Have you ever found yourself staring at a bank statement or bill that just doesn't add up? It can be frustrating when you notice an incorrect charge, leading to the need for a reimbursement request. Navigating this process doesn't have to be daunting, and with the right letter template, you can effectively communicate your concerns and get the resolution you deserve. Interested in learning how to draft the perfect letter for your situation? Keep reading for some helpful tips!

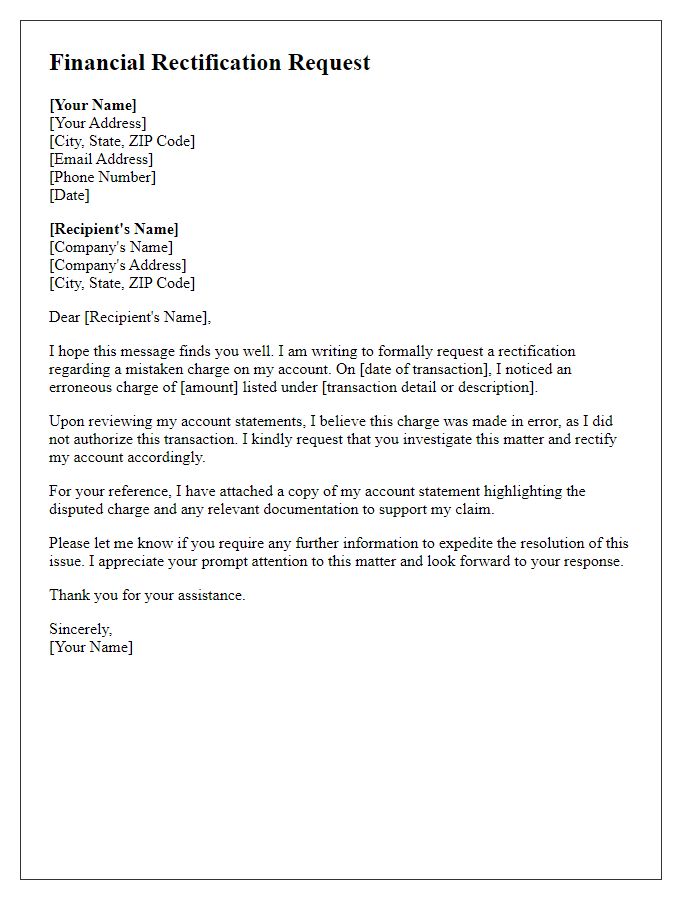

Clear subject line

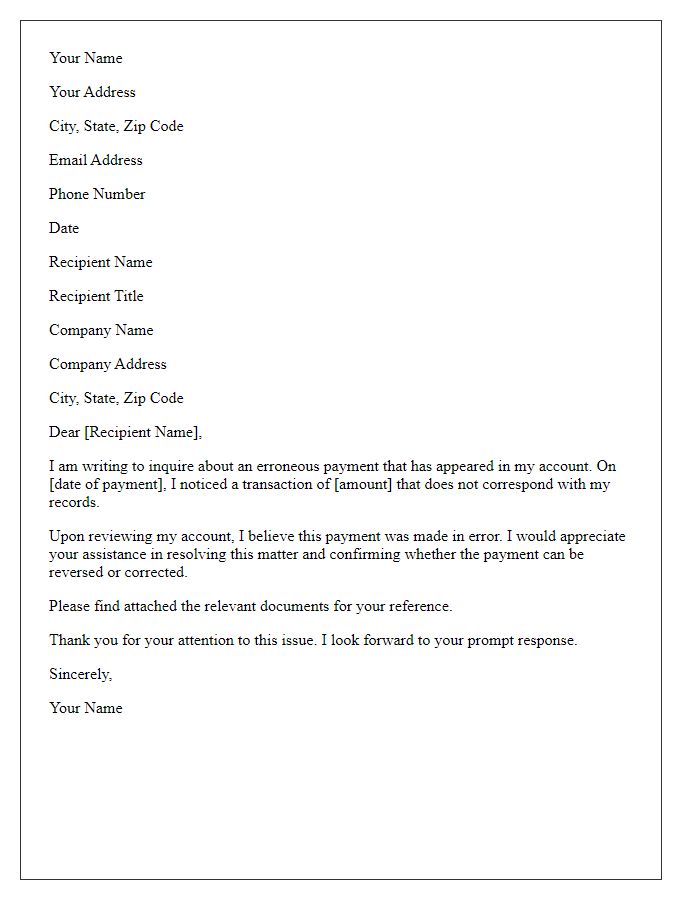

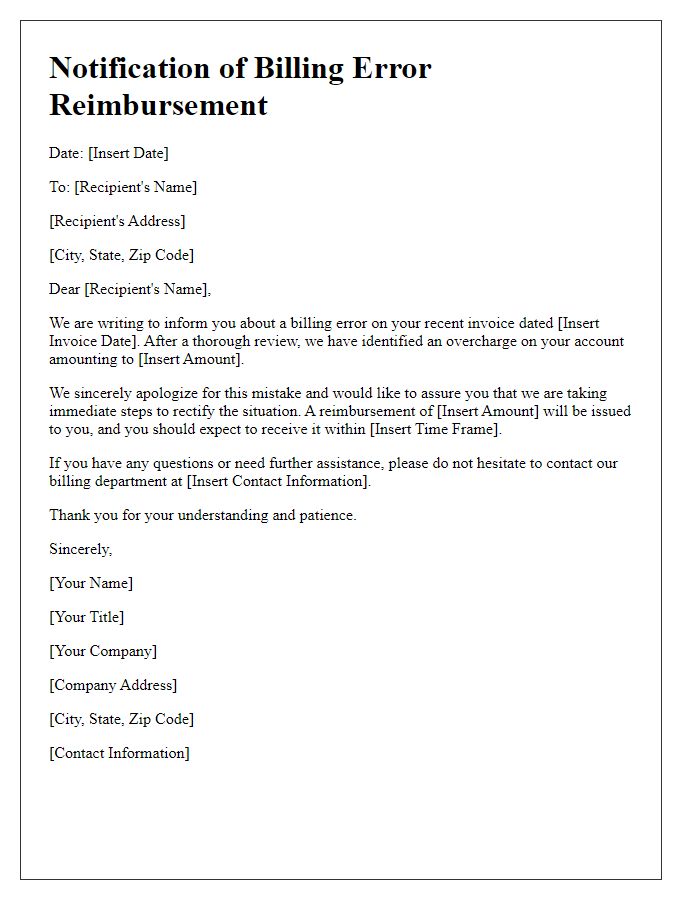

Incorrect charge reimbursement requests often arise due to billing discrepancies. Customers may notice unexpected fees on their credit card statements, such as duplicate charges or unauthorized transactions. For example, a $49.99 monthly subscription fee could appear multiple times if an error occurs during processing. Resolving these issues typically involves contacting customer service for an explanation and proof of the erroneous charge. If unresolved, customers might escalate the matter to their bank or credit card issuer, providing supporting documentation such as transaction records and correspondence related to the dispute. It's essential to act promptly, as financial institutions may have time limits for disputing charges, often within 60 days of the statement date.

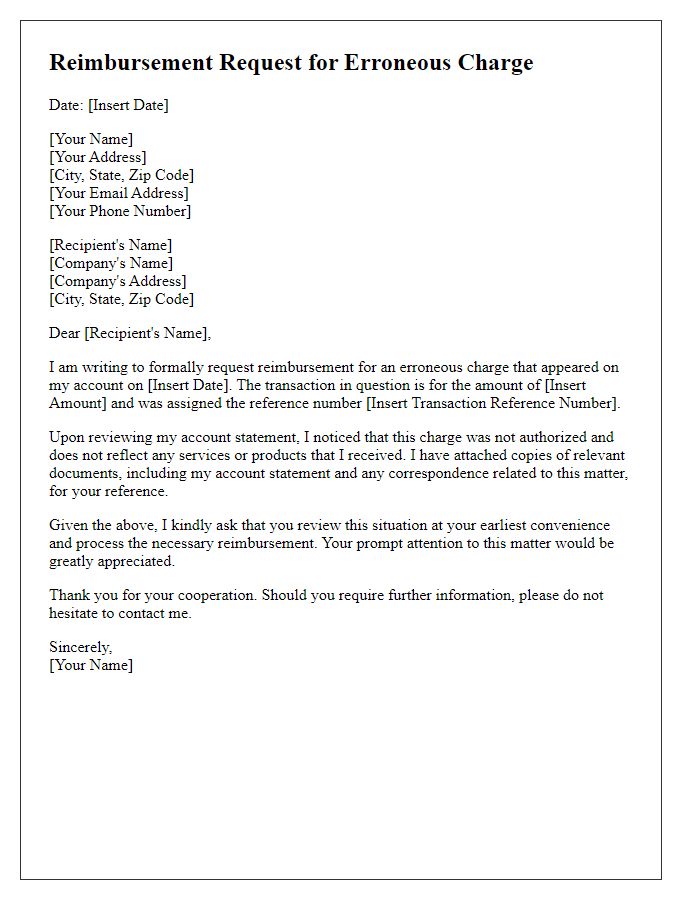

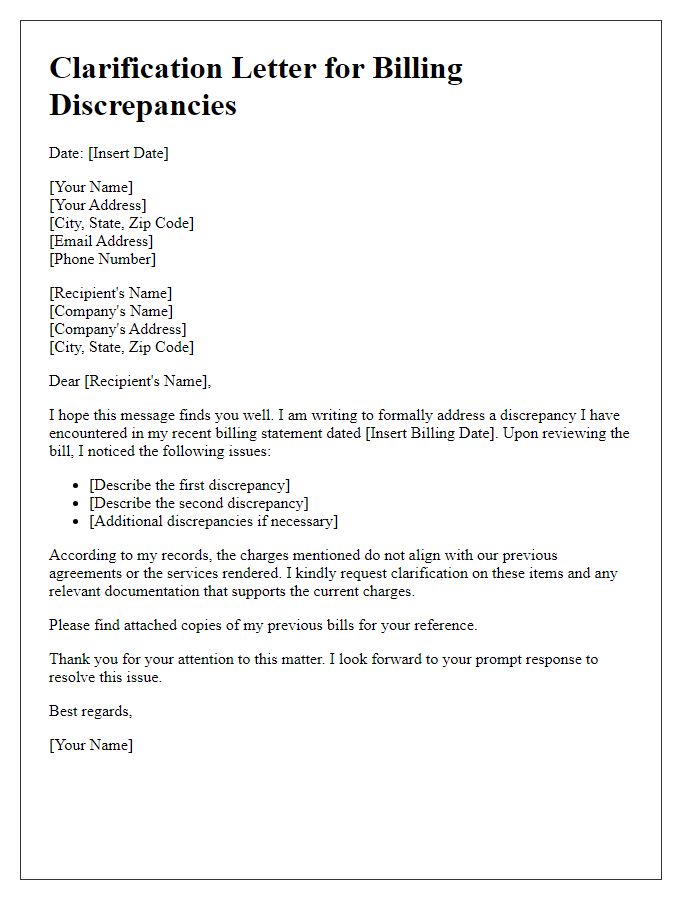

Formal salutation

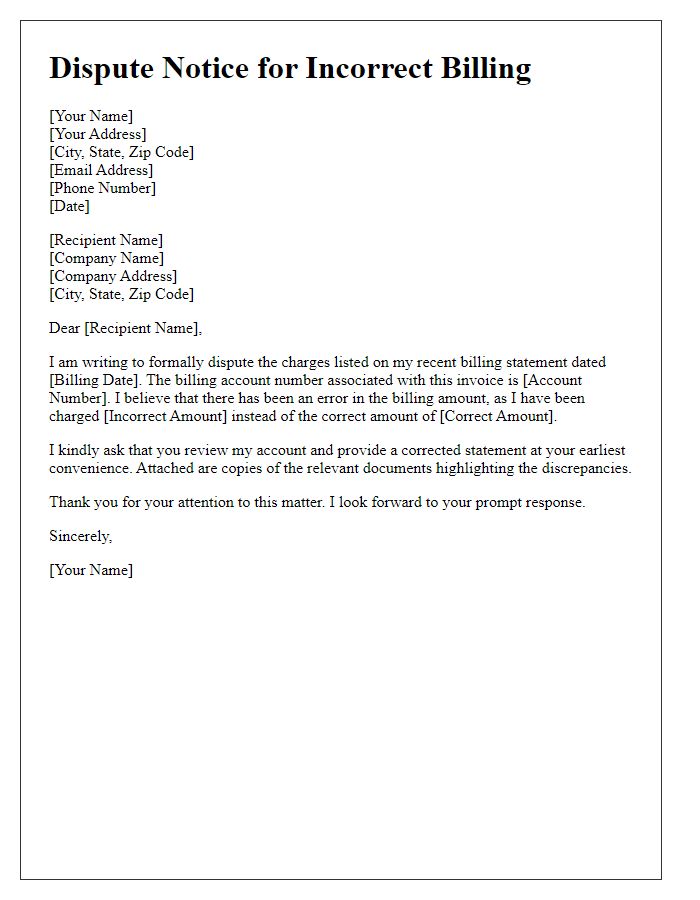

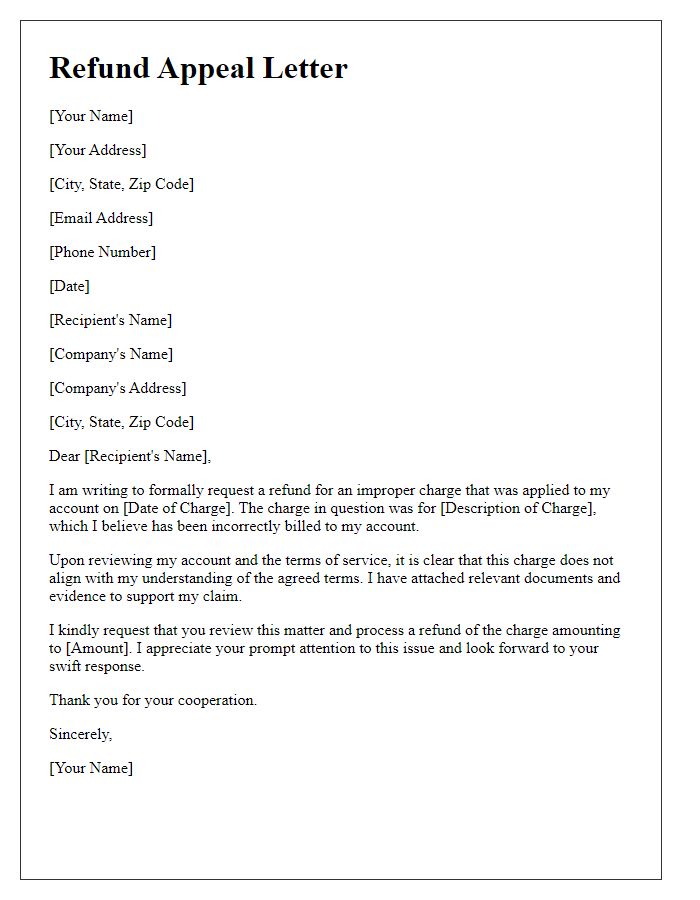

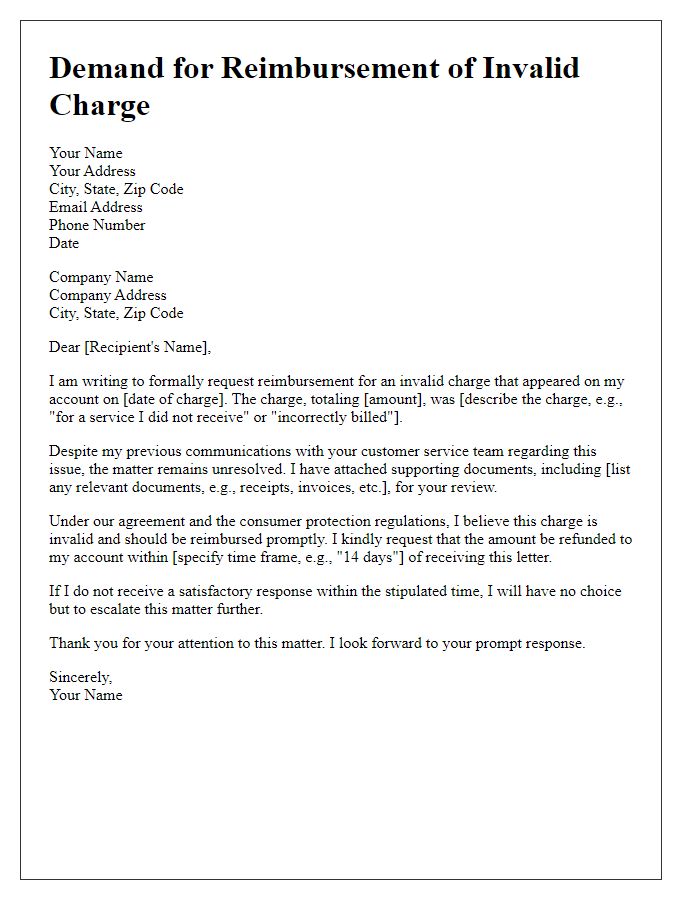

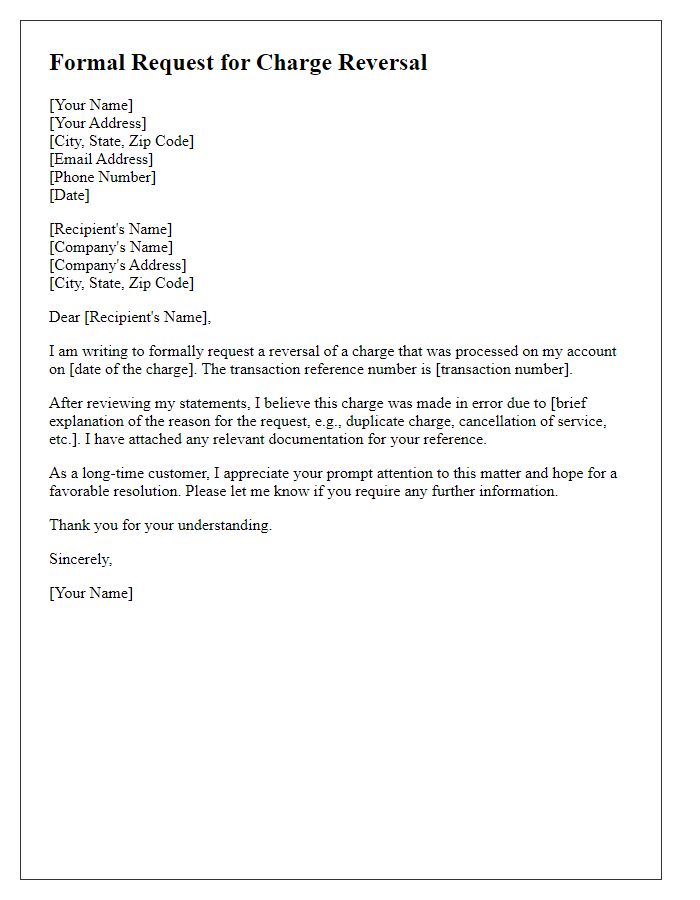

To request a reimbursement for an incorrect charge, it's essential to present clear details regarding the transaction and the nature of the discrepancy. Outline the specific amount charged erroneously, along with the date of the transaction and the associated account or order number. Clearly express the reason for the request, referencing any policies or agreements that support your claim. Include any documentation that substantiates your request, such as receipts or correspondence. It's crucial to maintain a polite and professional tone throughout the correspondence. Indicate your contact information for swift communication regarding the resolution of the reimbursement.

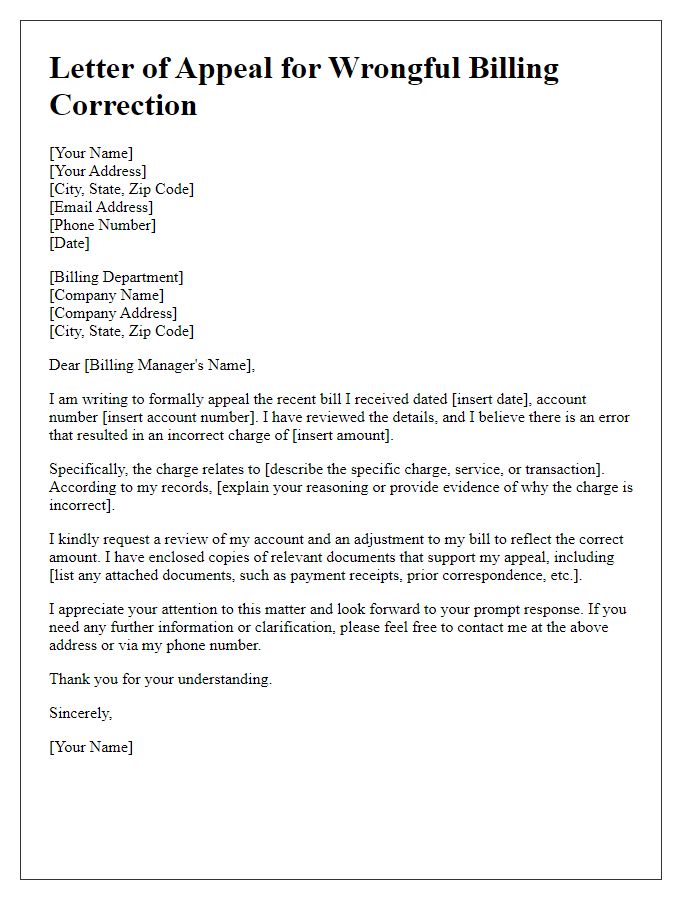

Detailed explanation of the incorrect charge

A recent review of my account statement revealed an incorrect charge of $120.50 dated September 15, 2023, from XYZ Services, a subscription-based company offering online content. This charge does not align with my subscription plan, which is a monthly fee of $99.99. Furthermore, I did not authorize any additional services or upgrades that would justify this extra fee. I have attached my billing history, indicating the lack of prior notifications regarding changes to my subscription plan. This discrepancy raises concerns about the billing practices of XYZ Services, and I kindly request a thorough investigation into this matter to facilitate a prompt reimbursement of the incorrect charge.

Supporting documentation

Incorrect charges on billing statements can lead to financial discrepancies for consumers. A detailed review of the account statement may reveal erroneous fees, such as unauthorized transactions or duplicate charges. Supporting documentation, including transaction receipts, bank statements, and correspondence with the service provider, is crucial for substantiating the claim. For instance, if a customer encounters a $150 charge from a restaurant chain, they should provide a receipt showing the correct amount paid, along with any communication made to the restaurant regarding the charge. This documentation aids in resolving disputes and facilitates timely reimbursement.

Request for prompt resolution

Incorrect charges on credit card statements can significantly impact financial planning and budgeting accuracy. For instance, an erroneous $150 charge on a Visa card could lead to overdraft fees in accounts linked to automatic payments. A case of this nature, reported to the customer service department at a company like Amazon, may result from a billing system glitch or a failure to apply promotional discounts. Swift action is necessary, as delays in resolution could harm customer trust and lead to potential loss of business. Proper channels must be utilized to escalate the access request, ensuring relevant transaction details such as date, amount, and description are documented for a timely response.

Comments