When it comes to managing finances, having a trusted advisor can make all the difference, and that's why I want to take a moment to express my heartfelt gratitude. Your expertise and guidance have helped me navigate some tricky financial waters, turning my worries into confidence. Not only have you provided invaluable advice, but your unwavering support has empowered me to make informed decisions for my future. I invite you to continue reading to learn how to express appreciation to someone who plays such a crucial role in your financial journey.

Personalization

Expressing gratitude to a financial advisor can strengthen your relationship and acknowledge their expertise. A personalized thank-you note highlighting specific achievements or assistance they provided can make your appreciation more meaningful. For example, mention how their guidance on retirement planning helped you secure a more comfortable future or how their investment strategies maximized your portfolio returns. Acknowledge their swift responses to your questions and their willingness to educate you throughout the process. Including details about your financial goals or milestones reached, such as saving for a child's education or purchasing a first home, will create a deeper connection and show genuine appreciation for their professional support.

Clarity and Specificity

Expressing gratitude to a financial advisor highlights the importance of their expertise in personal finance management. Acknowledging their role in achieving financial goals adds value to the relationship. Their insights into investment strategies, such as diversification in a portfolio, can lead to significant long-term wealth growth. Mentioning specific achievements, like a percentage increase in savings or successful retirement planning, enhances the sincerity of the appreciation. Careful attention to detail, including the timeliness of advice during critical life events, underscores their dedication and professionalism. This message serves as a meaningful recognition of their impact on financial well-being.

Tone and Professionalism

Exceptional financial advisors can profoundly influence clients' financial trajectories, often guiding successful wealth accumulation and investment strategies. A recent consultation with a certified financial planner highlighted personalized investment portfolios tailored to specific goals, ensuring diversified assets across sectors like technology, healthcare, and renewable energy. Comprehensive retirement planning strategies, emphasizing tax efficiency and risk management, demonstrated expertise in navigating fluctuating markets. Client engagement through regular performance reviews and proactive communication fosters trust, encouraging informed decision-making. Such professionalism in advising is crucial for clients aiming for long-term financial health.

Acknowledgment of Skills and Expertise

An exceptional financial advisor possesses a unique blend of skills and expertise that significantly impacts clients' financial well-being. Knowledge across various financial instruments, including stocks, bonds, and mutual funds, equips them to provide tailored investment strategies. Their proficiency in analyzing market trends, utilizing tools like technical analysis and fundamental analysis, ensures clients make informed decisions. Effective communication skills enable them to simplify complex financial concepts, fostering a transparent client-advisor relationship. Additionally, their understanding of taxation processes and retirement planning is crucial in optimizing clients' financial outcomes. Ongoing education and adaptability to the ever-evolving financial landscape enhance their ability to guide clients through economic uncertainties, securing both short-term growth and long-term stability.

Future Collaboration Intentions

Expressing gratitude towards a financial advisor implies recognizing their expertise in financial planning. Exceptional financial advisors often demonstrate profound analytical skills, understanding investment strategies, and navigating complex markets. With well-defined targets such as retirement planning or wealth accumulation, they provide tailored advice, often drawing upon their experiences with diverse clients. A successful collaboration may lead to enhanced financial health through strategic asset allocation and risk management. Acknowledging their contributions is critical, as advisors play a pivotal role in impacting clients' financial futures through informed decision-making and consistent support. Future intentions for collaboration can revolve around revisiting investment strategies, exploring emerging opportunities in sectors like technology or renewable energy, and ensuring enduring financial well-being.

Letter Template For Expressing Gratitude To Financial Advisor Samples

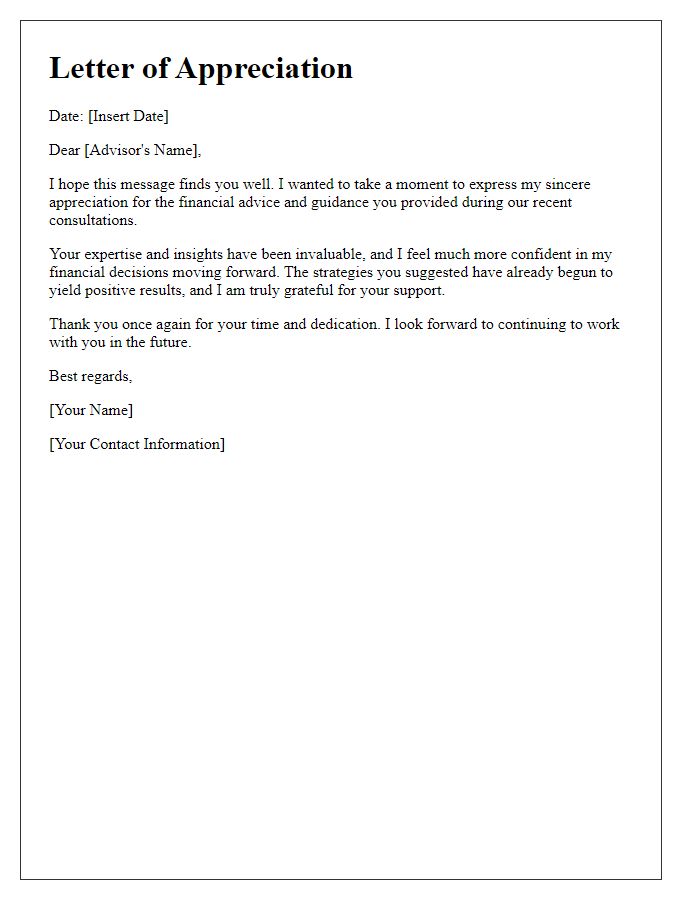

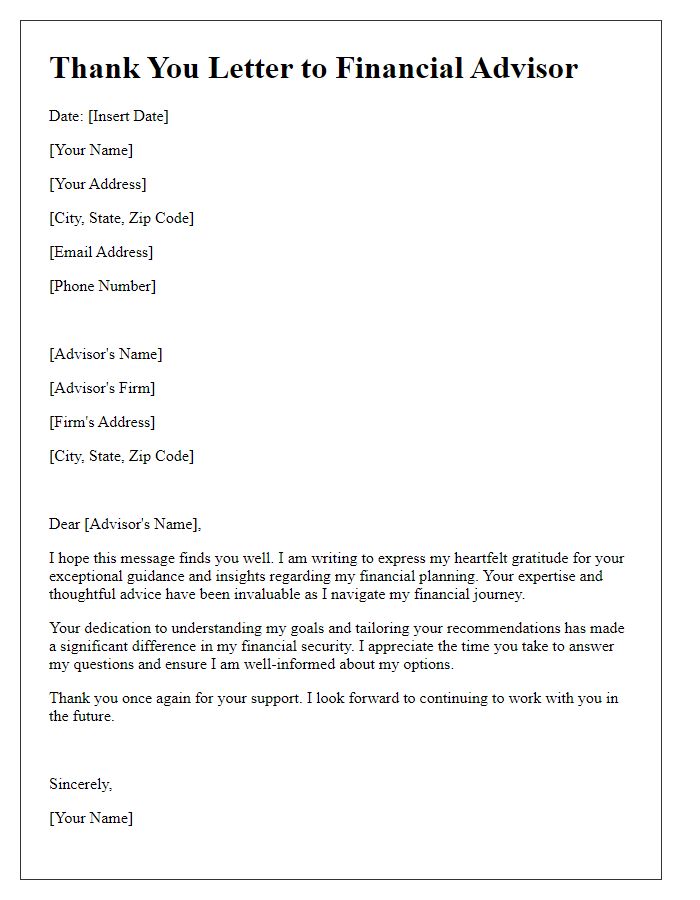

Letter template of gratitude towards my financial consultant's expertise.

Letter template of recognition for the hard work of my financial advisor.

Letter template of thanks for the successful financial planning assistance.

Letter template of gratitude for navigating my financial journey together.

Letter template of sincere appreciation for your financial management skills.

Comments