Hey there! If you've ever wondered how to navigate your utility account summary, you're in the right place. Understanding your utility bills doesn't have to be complicated, and breaking down the information can save you money and stress. Whether you're looking for ways to reduce your usage or simply want to stay informed, this article will provide you with all the tips you need. So, let's dive in and uncover some helpful insights together!

Account Holder Name

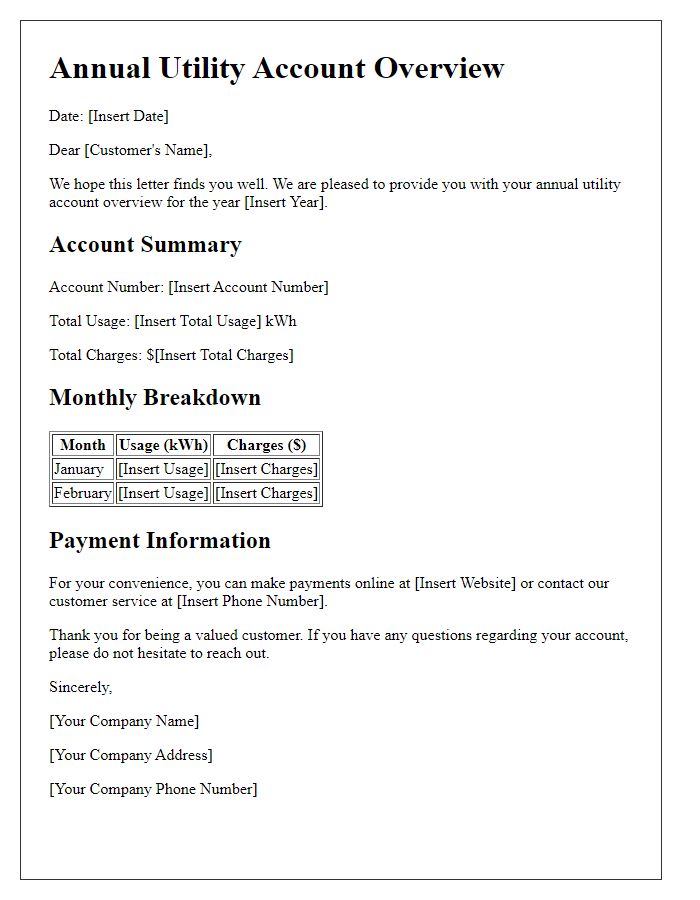

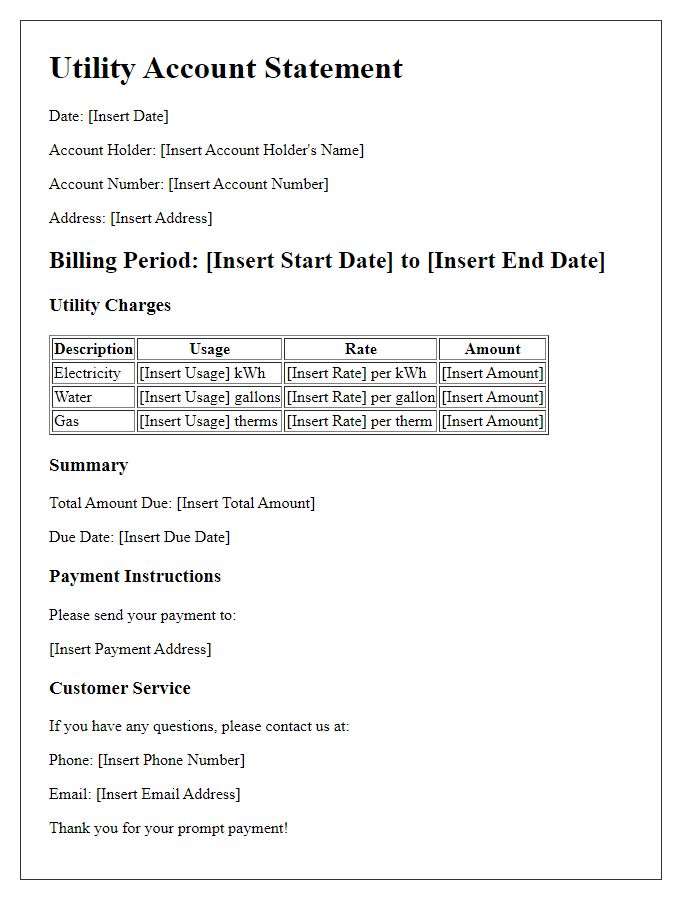

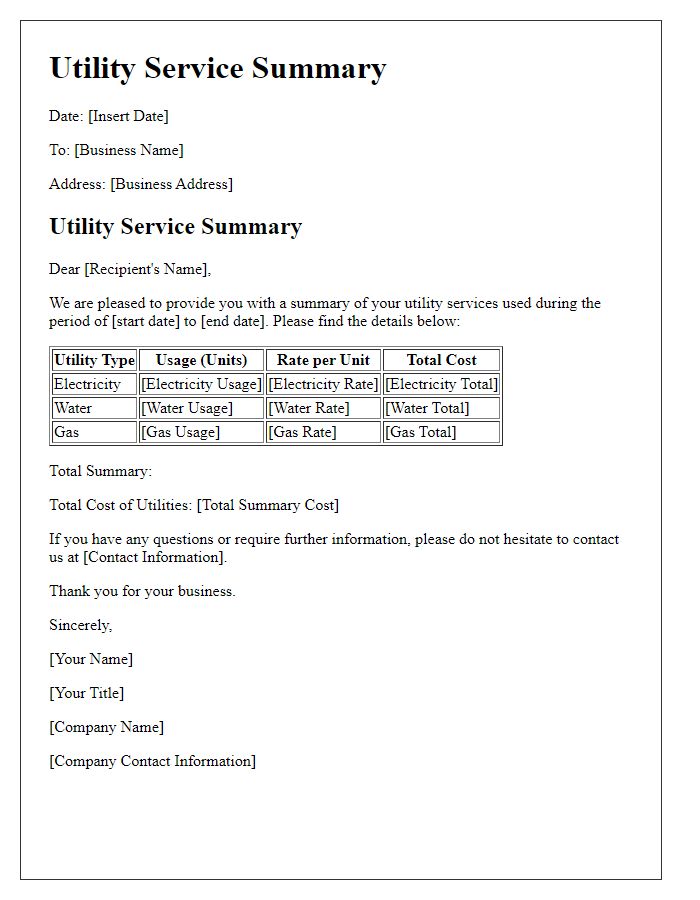

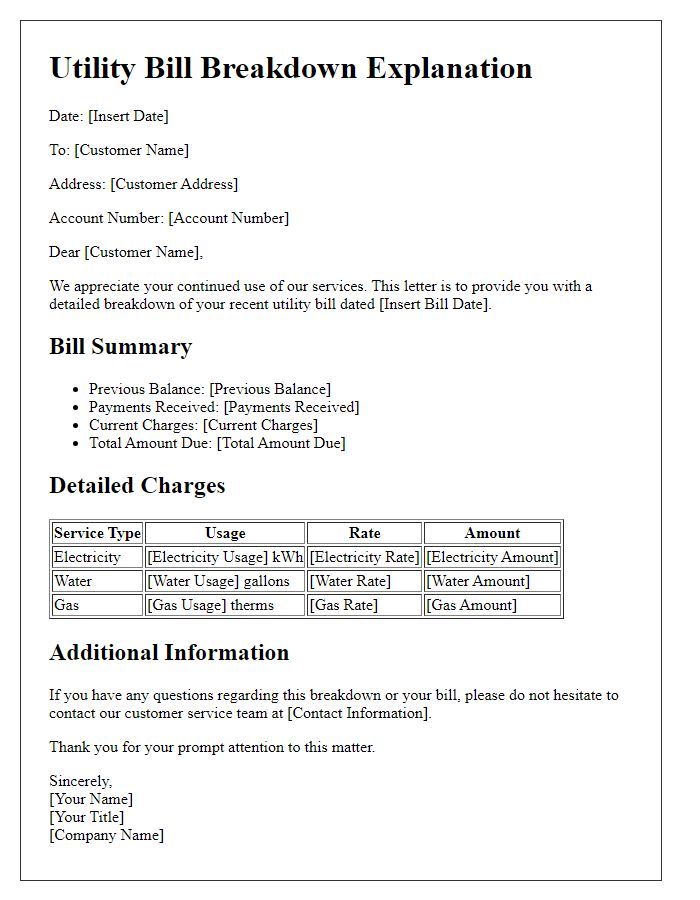

Utility account summaries provide crucial details about account holder status, billing history, and energy consumption patterns. An example of an account holder could be Michael Thompson, a resident in Denver, Colorado. This summary would include account number, monthly charges, due dates, and payment history. Additionally, it may highlight energy usage statistics, such as a comparison of kilowatt-hours (kWh) consumed over the past year, showcasing seasonal fluctuations. Furthermore, any outstanding balances, recent payments, and adjustment credits would be documented, ensuring a comprehensive overview of the account's financial standing and encouraging timely payments to avoid service disruptions.

Account Number

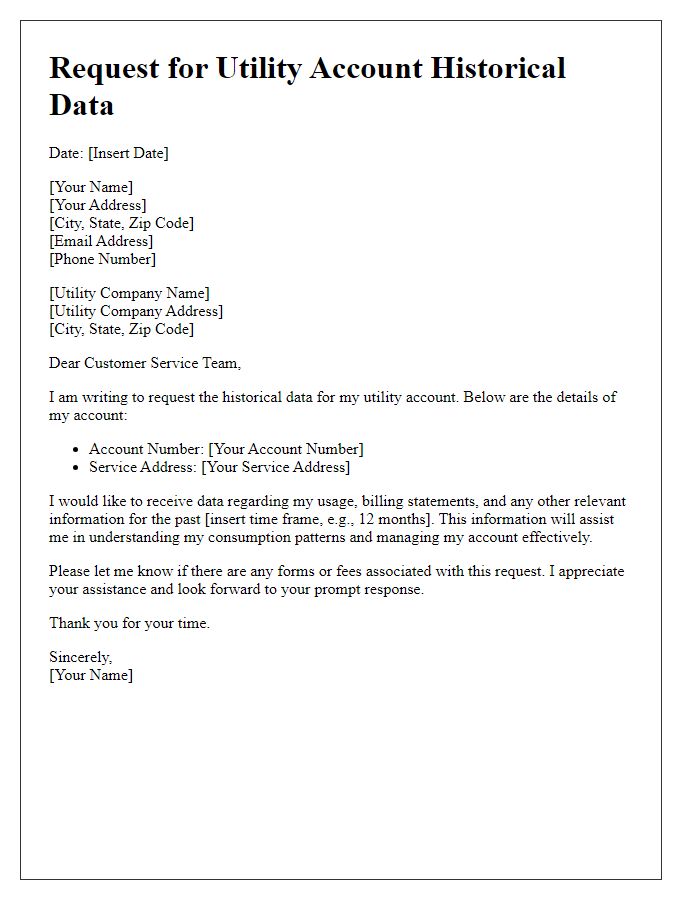

Utility account summaries provide essential information for managing energy usage and billing. Each account, identified by a unique 10-digit account number, encompasses various details such as monthly charges, payment history, and energy consumption statistics. For residential customers, the summary may also include a comparison of usage against previous months, facilitating insights into consumption patterns. Additionally, information regarding current rates and any outstanding balances helps users efficiently plan their payments. Understanding these summaries, typically issued monthly by utility providers like Pacific Gas and Electric or Con Edison, is crucial for maintaining awareness of household energy expenditures.

Billing Period Dates

Utility account summaries provide key information regarding billing periods, crucial for managing household expenses. Typically, a billing period spans around 30 days, starting from the first of each month, such as January 1 to January 31. During this timeframe, utility meters, like electric or water meters, are read to determine consumption levels. For example, a household in Denver, Colorado may see usage figures noted in kilowatt-hours for electricity or gallons for water. The billing statement also includes due dates, often set 15 days after the billing period closes, highlighting the importance of timeliness in payments to avoid late fees. Additionally, summaries may offer insights into historical usage patterns, helping consumers in budgeting and environmental awareness.

Total Amount Due

Utility bills provide essential information regarding the total amount due for services rendered, which may include electricity, water, and gas. The total amount due often encompasses base charges, consumption fees calculated based on recorded usage during the billing cycle, and any additional fees such as late payment penalties or service charges. Statements usually include due dates, which may vary but typically occur on a monthly basis, urging prompt payment to avoid disruptions in service. Accurate billing details, such as account numbers and service addresses, are crucial for customers to maintain proper records and facilitate correspondence with utility providers.

Payment Due Date

Utility accounts typically include critical information regarding payment due dates, usually scheduled on a specific day each month, such as the 15th. Late payments may incur various fees, often exceeding $15, which accumulate if payments remain outstanding for over 30 days. Consistent late payments can result in service disruptions, with potential disconnection occurring after multiple missed deadlines, often around the third consecutive month of non-payment. Customers are encouraged to review their account statements, which are often mailed or accessible online, to ensure timely payments. Utility providers may offer options like autopay, which ensures that account holders never miss a payment due date, promoting consistent service and preventing late fees.

Comments