Are you looking for the perfect way to express your gratitude for some invaluable financial advice? Writing a thoughtful letter can really make a difference, and it's a great opportunity to show appreciation for the guidance you received. Whether it was a professional advisor or a friend who shared their insights, crafting a heartfelt message is a meaningful gesture. Let's dive into some tips and a letter template to help you convey your thanks effectivelyâread on!

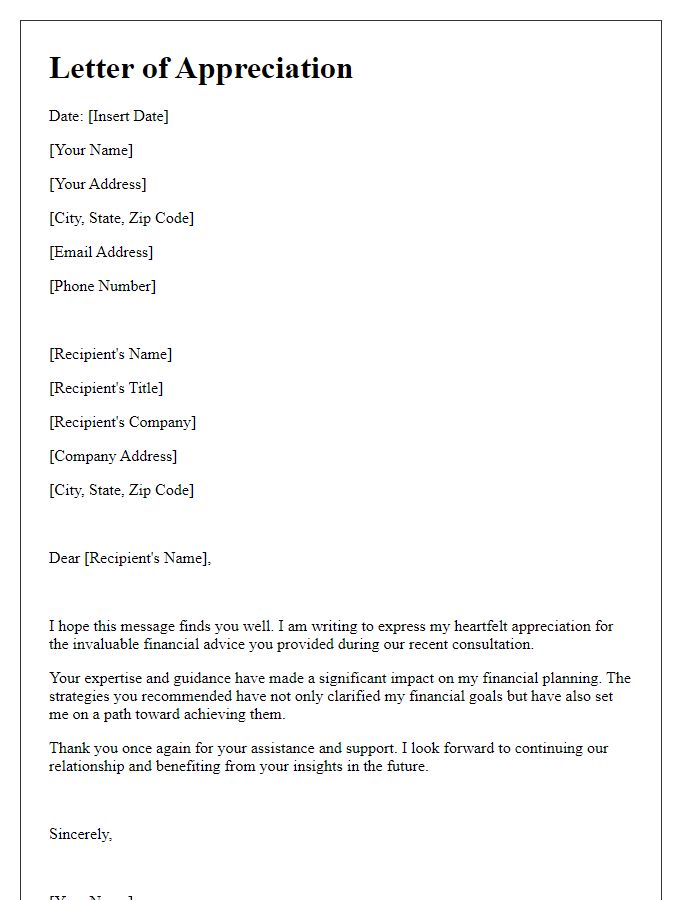

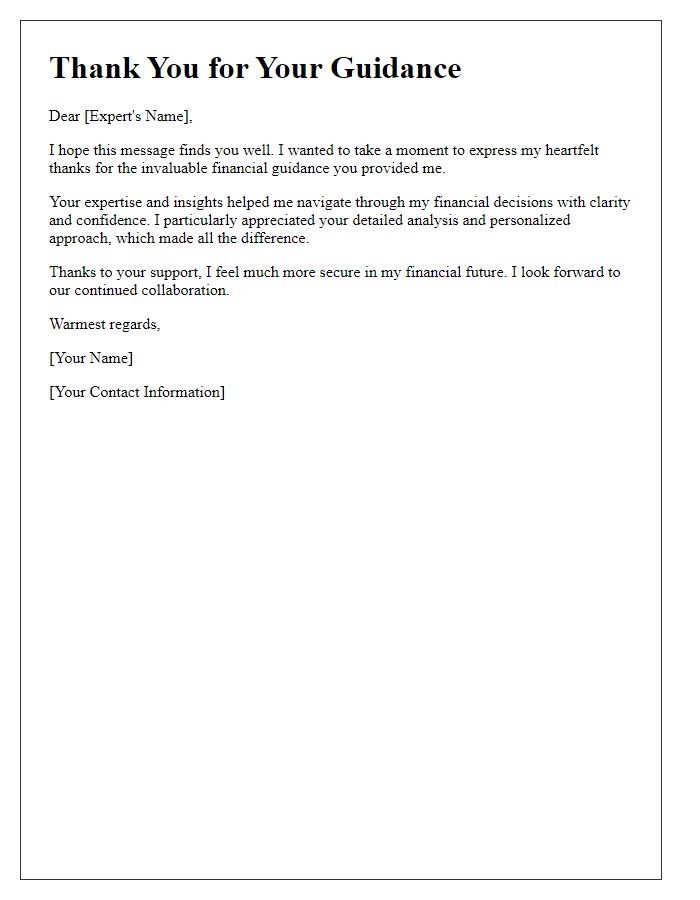

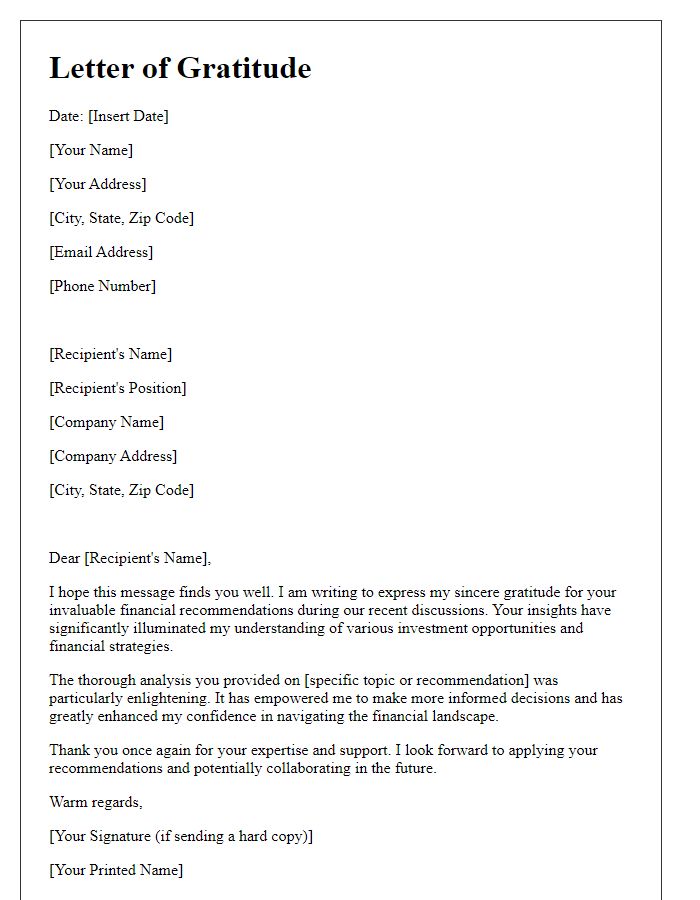

Clear subject line

Expressing gratitude for financial advice can be an opportunity to strengthen relationships and acknowledge the value of the guidance received. A well-crafted note can highlight key aspects of the advice that were particularly beneficial. Following your recent insight into diversification strategies for my investment portfolio, I have gained a clearer understanding of the potential risks and rewards associated with various asset classes such as stocks, bonds, and real estate. Your recommendations on allocating a specific percentage to growth-oriented investments (like technology stocks) versus safer options (such as government bonds) proved especially invaluable. The detailed analysis you provided regarding current market trends (notably the behavior of the S&P 500 index during the past quarter) helped solidify my investment choices. I genuinely appreciate the time you took to walk me through the intricacies of financial planning and your ongoing support in developing my financial literacy. Thank you for your expertise and guidance during this pivotal stage in managing my finances.

Personal greeting

Financial advice plays a crucial role in personal economic stability, guiding individuals towards informed decisions and successful investments. Expert insights from financial advisors can illuminate complex subjects such as asset management, budgeting techniques, retirement planning strategies, and risk assessment. Implementing recommendations from certified professionals can lead to improved financial literacy and a deeper understanding of market trends. Establishing a sound financial foundation allows for better preparation against unforeseen circumstances (like economic downturns or personal emergencies) and fosters a sense of security in one's financial future.

Specific gratitude mention

Gratitude for financial advice can be deeply enriching, highlighting specific instances. Expert consultation from a Certified Financial Planner, particularly during fluctuating market conditions in 2023, provided invaluable insights. Personalized strategies on investment diversification helped mitigate risks across assets like stocks, bonds, and real estate. The thorough analysis of retirement planning options, including 401(k) contributions and IRA benefits, clarified complex choices, allowing for a more secure financial future. Moreover, guidance on budgeting techniques and debt management created clarity in monthly cash flow, reducing stress and enhancing savings potential. Acknowledgment of this thoughtful and tailored approach underscores the impact of professional financial advice.

Impact of advice

Financial advice can significantly impact personal wealth management, influencing decisions regarding investments, savings, and expenditure. Implementing a budget can lead to improved financial health, helping individuals allocate funds efficiently across essential categories, such as housing, education, and retirement savings. Insightful advice regarding investment strategies can pave the way for long-term growth, often utilizing diversified portfolios composed of stocks, bonds, or mutual funds to minimize risk. Such guidance can lead to making informed choices that enhance financial stability, ultimately allowing individuals to achieve their financial goals, whether that be purchasing a home, funding children's education, or preparing for retirement. Regularly revisiting these advice points can reinforce sound financial practices, cultivating overall fiscal discipline and awareness of market trends.

Closing with appreciation

Receiving insightful financial advice can significantly impact one's economic well-being. Financial advisors often possess extensive experience in markets, investments, and personal finance strategies. Engaging with a knowledgeable advisor can lead to more informed decisions regarding asset allocation, tax strategies, and retirement planning. Expressing appreciation after receiving such guidance not only strengthens the relationship but also acknowledges the effort made by the advisor. A heartfelt thank-you note reinforces the value of personalized advice and encourages continued collaboration in future financial endeavors. This gesture can enhance the professional rapport and promote a lasting partnership rooted in trust and understanding.

Comments