In the ever-evolving landscape of global business, every shareholder's voice matters, especially as we embark on our exciting journey of international expansion. This is not just about numbers and markets; it's about fostering a community that thrives on collaboration and shared vision. We understand how important your participation is to shape our future, and we want to ensure you feel informed and included in every step we take. So, join us as we delve deeper into what this expansion means for us allâread more to discover how you can be part of this thrilling adventure!

Strategic alignment with company goals.

International expansion initiatives align strategically with company goals to enhance market penetration, increase revenue streams, and diversify product offerings. Entering emerging markets, such as Southeast Asia with a projected GDP growth of 5.2% in 2023, presents lucrative opportunities for revenue enhancement. Additionally, strategic partnerships with local firms can facilitate smoother entry and provide valuable insights into regional consumer behavior. Enhanced brand recognition on a global scale can fortify the company's competitive advantage. Engaging shareholders through transparent communication fosters collaboration and encourages investment in innovative strategies that support both short-term gains and long-term sustainability.

Risk assessment and mitigation strategies.

Shareholder participation plays a crucial role in the strategic planning for international expansion, especially regarding risk assessment and mitigation strategies. Key risks include market volatility in foreign exchange rates, regulatory compliance in various jurisdictions, and cultural differences that can affect operational efficiency. Companies often face challenges such as understanding local laws and consumer behavior, necessitating thorough market research. Additionally, geopolitical risks, particularly in regions like Eastern Europe and Asia, can impact supply chains. Mitigation strategies encompass diversifying supply sources, employing local expertise for compliance and cultural integration, and hedging against foreign exchange fluctuations through financial instruments. Engaging with shareholders can also leverage their insights, enhancing risk management frameworks to ensure sustainable growth and competitive advantage in the international arena.

Financial impact and ROI projections.

International expansion can significantly influence overall financial performance and shareholder value, providing pathways for growth in diverse markets. Successful ventures into emerging economies, such as India and Brazil, often yield substantial returns on investment (ROI), projected at 15-25% over the initial three years based on industry benchmarks. Market analysis indicates untapped potential in sectors like renewable energy and e-commerce, where customer bases are rapidly growing. Strategic investments in infrastructure and localized marketing efforts can enhance brand presence, driving revenue growth. Anticipated financial metrics, including a projected increase in annual revenue of $5 million by year two, illustrate the potential for robust profitability. Active shareholder participation not only encourages resource allocation but also fosters innovative strategies for market penetration and operational scalability.

Legal and regulatory compliance.

International expansion presents opportunities and challenges for companies seeking to enter new markets. Legal and regulatory compliance is crucial in navigating different jurisdictions, such as the European Union, which has stringent data protection laws like the General Data Protection Regulation (GDPR). Companies must also understand foreign investment regulations that may impose limits or require approvals, especially in countries like China with its Foreign Investment Law. Intellectual property laws must be adhered to meticulously to prevent infringement issues in regions like North America, where patent protection can vary significantly. Tax compliance is another critical consideration; countries may have complex tax treaties that affect repatriation of earnings. Therefore, thorough legal guidance and risk assessment are essential for ensuring successful and compliant international expansion.

Cultural and market understanding.

Shareholder involvement is crucial for successful international expansion, particularly in understanding diverse cultural dynamics and market behaviors. Each target country, such as Brazil or Japan, presents unique cultural nuances that can significantly influence consumer preferences and business practices. For instance, Brazil's emphasis on personal relationships in business contrasts sharply with Japan's focus on consensus and collective decision-making. Additionally, grasping local market trends--including purchasing power, competitive landscapes, and regulatory environments--is vital for tailoring products and marketing approaches. Engaging local experts or utilizing market research firms can enhance this understanding, ensuring strategies align with local expectations. Ultimately, fostering strong shareholder participation can lead to informed decision-making and sustainable growth in new markets.

Letter Template For Shareholder Participation In International Expansion Samples

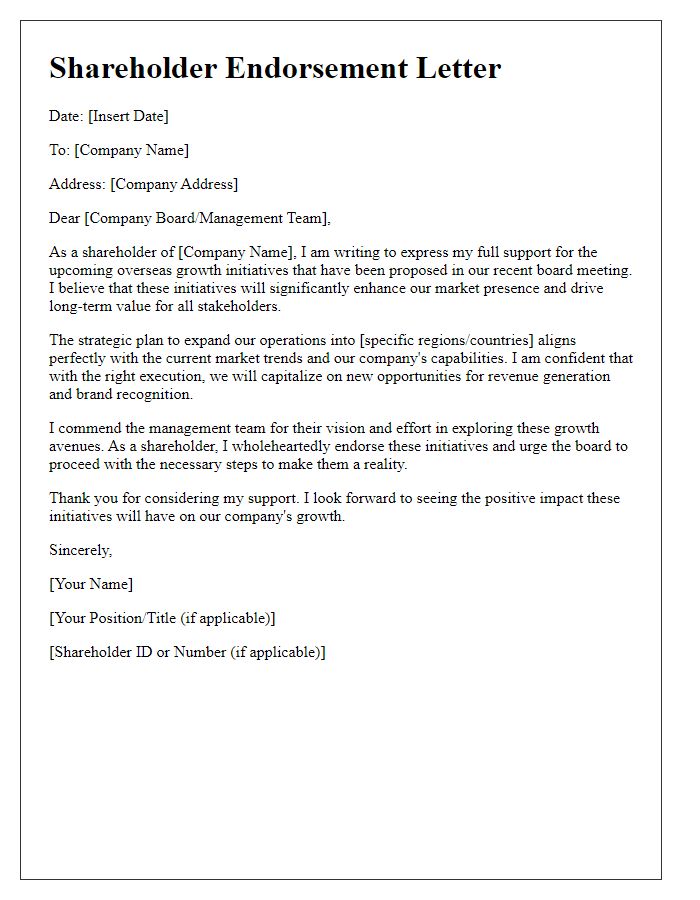

Letter template of shareholder endorsement for overseas growth initiatives

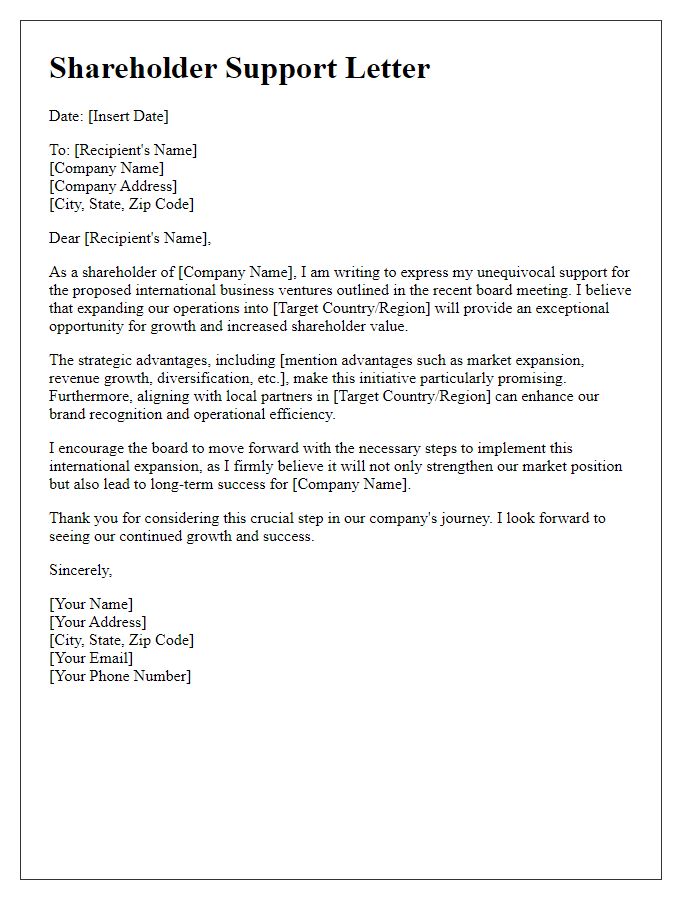

Letter template of shareholder support for international business ventures

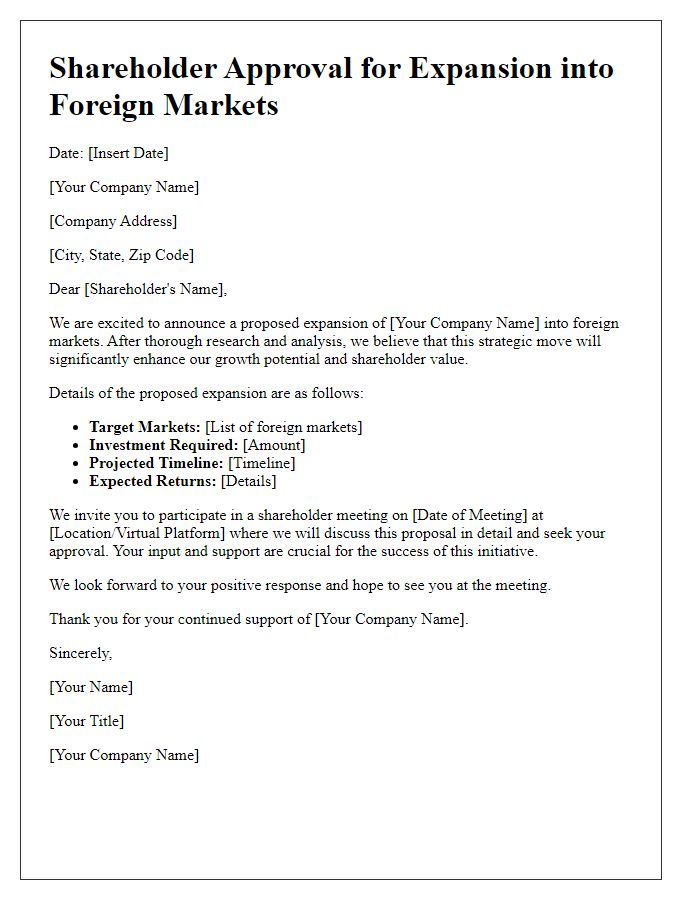

Letter template of shareholder approval for expansion into foreign markets

Letter template of shareholder interest in cross-border investment opportunities

Letter template of shareholder affirmation for global strategic initiatives

Letter template of shareholder participation in multinational expansion plans

Letter template of shareholder collaboration on international development projects

Comments