Are you feeling uneasy about a recent decision made by your company that doesn't sit right with you? You're not alone, as many shareholders often find themselves in similar situations, seeking to voice their concerns effectively. Crafting an appeal letter is a powerful way to communicate your viewpoints and influence change within the organization. If you're ready to rally your fellow shareholders and make your voice heard, read on to discover useful tips and a template for your appeal letter.

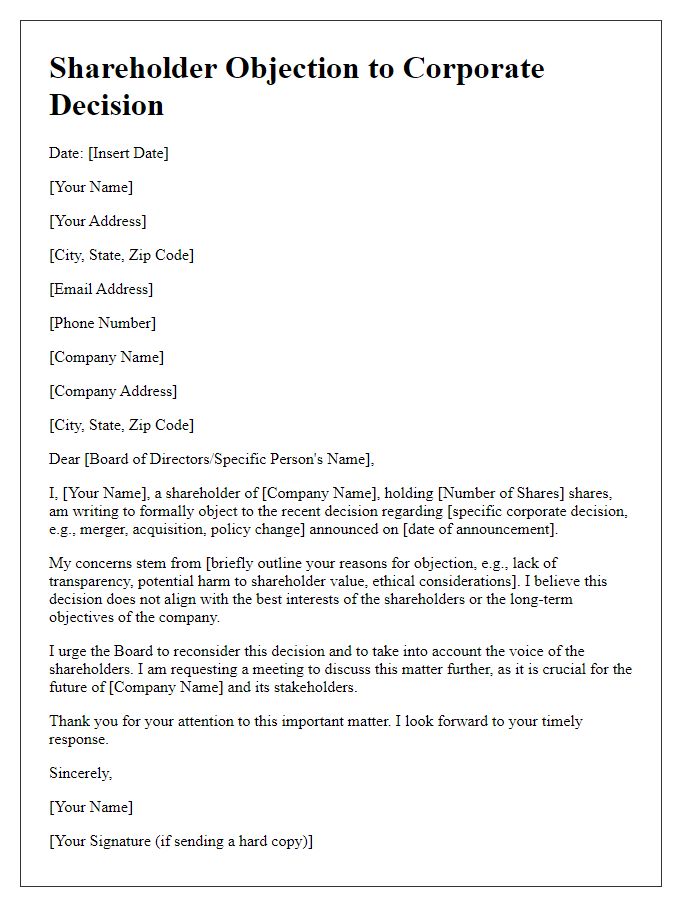

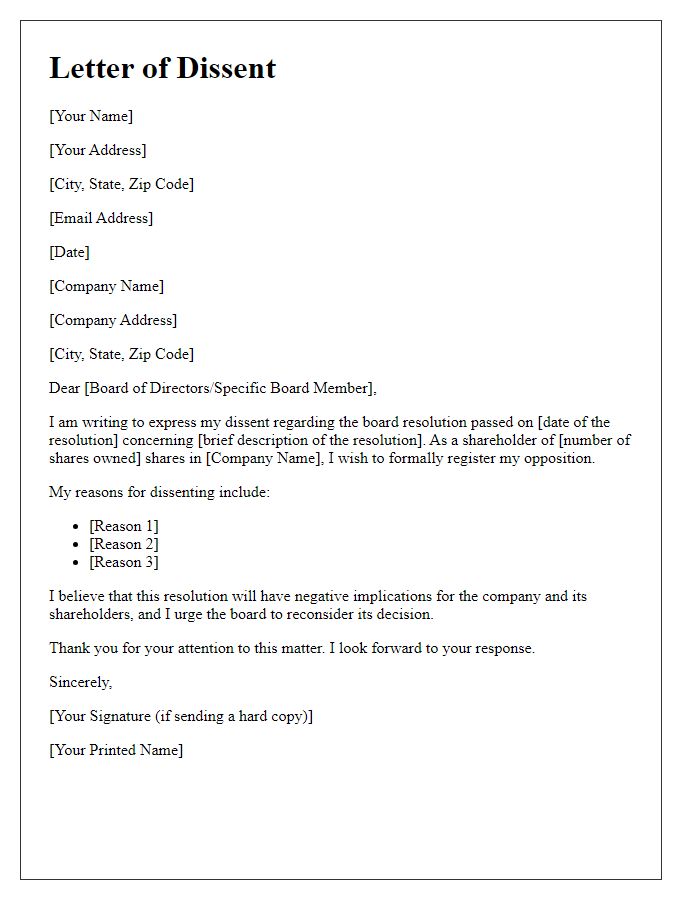

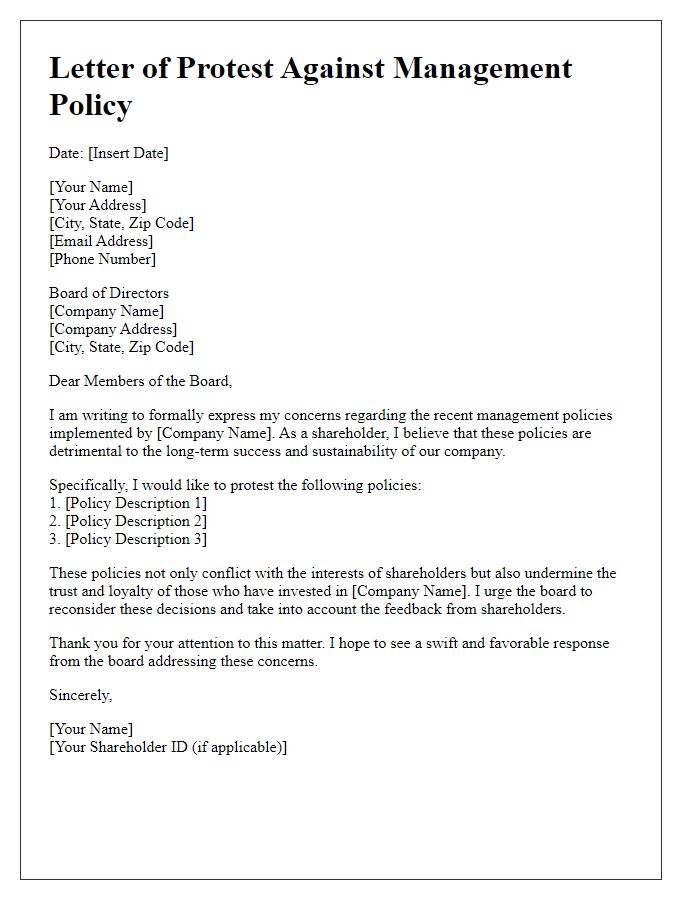

Polite salutation and introduction.

Shareholders often face important decisions impacting the future of their investments. A recent decision made by the board of directors has sparked concern among stakeholders, leading to an appeal for reconsideration. The appeal aims to address issues such as financial transparency, potential impacts on share value, and alignment with long-term strategic goals. Such actions by shareholders can influence corporate governance, ensuring the interests of investors are represented. Engaging in dialogue with the board creates opportunities for improvement, ultimately fostering a healthier corporate environment.

Clear statement of the objection.

The recent board decision to implement a significant salary increase for executives at Tech Innovations Inc. has sparked concern among shareholders. This decision, announced on October 15, 2023, comes at a time when the company is facing stagnated revenue growth, reporting only a 2% increase in Q3 compared to the same period last year, while operational costs have escalated by over 10%. Many stakeholders believe this increase is not aligned with the company's current financial performance and sustainability goals, as annual profits have decreased by 15% over the past two years. This disparity raises questions about executive accountability and the prioritization of shareholder interests, which should take precedence in corporate governance decisions. Shareholders advocate for a reversal of this decision to maintain trust and promote equitable treatment within the organization.

Supporting evidence and reasoning.

Shareholders may express concerns regarding managerial decisions impacting corporate governance, financial performance, or sustainability efforts. For instance, a proposed merger might raise eyebrows if it threatens to diminish shareholder value, which can occur if the acquiring company has a history of underperformance, demonstrated by a stock price decline of 15% over two years. Additionally, environmental sustainability issues may arise, particularly if the company plans to invest heavily in fossil fuel projects, contradicting trends towards renewable energy seen globally, with investments in renewables hitting $500 billion in 2021. Documentation such as financial reports, market analysis, and environmental impact assessments should be gathered to bolster the appeal and provide specific examples, potentially referencing a similar case where shareholder intervention led to a more favorable outcome, like the 2018 Unilever campaign regarding palm oil sourcing, showcasing the power of collective action in shaping company policies.

Proposed alternative or solution.

Shareholders play a critical role in the governance of companies, influencing decisions that may significantly impact stock performance and overall corporate health. A growing concern, such as the recent proposal for restructuring, can lead to discontent among stakeholders. In this context, shareholders might advocate for an alternative strategy that emphasizes sustainable growth rather than short-term gains. For instance, shareholders could suggest investing in renewable energy initiatives or enhancing research and development (R&D) efforts, potentially positioned at a facility near Silicon Valley. Engaging with company management through a constructive dialogue can lead to a mutually beneficial outcome, fostering a collaborative atmosphere that prioritizes long-term shareholder value while addressing corporate responsibilities.

Respectful closing and contact information.

Shareholder appeals against company decisions require careful communication, emphasizing the significance of the concerns raised. A respectful closing can foster a positive tone, encouraging a dialogue. Key contact information is essential for facilitating a response: For further discussion, please reach me via email at [YourEmail@example.com], or contact me directly at [YourPhoneNumber]. I appreciate your attention to this matter and look forward to your prompt response. Thank you for considering the perspectives of shareholders committed to the future success of [Company Name].

Comments