Are you feeling overwhelmed by a recent disputed charge on your statement? You're not alone, as many consumers face similar situations and often find it challenging to navigate the investigation process. In this article, we'll break down the steps you need to take in order to address a disputed charge effectively and ensure that your rights are protected. So, grab a cup of coffee and let's dive into the details to empower you with the knowledge you need!

Account Information

Disputed charges on credit card statements often require detailed investigation due to their potential impact on an individual's financial record. Account information, essential for this process, typically includes the credit card number, expiration date, and the name associated with the account. Specific transaction details, such as the date of the charge, merchant name, and amount, play a critical role in clarifying the nature of the dispute. Additionally, relevant supporting documents, such as receipts or prior correspondence, can further validate claims and assist in a thorough examination of the disputed charge. This comprehensive approach ensures that the investigation is conducted with accuracy and transparency.

Detailed Transaction Description

When investigating a disputed charge on credit statements, it is critical to provide an exhaustive transaction description. The charge in question relates to a purchase made on March 15, 2023, at "Gadget World," a prominent electronics retailer located in San Francisco, California. The transaction amount totaled $299.99 for a smartphone accessory labeled "SmartGrip Pro." This item, designed for enhanced grip and usability of mobile devices, was purchased using a Visa credit card ending in 1234. The receipt number, which is essential for verification, is 456789. Despite having successfully completed this purchase, an unexpected charge of $399.99 appeared on the statement dated March 20, 2023. This discrepancy necessitates thorough examination to ascertain its validity and rectify any billing errors. Additionally, customer support was contacted on March 25, 2023, for clarification, but the response remains unresolved, prompting further investigation into the matter.

Dispute Reason and Evidence

Disputed charges on credit card statements often occur due to unauthorized transactions or discrepancies in billing amounts. A common reason for such disputes arises when consumers notice unfamiliar charges, potentially from merchants located in different countries or often involving subscription services. Evidence supporting this dispute may include transaction receipts, communication records with the merchant, or screenshots showing the cancellation of a service. Additionally, consumers should gather dates, amounts, and descriptions of the disputed charges, including the transaction date and any relevant account numbers. Thorough documentation assists credit card companies in the investigation process, which usually takes 30 to 90 days to resolve.

Requested Resolution

Disputed charges often arise from unauthorized transactions or billing errors on credit card statements. Consumers should address these issues promptly to ensure correct account management. Documenting the transaction details, such as the date, amount, and merchant name, enhances clarity during the investigation. Submitting a detailed request for resolution to the bank or financial institution, including any supportive evidence like receipts or email correspondence, can expedite the review process. Regulatory guidelines set forth by entities like the Fair Credit Billing Act mandate institutions to resolve disputes within a specific timeframe, typically ranging from one to two billing cycles. Consumer awareness of these rights is crucial for effective financial dispute resolution.

Contact Information

For a thorough investigation of disputed charges on credit or debit accounts, ensure to gather vital contact information. Your full name as it appears on the statement, account number (usually a 16-digit number for credit cards), and the name of the financial institution (e.g., Bank of America or Chase) are crucial. Also, include any date of the transaction you are disputing (for instance, January 15, 2023), the amount charged (such as $150.00), and a detailed description of the item or service in question. Additionally, provide your mailing address, email address, and phone number for prompt communication regarding the status of the investigation.

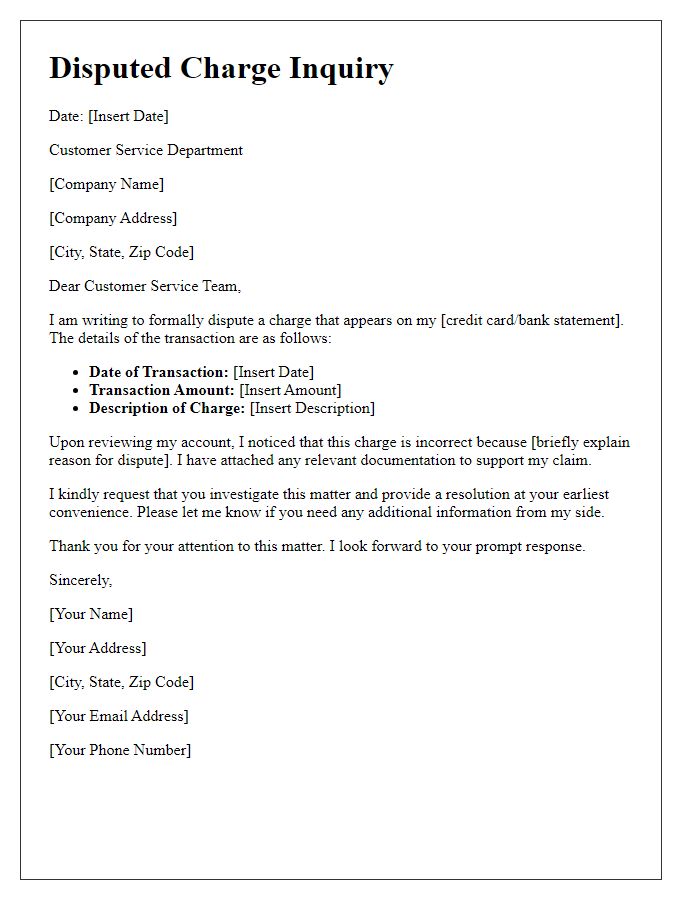

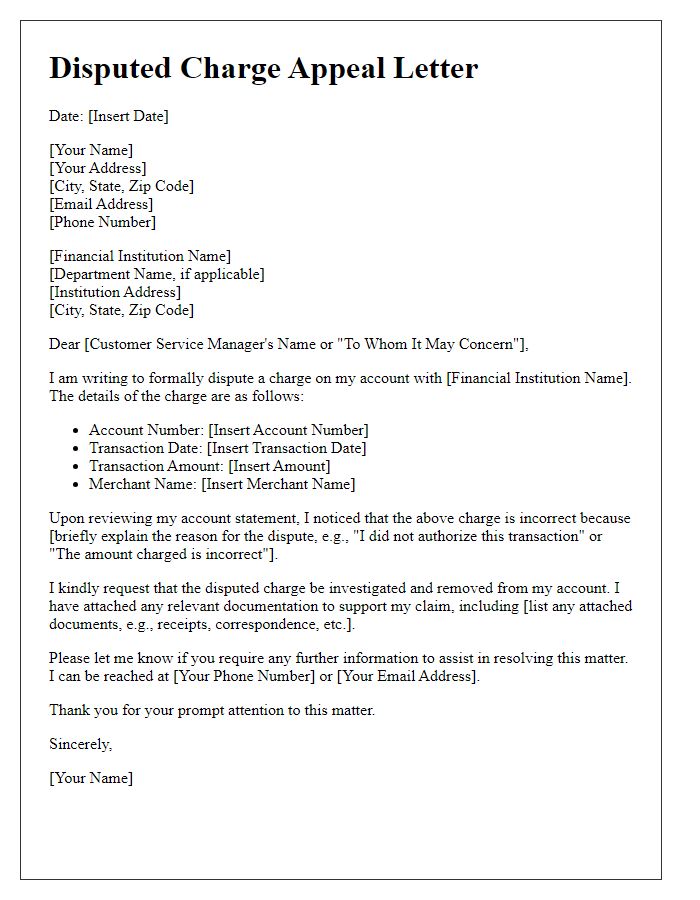

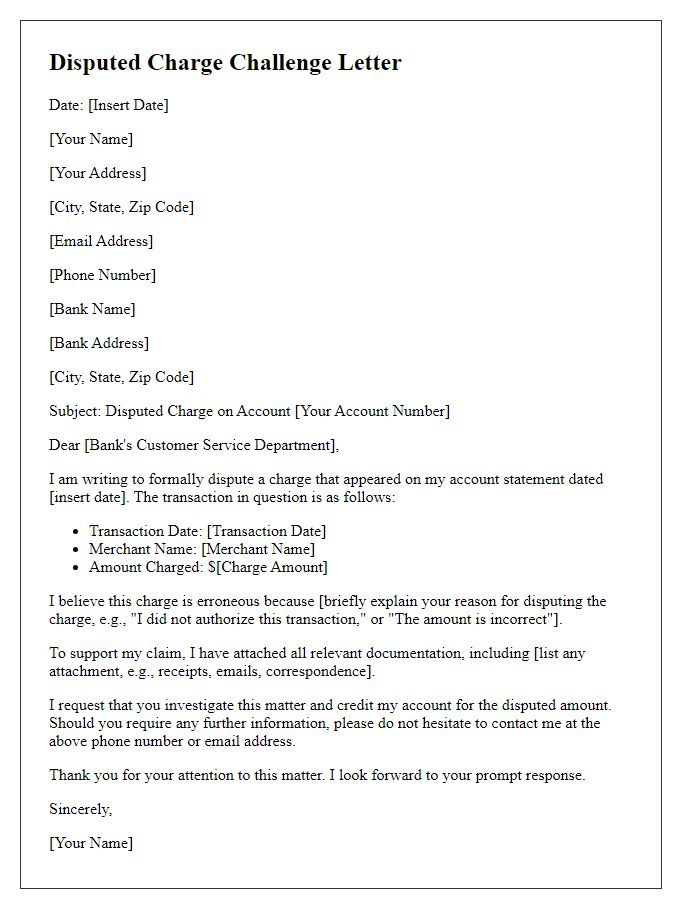

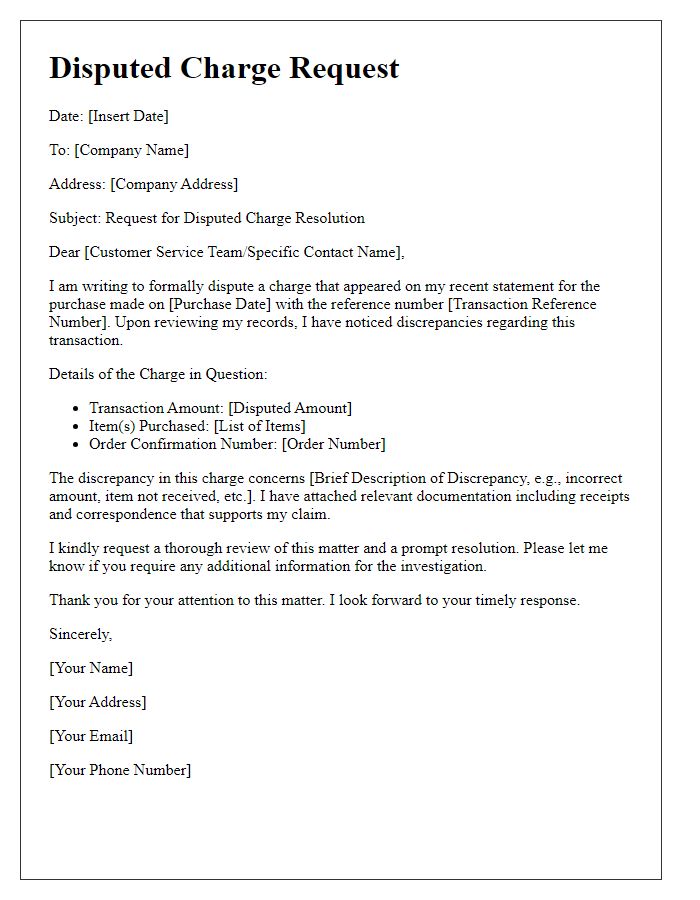

Letter Template For Disputed Charge Investigation Samples

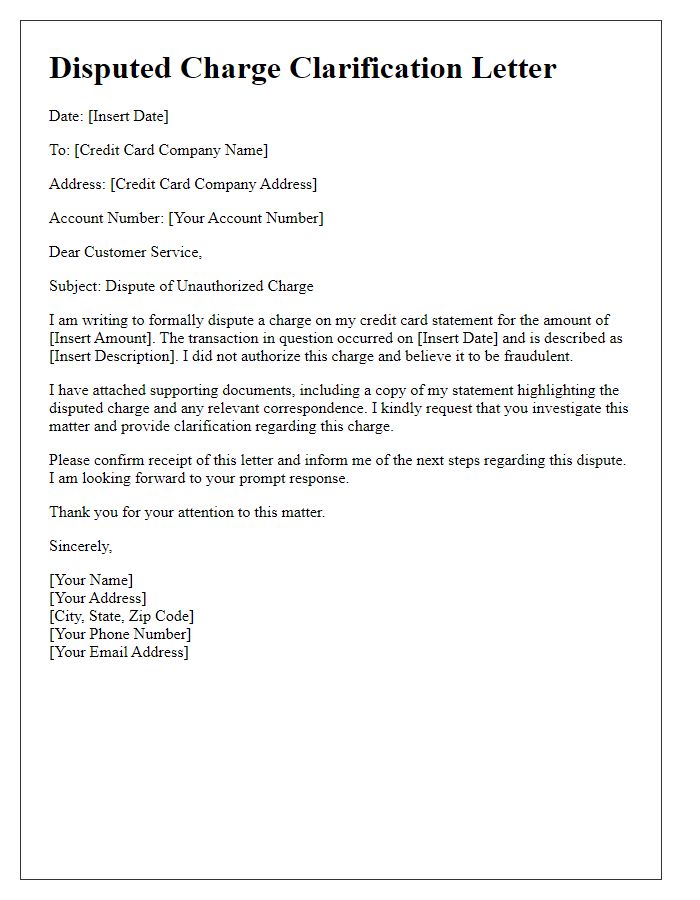

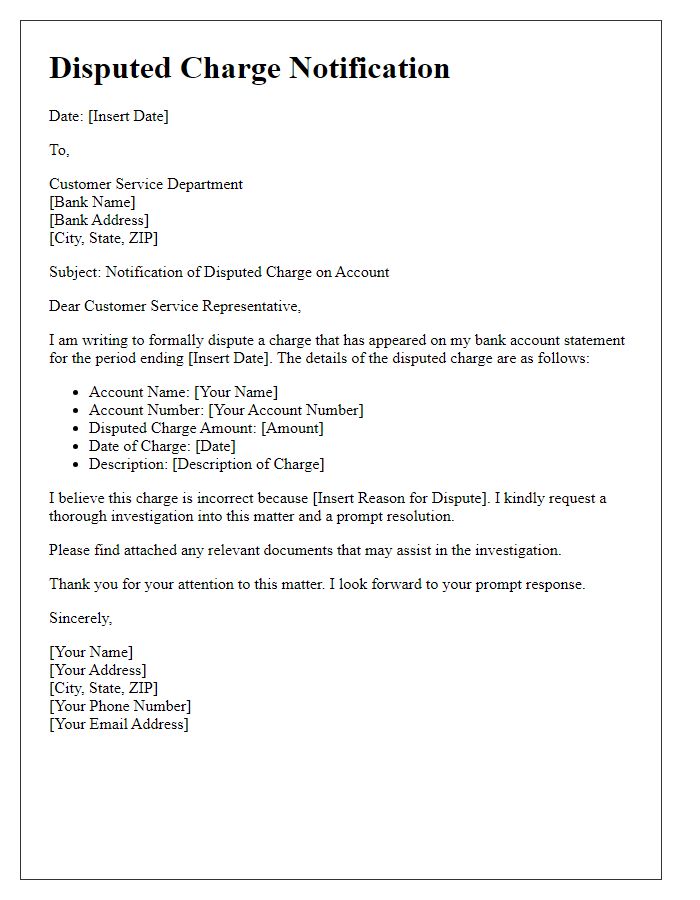

Letter template of disputed charge clarification for credit card companies.

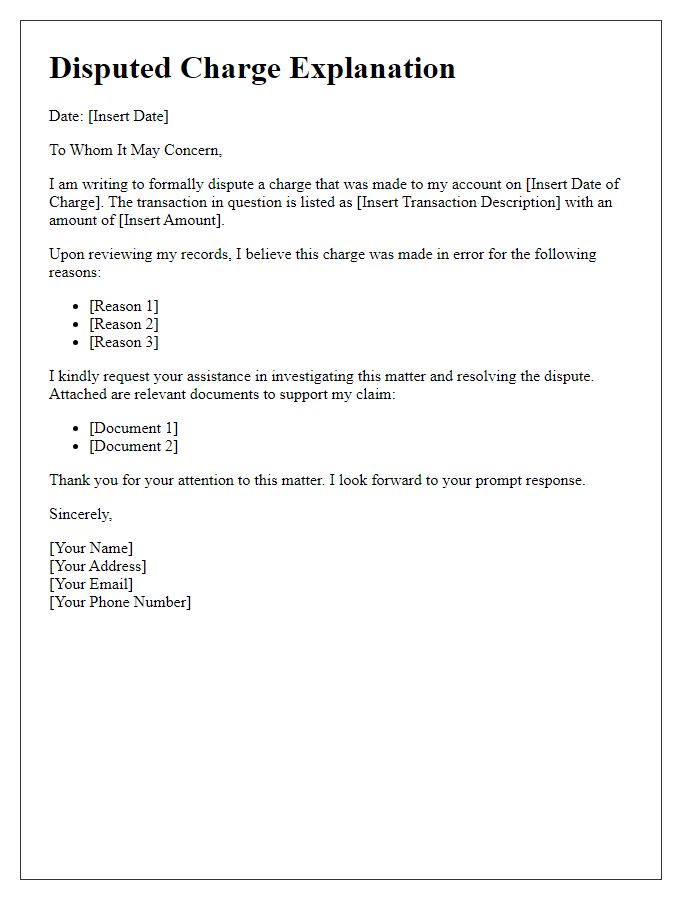

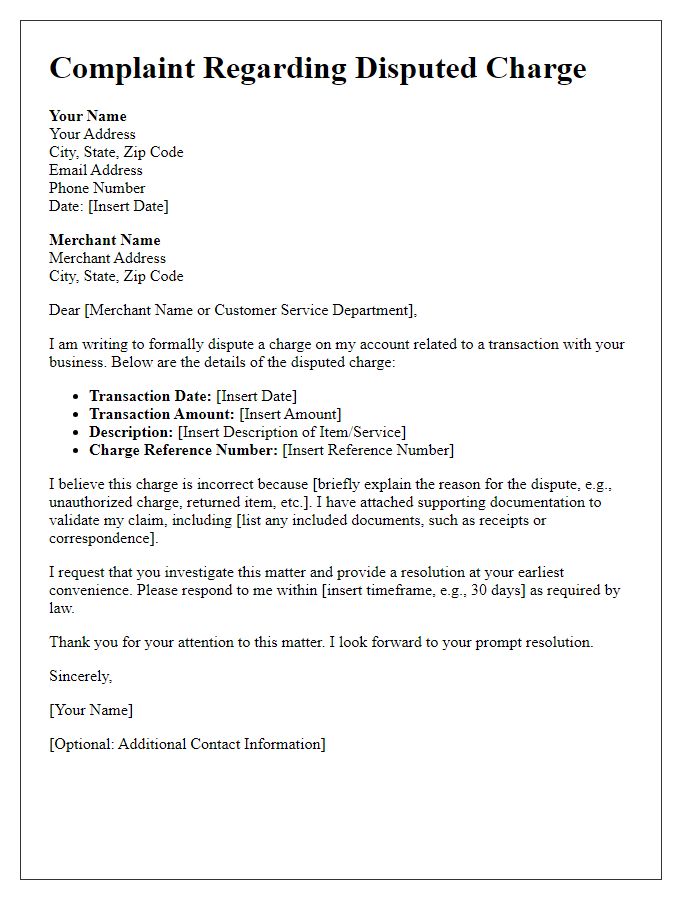

Letter template of disputed charge explanation for e-commerce platforms.

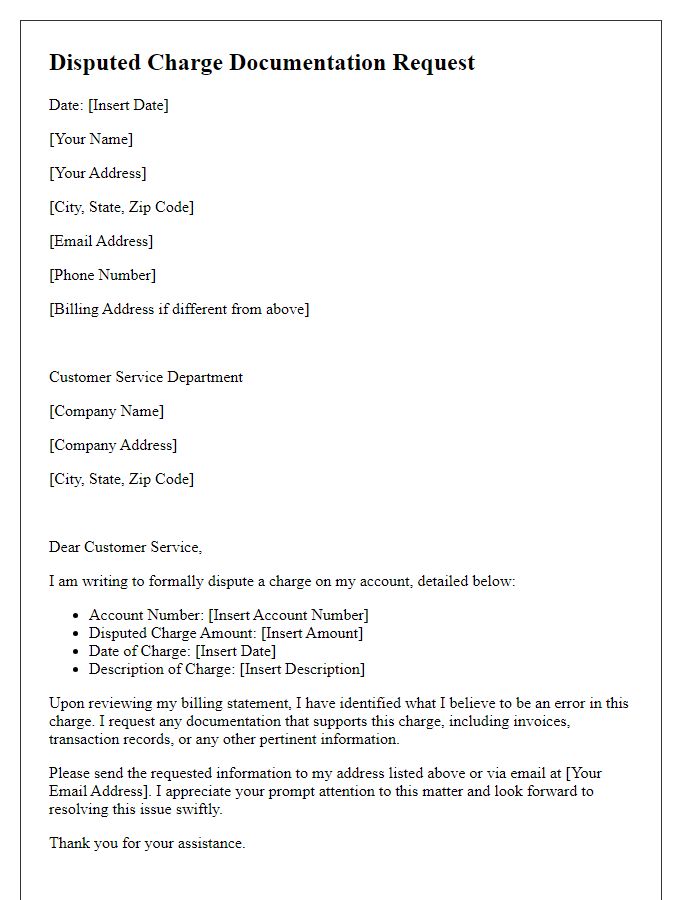

Letter template of disputed charge documentation request for billing errors.

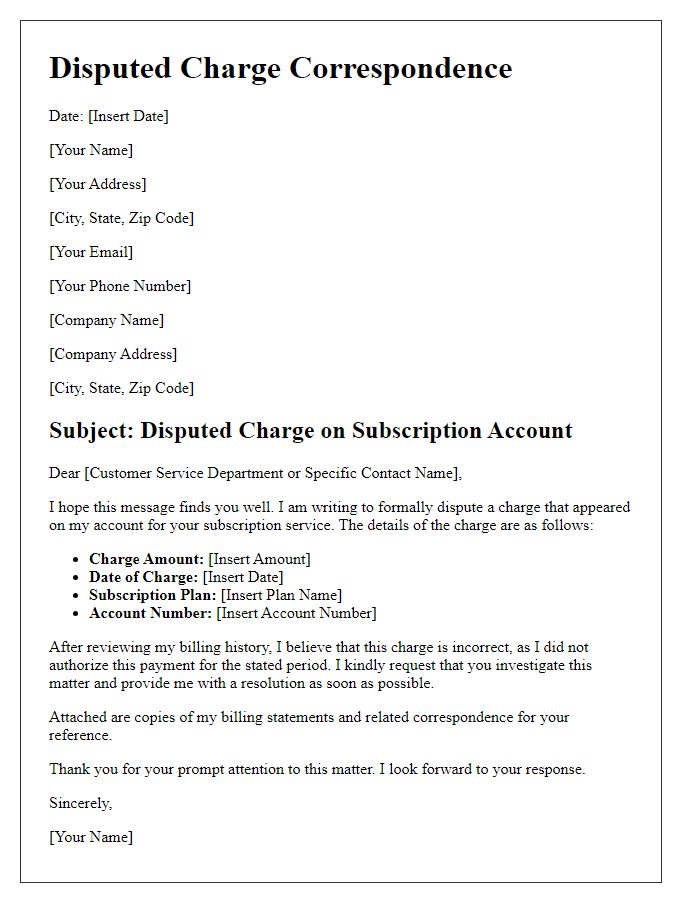

Letter template of disputed charge correspondence for subscription services.

Comments