Are you shipping valuable goods and want to protect your investment during transit? Understanding transit insurance agreements is crucial for safeguarding your assets and ensuring peace of mind. In this article, we'll break down the key components of a transit insurance agreement, highlighting why it's essential for anyone involved in shipping. So, let's dive in and explore how you can secure your shipmentsâread on for more insights!

Parties Involved

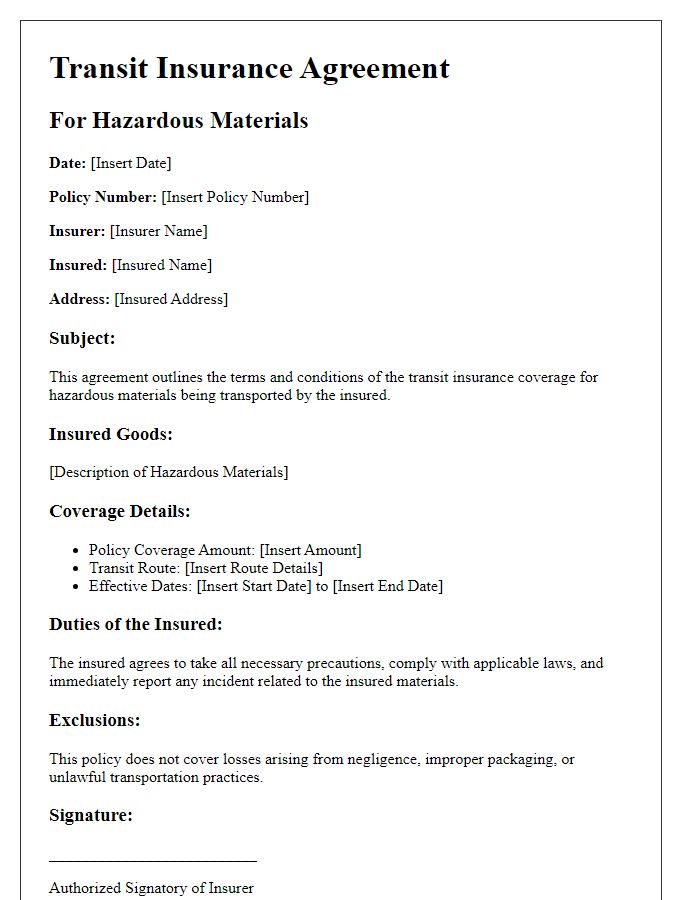

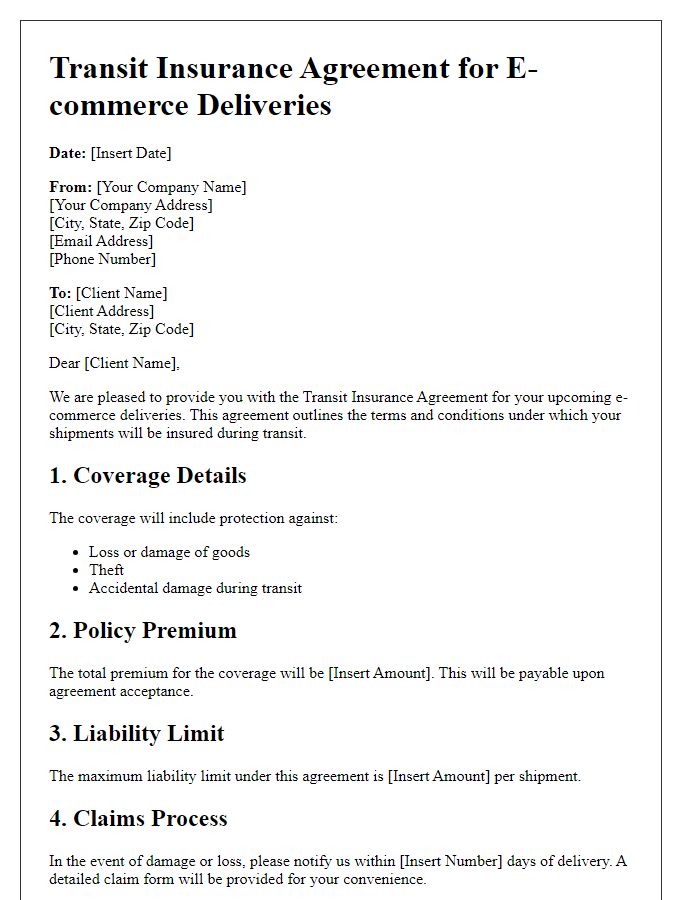

The transit insurance agreement involves multiple parties including the insured party (the individual or entity purchasing the insurance, such as a shipping company or a manufacturer), the insurer (the insurance company providing coverage, possibly a well-known entity like Allianz or AIG), and any third parties involved in the shipping process (like logistics providers or freight forwarders). Each party plays a vital role; the insured protects their goods during transport, the insurer assesses risks and provides financial compensation in the event of loss or damage, while third parties facilitate the logistics and handling of the cargo, ensuring compliance with regulations. The agreement outlines specific responsibilities, coverage limits, including total insured value expressed in currency amounts, and claims processing details contingent on timely reporting and documentation of incidents related to cargo transit.

Scope of Coverage

Transit insurance provides essential protection for goods in transit, encompassing various transit methods like shipping, trucking, or airfreight across domestic or international routes. Coverage typically includes loss or damage due to theft, accidents, or natural disasters (like floods or earthquakes) during transportation. Policies detail specific exclusions, such as inherent vice (damage caused by the nature of the goods themselves) and negligence. Additionally, the insured value often aligns with the cost of goods, including packaging and freight charges, ensuring comprehensive financial protection during the transport process. Claims must be promptly reported, usually within a specific timeframe, to ensure validation and processing according to the insurer's guidelines.

Terms and Conditions

The transit insurance agreement outlines specific terms and conditions regarding the coverage of goods during transportation. This coverage includes protection against risks such as theft, damage, and loss while items are in transit, whether by road, rail, air, or sea. The policy typically includes details such as the insured value, which represents the maximum compensation amount in cases of loss, and a list of exclusions, highlighting situations not covered under the policy, such as natural disasters or improper packaging. Additionally, any claims must be filed within a stipulated time frame, often within 30 days of the incident, ensuring timely processing. The insurer may require documentation such as receipts, photographs of damage, transport receipts, and police reports for claims validation. Overall, a thorough understanding of these terms is crucial for businesses to ensure adequate protection for their assets during transit.

Premium Details

Premium details for transit insurance agreements can vary significantly based on the value of goods, risk factors, and transportation methods. For example, a standard coverage policy for cargo valued at $100,000 may have an annual premium ranging from 0.5% to 2% of the total insured value, which translates to $500 to $2,000. Factors influencing premium rates include the type of goods (fragile items like electronics, or perishable goods like food), transit duration (longer journeys typically pose higher risks), and transportation methods (shipping via air, sea, or road show differing levels of risk). Additionally, geographical considerations such as political stability or weather conditions in transit routes can also substantially impact premium calculations.

Claims Procedure

Transit insurance claims involve multiple steps to ensure proper documentation and swift processing. Firstly, notification of the incident should be made immediately, ideally within 24 hours of discovery, to the insurance provider, such as XYZ Insurance Company. Important details, including the policy number and description of damages, must be included. Documentation is crucial; collecting supporting evidence, such as photographs of the damaged goods, transport receipts, and delivery records, facilitates a clearer understanding of the claim. Submitting a completed claim form, which can often be found on the company's website, is necessary alongside the evidence. A key aspect is the assessment process, where an adjuster evaluates the claim, ensuring compliance with the policy's terms and conditions. Finally, maintaining communication with the insurance provider throughout the procedure assists in resolving any queries or additional requirements promptly. Proper adherence to these steps ensures a smoother claims experience and expedites potential reimbursements.

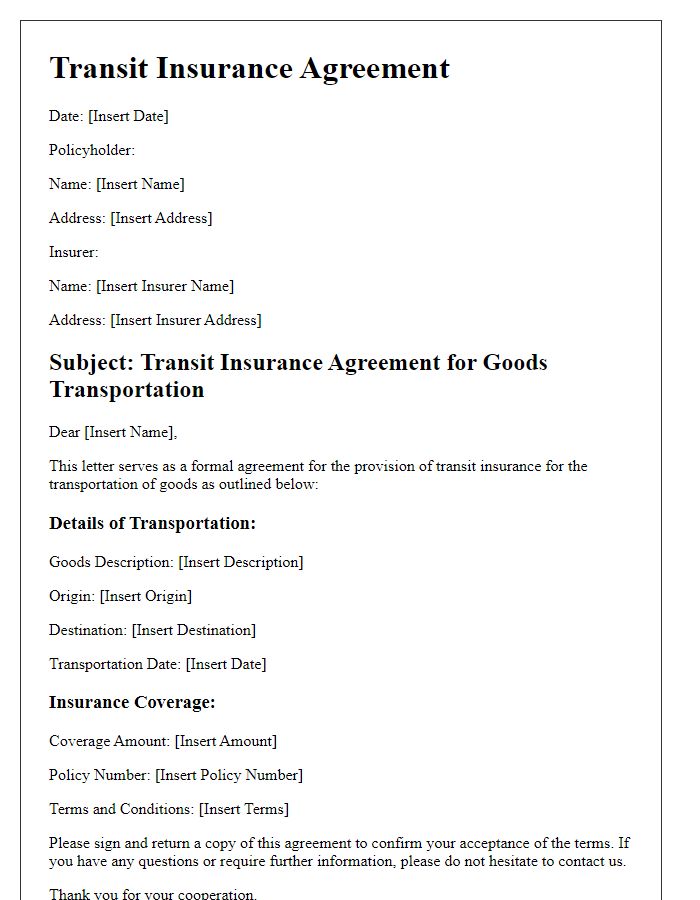

Letter Template For Transit Insurance Agreement Samples

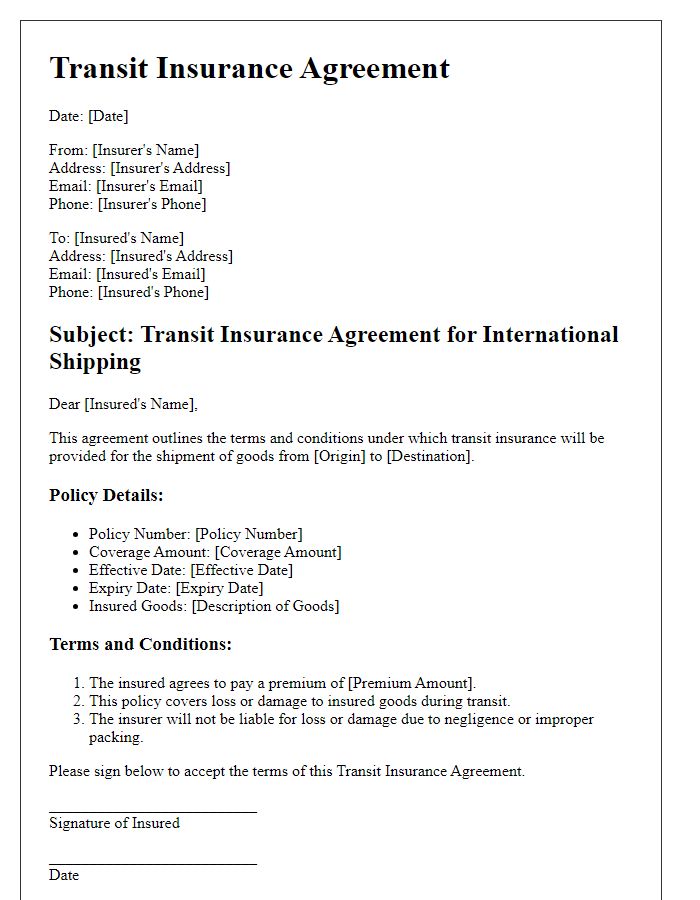

Letter template of Transit Insurance Agreement for International Shipping

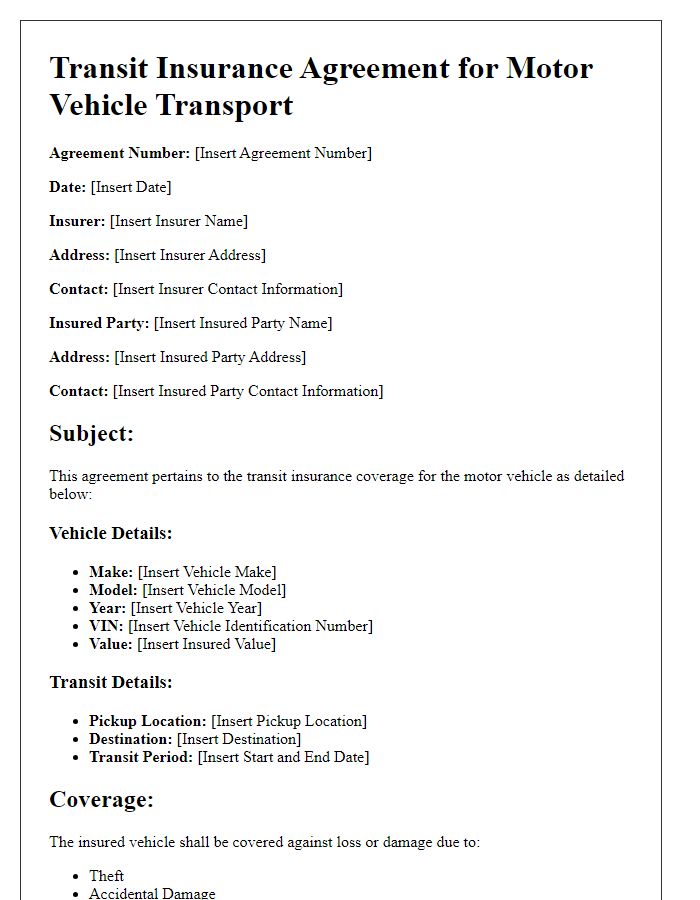

Letter template of Transit Insurance Agreement for Motor Vehicle Transport

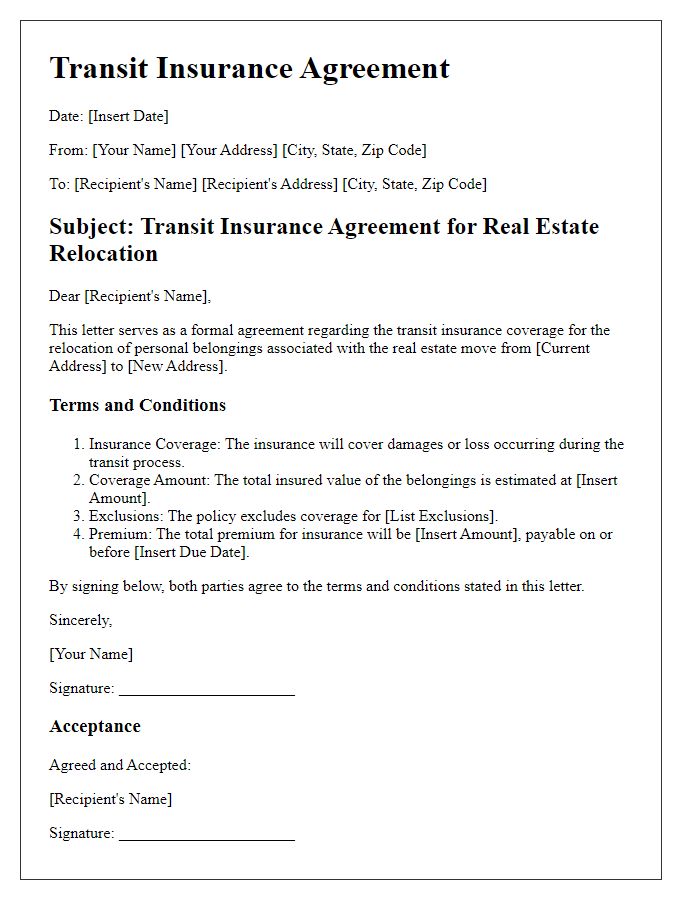

Letter template of Transit Insurance Agreement for Real Estate Relocation

Comments