We are thrilled to receive your generous contribution to our fundraiser! Your support not only helps us reach our goals but also inspires others in our community to join the cause. Every dollar counts, and thanks to you, we are one step closer to making a meaningful impact. Want to find out how your donation is transforming lives? Keep reading to learn more!

Donor's personal details

Fundraisers often rely on the generosity of donors to support their goals. Recognizing and acknowledging contributions is essential in maintaining relationships. A donation acknowledgement can serve various purposes such as tax deductions or simply showing appreciation. Personal details of donors, including names, addresses, and contribution amounts, help in tailoring the message to reflect genuine gratitude. Most organizations issue official receipts which comply with tax regulations to ensure donors can benefit from any eligible tax deductions. Acknowledging donations creates a sense of community and encourages future contributions.

Donation amount and purpose

Charitable donations significantly contribute to the success of fundraising efforts, often exceeding expectations. For instance, a $500 donation raised for a local food bank can provide 2,500 meals to families in need, illustrating the powerful impact of generosity. Acknowledging such contributions is essential for maintaining supporter relationships; individuals appreciate recognition for their efforts. Donors also find satisfaction in understanding how their gifts are utilized to address community challenges. Transparent communication about the destination and purpose of funds fosters trust, encouraging ongoing engagement in future initiatives.

Gratitude expression and appreciation

Generous donations made to community fundraisers significantly impact local initiatives and support critical causes. For instance, a successful event, such as the annual charity gala in San Francisco, can raise over $100,000 for homeless shelters, providing essential resources for over 500 individuals. Acknowledging these contributions fosters a sense of community and encourages continued support for future events. Organizations often express gratitude through personalized thank-you notes, highlighting the specific impact of each donor's contribution. This appreciation not only strengthens relationships but also inspires others to participate in upcoming fundraising efforts that focus on enhancing community well-being and providing vital services.

Tax information and benefits

Donations to fundraisers often bring significant impacts to charitable organizations. Acknowledgment letters provide essential tax information to donors, addressing rules from the Internal Revenue Service (IRS) in the United States. Charitable contributions can qualify for tax deductions, subject to specific thresholds. For example, donations exceeding $250 require written acknowledgment including the amount donated and a statement indicating whether any goods or services were provided in exchange. Organizations must issue these letters promptly, ideally within the calendar year of the donation. Additionally, tax-exempt status under Section 501(c)(3) of the IRS code ensures that contributions are fully deductible, enhancing the donor's ability to support causes like education, health, and community development. Proper documentation is crucial for both the organization and the donor to facilitate a smooth tax filing process.

Future engagement and impact update

Acknowledging donations to fundraisers is vital for engagement and impact. For instance, a community-driven initiative raised $50,000 in October 2023 to support local education programs in Austin, Texas. This generous contribution enables the enhancement of classroom resources and the development of extracurricular activities for over 1,000 students. Future engagement opportunities include volunteer days, where supporters can contribute hands-on assistance to initiatives. Impact updates will be shared bi-annually, highlighting the progress of funded projects, showcasing student success stories, and detailing community benefits resulting from the donations. Such transparency builds trust and encourages continued support.

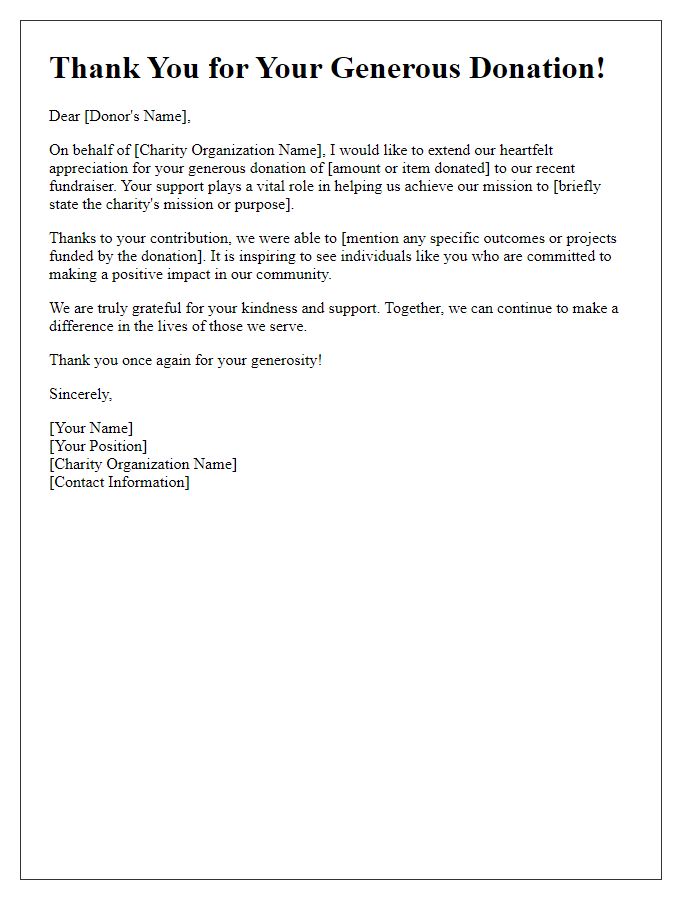

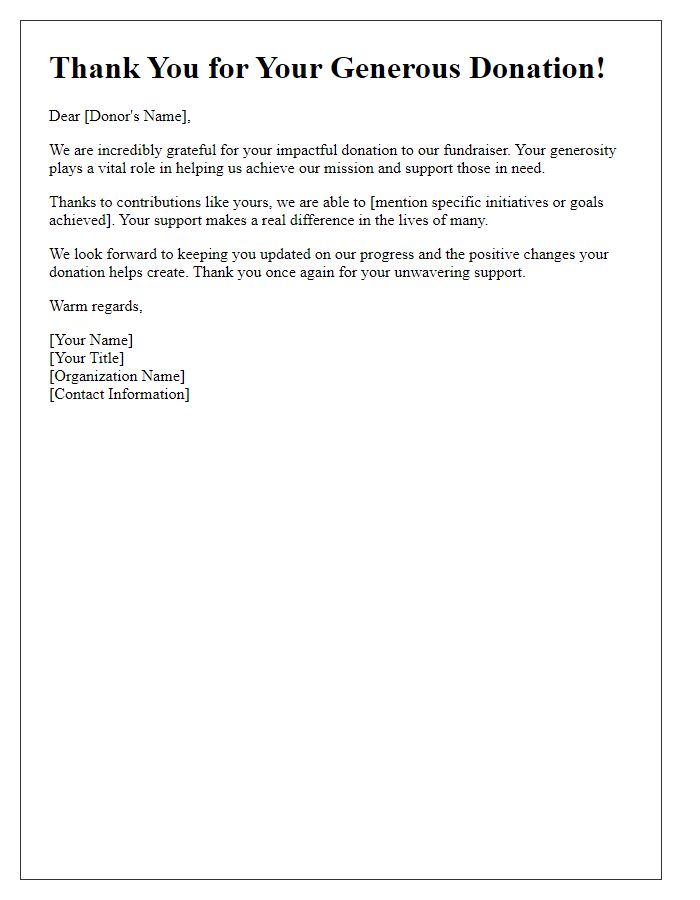

Letter Template For Acknowledging Donation To Fundraiser Samples

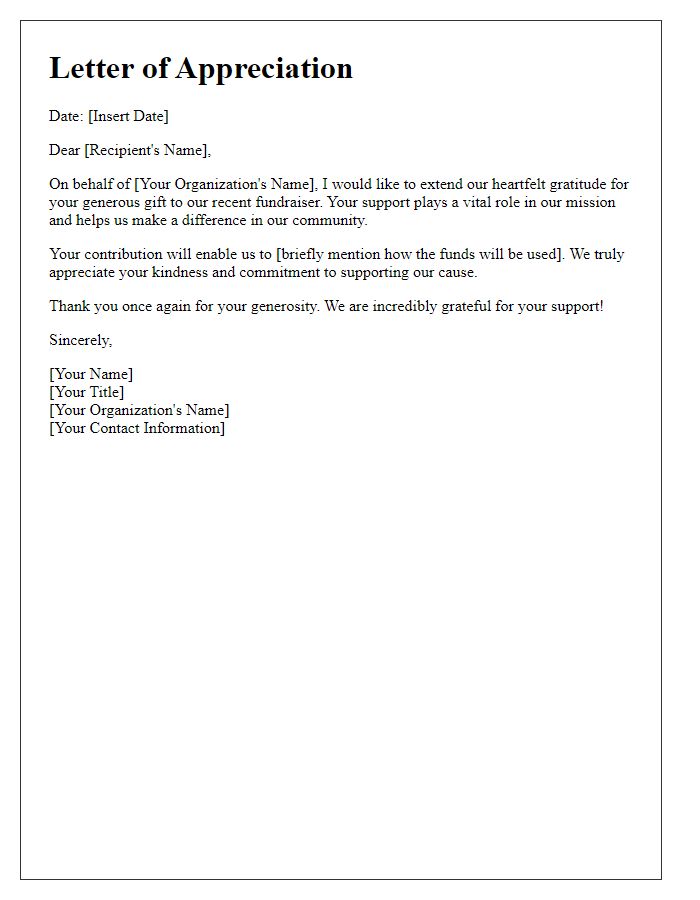

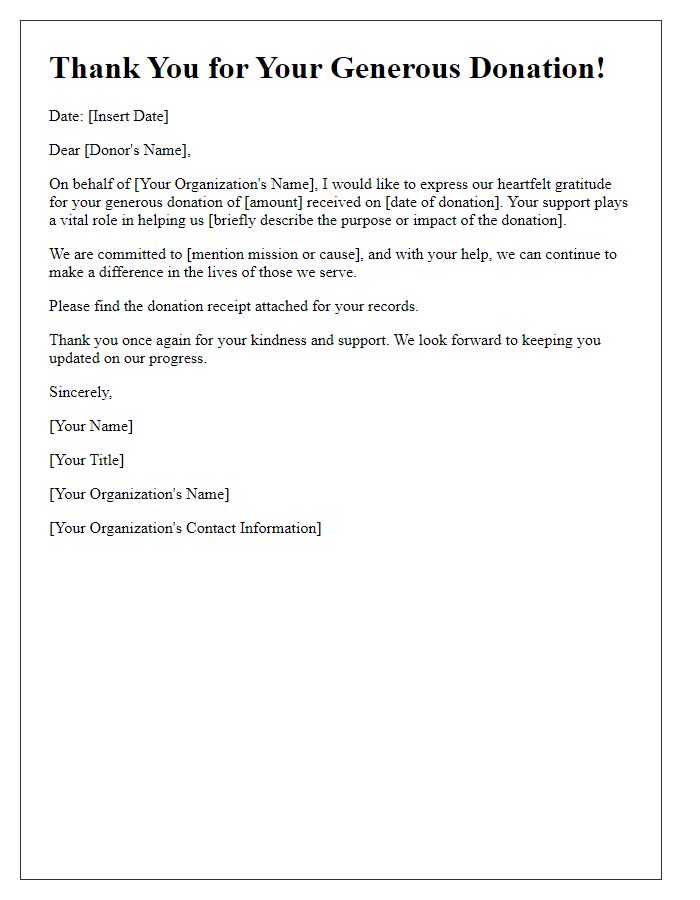

Letter template of appreciation for the generous gift to the fundraiser.

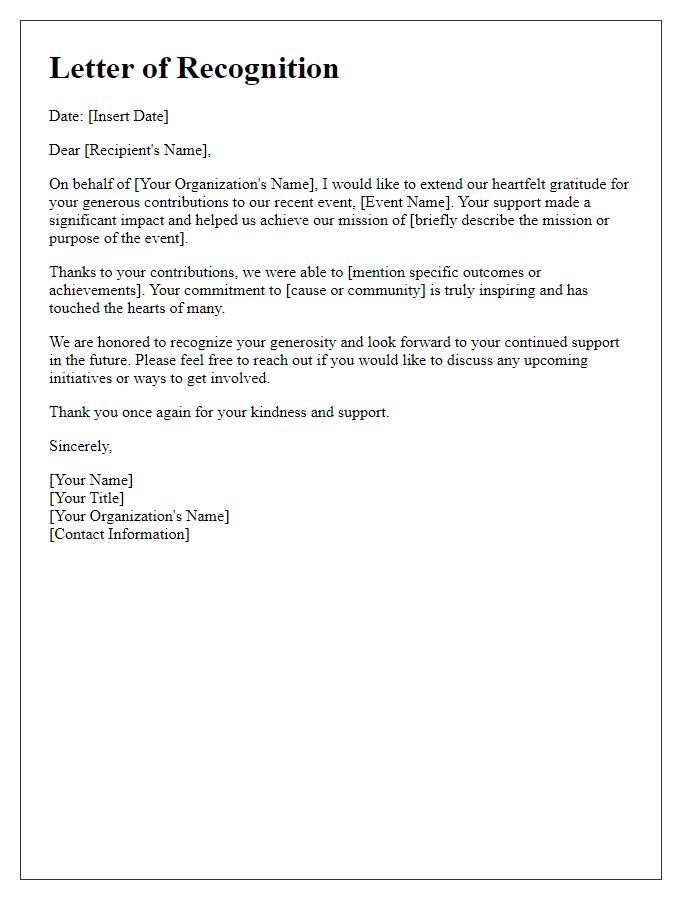

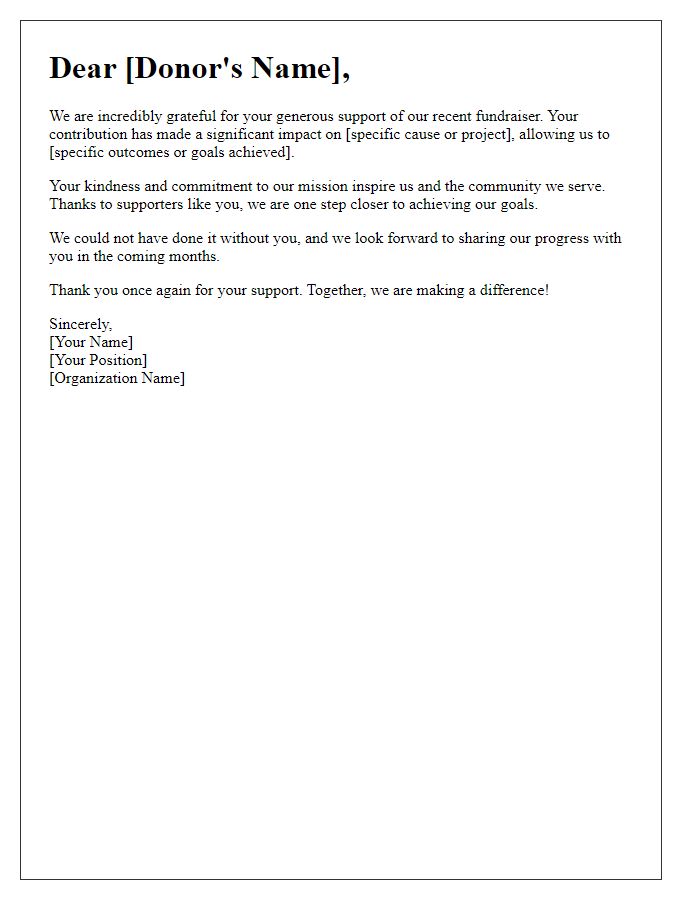

Letter template of recognition for charitable contributions to our event.

Comments