Are you looking to streamline your mileage reimbursement process within your organization? Understanding the nuances of a mileage reimbursement policy can save time and reduce confusion for both employees and employers. This article will guide you through the essential components of an effective policy, ensuring that your team feels supported while accurately tracking their expenses. Read on to discover practical tips and tricks for implementing a seamless mileage reimbursement system!

Purpose and Scope

Mileage reimbursement policies serve as essential guidelines for compensating employees for the use of personal vehicles during work-related activities. This policy applies to all employees, including full-time and part-time staff, who incur travel-related expenses while conducting business on behalf of the organization. Specific details include reimbursement rates, adhering to IRS guidelines, which can vary annually, documentation requirements, such as keeping accurate mileage logs, and submission processes for reimbursement claims, typically requiring forms to be filed within 30 days of travel. This policy aims to ensure fair compensation while maintaining transparent and accountable financial practices within the organization.

Eligibility Criteria

Employees must meet specific eligibility criteria to qualify for mileage reimbursement under the company policy. Only employees who regularly use personal vehicles for business purposes, such as attending off-site meetings, client visits, or training sessions, are eligible. Reimbursement applies only to employees who maintain a valid driver's license and automobile insurance coverage compliant with state regulations. Additionally, the mileage must be directly related to work activities and documented accurately. Trips that deviate from the regular commute or are categorized as personal use do not qualify for mileage reimbursement. Employees must submit a mileage log detailing the starting point, destination, purpose of the trip, and total miles traveled to receive compensation. The reimbursement rate is based on the Federal mileage rate, which is subject to change annually, currently set at $0.655 per mile (as of 2023), ensuring fair compensation for the use of personal vehicles in business operations.

Mileage Reimbursement Rates

Mileage reimbursement policies are critical for organizations compensating employees for travel-related expenses. The current reimbursement rate, set at 65.5 cents per mile as of January 2023 by the IRS (Internal Revenue Service), covers vehicle operation costs, including fuel, maintenance, and depreciation. Employees must maintain accurate mileage logs documenting essential details like date, purpose of travel, starting point, ending location, and total miles driven for legitimate business activities. Reimbursement requests usually require submission within a specified timeframe, typically within 30 days post-trip, to ensure timely processing. Organizations may also set limits on mileage incurred without prior approval, often defining acceptable geographical boundaries, such as within city limits or specific counties.

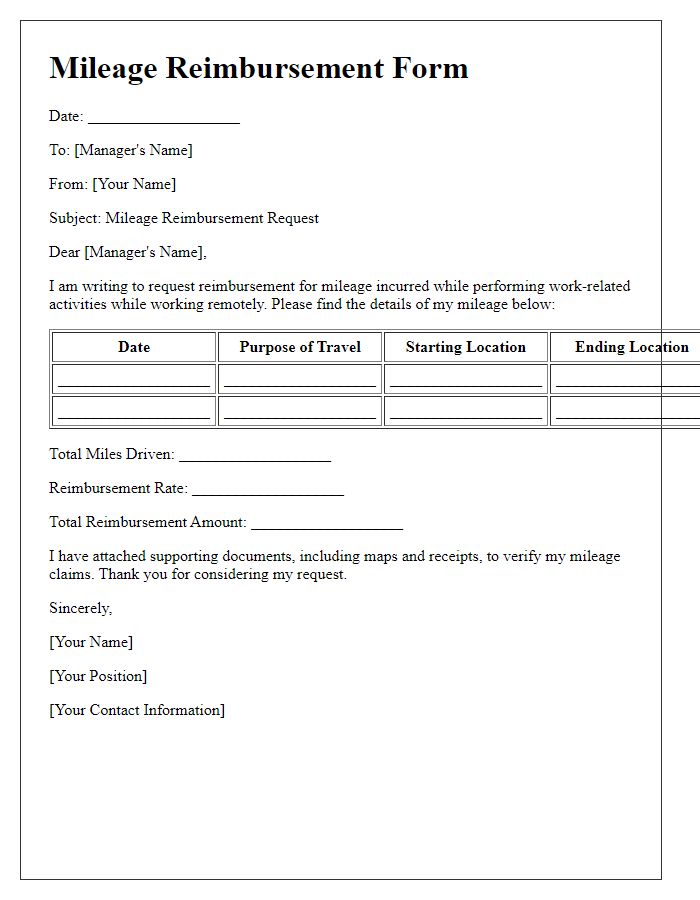

Submission and Documentation Process

Mileage reimbursement policies establish clear guidelines for employees to recoup travel expenses incurred during work-related activities. Employees must document mileage using odometer readings from their vehicles, noting starting and ending points, with specific destinations such as client sites or meeting locations. Accurate record-keeping requires submission of a mileage log, which should include dates, purpose of travel, and total miles driven. Documentation must comply with IRS standard mileage rates (65.5 cents per mile for 2023) to ensure proper reimbursement. Additionally, receipts for fuel expenses may be requested for verification. The submission process typically involves filling out a reimbursement form, attaching mileage logs, and submitting them to the finance department by the designated deadline each month. Failure to adhere to these procedures may delay or nullify reimbursement claims.

Payment Schedule and Method

The mileage reimbursement policy outlines the procedure for employees to request reimbursement for using personal vehicles for work-related travel. Reimbursements will be processed on a bi-weekly payment schedule, aligned with the company's payroll cycle. Employees must submit mileage logs detailing dates, destinations, and total miles driven on a standard reimbursement form. The reimbursement rate, set at the current IRS standard rate (currently $0.655 per mile in 2023), will apply to approved travel. Payments will be issued via direct deposit or paper check, depending on employee preference outlined in the payroll system. Submissions for reimbursement must be completed within 30 days of the travel date to ensure timely processing and compliance with internal audit requirements.

Letter Template For Mileage Reimbursement Policy Samples

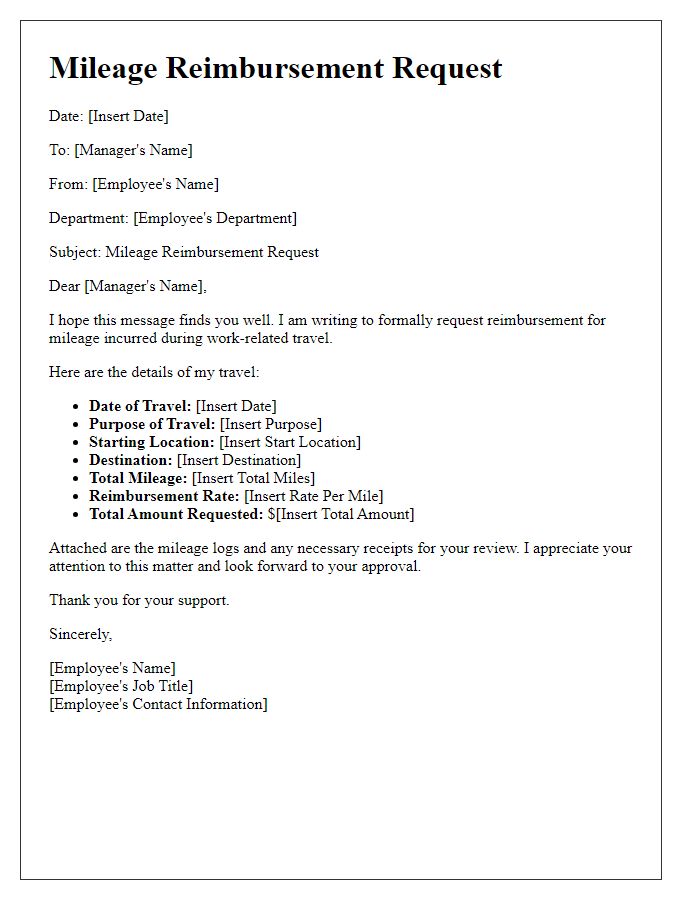

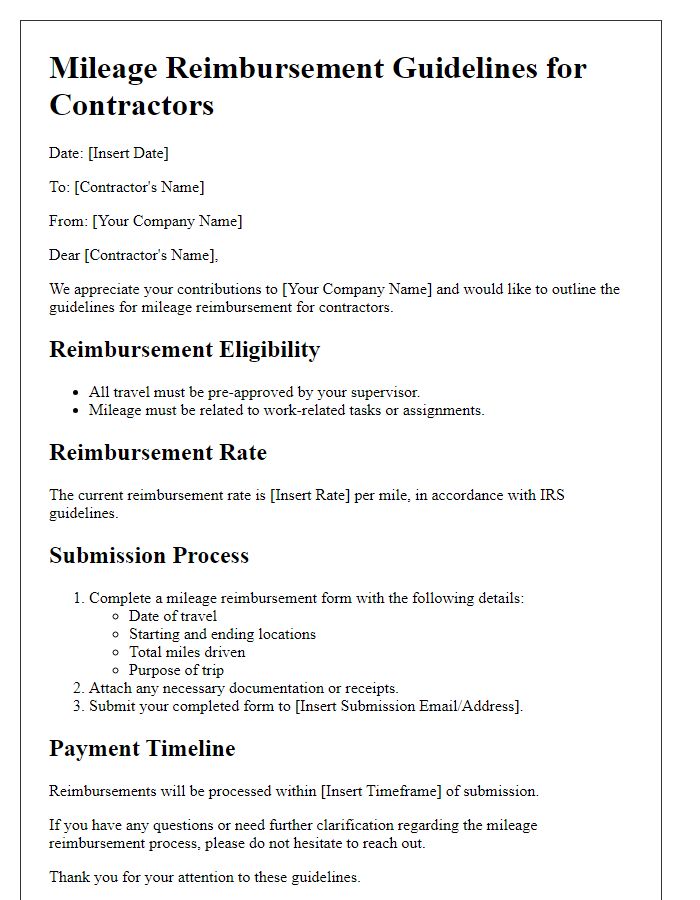

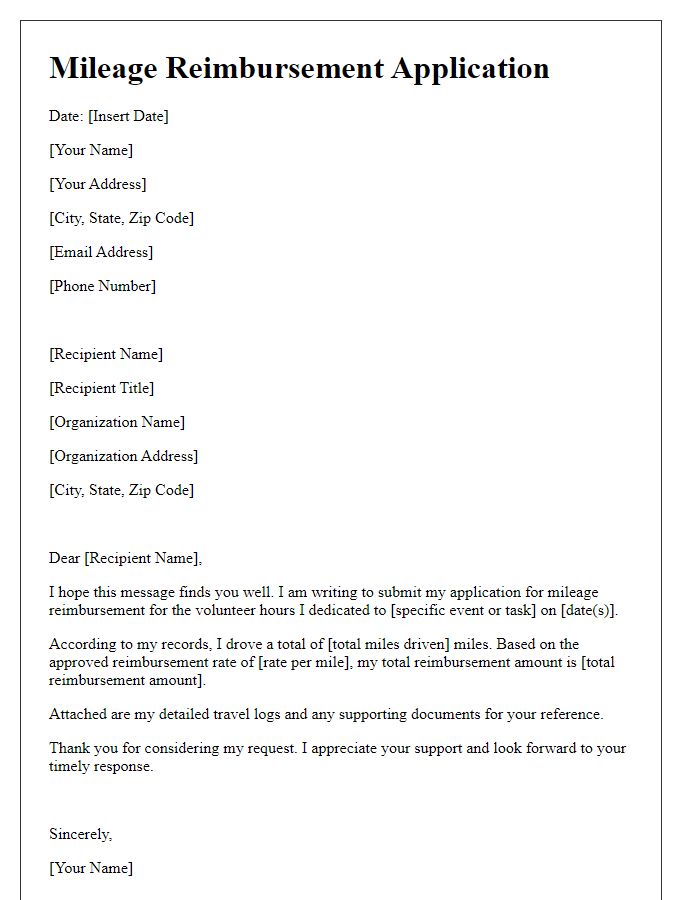

Letter template of mileage reimbursement explanation for the finance team.

Letter template of mileage reimbursement update for staff communication.

Letter template of mileage reimbursement confirmation for approved claims.

Letter template of mileage reimbursement reminder for quarterly submissions.

Comments