Are you looking to streamline your employee travel reimbursement process? In this article, we'll explore an easy-to-follow letter template that can help you effectively communicate travel expenses and ensure timely reimbursements. Whether you're an employee submitting your expenses or a manager reviewing them, having a clear and concise template is essential for smooth operations. Join us as we dive deeper into the essential components of a reimbursement letter!

Employee and employer details

Employee travel reimbursement processes involve several key details including employee information and company policies. Employee information includes the full name, employee identification number, job title, department, and contact information. Employer details typically include the company name, address, contact person for reimbursement queries, and the specific department handling these requests, such as finance or human resources. The reimbursement request should include travel dates, purpose (e.g., attending a conference in San Francisco), and itemized expenses (meals, transportation, lodging) to ensure clarity and compliance with company policy. Additional supporting documents may include receipts, travel itineraries, and approval emails to validate the incurred expenses.

Travel dates and purpose

Travel reimbursement requests require detailed information for processing. Specify travel dates, often necessary for accounting and policy compliance, such as the start date on March 1, 2023, and the end date on March 5, 2023. Clearly outline the purpose of travel, for example, attending the 2023 International Marketing Conference held in San Francisco, California, focused on emerging digital trends. Itemize the expenses to include transportation, accommodation, meals, and incidentals, ensuring that each item complies with company policy. Accurate submission aids in prompt reimbursement processing.

Expense breakdown and receipts

Travel reimbursements for employees involve detailed documentation to ensure compliance with company policy. Expenses may include transportation fees (airfare, train tickets, car rentals), accommodation costs (hotel stays), meal expenditures (daily allowances or itemized receipts), and incidental charges (parking fees, tolls). Each expense should be itemized, showing the date, description, and amount, which helps streamline the reimbursement process. Receipts serve as proof of each expenditure, often required for amounts exceeding a specific threshold, such as $25. Accuracy in this documentation is crucial to facilitate prompt reimbursements and maintain budgetary transparency within the organization.

Company reimbursement policy

Company travel reimbursement policy outlines procedures for employee expenses incurred during business trips. Eligible expenses include transportation (airfare, train tickets, car rentals), lodging (hotel accommodations), and meals. Employees must provide original receipts, detailed invoices, or proof of payment for all claims, ensuring amounts align with budget limits established by the finance department. Expenses must be submitted within 30 days of travel completion to qualify for reimbursement. Approval workflows involve direct supervisors reviewing claims, followed by finance department verification, ensuring timely processing. Exceptions may apply for international travel, requiring prior authorization.

Submission and approval process

Employee travel reimbursement is a structured process essential for managing expenses incurred during work-related travel. Employees must submit detailed expense reports that include transportation costs (such as airfare or gas), lodging fees (including daily rates for hotels), and meal allowances (typically calculated per diem based on the travel location). Documentation like receipts, itineraries, and approval forms is necessary for verification and compliance with company policy. The submission should be directed to the finance department, where personnel will review expenses for adherence to the organization's reimbursement policy. Approval timelines generally range from one to two weeks, during which potential discrepancies or questions can be addressed. Ultimately, timely reimbursements uphold employee satisfaction while ensuring careful financial management within the company.

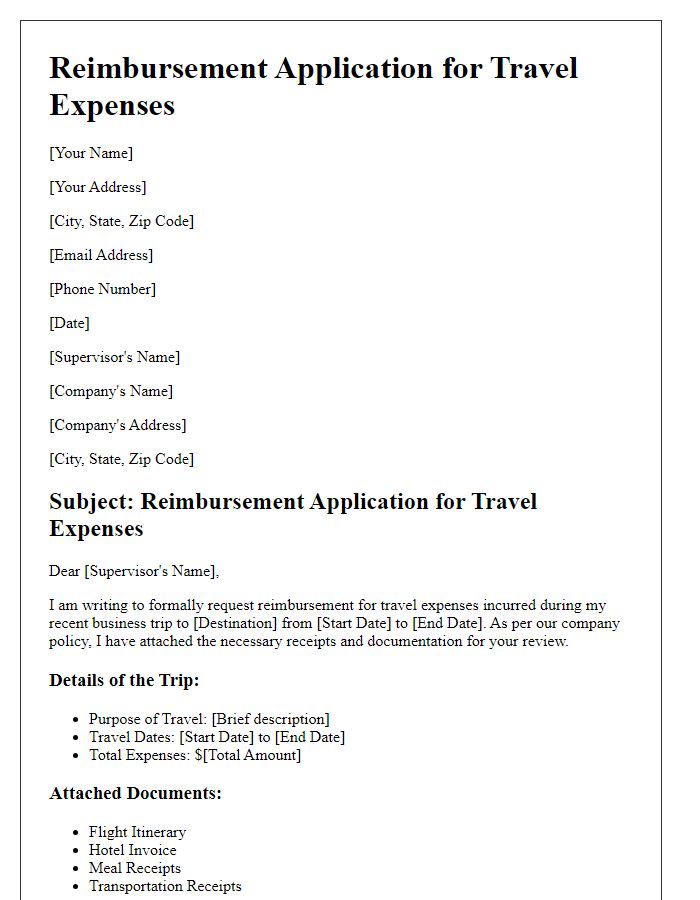

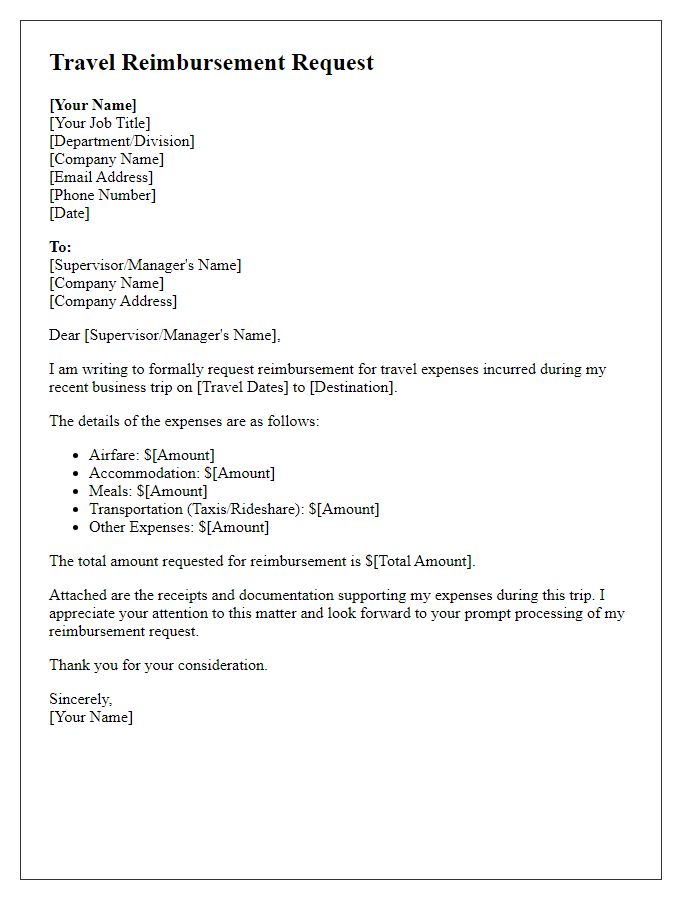

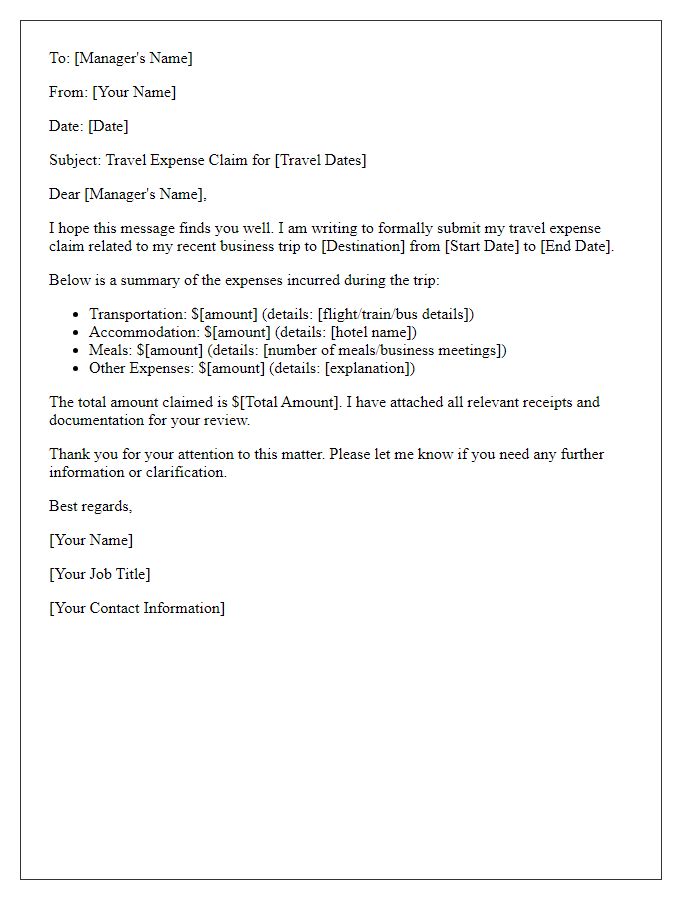

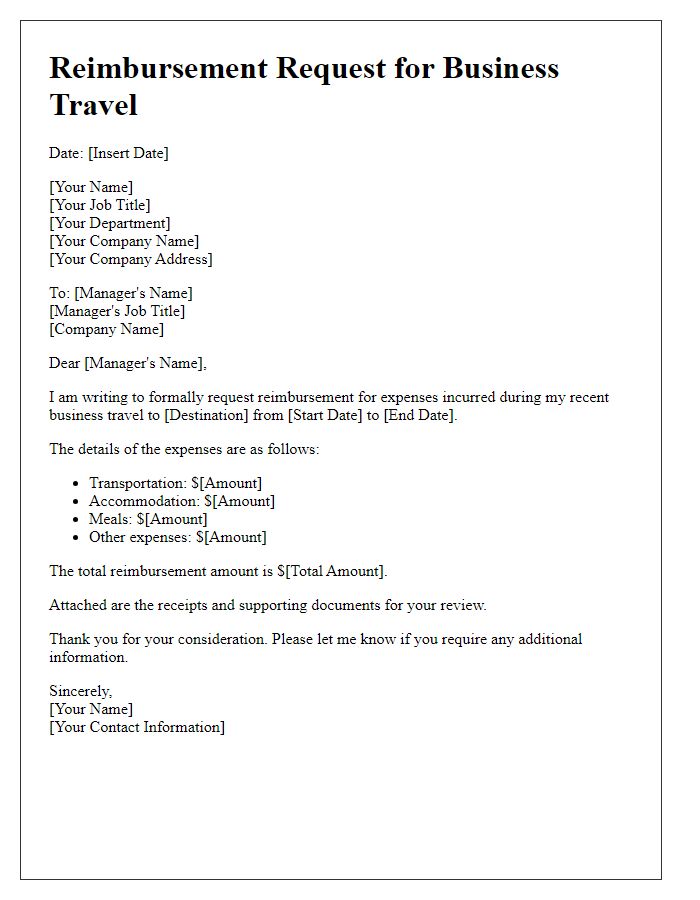

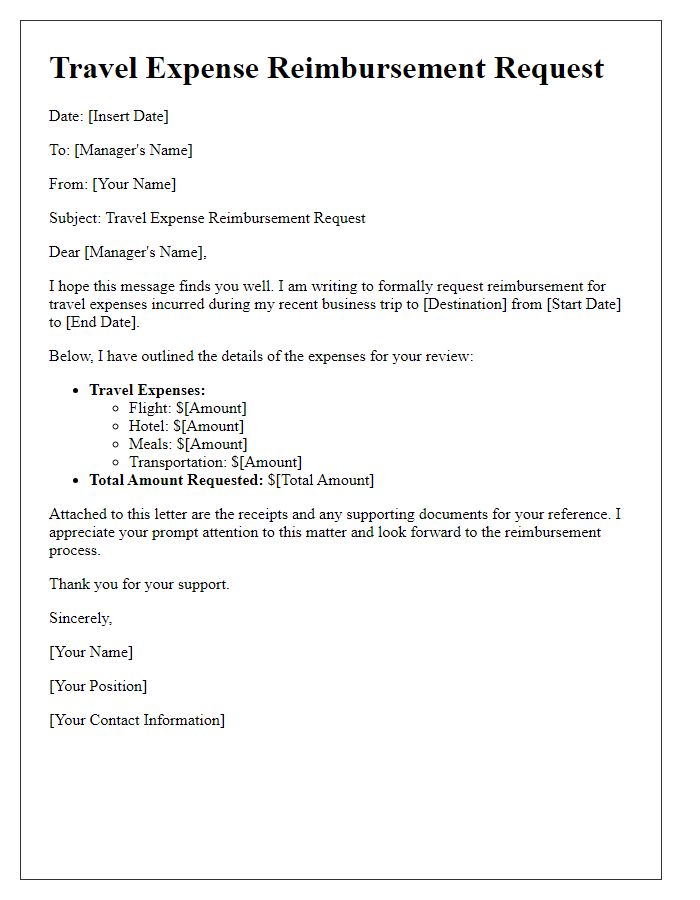

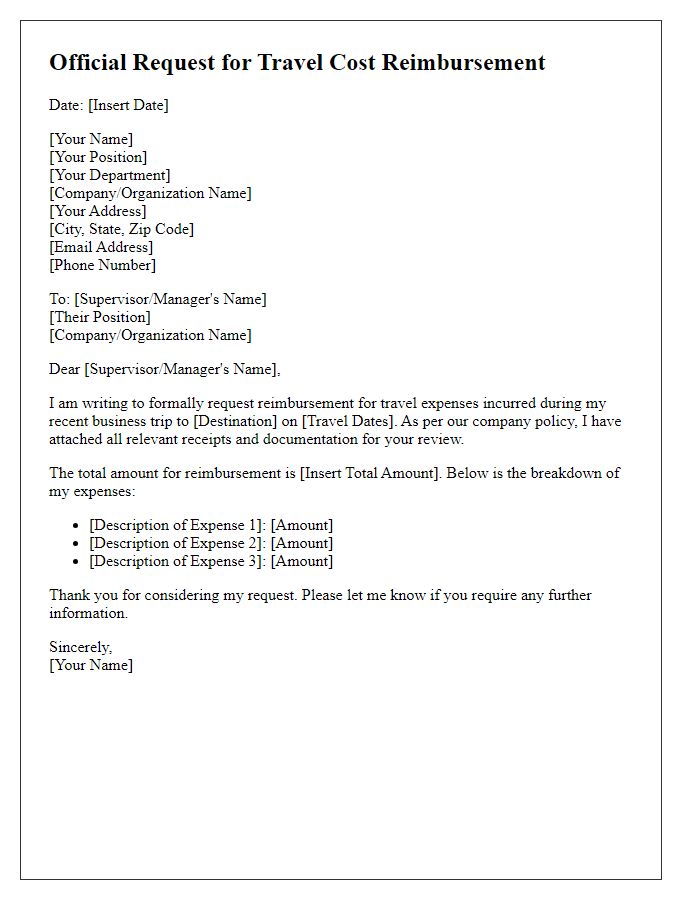

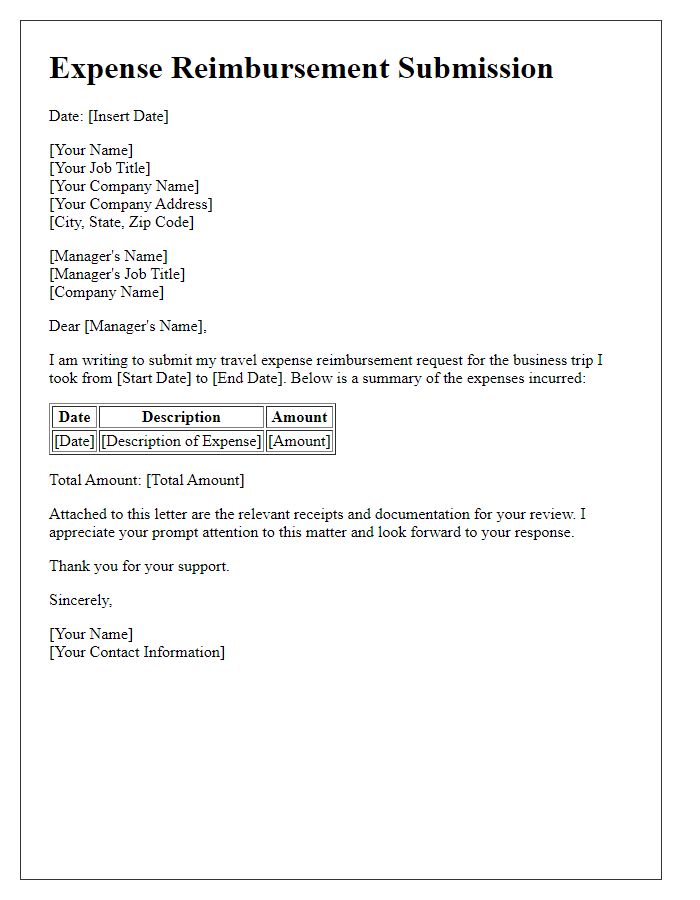

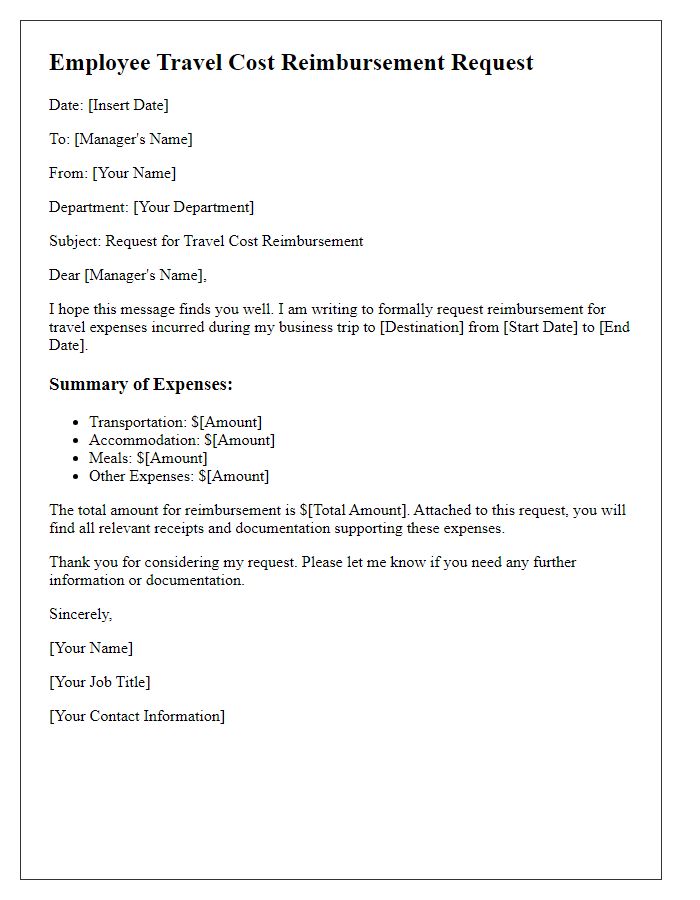

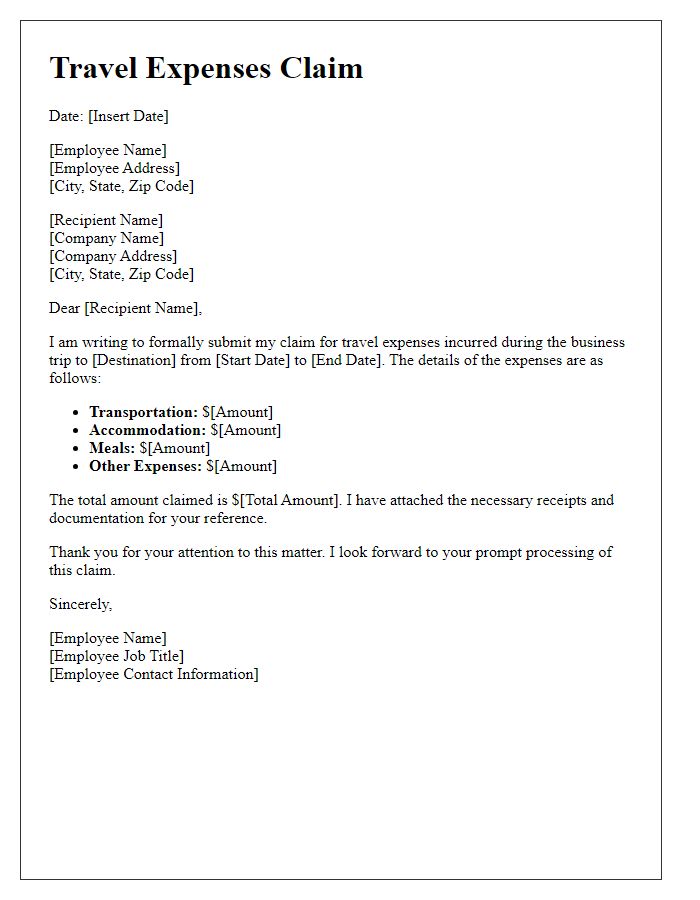

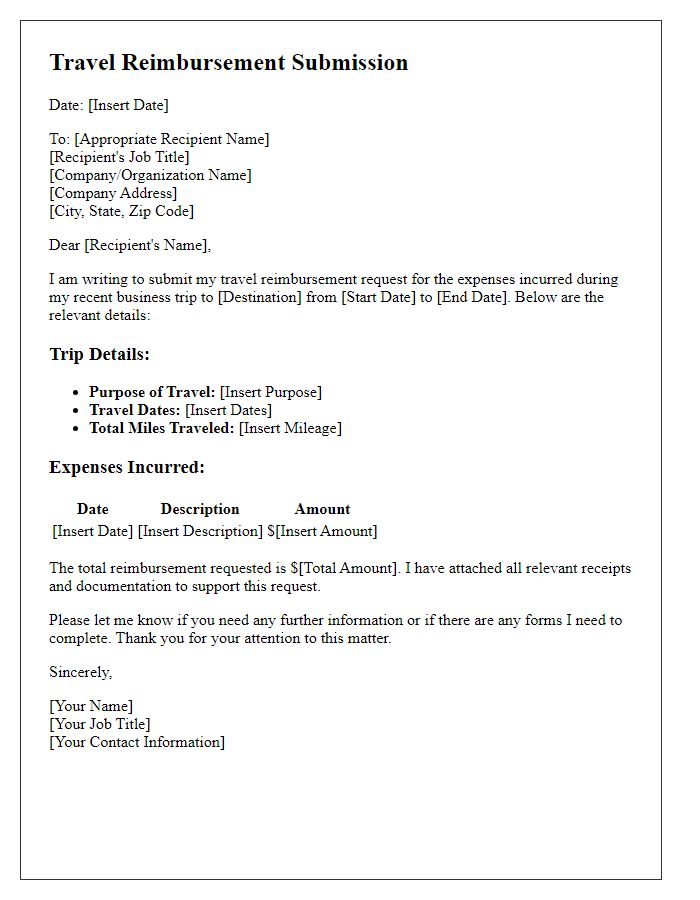

Letter Template For Employee Travel Reimbursement Samples

Letter template of reimbursement application for employee travel expenses

Comments