Are you facing a frustrating situation with a bill that just doesn't seem right? It can be overwhelming to navigate the complexities of billing disputes, especially when you feel your concerns are not being taken seriously. In this article, we'll guide you through crafting the perfect formal letter to address your bill payment dispute, making sure your voice is heard clearly and effectively. So, let's dive in and empower you to tackle that billing issue head-on!

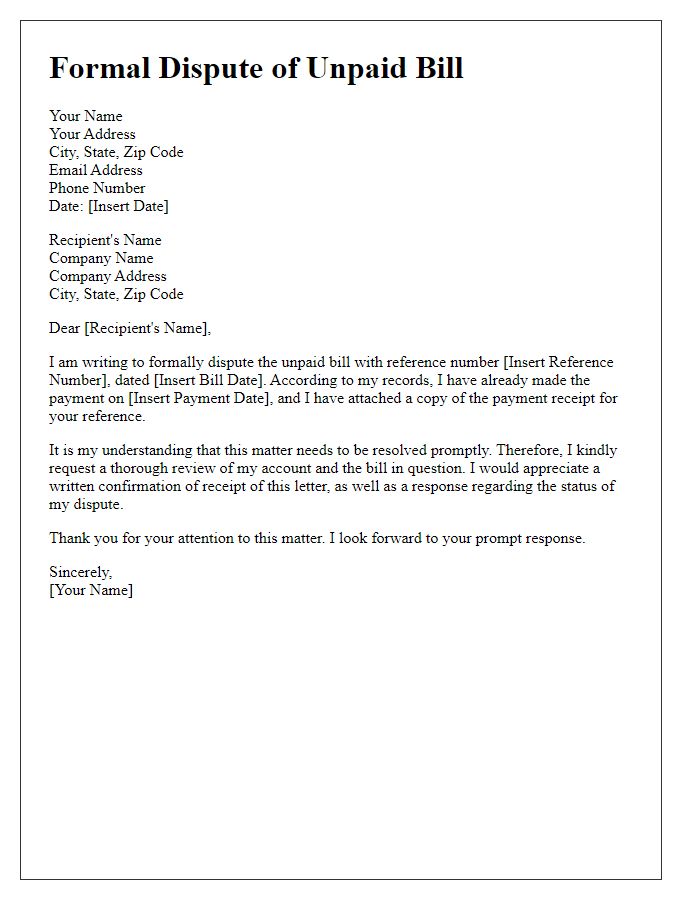

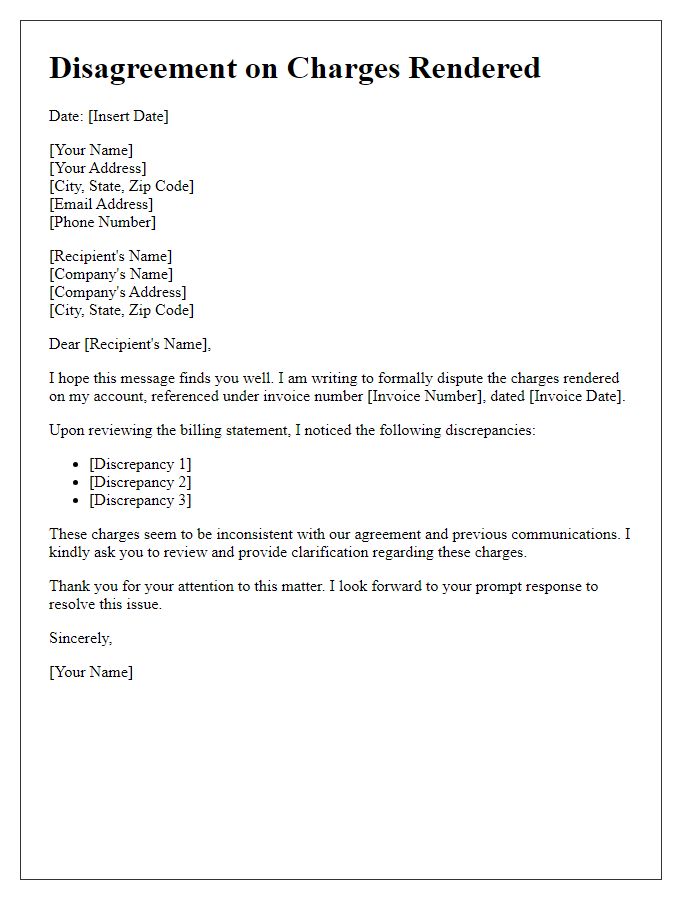

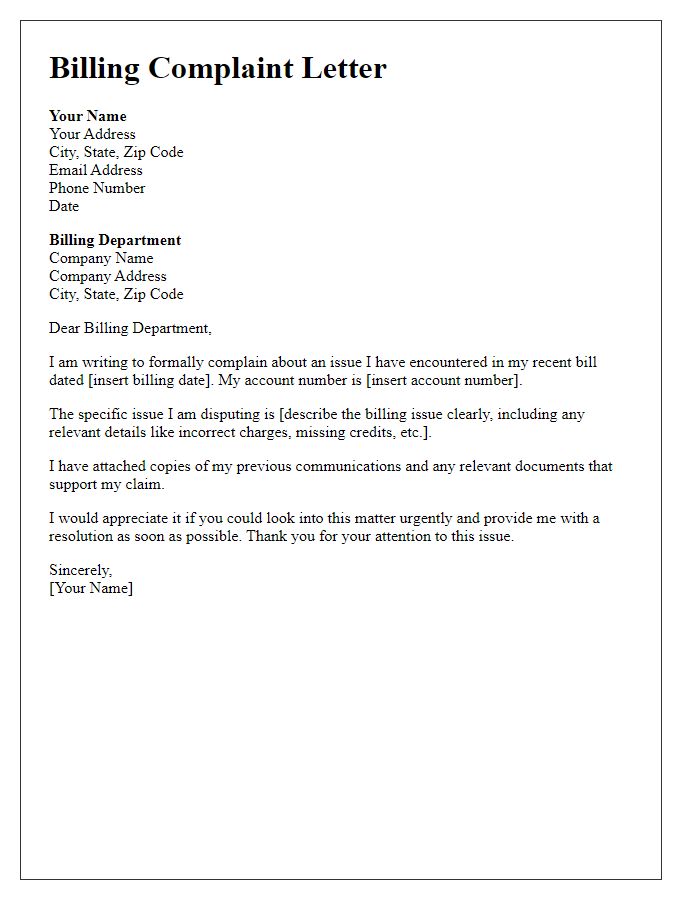

Sender's Contact Information

Disputes regarding bill payments can stem from various issues including incorrect charges, service discrepancies, or unauthorized fees. Accurate documentation such as account numbers and billing dates (for instance, January 2023) is crucial for resolving these matters efficiently. Specific service details, like the internet plan (e.g., 100 Mbps broadband service), can further clarify the nature of the dispute. Providing a concise summary of the charges in question, with clear references to the billing statement (such as invoice number 456789), will facilitate a more effective communication process with the billing department of the relevant company.

Recipient's Contact Information

A formal bill payment dispute requires careful documentation of relevant details. The Recipient's Contact Information should include the following key elements: the complete name of the recipient (for example, John Smith), the title or position of the recipient (such as Billing Manager), the organization's name (like ABC Utility Company), and the full mailing address (including street number, city, state, and ZIP code, for example, 123 Main St, Springfield, IL, 62701). Additionally, the contact number (including area code, for instance, (555) 123-4567) and email address (for example, john.smith@abcutility.com) are crucial for direct communication regarding the dispute. Proper formatting ensures clarity and professionalism in the correspondence.

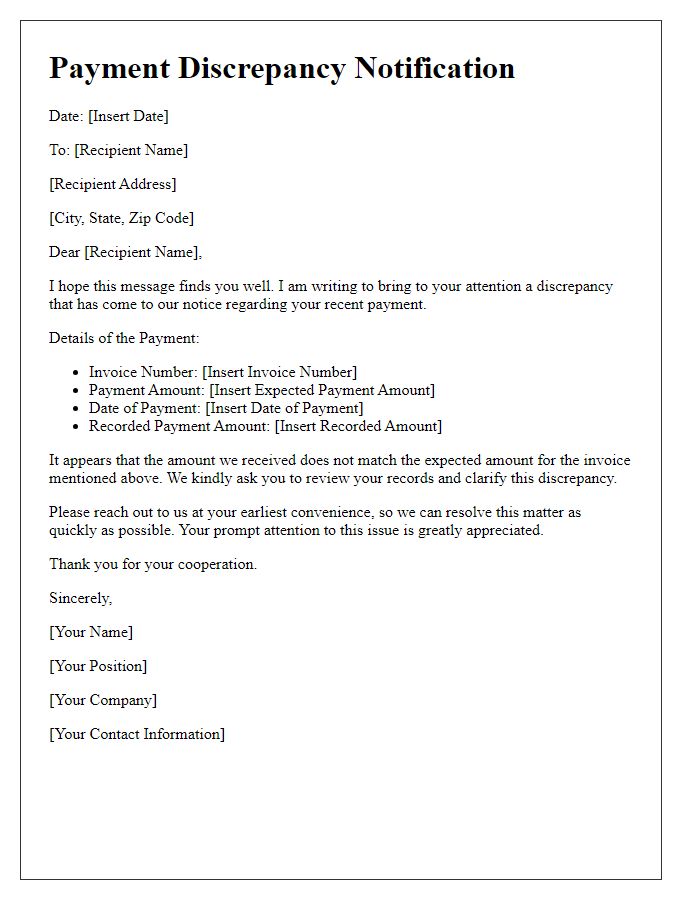

Subject Line: Clearly Define Purpose

Formal bill payment disputes can occur due to discrepancies in amounts charged, disputed services, or unauthorized fees. Customers must gather relevant documents, such as payment receipts and service agreements, to support their claims. For instance, a discrepancy noted on a utility bill from XYZ Energy Company for September 2023 may involve a charge of $150, while the expected payment based on previous months averages $120. Clear communication is essential in resolving such disputes, as companies often have specific procedures in place for addressing billing issues. Timely submission of the dispute often leads to faster resolution, enabling customers to protect their financial interests effectively.

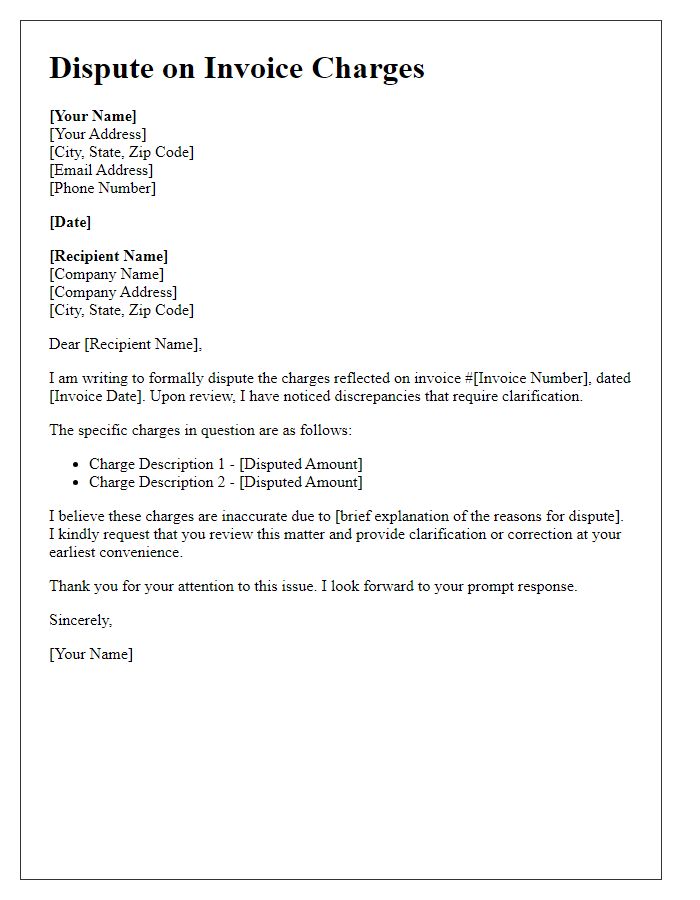

Detailed Explanation of Dispute

A formal bill payment dispute often arises when discrepancies occur between the billed amount and actual services rendered or agreed-upon terms. For instance, a customer may receive a utility bill from XYZ Electric Company, showing charges of $250 for the month of September 2023, despite prior agreements indicating a maximum charge of $200 due to a promotional discount. Additionally, the bill may include late fees of $30 applied even though the payment was submitted on the due date. Customers can refer to their payment records, including transaction timestamps from their bank statements, and corroborate discussions with customer service representatives to substantiate their claims. Engaging relevant documentation adds credibility to the dispute, ensuring a thorough examination of the billing process and accounting for all variables involved.

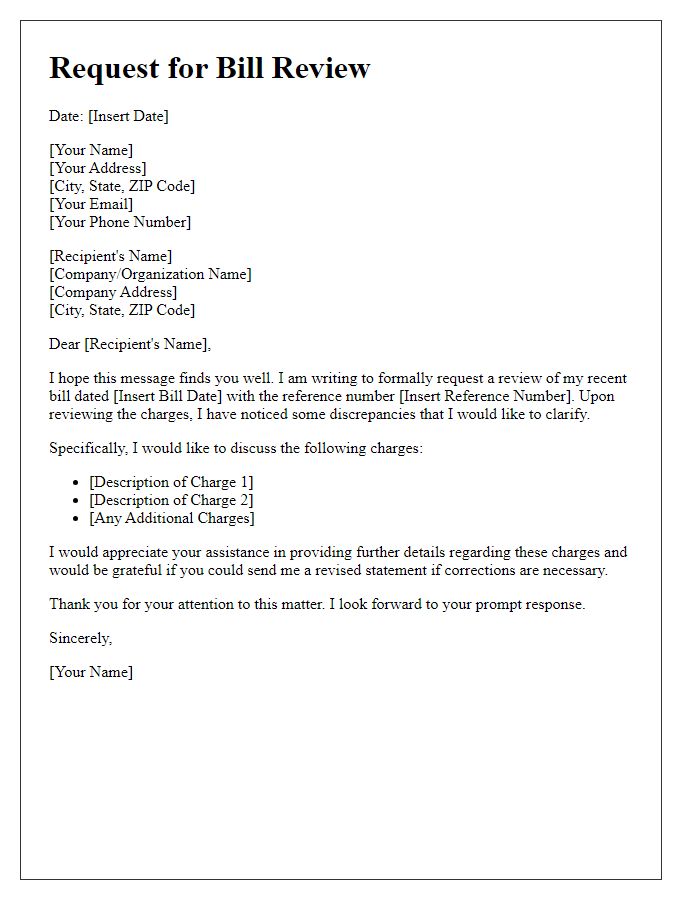

Request for Specific Action/Resolution

A formal bill payment dispute often arises from discrepancies in charged amounts, service failures, or unapproved transactions. The customer, typically aware of their account details and previous communications, asserts a claim based on evidence. The statement may include specific invoice numbers, dates of service, and the total disputed amount, emphasizing the urgency for resolution. It is essential to reference any previous correspondence or agreements related to the billing issue, which can strengthen the case. Prompt action from the billing department is crucial for maintaining trust and ensuring customer retention.

Comments