Hey there! If you've ever found yourself in a tight spot with your insurance coverage, you know how important it is to stay informed. A lapse in insurance can lead to serious issues, including termination of your policy, and understanding your options is crucial for maintaining financial security. In this article, we'll walk you through the process of dealing with a coverage lapse and how to navigate your options effectively. So, let's dive in and explore ways to ensure you're protected when you need it most!

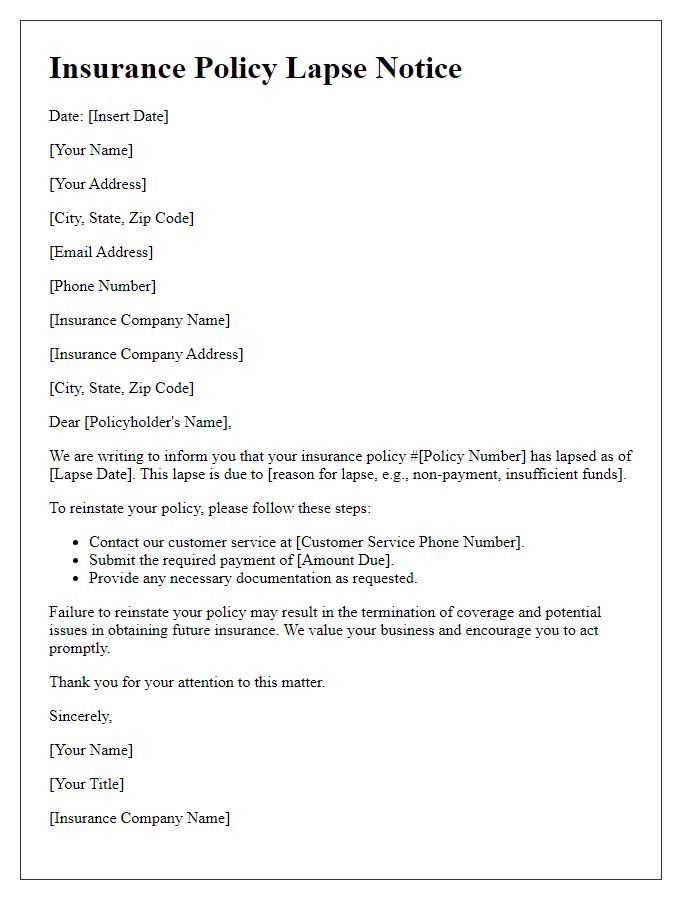

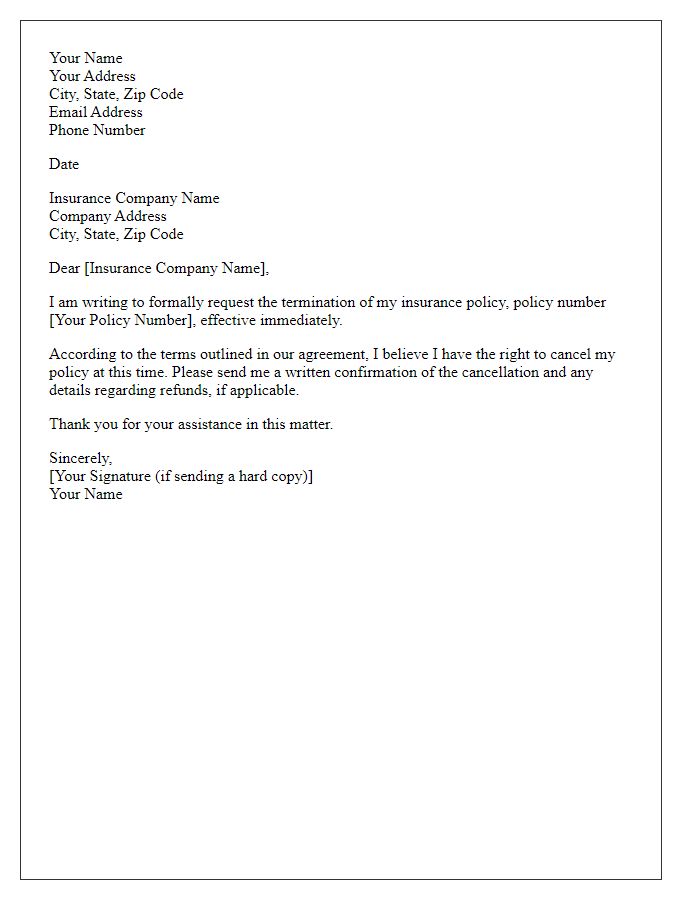

Policyholder Information

Insurance policy coverage retention is critical for maintaining protection against unforeseen events, such as accidents or natural disasters. Policy lapses often occur due to non-payment of premiums, which can leave policyholders exposed to significant financial liabilities. For instance, a lapse in homeowners insurance could leave a residence in California vulnerable to damage from wildfires, while auto insurance lapses could lead to legal penalties and financial strain in an accident scenario. Additionally, insurance providers typically issue termination notifications, detailing the lapse's effective date and associated consequences. Maintaining updated contact information ensures that policyholders receive these important communications promptly. Policyholders are encouraged to review their coverage and payment details regularly to avoid these undesirable situations.

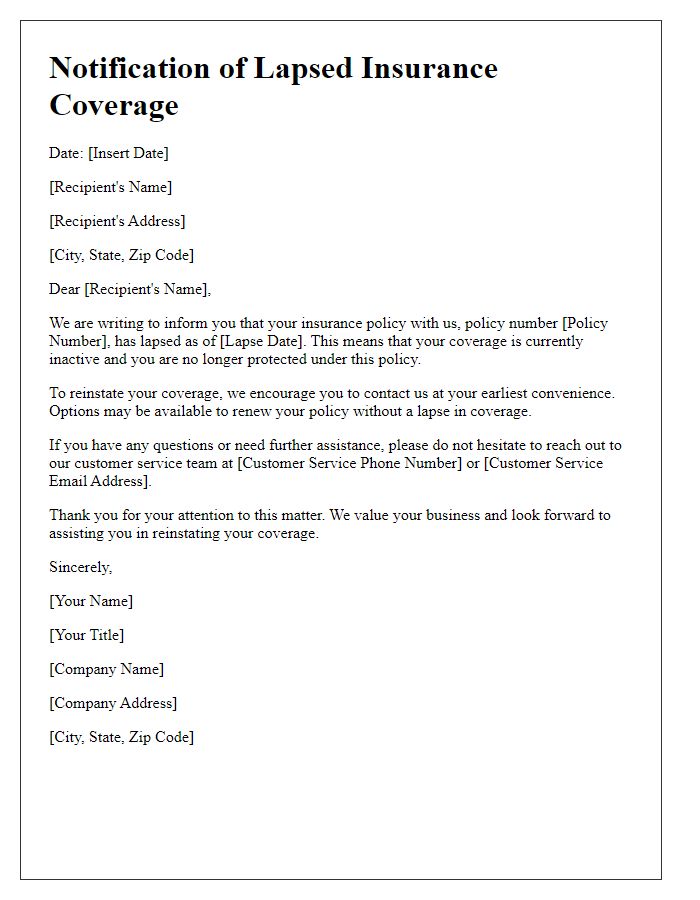

Coverage Details

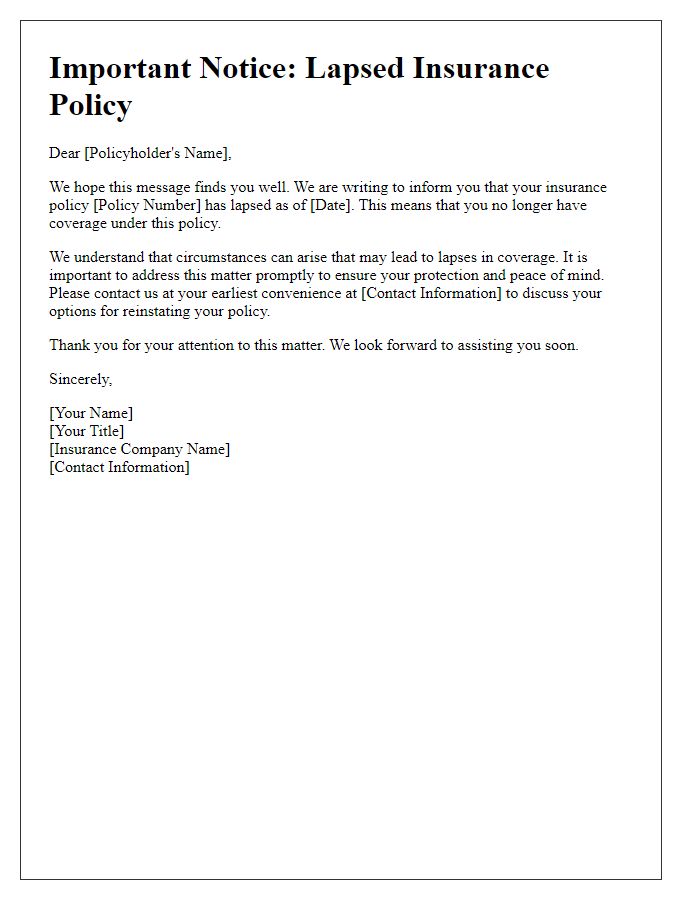

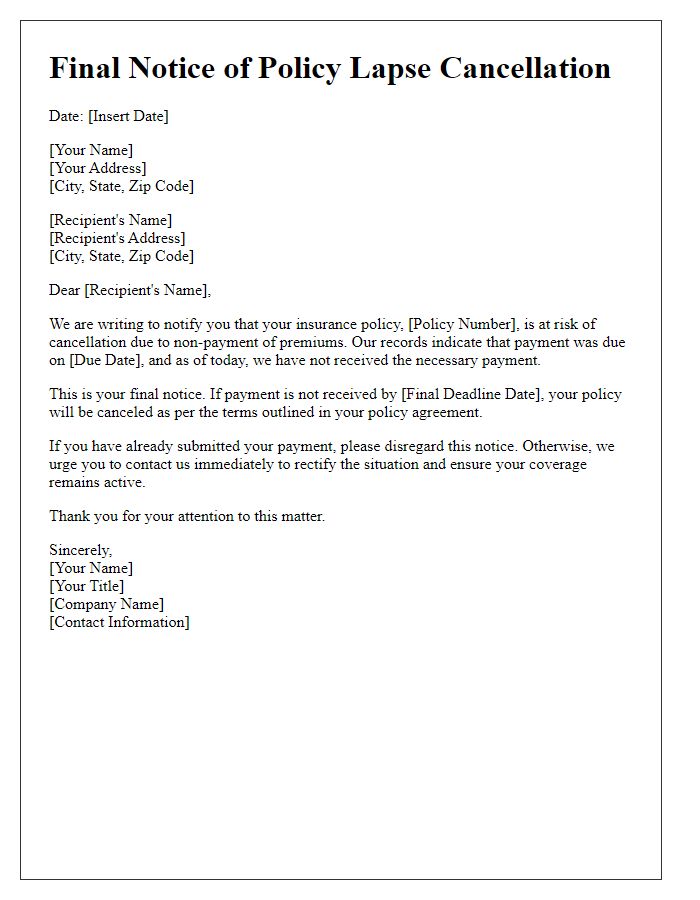

Insurance coverage lapse termination can result from missed premium payments, affecting policies such as auto insurance, health insurance, or homeowners insurance. A lapse occurs when the premium payment is not received by the insurer within the grace period, which typically lasts around 30 days. Policyholders may receive notifications via mail or email from the insurance company, emphasizing the date of the lapse and the importance of maintaining continuous coverage. If a policy lapses, reinstatement may require the submission of updated information, payment of back premiums, and sometimes penalties. The implications of having a lapsed policy include potential liabilities in case of accidents, higher rates upon reinstatement, and challenges in acquiring new coverage in the future.

Lapse Reason

Insurance coverage lapses can occur due to various reasons, including non-payment of premiums, changes in personal circumstances, or failure to meet renewal requirements. In some cases, policyholders may overlook payment deadlines, leading to a grace period of typically 30 days. If payment isn't received during this timeframe, insurance providers, like State Farm, can terminate coverage, leaving individuals vulnerable, especially for critical areas such as health or auto insurance. Additionally, changes such as relocation or updated underwriting policies can impact coverage status, resulting in notification letters sent to policyholders to clarify terms and potential reinstatement options.

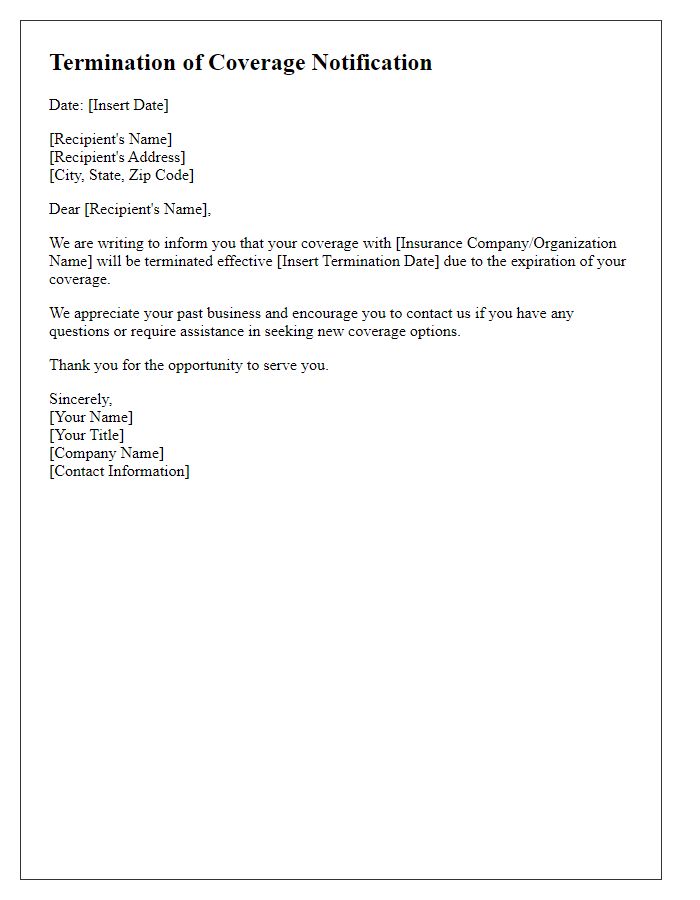

Termination Date

An insurance coverage lapse can lead to serious financial consequences for policyholders. For instance, if a health insurance plan offered by a provider like Blue Cross or UnitedHealthcare experiences a lapse due to non-payment, coverage typically terminates 30 days after the missed premium payment. During this lapse period, individuals may face high out-of-pocket expenses for medical services as preventive care, essential treatments, and routine check-ups become uncovered. Additionally, reinstating a lapsed policy can result in increased premiums or the imposition of waiting periods for pre-existing conditions, impacting the financial stability of families relying on consistent health insurance coverage. It's crucial for policyholders to stay informed about their payment due dates, policy conditions, and the implications of any coverage interruption to avoid unexpected financial burdens.

Contact Information

Insurance coverage lapse termination can lead to significant financial consequences for policyholders. Typically occurring due to missed premium payments, this situation can impact health insurance policies and auto insurance coverage, leaving individuals exposed to unexpected medical bills or vehicle repair costs. Each state in the United States, such as California or Texas, has specific regulations governing notification periods, often requiring a notice of at least 30 days before termination takes effect. Additionally, insurance companies often provide grace periods, which may last from 10 to 31 days, allowing policyholders to rectify their payment status without losing coverage. Responding promptly to communication from insurers is crucial in maintaining policy validity and ensuring continuous protection from potential liabilities.

Comments