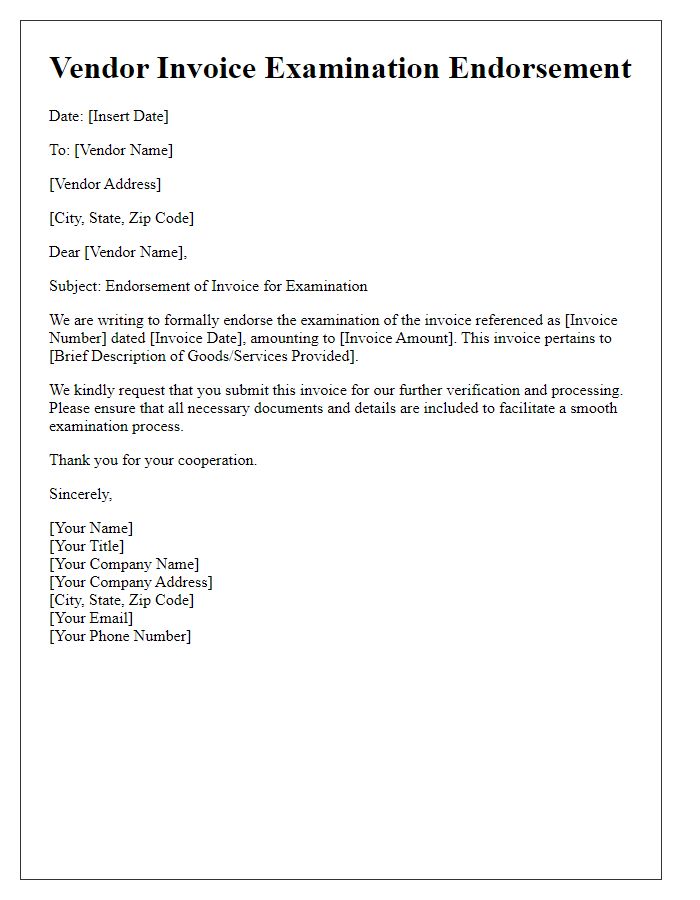

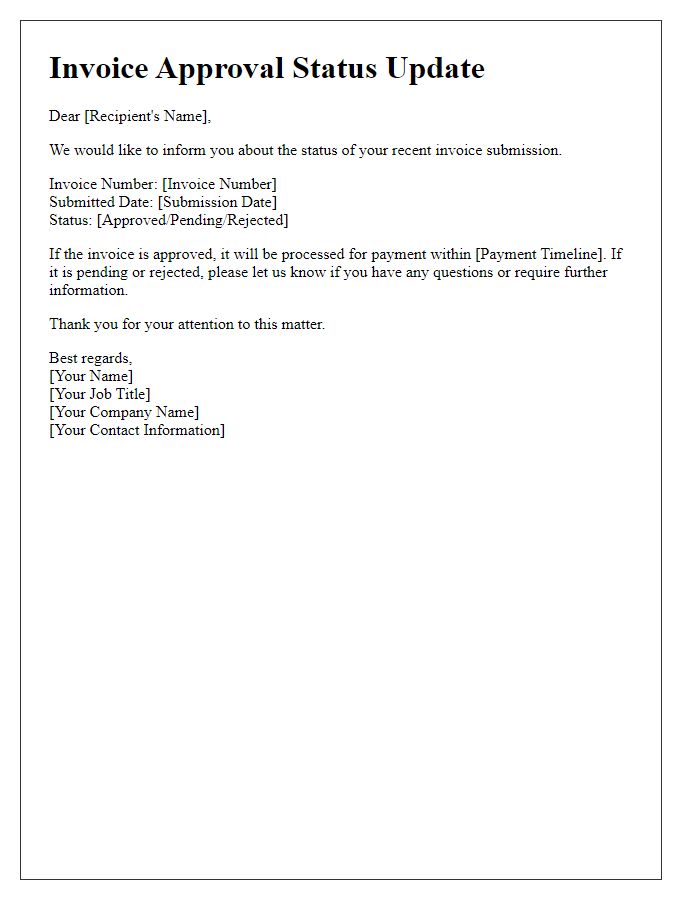

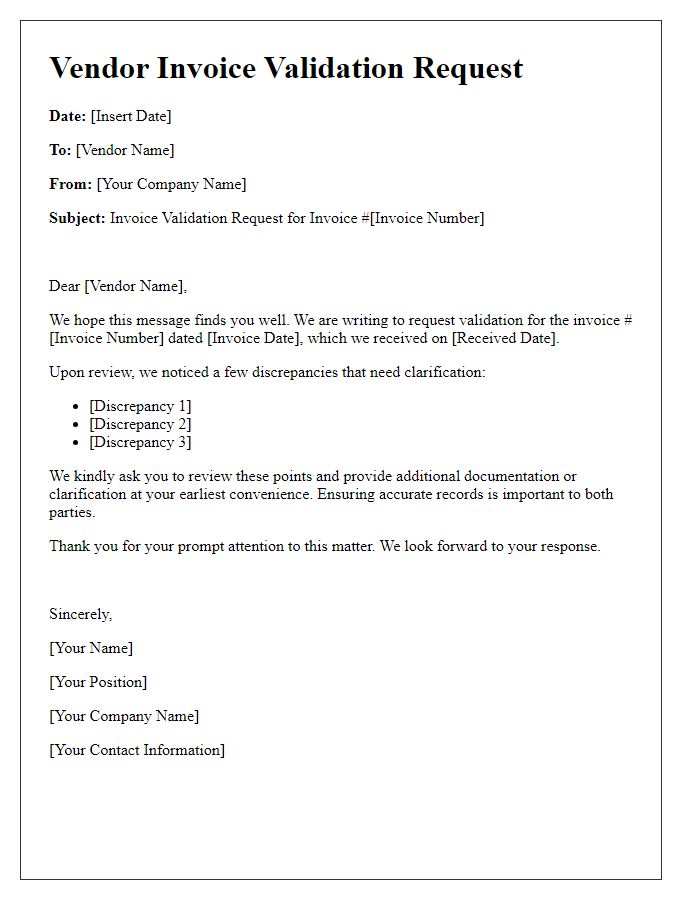

Invoice Details

An efficient vendor invoice approval process is vital for maintaining accurate financial records. Invoice details typically consist of elements such as invoice number (unique identifier assigned by the vendor), date of issue (date the invoice was created), due date (when payment is expected), and total amount due (the sum of all charges listed). Additional components include a breakdown of services or products provided, along with quantities and prices, which support verification against purchase orders (documents authorizing the purchase). Vendor information (such as name, address, and contact details) must also be accurately recorded. Ensuring that these details are meticulously checked can prevent discrepancies and uphold integrity in payment systems.

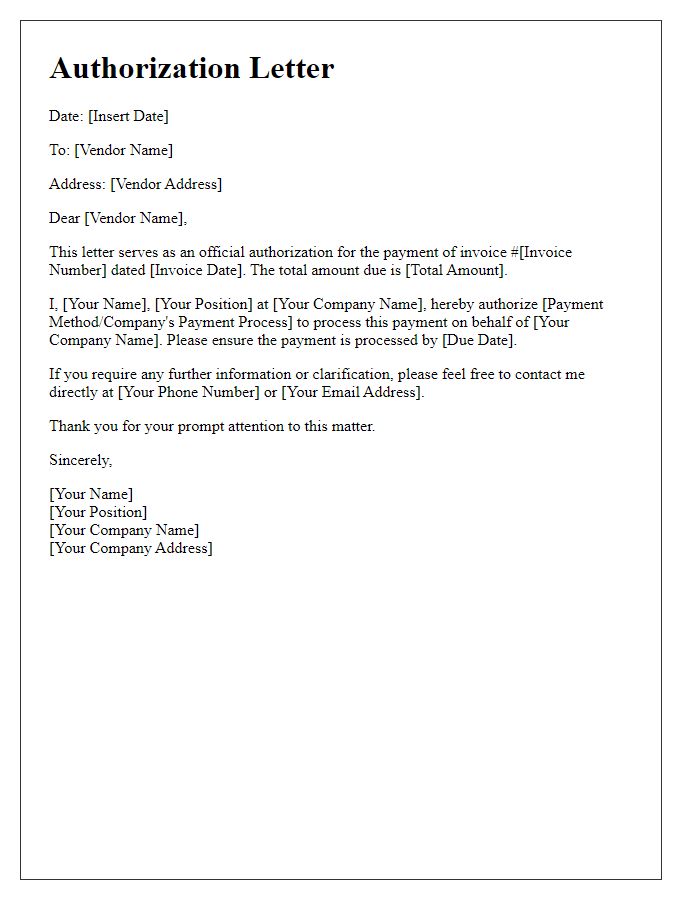

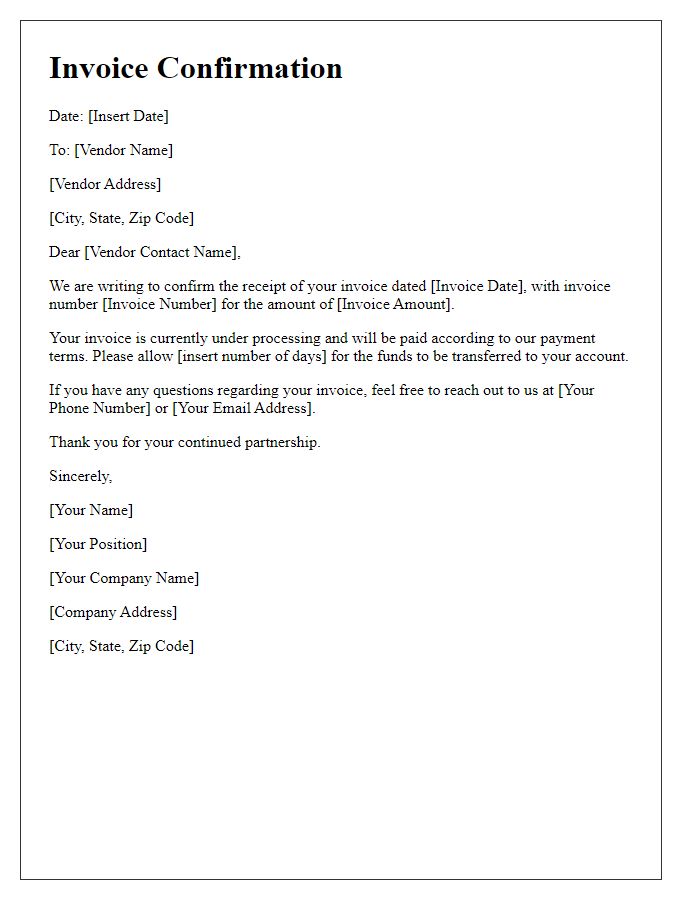

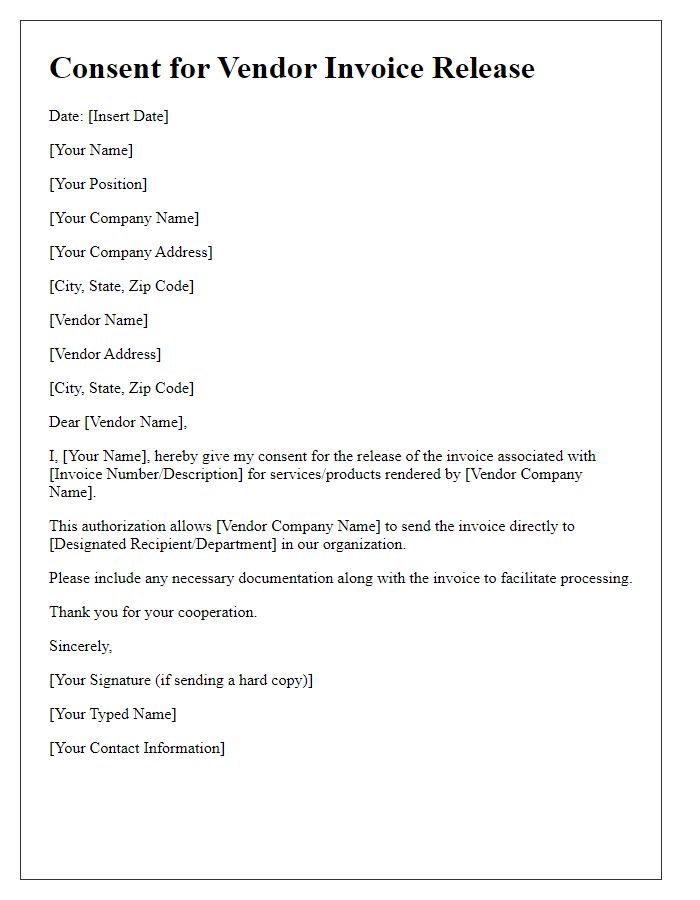

Approval Confirmation

Vendor invoice approval processes can involve multiple steps, ensuring accuracy and compliance. An invoice (a document requesting payment for goods or services rendered) typically includes essential details like invoice number, vendor name, itemized list of services/products, and total amount due. Once the accounts payable department reviews the invoice, it is matched with purchase orders and receipts to validate authenticity. Approval notifications are then sent to the relevant stakeholders, ensuring timely payment and maintaining good relationships with vendors. Documentation should be stored in a dedicated system for future reference and audit purposes, enhancing financial accountability.

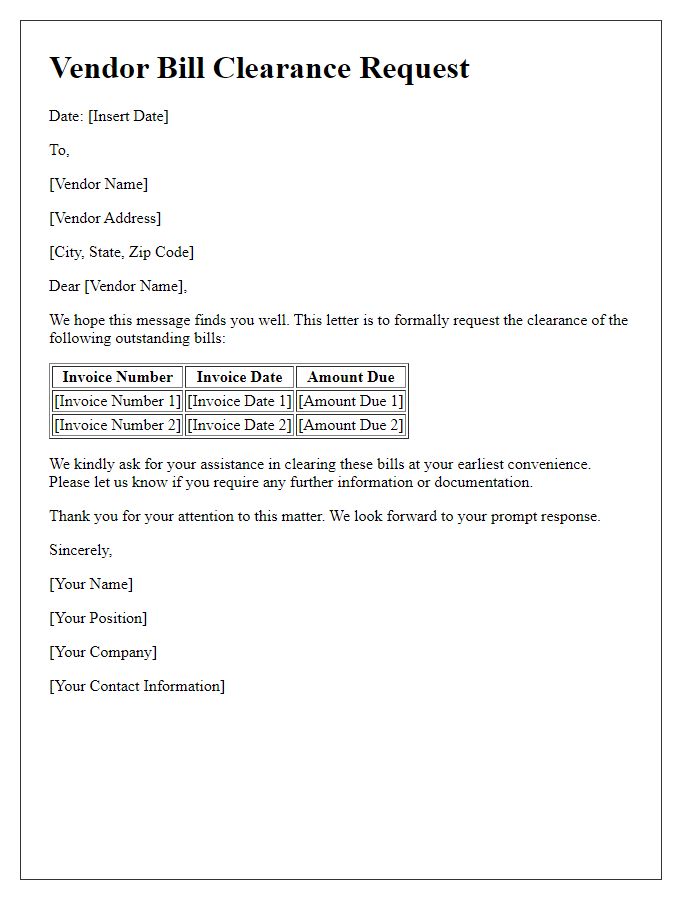

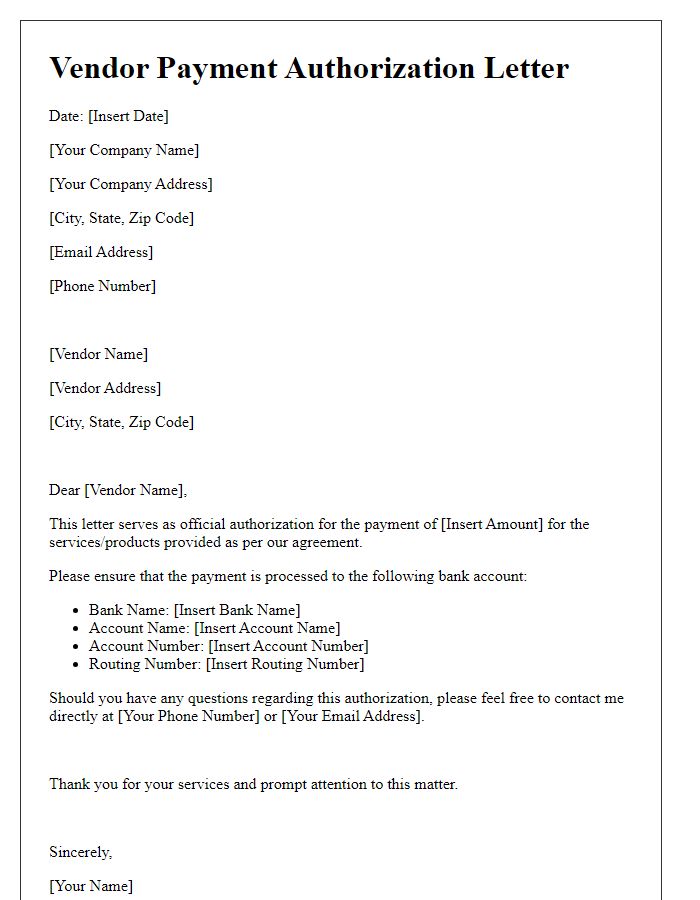

Payment Terms

Vendor invoices often include specific payment terms that outline the conditions under which payment will be made. These terms can vary widely among businesses and industries. For instance, Net 30 indicates that the payment is due within 30 days of the invoice date, while early payment discounts, such as 2/10 Net 30, offer a 2% discount if the invoice is paid within 10 days. Clear payment terms are essential for maintaining positive relationships with vendors and ensuring timely processing of invoices. Additionally, including details such as late payment fees, allowed methods of payment, and any necessary documentation for approval streamlines the invoice handling process, contributing to efficient cash flow management within the organization.

Contact Information

Vendor invoices must include comprehensive contact information, which is crucial for processing and approval. Vendor names should be clearly stated, accompanied by addresses that include street names, city names, state codes, and zip codes for accuracy. Important contact numbers must be provided, including both primary phone numbers and alternative contacts such as fax numbers (often in the format of area codes) or email addresses. This information ensures seamless communication during invoice inquiries or issues. Accuracy in this section minimizes disruptions in payment processes, facilitating timely transactions and maintaining vendor relationships.

Comments