Are you planning your next adventure and feeling a bit overwhelmed by the thought of travel insurance? You're not alone; many travelers find themselves confused by the various options available. In this article, we'll break down the essentials of travel insurance to help you navigate your choices with ease. So, buckle up and get ready to explore your travel insurance options in more detail!

Recipient's information

Travel insurance options can vary significantly based on the traveler's destination, duration of stay, and specific needs. Comprehensive plans in the United States, such as those from Allianz or World Nomads, often cover medical emergencies, trip cancellations, and lost luggage, offering peace of mind to international travelers. Policies may range from $30 to $500, depending on coverage limits and add-ons like extreme sports or pre-existing conditions. It's essential for travelers visiting regions with high healthcare costs, like Europe or Australia, to consider robust insurance to mitigate potential expenses. Additionally, some credit cards offer travel insurance benefits, which may provide an alternative for those looking to reduce costs while still ensuring protection during their journeys.

Purpose of the letter

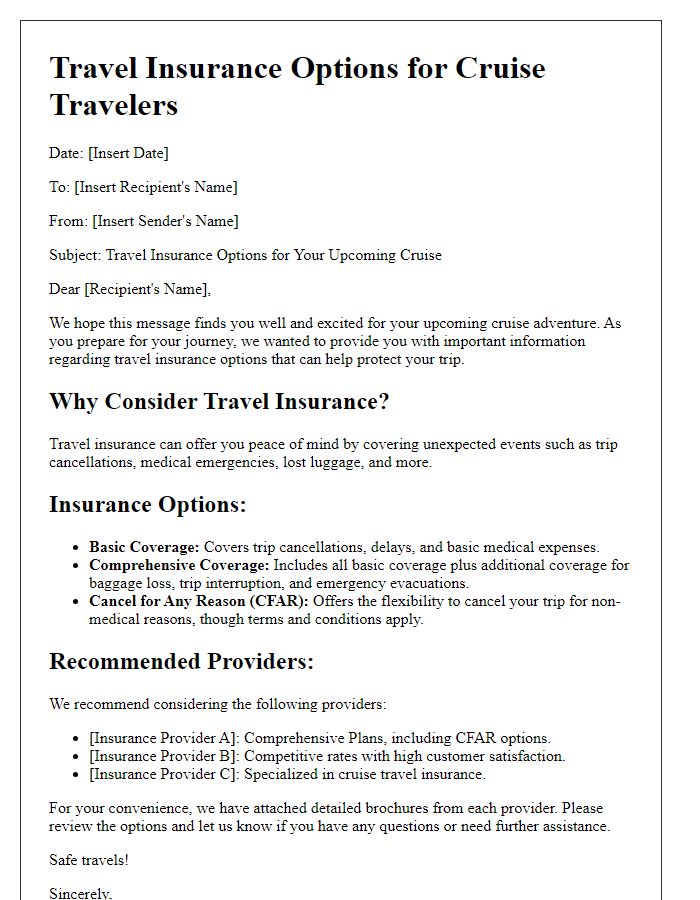

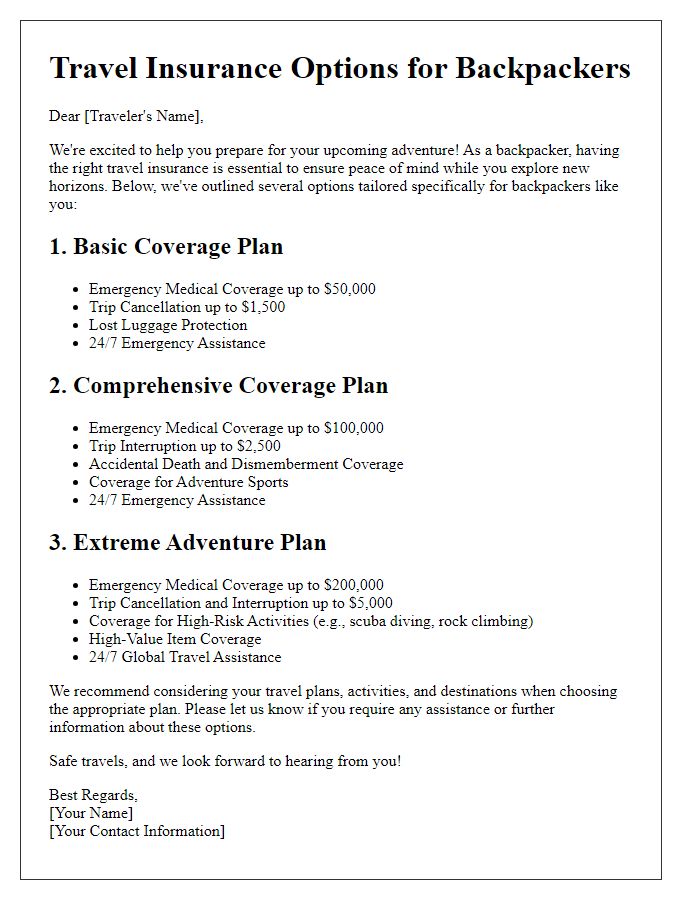

Travel insurance options provide essential coverage for unexpected events during trips. Policies typically include medical coverage, trip cancellation, lost luggage, and emergency assistance benefits. Popular providers like Allianz Global Assistance and World Nomads offer various plans tailored for different traveler needs. Coverage limits and deductibles can vary significantly, affecting the overall cost. Understanding the specific terms and conditions, including exclusions for pre-existing conditions or adventure sports, is vital for making an informed decision. Travelers should consider the destination, duration of travel, and personal health when selecting the appropriate insurance plan.

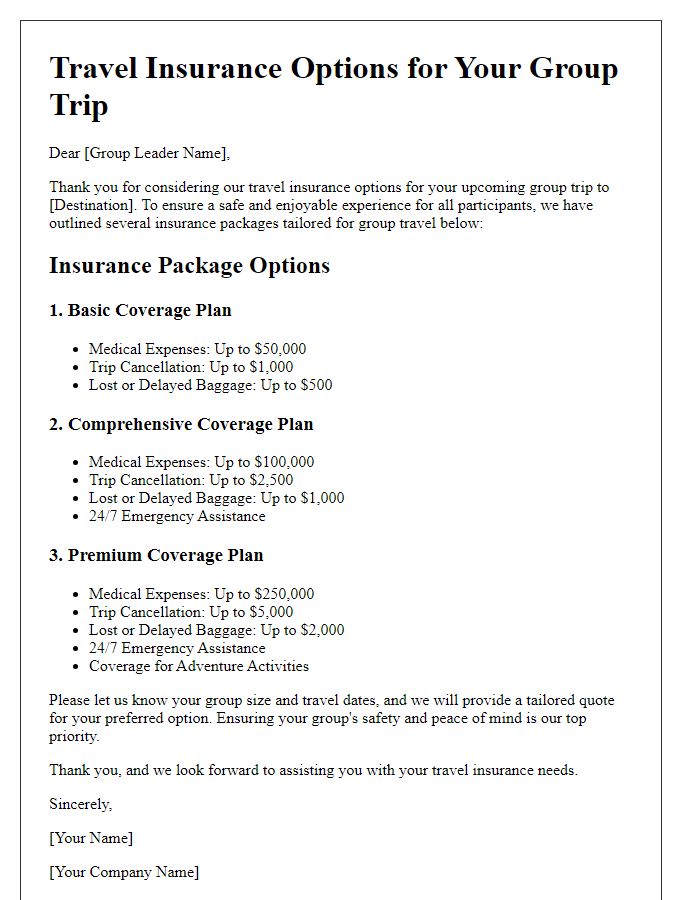

Coverage details and options

Travel insurance offers various coverage options essential for safeguarding against unforeseen circumstances during a trip. Medical coverage provides financial protection for emergency medical expenses incurred abroad, covering costs up to $1 million in some policies. Trip cancellation insurance reimburses non-refundable expenses if a trip has to be canceled due to valid reasons such as illness or natural disasters, often covering up to 100% of travel costs. Lost luggage insurance compensates travelers for personal belongings lost during transit, with some plans providing up to $2,500 for essential items. Emergency evacuation coverage arranges and pays for transportation to the nearest medical facility, ensuring safety in remote locations, with costs potentially exceeding $100,000. Furthermore, rental car damage coverage protects against costs associated with damages to rental vehicles, including liability coverage, which may vary by location.

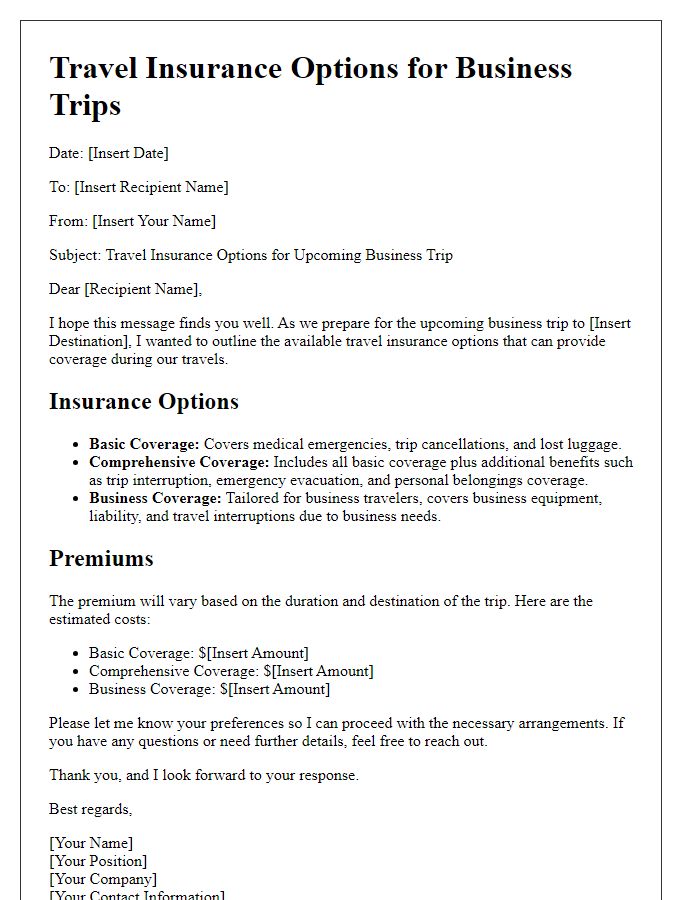

Pricing and payment options

Travel insurance options provide essential coverage for unexpected incidents while traveling. Policies vary based on pricing structures, which can range from $40 to over $300, depending on factors like trip duration, destination, and coverage limits. Payment options typically include credit cards, debit cards, and third-party payment platforms, allowing travelers to choose the method that best suits their financial situation. Some providers offer monthly payment plans for policies exceeding certain price thresholds, making it more manageable for travelers to budget. Additionally, special discounts may apply for group travel or multi-trip policies, offering significant savings. Reviewing terms and conditions of each option ensures travelers choose comprehensive coverage tailored to their unique travel needs.

Contact information and next steps

Travel insurance options provide essential coverage for unexpected events, including trip cancellations, medical emergencies, and lost luggage. Top providers, such as Allianz and Travel Guard, offer various plans tailored to different travel needs, with coverage limits often ranging from $10,000 to over $1 million depending on the policy. Travelers should consider factors such as destination risks, like high theft rates in certain areas, the duration of their trip, and personal health conditions that may require additional medical support. Reviewing policy details, including exclusions and claim procedures, is crucial to ensure adequate protection during travel. Travelers are encouraged to contact insurance providers via dedicated customer service hotlines or online chat for personalized assistance and to clarify next steps, including policy purchase and activation procedures.

Comments