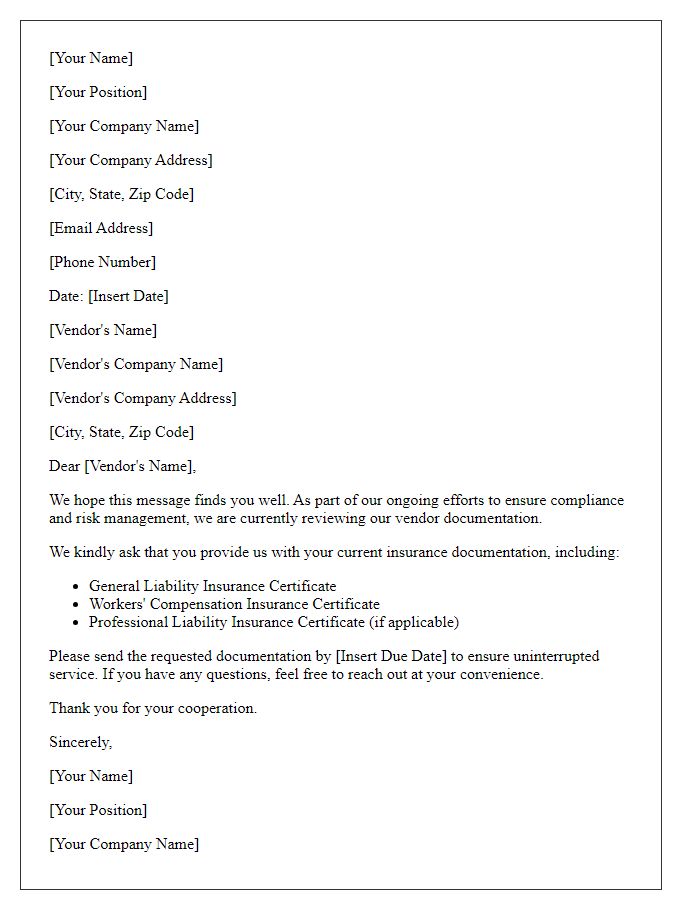

Are you ready to ensure that your vendor partnerships are secure and compliant? Confirming insurance coverage with your vendors is a vital step to protect your business from potential risks and liabilities. By establishing clear communication about insurance requirements, you create a foundation of trust and accountability. So, let's dive into the details of crafting the perfect letter for vendor insurance coverage confirmationâread on to learn more!

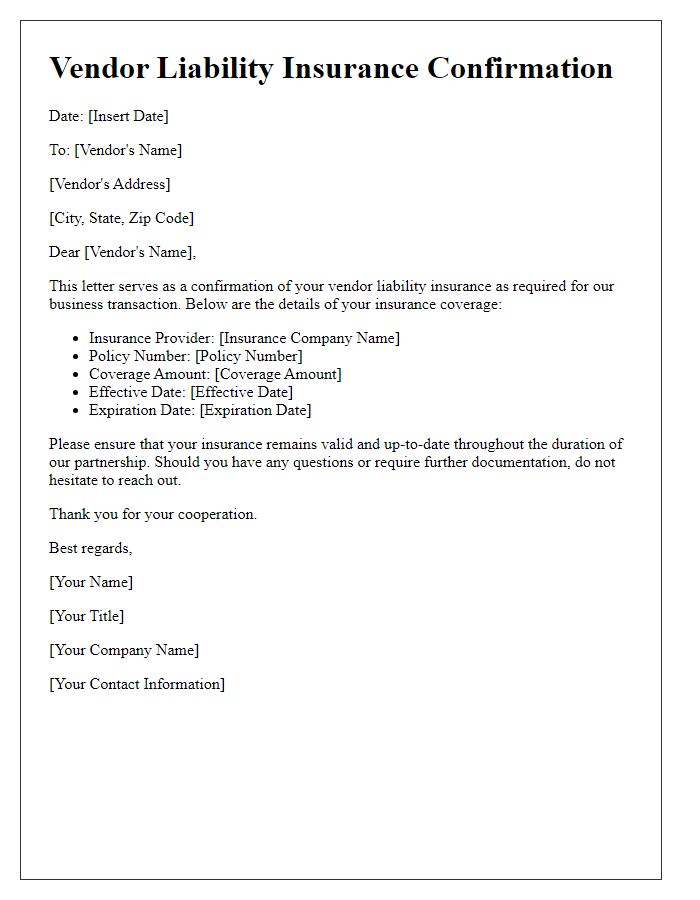

Vendor's Full Legal Name and Contact Information

Vendor insurance coverage confirmation is crucial for maintaining compliance and protecting against potential liabilities in business transactions. Vendors such as ABC Supplies LLC, located at 123 Commerce St, Springfield, USA, play a significant role in ensuring the smooth operation of various projects. Insurance policies, including general liability, professional indemnity, and workers' compensation, should be verified for adequacy and currency. For instance, general liability coverage must meet a minimum limit, often around $1 million per occurrence, to ensure protection against claims of bodily injury or property damage during business operations. Regular updates and reviews of these insurance documents, including coverage limits and expiration dates, are vital for both parties to mitigate risks effectively while fostering a secure business relationship.

Insurance Provider's Details and Policy Number

Vendor insurance coverage confirmation is essential for ensuring compliance with contractual obligations. Insurance provider details, such as company name (e.g., ABC Insurance Services), contact information, and physical address, are critical for verification processes. Additionally, the insurance policy number (e.g., 123456789) serves as a unique identifier for the specific coverage plan. This information ensures clarity in assessing liability coverage, including general and professional liability limits. It also confirms the duration of coverage, which is typically outlined in the policy documents. Accurate details streamline communication between all parties involved, fostering transparency and trust in business relationships.

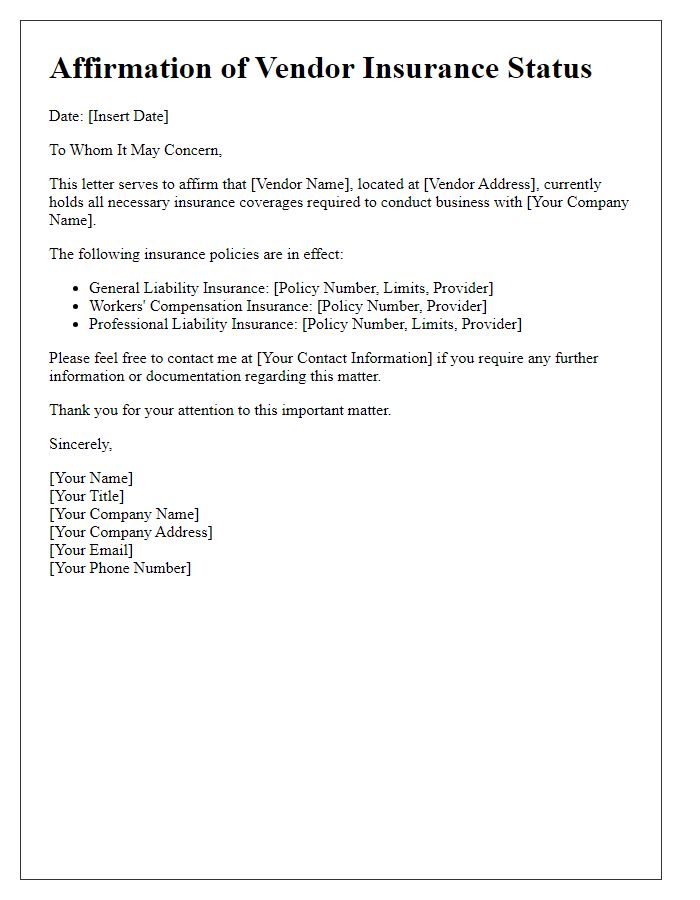

Type and Scope of Insurance Coverage

Vendors often require specific insurance coverage to comply with contracts and protect against potential liabilities. Standard insurance policies may include General Liability Insurance, which covers bodily injury and property damage, typically with coverage limits of $1 million per occurrence and $2 million in aggregate. Additional coverage types may involve Professional Liability Insurance, safeguarding against claims of negligence or malpractice in service provision, often with similar coverage limits. Workers' Compensation Insurance is vital for protecting employees in case of job-related injuries, generally mandated by state laws. Moreover, Commercial Auto Insurance is necessary for vendors using vehicles in business operations, ensuring coverage for damages caused during transportation. Vendors must provide proof of these insurance coverages, detailing the type and limits, to demonstrate compliance with the contractual insurance requirements.

Effective Dates of Coverage

Vendor insurance coverage confirmation is essential for risk management in business operations. This document typically outlines the effective dates of coverage, which indicate the specific period during which the vendor's insurance policy is active. Insurance coverage may include general liability, property damage, and workers' compensation. Accurate record-keeping is important, as policies often have renewal dates that could affect a company's liability and financial security. Clear communication about coverage effective dates helps to ensure compliance with contractual obligations and protects both parties from potential legal liability in case of incidents. Regular updates throughout the year are encouraged to keep all stakeholders informed.

Signature and Authorization of Insurance Provider

Insurance coverage confirmation is vital for businesses working with vendors. The document requires detailed information about the insurance provider, including their name, address, and contact number, ensuring prompt communication in case of claims. Furthermore, it specifies the types of coverage held by the vendor, such as general liability, professional liability, and workers' compensation, providing clarity on the extent of protection. The document also necessitates signatures from both the vendor and the insurance provider, indicating authorization and agreement to the terms outlined within the confirmation. This formal acknowledgment serves as a safeguard for both the business and its partners, as it verifies compliance with risk management protocols and diminishes potential liabilities.

Comments