Looking for a straightforward way to manage your billing process? Crafting an invoice for your social service agency doesn't have to be a chore! With our expertly designed letter template, you can communicate clearly and professionally while ensuring that all essential details are covered. Want to learn more about creating effective invoices? Read on!

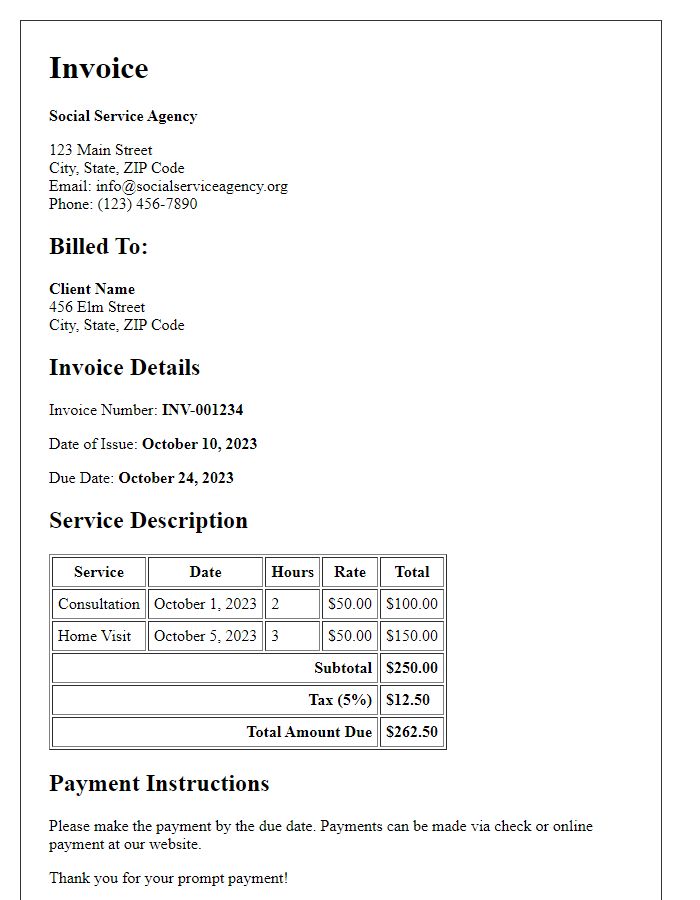

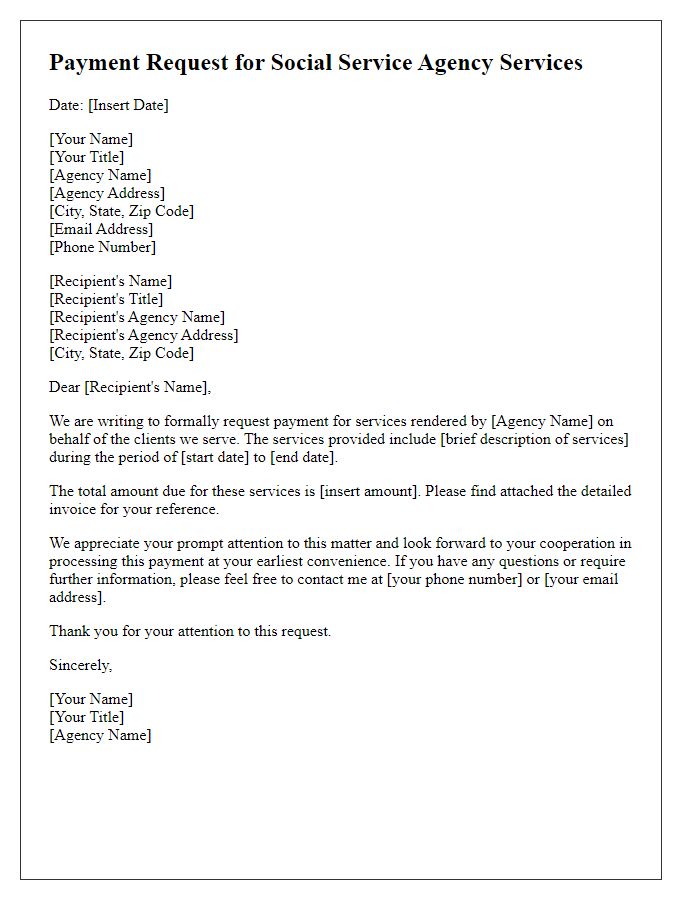

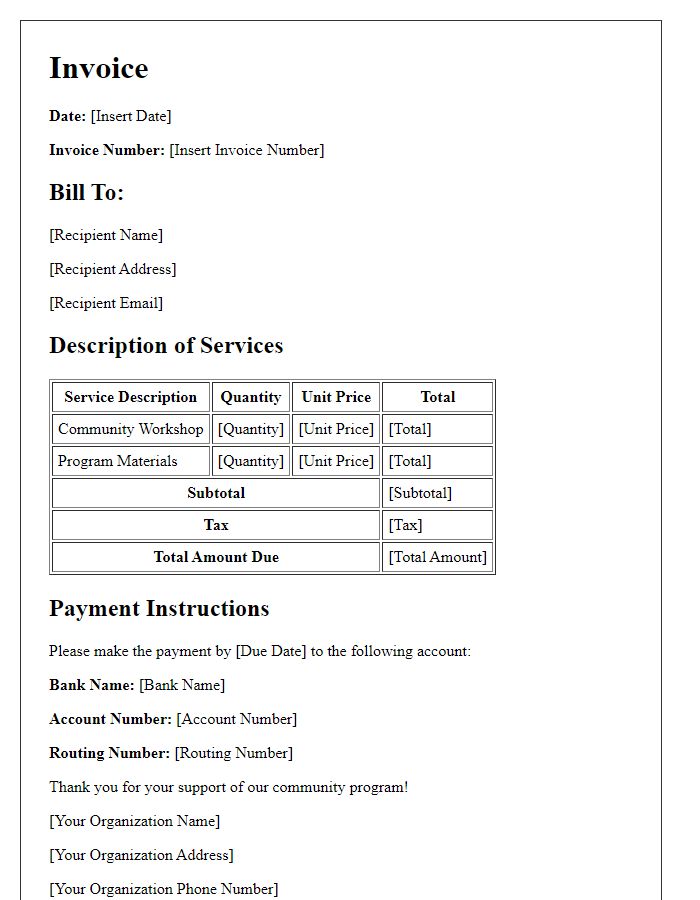

Agency Contact Information

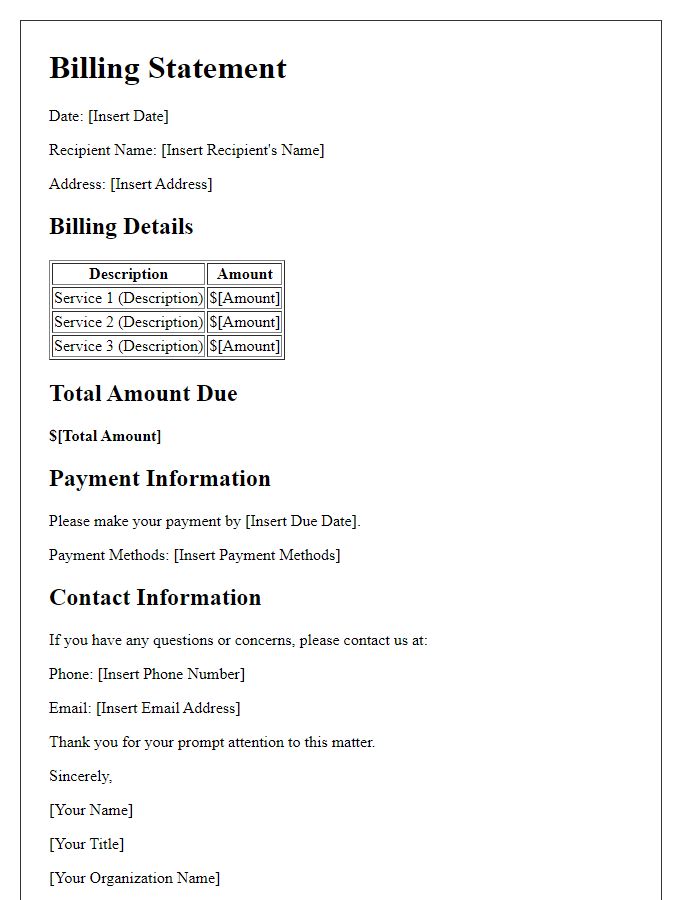

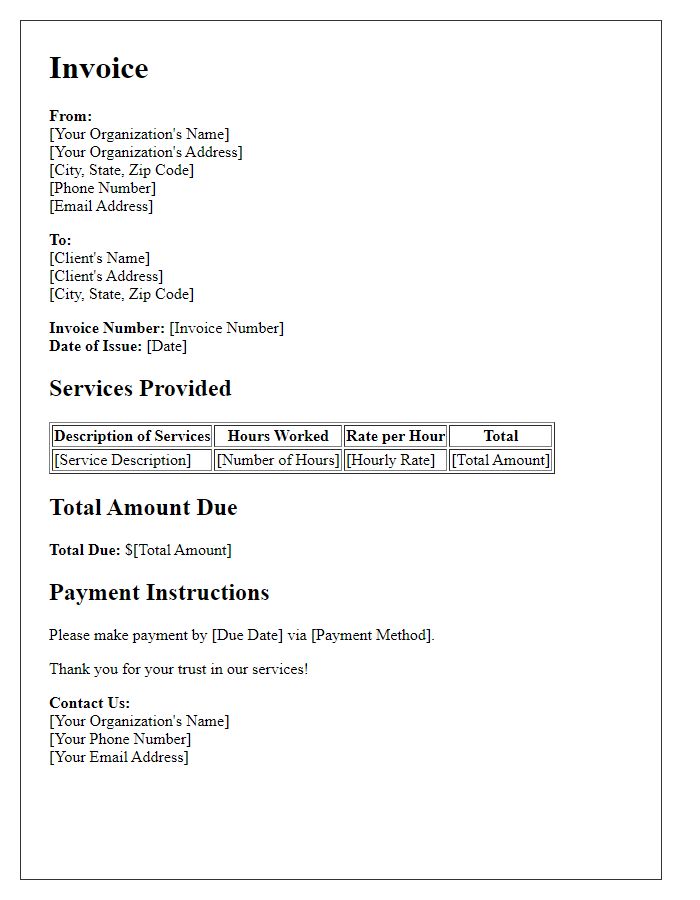

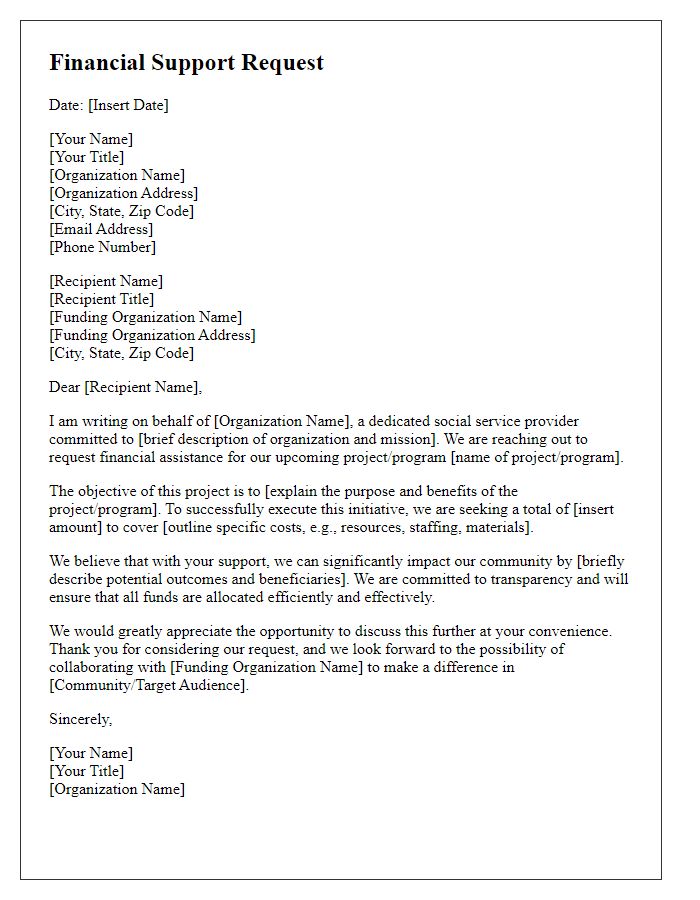

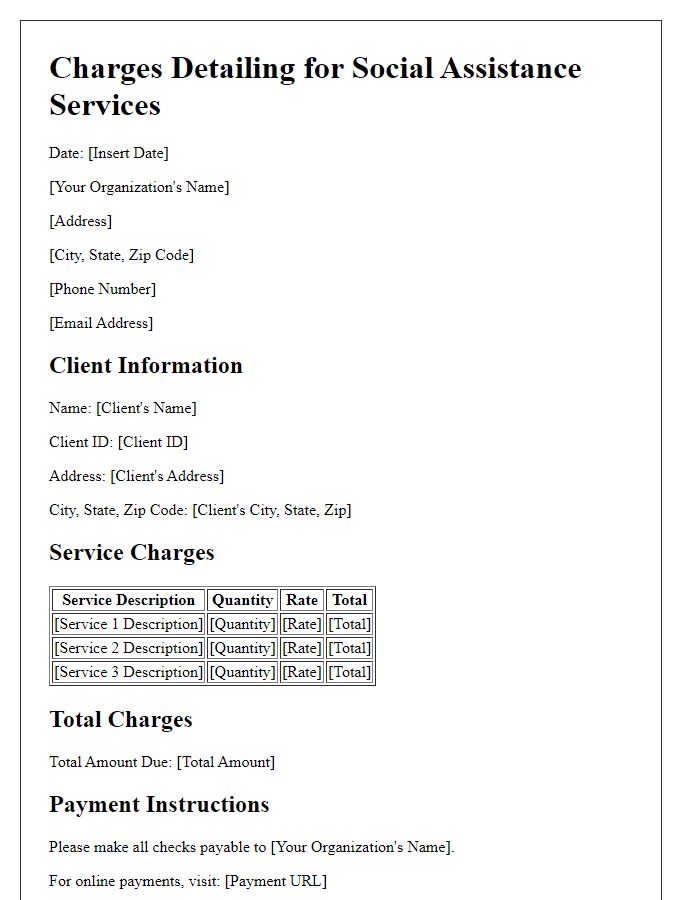

The issuance of invoices by social service agencies includes crucial details that ensure clarity and transparency in transactions. Relevant sections in an invoice should encompass agency contact information, including the agency name, physical address, email address, and phone number. Specifying the invoice number enables easy tracking of financial records. Dates are vital for identifying the service period and payment due date, which can vary based on contractual agreements. Service descriptions should accurately outline the nature of the services provided, including any relevant case numbers or client identifiers pertinent to the social services rendered. Financial figures, including the total amount due, payment methods accepted, and tax identification numbers (if applicable), should also feature prominently to facilitate smooth processing and compliance with regulatory standards.

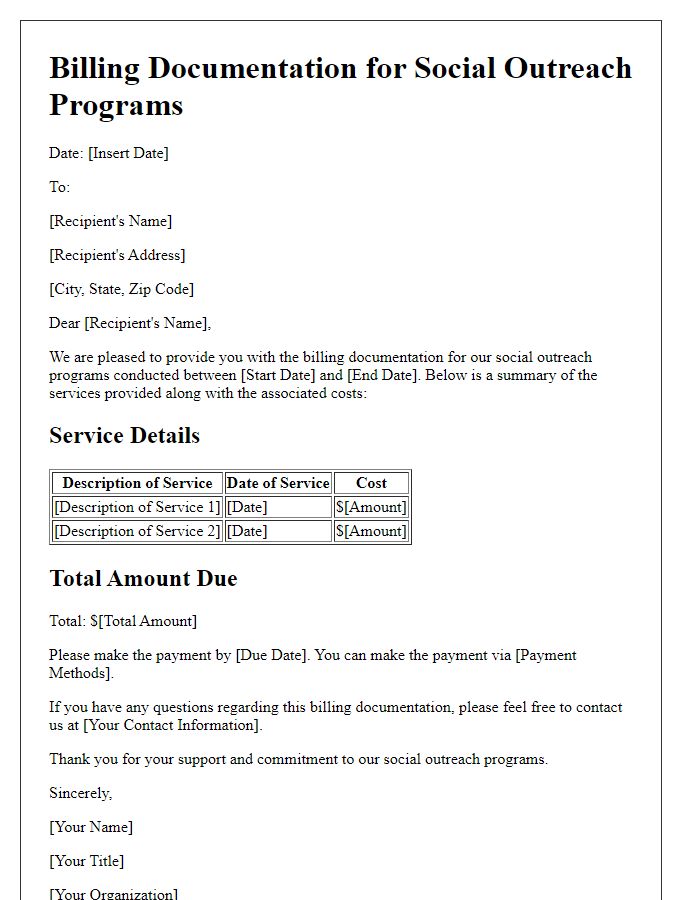

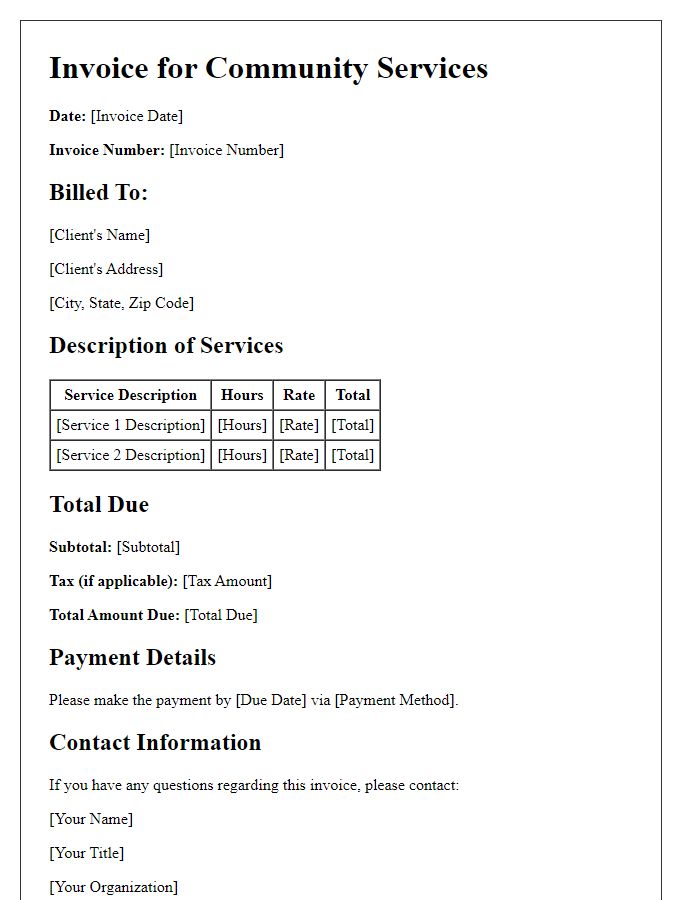

Client Details

A social service agency's invoice utilizes specific client details to ensure accurate billing and payment processing. Key elements include the client's full name, which identifies the individual or household receiving services. The agency's address serves as a point of contact for correspondence regarding the invoice. The service period dates establish the timeframe for which services were rendered, often formatted in month and year, ensuring clarity. Itemized services include descriptions such as counseling sessions, case management, or therapy appointments, detailing the type of assistance provided. The hourly rate or fixed fee for services highlights the cost associated with each service. The total amount due summarizes all fees, providing a clear financial expectation. Payment terms specify the due date, which is generally set 30 days from the invoice date, encouraging timely payment. Finally, a contact number for billing inquiries ensures clients can easily reach out for any clarification regarding their invoice.

Invoice Number and Date

Social service agencies often require accurate record-keeping and transparency in financial transactions. An invoice issued by such an agency usually includes essential details like Invoice Number, which serves as a unique identifier for tracking and referencing the financial document, and Date, which indicates when the invoice was generated or the services were rendered. These elements are crucial for maintaining proper documentation for both the agency and the clients, ensuring clarity in billing processes related to social services, such as health care assistance, counseling sessions, or community outreach programs. Invoices might also entail service descriptions, amounts due, and payment terms to facilitate smooth transactions.

Service Description and Fee Breakdown

An invoice issued by a social service agency typically includes essential details such as the service description, which outlines specific support provided to clients, like mental health counseling sessions or community outreach programs. Fee breakdown is crucial; it lists individual charges for each service rendered, ensuring transparency. For example, a session of family counseling may be $75, while group therapy could cost $50 per participant. Including invoice date and payment terms, such as net 30 days, is important for clarity. The agency's contact information and budget codes for internal tracking purposes help streamline financial processes.

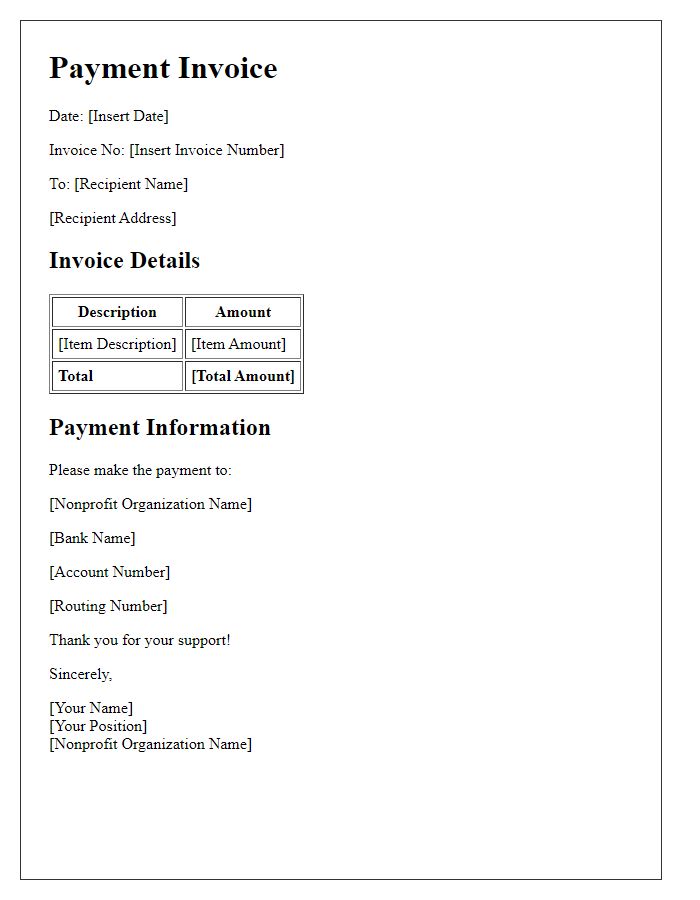

Payment Terms and Methods

Invoices from social service agencies outline essential payment terms and methods to ensure clarity and timely transactions. Agencies typically specify a payment due date, often net 30 days from the invoice date, allowing clients ample time to process payments. Accepted payment methods may include checks, electronic fund transfers, or credit card payments, catering to diverse client preferences. Agencies often include details for direct deposit, such as bank account information and routing numbers, ensuring secure and efficient transactions. Clear policies on late payment fees, usually 1-1.5% per month, encourage prompt settlement of invoices while maintaining transparency in the billing process.

Comments