Are you aware of the potential for non-resident tuition exemptions? Millions of students across the country are exploring this opportunity, which can significantly ease the financial burden of higher education. In this article, we'll break down the process, eligibility criteria, and essential tips you need to know to navigate this often-overlooked benefit effectively. So, let's dive in and see how you can make your college experience more affordableâkeep reading to find out more!

Eligibility criteria

Non-resident tuition exemption policies provide opportunities for students from specific circumstances to access educational institutions without incurring the full out-of-state tuition fees. Eligibility criteria typically include factors such as state residency, duration of residence, and connections to the state such as employment or military service. For example, students who have lived in the state for a minimum of 12 consecutive months may qualify, along with dependents of active-duty military personnel stationed in the state. Additionally, certain scholarship recipients or those who meet specific academic standards may also be eligible. Documentation such as proof of residency, tax returns, and financial aid applications is often required to verify eligibility for this exemption at institutions like public universities or community colleges.

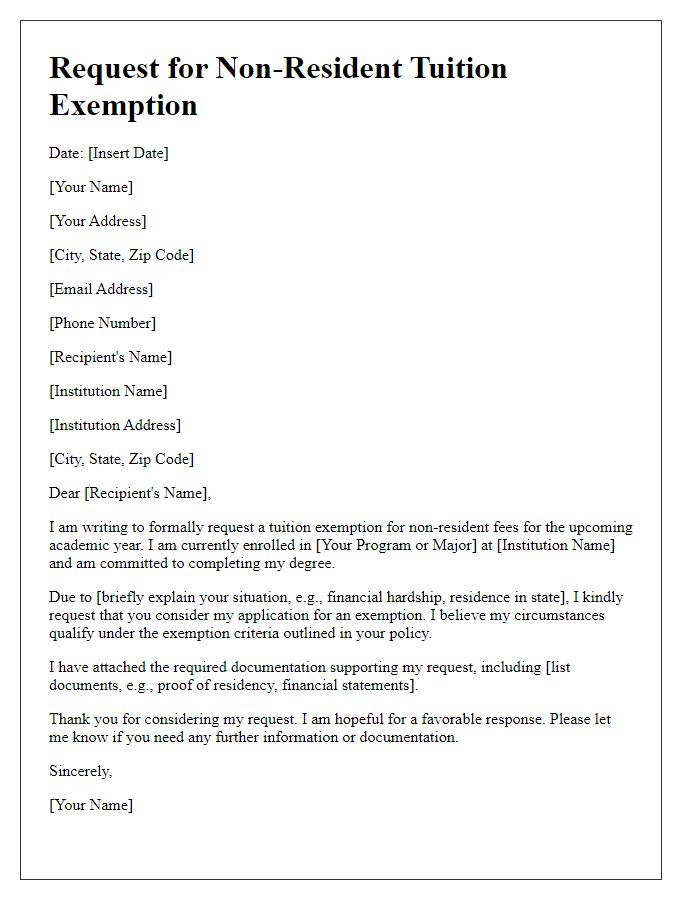

Required documentation

To request a non-resident tuition exemption, students must submit a comprehensive set of documentation to demonstrate eligibility. Essential documents include a completed application form specific to the institution, proof of residency (such as a recent utility bill or lease agreement) indicating continuous residence in the state for at least 12 months prior to enrollment, and a copy of the student's identification (government-issued ID or driver's license). Academic records, including transcripts, may also be required to verify full-time status and enrollment in eligible courses. Additionally, proof of financial independence, such as tax returns or income statements, could be requested to assess the financial need aspect. It's crucial to review the specific requirements outlined by the prospective educational institution, as protocols may vary significantly between state universities and community colleges. Timeliness in documentation submission is imperative, with many institutions setting firm deadlines ahead of registration periods.

Deadline for submission

The non-resident tuition exemption application process requires timely submission of necessary documentation to ensure eligibility for reduced tuition fees. Specific deadlines for submission vary by institution, typically falling between February 1 and June 1 for the upcoming academic year. Applicants need to compile forms such as residency affidavits, tax documents, and proof of residency status within the stipulated timeframe. Institutions may enforce strict late submission policies, potentially disqualifying applicants from consideration for the exemption. Therefore, prospective students should verify the specific deadline published by their institution's admissions office or website to ensure compliance with all requirements.

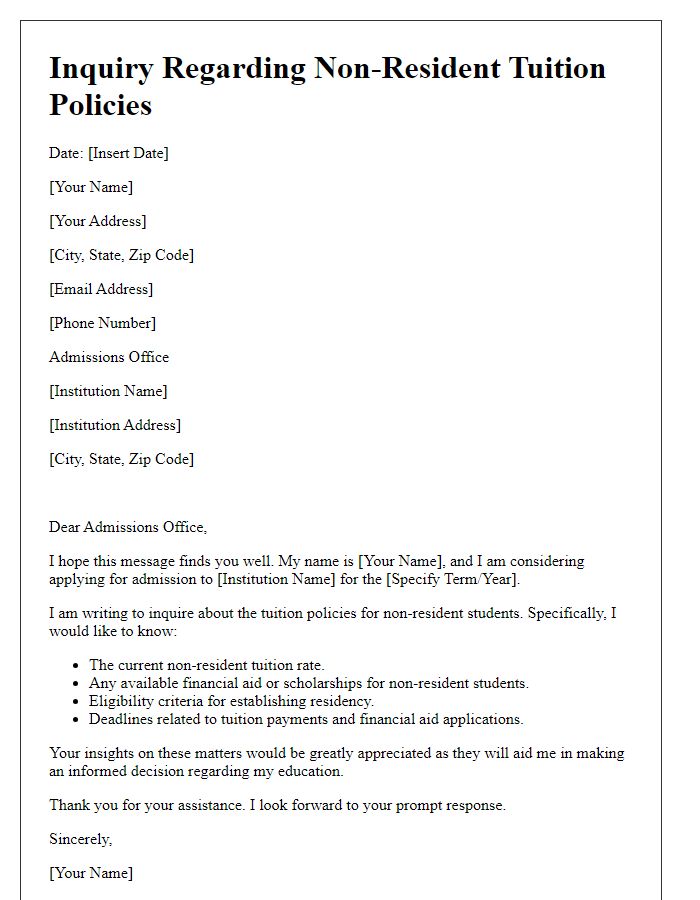

Contact information

Non-resident tuition exemption policies can significantly impact educational opportunities for students. Institutions such as universities and colleges often implement these policies to promote diversity and inclusivity. In many cases, criteria for exemption will vary by state, with different regulations applicable in places like California or New York. Students might be required to prove residency or fulfill specific academic criteria. Contact information for relevant offices, such as the admissions office or registrar, is typically crucial in navigating these exemptions efficiently. It's essential for students to gather detailed information from official channels to ensure they meet all necessary requirements before applying for the exemption.

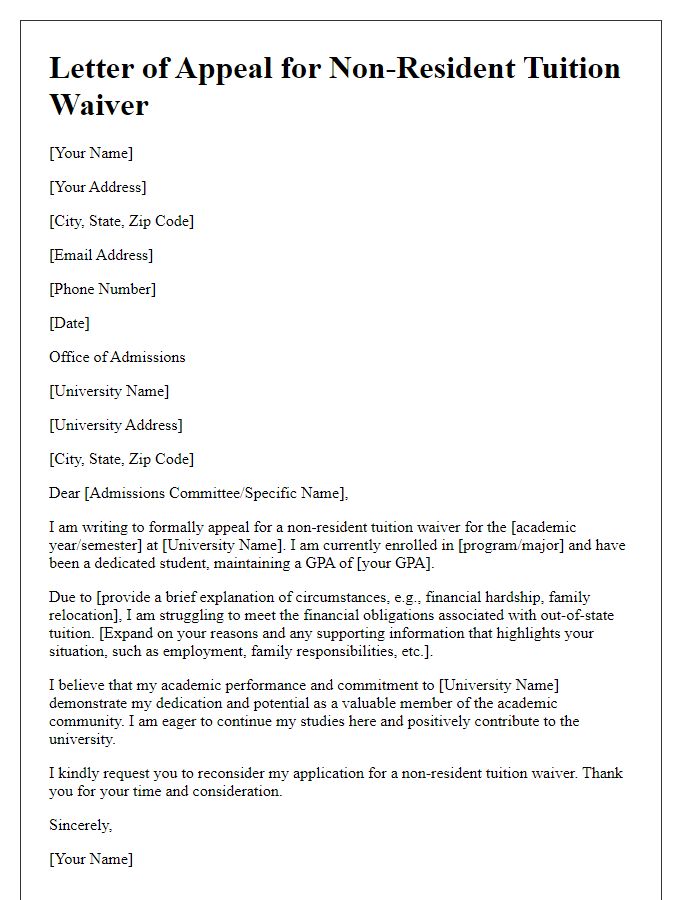

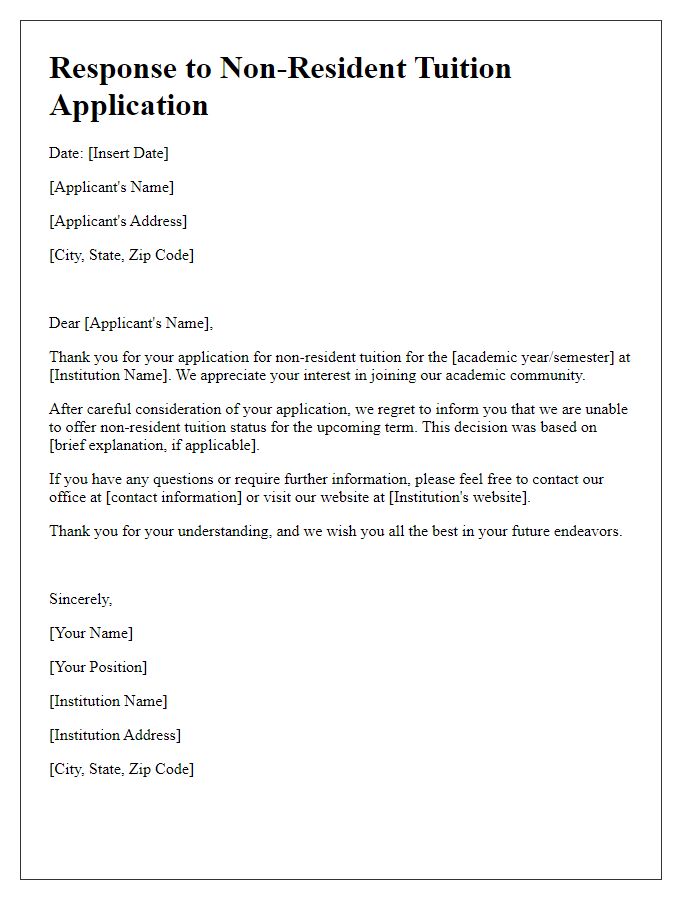

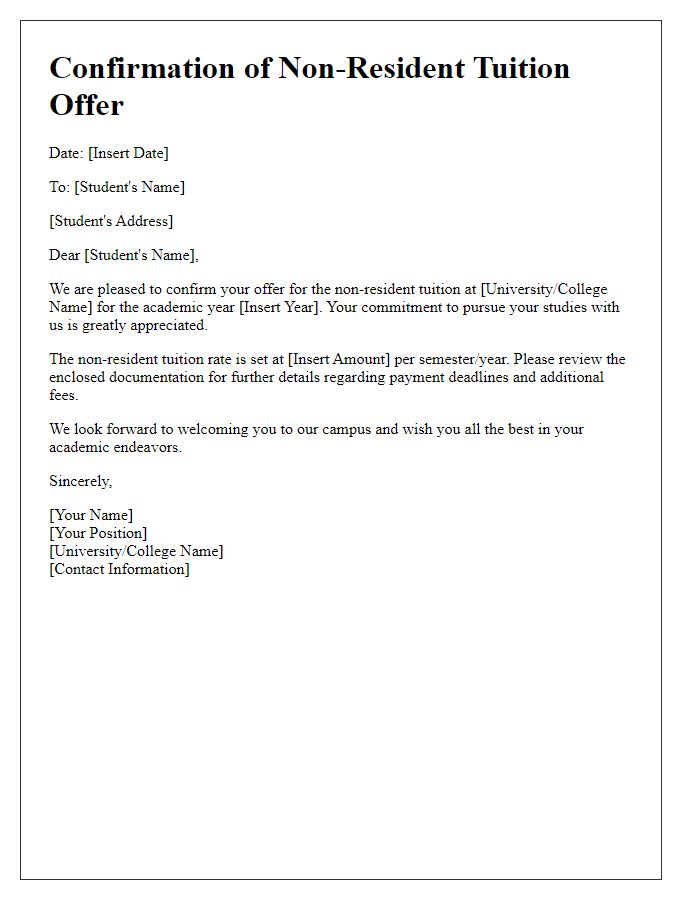

Formal tone and structure

A non-resident tuition exemption allows eligible students to pay in-state tuition rates regardless of residency status. This exemption can significantly reduce the cost of education at public universities, which can range from $10,000 to $50,000 per year depending on the institution. Eligibility criteria often include factors such as employment of a parent or guardian in the state, attending high school in the state for a specific duration (usually three years), or proving significant ties to the state, such as property ownership. Important events like enrollment deadlines and application submission dates must be closely monitored to ensure eligibility is considered. Documentation, such as proof of residency, tax returns, and school records, may be required, which can take time to compile, emphasizing the need for early preparation. Understanding this process can help students ease financial burdens while pursuing their academic goals.

Comments