Are you a contractor looking to streamline your financial reconciliation with your subcontractors? In our latest article, we dive into the essential components of an effective letter template that can help ensure transparency and accuracy in your financial dealings. We'll walk you through key elements to include, making it easier for both parties to stay on the same page. So, let's unravel the best practices for a seamless reconciliation processâread on to discover more!

Contact Information

Proper management of subcontractor financial reconciliation involves accurate contact information. Essential details include the subcontractor's full name, business address, and primary contact number. Additionally, an email address should be provided for digital correspondence. Financial records should reference the contract number, project location, and completion date to ensure clarity. Maintaining up-to-date contact information streamlines communication, facilitating prompt resolution of discrepancies and timely payments, ultimately fostering a trustworthy business relationship.

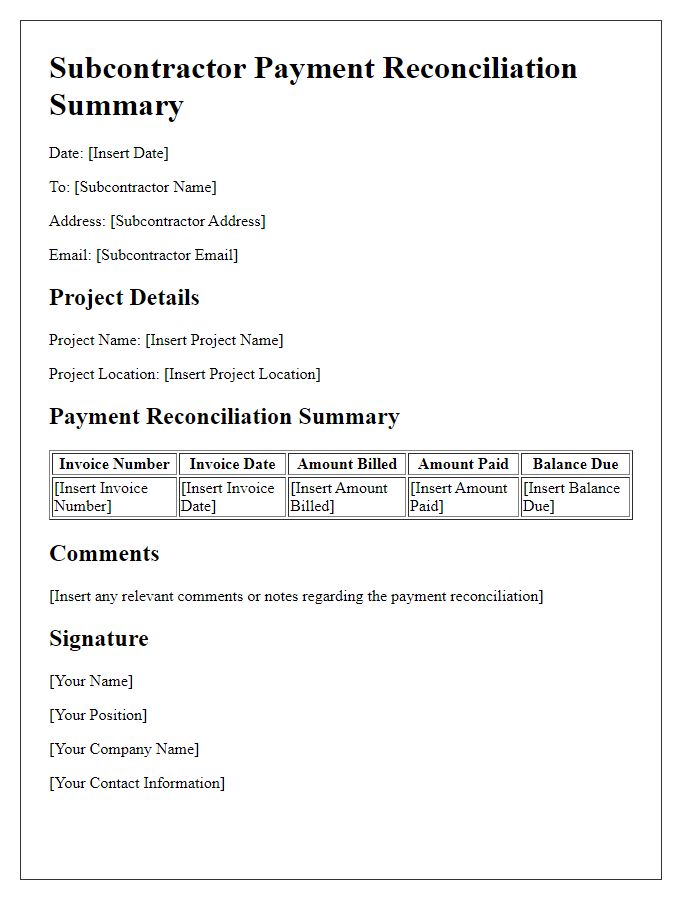

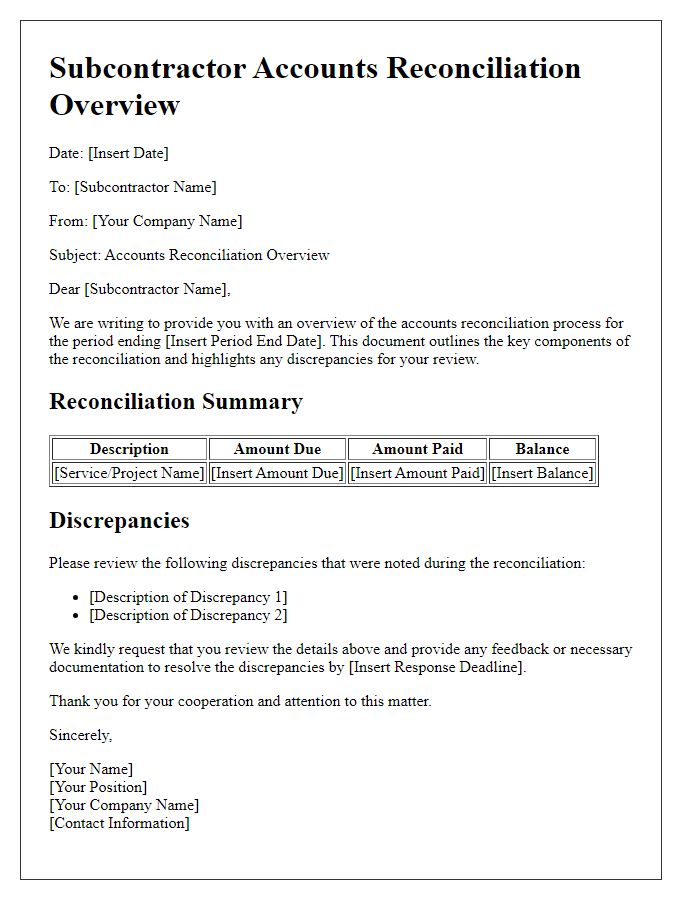

Statement of Accounts

The financial reconciliation process for subcontractors involves compiling a comprehensive Statement of Accounts, which details all transactions between the primary contractor and the subcontractor. This document typically includes invoice numbers, with a summary of services rendered, payment dates, and outstanding balances connected to specific projects, often cited with project codes. Accurate recording of amounts, like total liabilities exceeding $10,000, is essential for effective tracking and management of funds. Discrepancies should be highlighted, indicating their nature, such as payment delays or incorrect invoicing, requiring resolution through communication between involved parties. Additionally, including dates of any financial agreements or amendments ensures clarity in the reconciliation process, enhancing transparency and accountability in contractual obligations.

Reconciliation Summary

Financial reconciliation for subcontractors involves a detailed comparison of invoiced amounts against paid amounts, ensuring accuracy in project expenses. The process includes reviewing evidence such as invoices, payment records, and contractual agreements. Detailed notes on discrepancies may highlight differences in labor hours billed (for example, 120 hours invoiced but only 100 hours paid), material costs (like $5,000 for lumber versus $4,500 disbursed), or variations from the agreed contract terms (for instance, specified rates versus billed rates). Timely reconciliation, ideally conducted monthly, fosters transparent financial management, minimizes disputes, and reinforces positive relationships between the main contractor and subcontractors in construction projects.

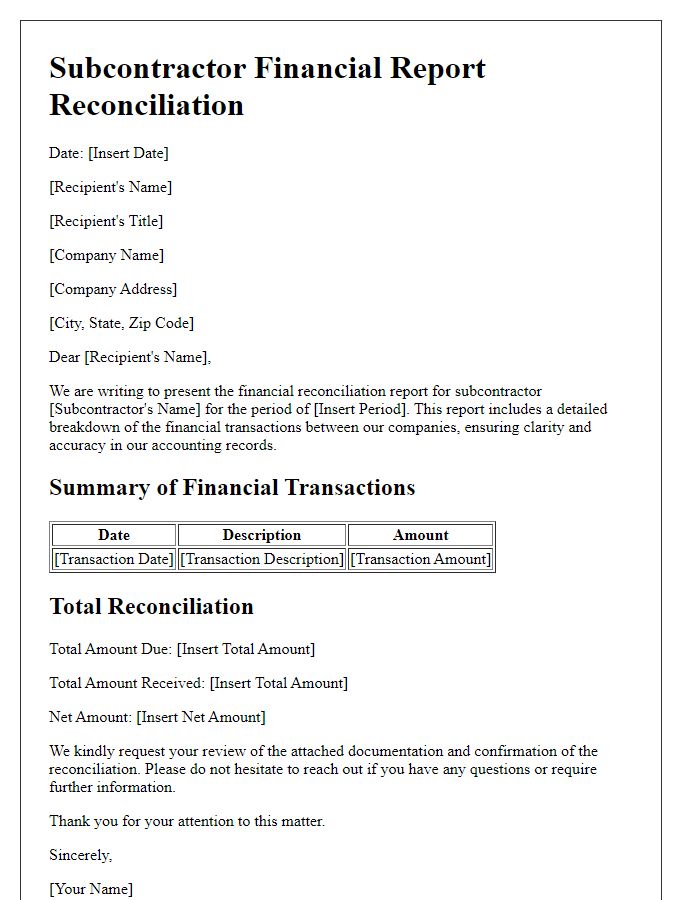

Payment Discrepancies

Payment discrepancies in subcontractor financial reconciliation often arise during project evaluations within the construction industry. Common issues include variations in invoices, missing documentation, or errors in project estimates that can lead to inaccuracies in financial records. Subcontractors, who typically handle specific tasks such as wiring, plumbing, or masonry, may notice inconsistencies in payment amounts compared to work delivered, often detailed in contract agreements. Analyzing these discrepancies is critical, as they can significantly impact cash flow. Maintaining comprehensive documentation, including change orders and work completion reports, enables project managers to address disparities efficiently. Regular audits and clear communication between the main contractor and subcontractors are essential in ensuring financial accuracy and fostering suitable business relationships.

Resolution Proposal

In the subcontractor financial reconciliation process, accurate tracking of expenditures, invoices, and payments is crucial for maintaining project integrity. To resolve discrepancies, it is essential to compile detailed documentation, including invoice numbers, payment dates, and project milestones. Conducting a thorough review against the contract terms established in the agreement dated January 15, 2023, ensures alignment with the budget outlined at $1,000,000. Utilize accounting software such as QuickBooks or Xero for real-time reconciliation updates. Engage in communication with the subcontractor's finance manager, scheduled on March 10, 2023, to discuss variances identified during this review. Regular bi-weekly audits are recommended for maintaining ongoing accuracy, fostering trust, and enhancing financial clarity in future collaborations.

Comments