Are you feeling overwhelmed by a past due notice from your utility provider? You're not aloneâmany people experience financial hiccups from time to time, and it's important to respond appropriately to avoid further complications. Crafting a well-worded letter can be an effective way to communicate your situation and seek assistance. Read on to discover a helpful template and tips for constructing your response to get back on track.

Accurate Account Information

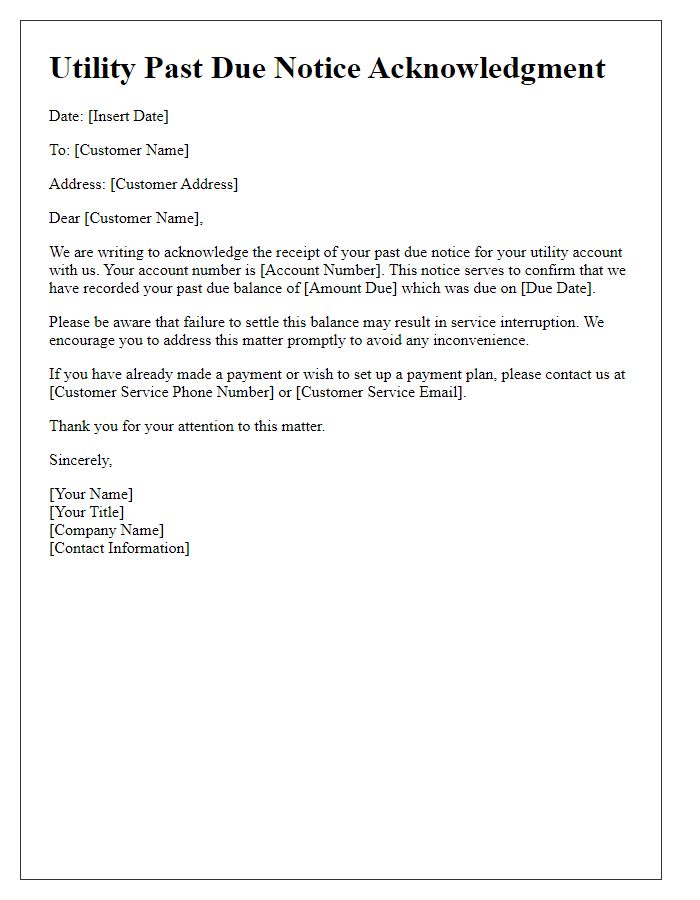

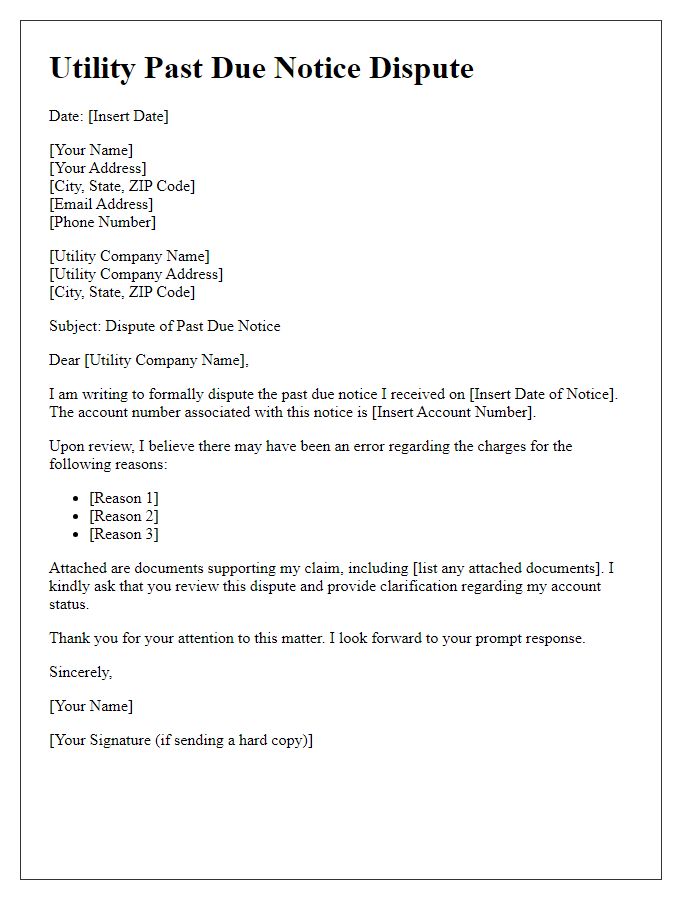

Accurate account information is crucial for effective communication between utility companies and their customers. Ensuring that account details, such as account number, billing address, and service address, are correct helps prevent misunderstandings related to past due notices. Inaccurate information can lead to missed payments or disconnection of services, impacting customer satisfaction. Customers should verify that their records correspond with utility records, particularly during transitional periods, such as moving or changing payment methods. Furthermore, utility companies may provide customer service hotlines or online portals to assist in updating this information promptly. Keeping detailed records of communications can also enhance the resolution process regarding disputes or inquiries about past due notices.

Clear Communication of Payment Intent

Timely payment of utility bills is crucial for maintaining services, especially in urban areas where public utilities like water, electricity, and gas directly impact daily living. For instance, overdue notifications are typically issued after a grace period of 30 days, signaling potential service disruption. Customers may communicate their intention to settle past due amounts through methods such as emails or customer service calls, ensuring clear communication with utility providers. Local regulations, often outlined in consumer protection laws, mandate that utilities must provide detailed payment plans or assistance options for financially struggling customers. Addressing past due notices promptly can prevent late fees and service disconnection, fostering a responsible customer-provider relationship.

Explanation for Delay

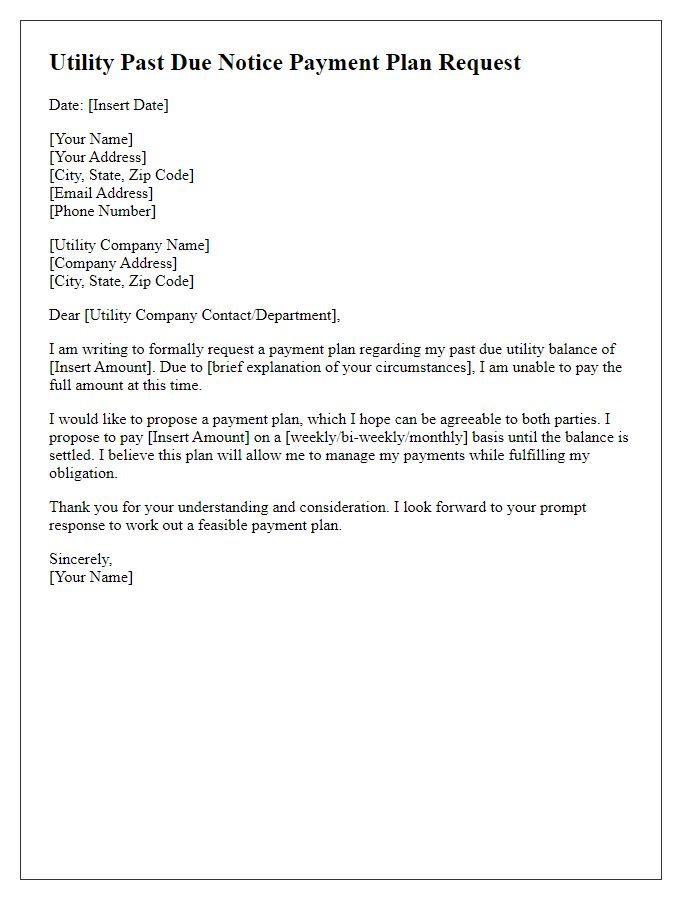

Customers sometimes face unexpected challenges that can lead to delays in utility bill payments. Financial hardships (like job loss or unexpected medical expenses) can disrupt cash flow, causing overdue balances. Communication during this time is crucial; reaching out to the utility provider can clarify options for payment plans or assistance programs. In some cases, utility companies, like Pacific Gas and Electric Company (PG&E) or Con Edison, may offer relief programs for low-income customers or those experiencing temporary difficulties, demonstrating a commitment to customer service and community support. Documenting the reasons for the delay, along with any relevant account numbers or payment history, can facilitate a constructive dialogue with the utility provider.

Commitment to Payment Plan

Utility payment plans offer vital support to customers facing financial difficulties in meeting their obligations. Such plans usually establish a structured arrangement, allowing customers to settle overdue amounts in manageable installments over a specified period. For example, a typical agreement might feature monthly payments--often between 10% to 25% of the overdue balance--spread out over several months, depending on the total amount owed and the individual's financial capacity. Customers who participate often benefit from reduced late fees and maintained essential services, promoting better management of personal finances while fostering positive relationships with service providers like local electricity or water companies. Responsiveness to past due notices is crucial for ensuring uninterrupted utility service and overall community well-being.

Contact Information for Resolution

Past due notices for utility bills can create significant stress for consumers, particularly households in urban areas. Utility companies, such as electric (e.g., Pacific Gas and Electric in California) or water services (e.g., New York City's Department of Environmental Protection), often send notices when payments are overdue by 30 days or more. In these notices, customers are typically encouraged to contact customer service (available 24/7) to explore resolution options. High utility rates, especially in metropolitan regions, can contribute to financial strain for many families. It is crucial for consumers to understand their options for payment plans or financial assistance programs, such as the Low-Income Home Energy Assistance Program (LIHEAP), which provides aid to qualifying individuals struggling with heating and cooling expenses. Timely communication with utility providers is essential for preventing service disconnection and ensuring continuous access to essential resources like electricity and water.

Comments