Hey there! We all know that sometimes life gets busy, and payments can slip our minds. That's why we're reaching out to gently remind you about your overdue service payment. We truly value your partnership and want to ensure that everything remains smooth and seamless for you. If you're curious about the details and how to get back on track, keep reading!

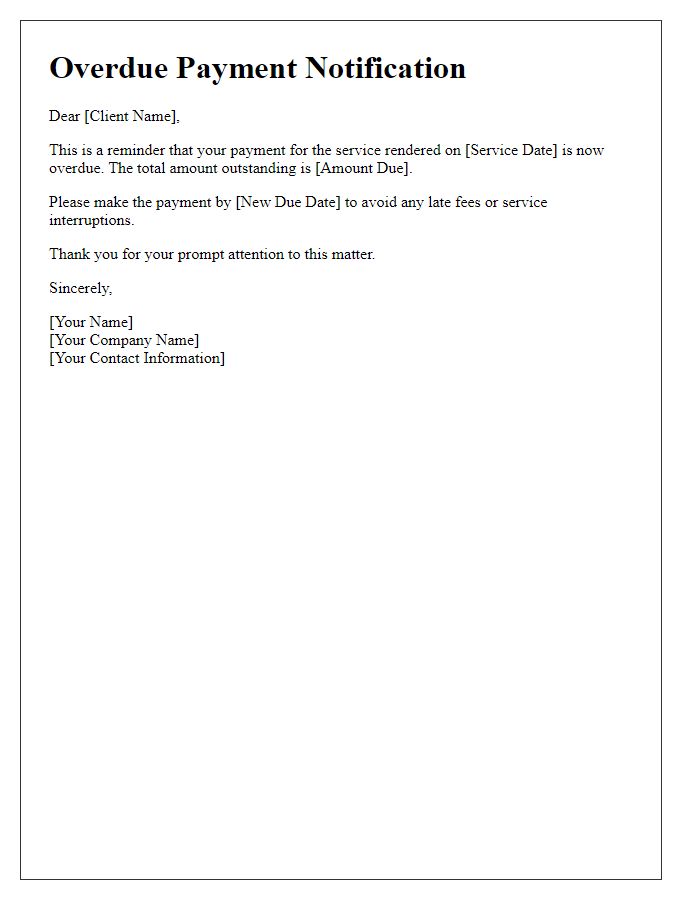

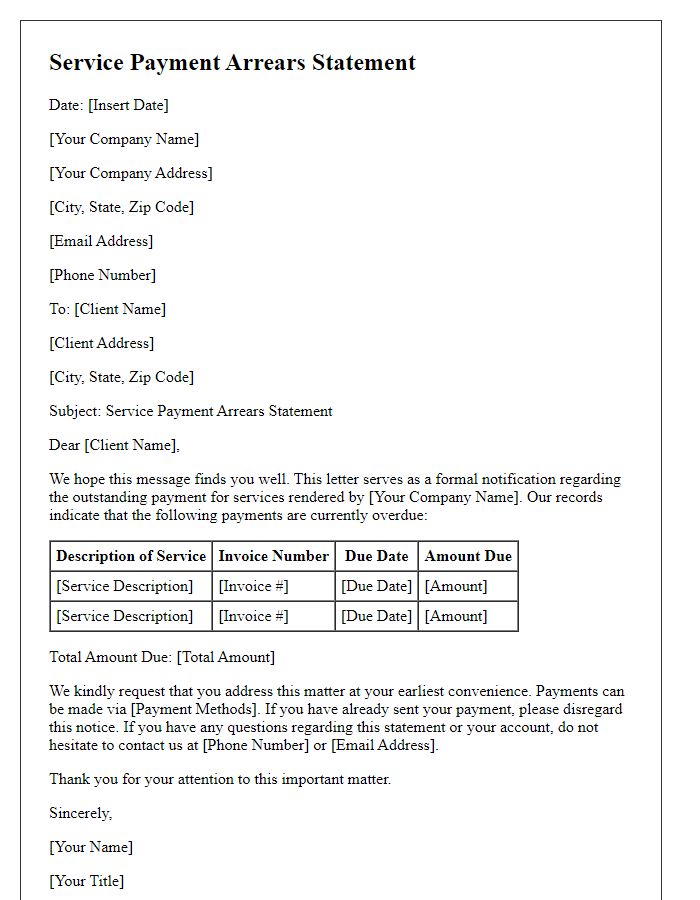

Clear and professional tone

Overdue service payments can significantly impact small business operations and cash flow management. Payment delays exceeding 30 days often lead to strained relationships between service providers and clients. Invoices for services rendered, such as consultation or maintenance, may require reminders, ensuring clarity regarding payment terms. Additional fees may apply after 60 days, according to standard industry practices. Maintaining a professional tone in communication is essential, fostering prompt resolution while preserving the client relationship. Consistent follow-ups can reinforce the importance of timely payments in sustaining service quality.

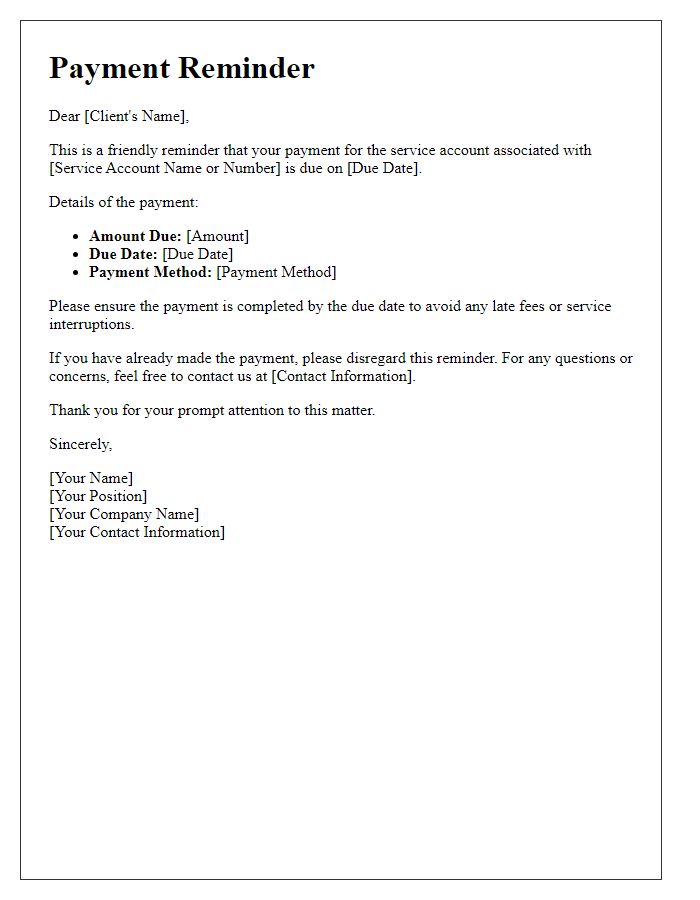

Specific due date details

Timely payment for service invoices is crucial for maintaining operational efficiency. Customers are reminded that invoices, including Invoice #12345, dated October 1, 2023, were due on October 15, 2023, for services rendered in September. As of now, a balance of $500 remains outstanding. Late payments can incur additional fees, which accumulate at a rate of 1.5% per month beyond the due date. Failure to settle payments may lead to suspension of services until the account is brought current. Prompt payment within the next 7 days is encouraged to avoid disruptions and additional charges.

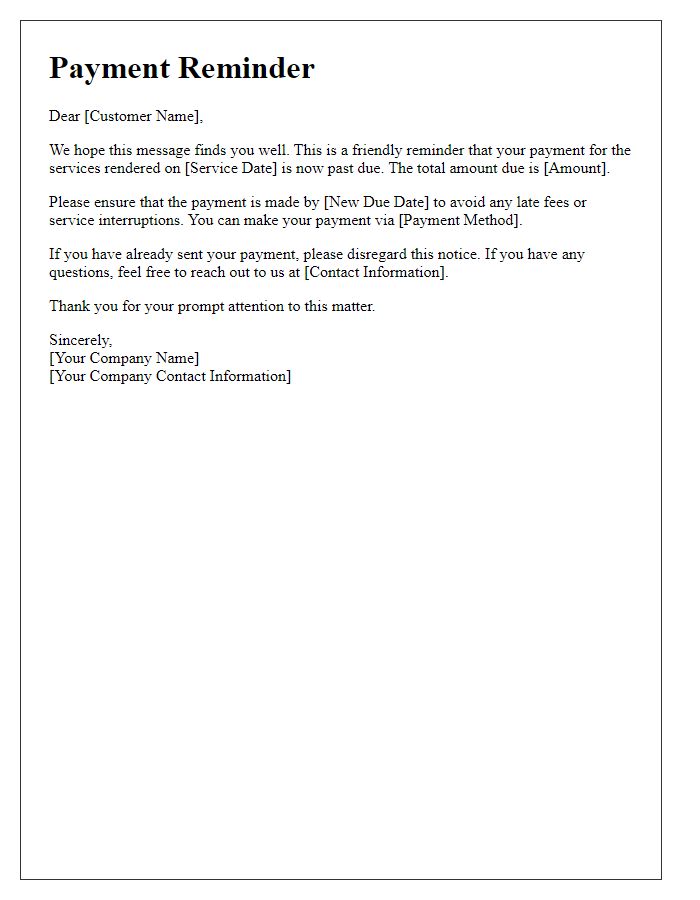

Payment instructions

Overdue service payments can disrupt the financial flow of businesses, affecting cash flow management and operational stability. Invoices typically have a due date, which, if missed, can result in late fees, typically ranging from 1% to 5% of the total balance per month. Payment instructions often include specific methods such as bank transfers, credit card payments, or online payment portals. Effective reminders sent via email or postal mail should specify the original due date, the outstanding balance, and detailed instructions for payment submission. Companies may also include a contact number or email for any inquiries, ensuring customers feel supported while addressing their overdue accounts.

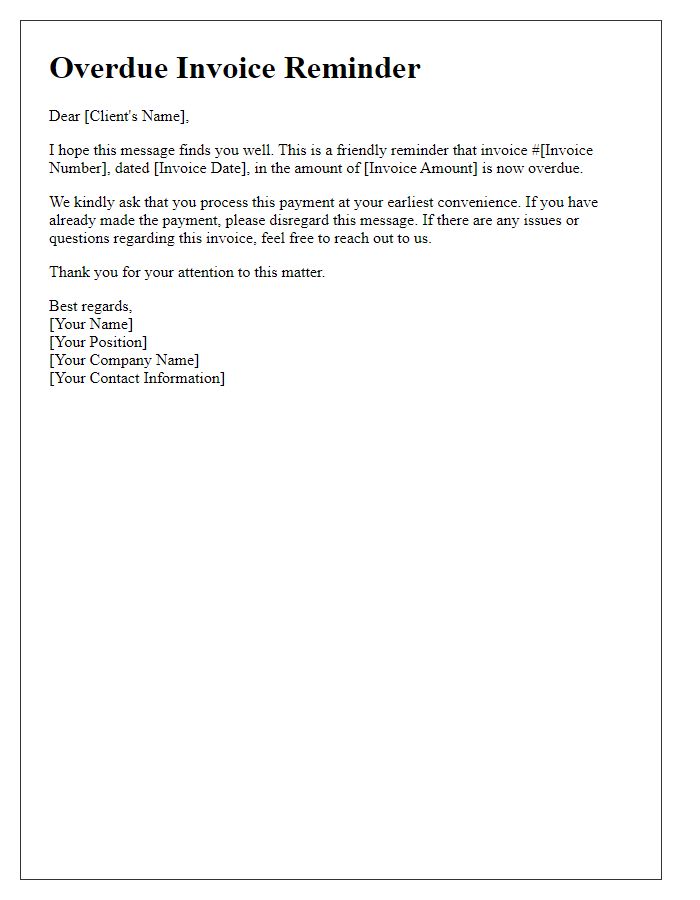

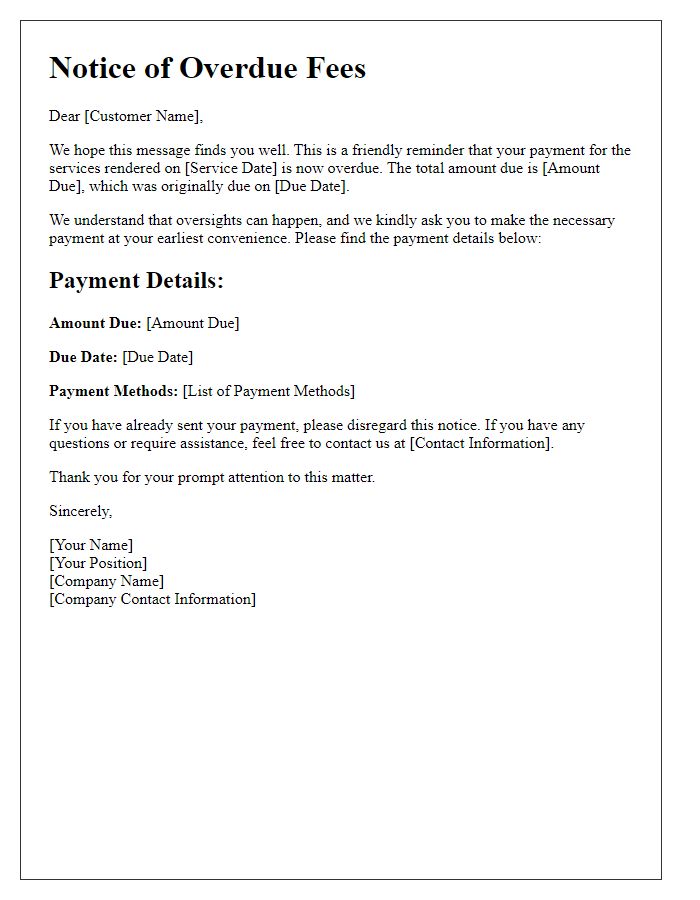

Contact information for queries

Overdue service payments can lead to disruptions in service continuity and additional fees. Clients are typically informed through reminder notifications upon reaching a 30-day overdue mark. Payment details, including invoice numbers and due amounts, contribute to clarity in communication. Providing contact information, such as a direct phone line (e.g., +1-800-555-0199) or email address (e.g., billing@company.com), ensures immediate assistance for any inquiries. Prompt resolution helps in maintaining a good customer relationship and enhancing service satisfaction.

Consequences of non-payment

Failure to settle overdue service payments can lead to significant repercussions for clients, including service suspension or termination. For instance, utility services such as electricity or water, provided by companies like Pacific Gas and Electric or Veolia, may be halted within 30 days of non-payment. Additionally, credit score deterioration can result from unpaid balances reported to credit bureaus, negatively impacting future loan applications or mortgage approvals. Legal action may also be initiated after repeated reminder notices, potentially involving collection agencies and resulting in added fees. Clients must understand that timely payments ensure uninterrupted service and maintain a positive credit history.

Comments