Are you looking to terminate your insurance policy but unsure how to communicate your decision? Writing a termination notice can feel daunting, but it doesn't have to be! In this article, we'll guide you through a straightforward letter template that makes the process simple and clear. So, let's dive in and help you navigate this essential task!

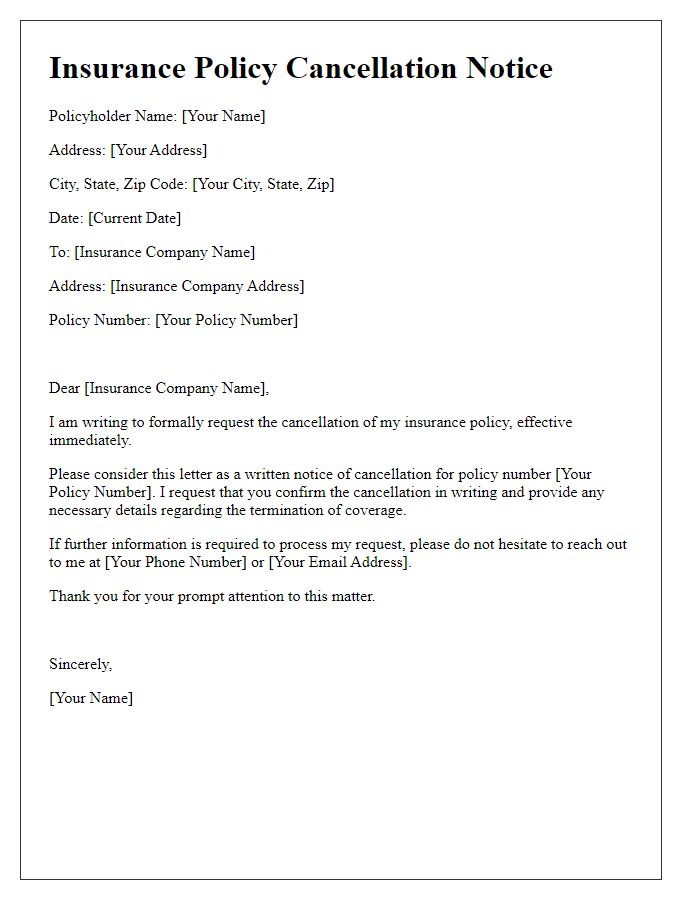

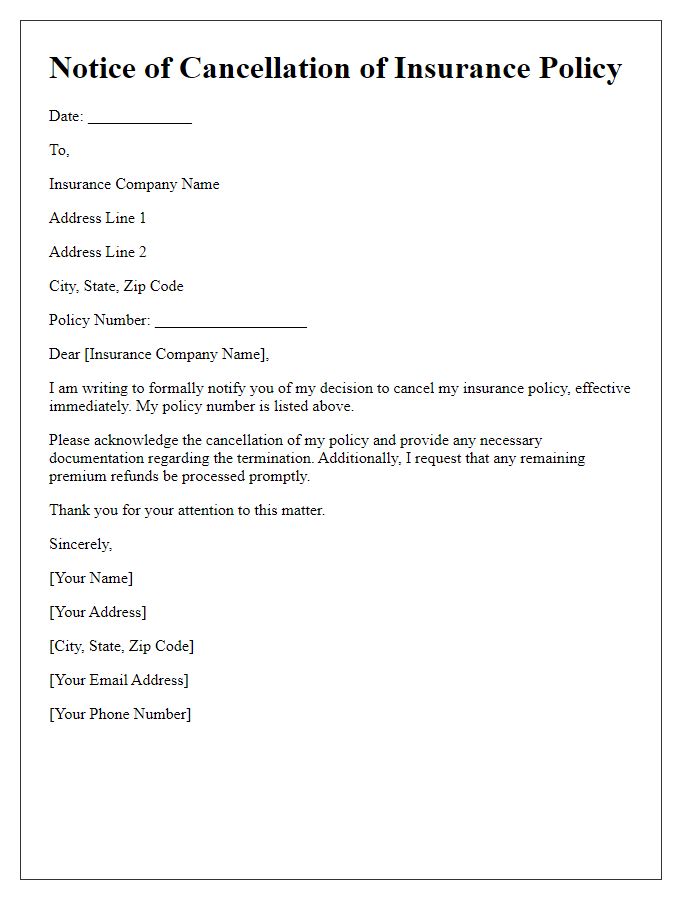

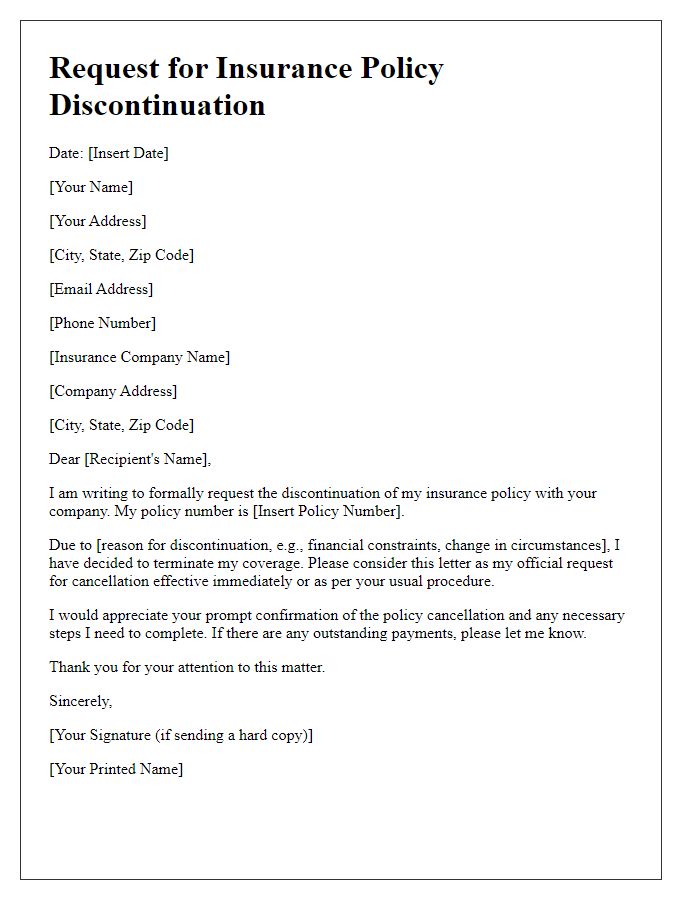

Policyholder Information

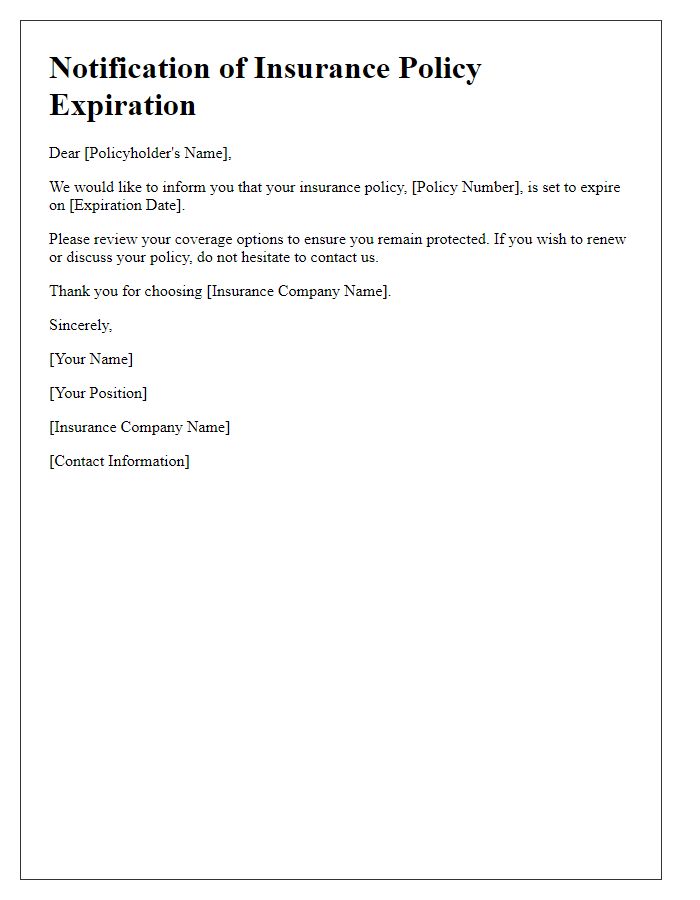

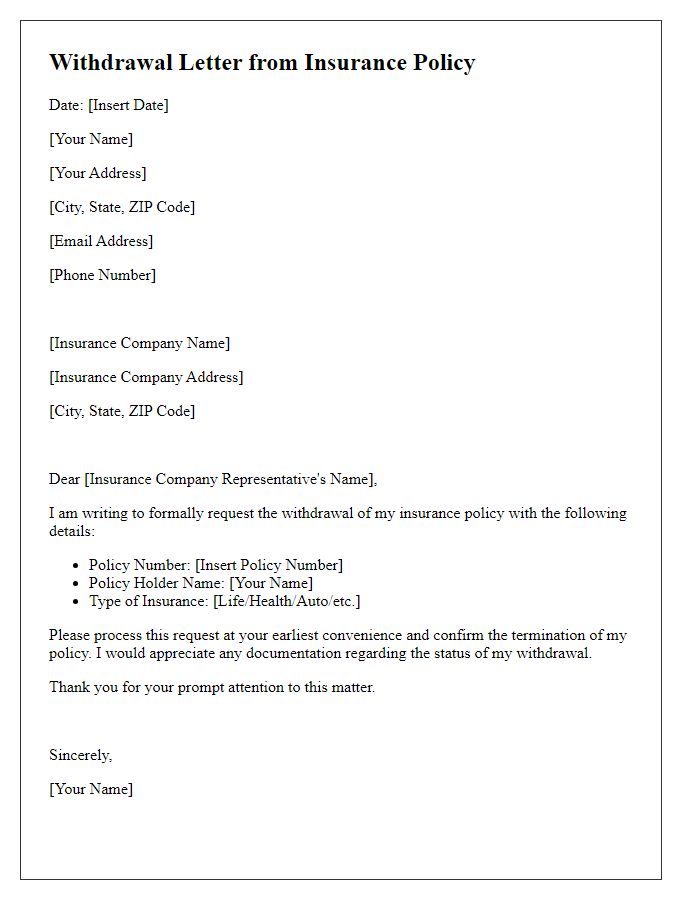

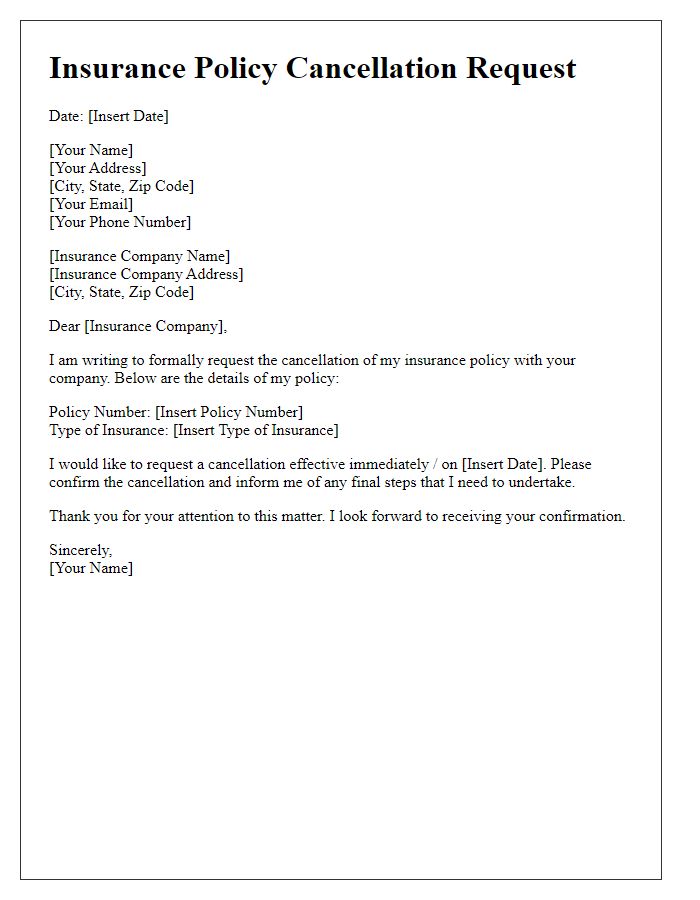

Insurance policy termination notices must include essential details to ensure clarity and proper processing. The document should start with the policyholder's full name, which identifies the individual associated with the policy. This must be accompanied by the policy number, a unique identifier assigned by the insurance company, that corresponds to the specific insurance policy. The policyholder's address, including city, state, and zip code, helps in verifying the individual's identity and in directing communications accurately. Additionally, the date of the notice should be present, indicating when the termination request was made, providing a clear timeline for the insurance provider. Lastly, inclusion of any relevant account information, such as a contact number or email, ensures that the insurance company can respond or clarify any concerns promptly.

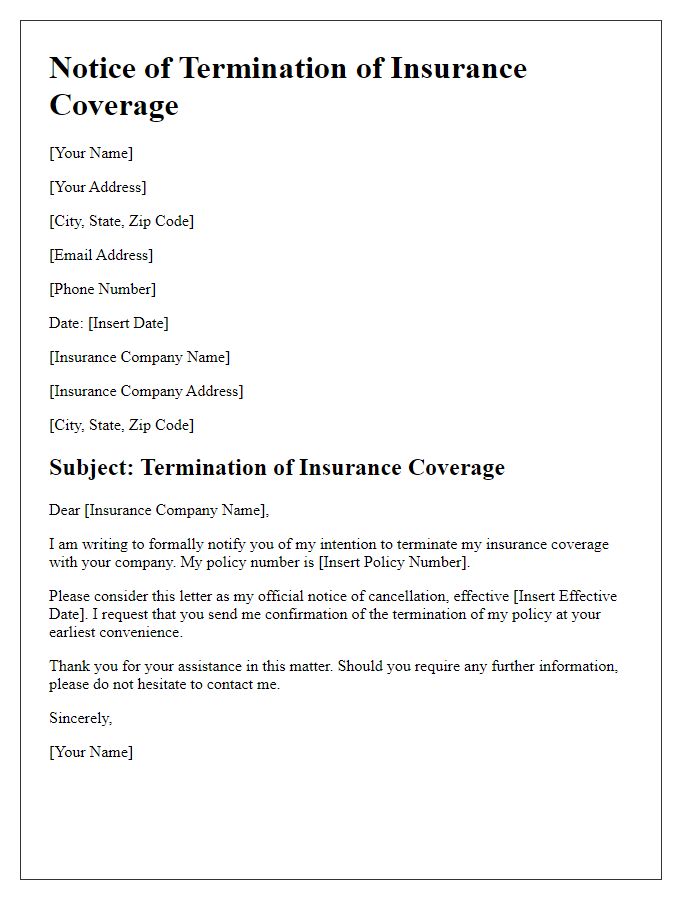

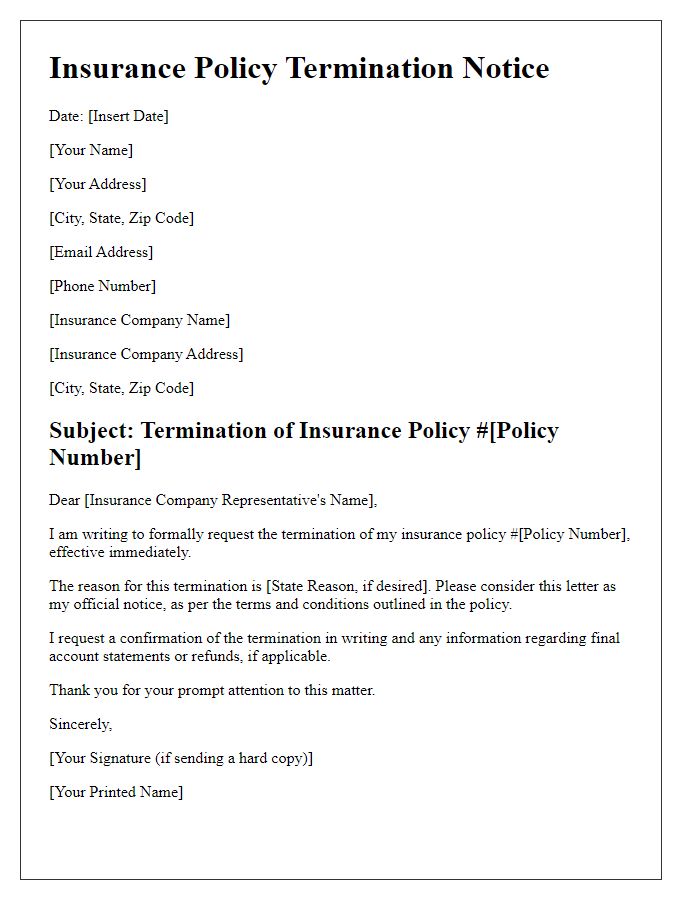

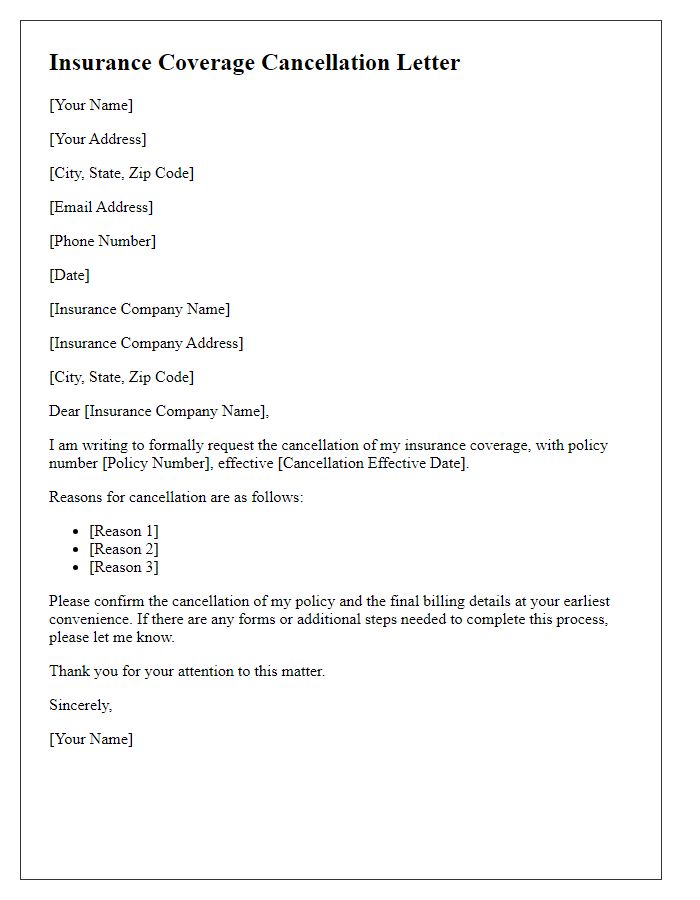

Policy Details

Insurance policy termination occurs when a client decides to end their agreement with an insurance provider. Key details include the policy number (a unique identifier for the insurance contract), the effective date (the date when the policy officially ends), and any aspects related to premiums (payments made for coverage) already paid. Important information about the reason for termination, such as cancellation due to non-payment or opting for a different insurer, should be clarified. Understanding the implications of policy termination, such as potential loss of coverage or the need for new insurance arrangements, is crucial for the policyholder. The documentation must also reference any statutory notice requirements mandated by regional regulations, ensuring compliance with local insurance laws.

Termination Effective Date

To ensure clarity and understanding in insurance policy communications, a termination notice for an insurance policy must include key details. The termination notice should specify the effective date of the policy termination, clearly stating the day the coverage will cease. For instance, if the termination date is set for December 31, 2023, it should be highlighted prominently within the notice. Furthermore, policyholders should be informed about any outstanding premiums due or the return of unearned premiums, emphasizing the importance of addressing these financial matters. The notice should also include the policy number for easy reference and any necessary steps for the policyholder to finalize the termination process, ensuring a smooth conclusion to their insurance coverage.

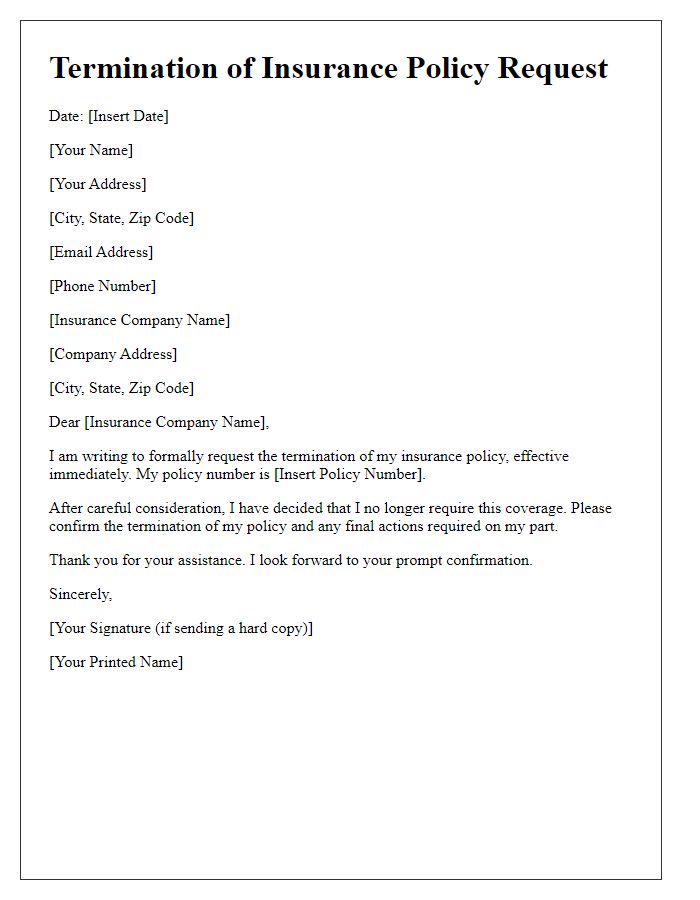

Reason for Termination

Insurance policy termination often involves several key reasons affecting the insured party's coverage. Policyholders may experience changes in personal circumstances, such as financial constraints, leading to the decision to terminate their health insurance policy. Pre-existing medical conditions, such as chronic illnesses like diabetes or hypertension, might also prompt individuals to seek alternative coverage that offers better benefits or lower premiums. Additionally, dissatisfaction with the insurer's customer service, claim processing efficiency, or coverage limitations can motivate policy termination. Furthermore, life events such as marriage, relocation, or changes in employment status may necessitate a review and potential cancellation of existing policies, especially if new policies better suit the individual's needs. Each of these factors plays a significant role in the decision-making process related to insurance policy termination.

Contact Information

Insurance policy termination notices require clear and concise communication of relevant details to ensure accurate processing. A sender's contact information (including name, phone number, email address) is crucial for any necessary correspondence regarding the policy cancellation. The insurance company's details, such as the official name, policy number, and the mailing address for correspondence, should be included to ensure the termination notice reaches the appropriate department. Mentioning any specific terms related to the cancellation policy--like notice periods and potential effects on future coverage--provides essential context for both the sender and the recipient, clarifying expectations during the cancellation process.

Comments