Are you looking for a simple yet effective way to confirm the end of an employee's service? Drafting an end-of-service confirmation letter can streamline this process and provide clarity for both parties involved. In this article, we'll break down the essential components of a well-structured letter that conveys appreciation while outlining important details. Let's dive in and explore how to create the perfect end-of-service confirmation letter together!

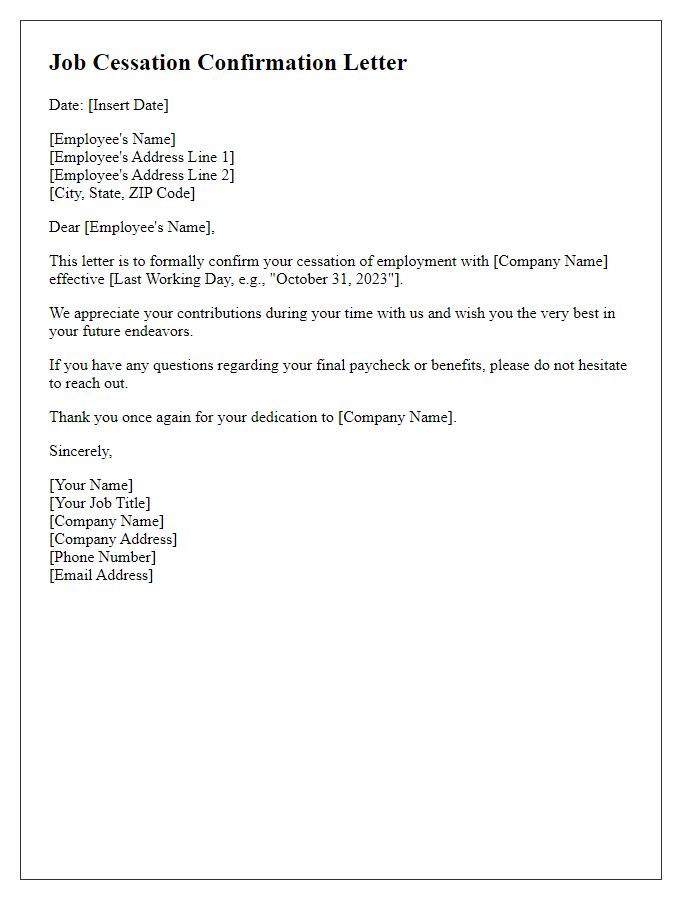

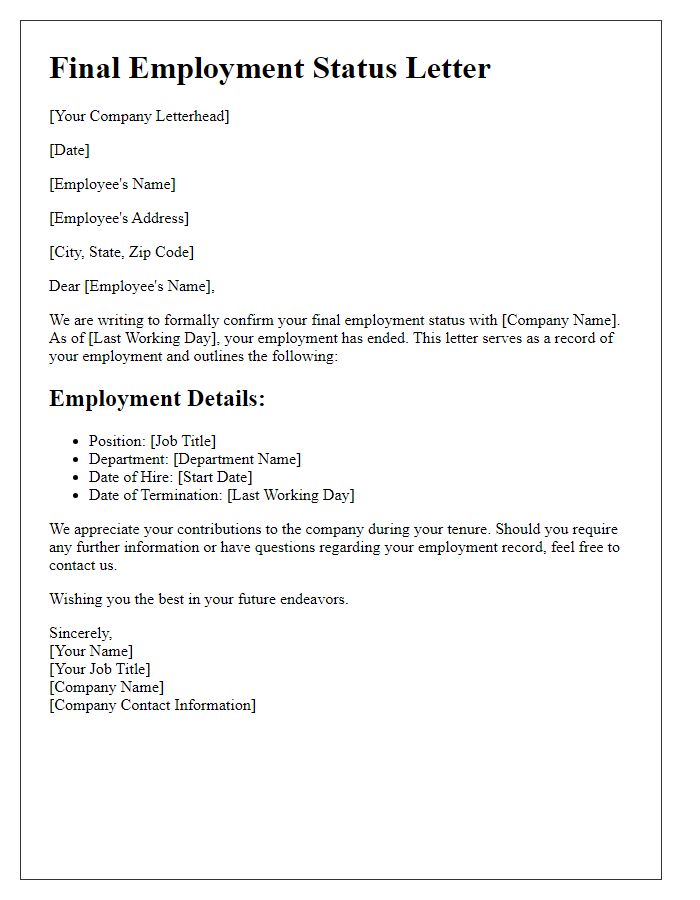

Official Company Letterhead

End-of-service confirmation serves as a formal acknowledgment of an employee's departure from a company, typically on institutional stationery that displays the company logo and contact details. This document should include essential information such as the employee's full name, last working day, and position, which in this context is vital to avoid any discrepancies. Additionally, it may provide a summary of the employee's contributions during their tenure, such as specific projects completed or achievements recognized, fostering a positive atmosphere for their future endeavors. An official signature from a senior management member reinforces the validity of the document, while the date of issuance strengthens its relevance in any potential future reference.

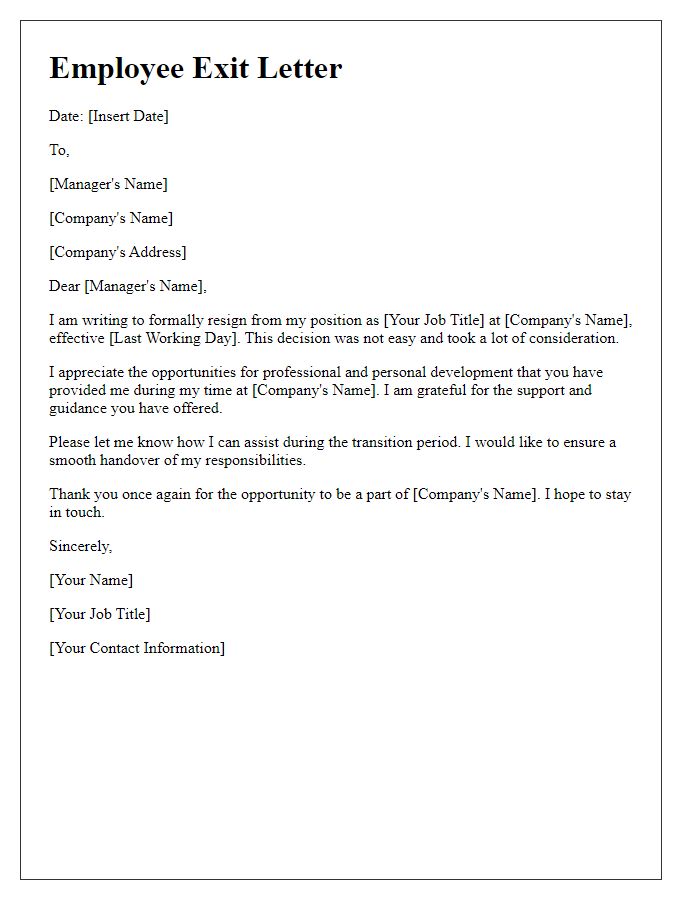

Employee Details (Full Name, Position, Employee ID)

An end-of-service confirmation letter serves to officially acknowledge the conclusion of employment for a specific individual. This document typically includes detailed employee information such as the Full Name of the employee, which identifies the person involved, their Position within the organization--indicating their specific role and responsibilities, and their Employee ID, a unique identifier allocated by the company for internal record-keeping. The letter may also mention the final working date, which signifies the transition point from employee status to former employee status, ensuring all parties have clarity on the timeline of the employment cessation. Additionally, any pertinent information regarding final settlements or references for future employment may be included to facilitate a smooth exit process.

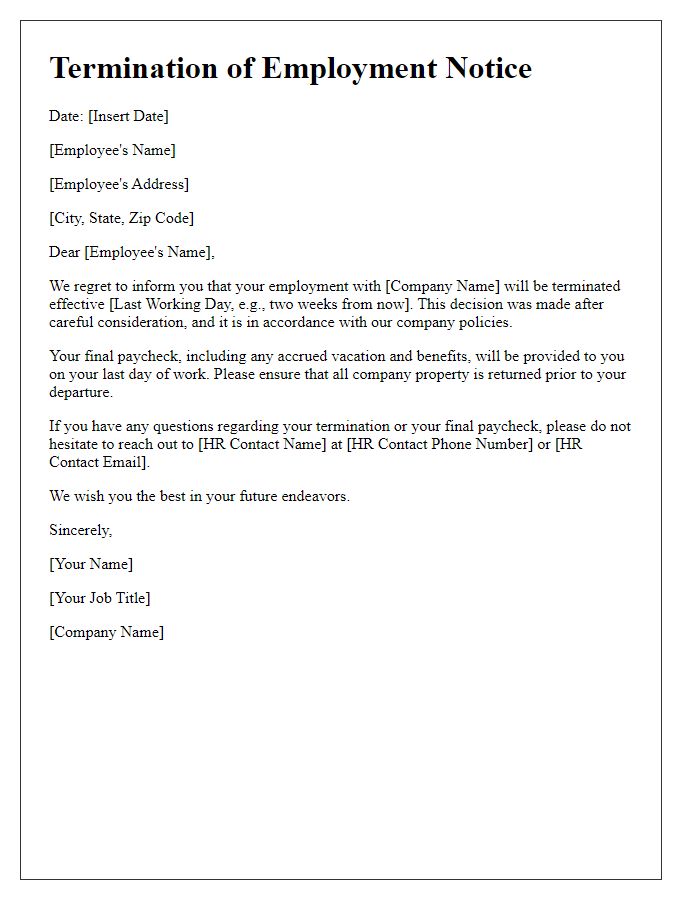

Employment Period (Start and End Dates)

The end-of-service confirmation letter states the official conclusion of an employee's tenure, including critical details. The employment period typically starts with the hire date, often noted as the first day of work, and concludes with the termination date, marking the final day of employment. This letter serves as a formal acknowledgment of the duration of service, which might range from a few months to several years, depending on the employment agreement. It may also include significant milestones achieved during the employee's time, such as promotions, awards, or contributions to specific projects, which add context to the individual's professional journey. Moreover, the confirmation letter usually confirms the final settlement details, which include any outstanding dues, severance pay, or benefits applicable upon leaving the organization.

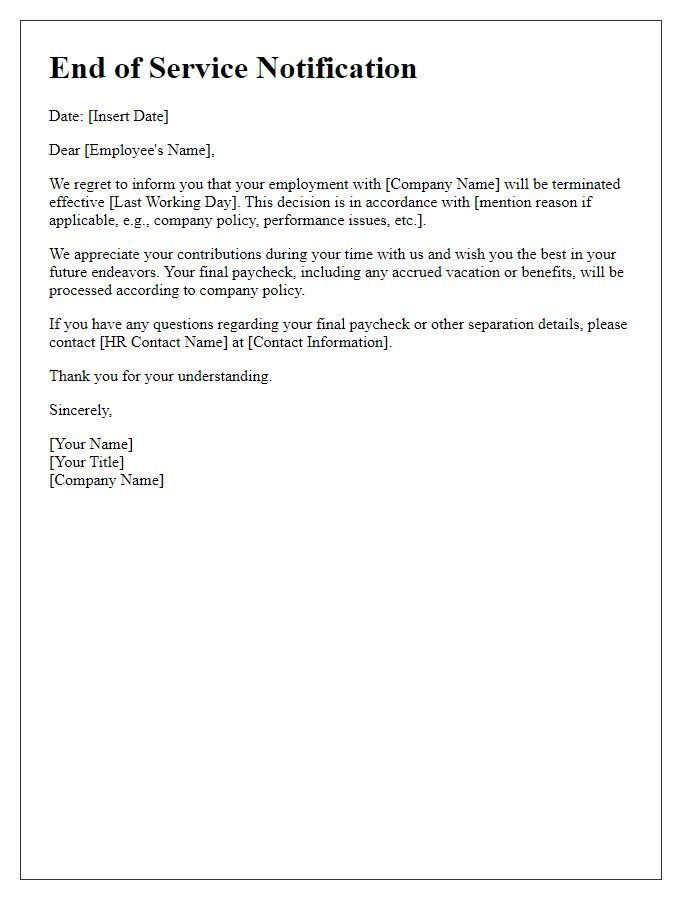

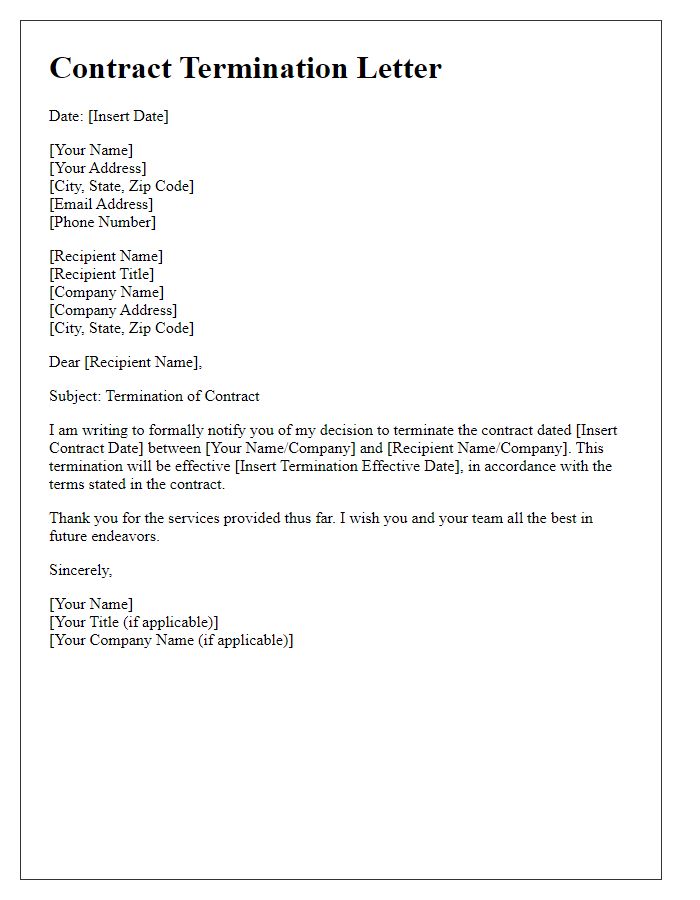

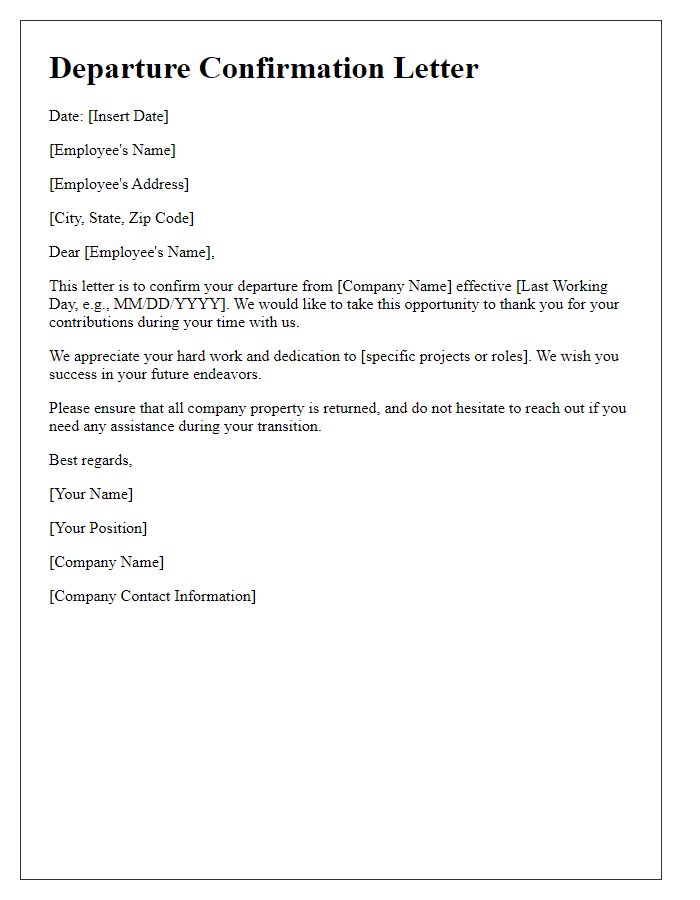

Reason for Service Termination

End-of-service confirmation letters are official documents that communicate the conclusion of employment or service for an individual or organization. These letters often include various key details such as the employment duration, the specific reason for termination, and any benefits or final payments owed. A common reason for service termination might involve factors such as budgetary constraints, organizational restructuring, performance-based evaluations, or voluntary resignation. Including precise dates (e.g., last working day) is essential for documenting the termination process formally. Clarity on any exit procedures, post-employment benefits, and relevant contact information for future inquiries can also be crucial elements of the letter.

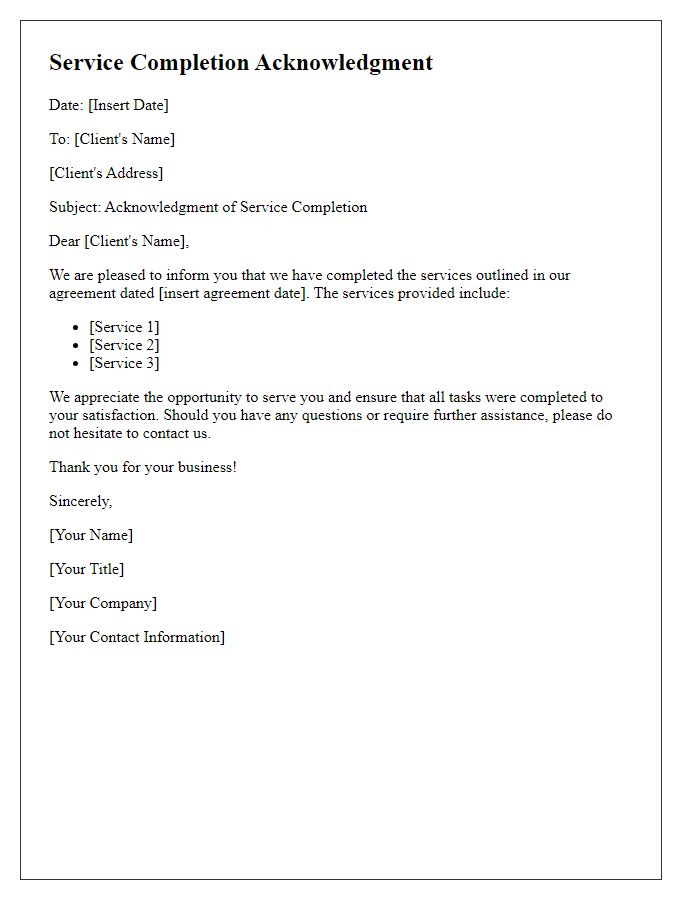

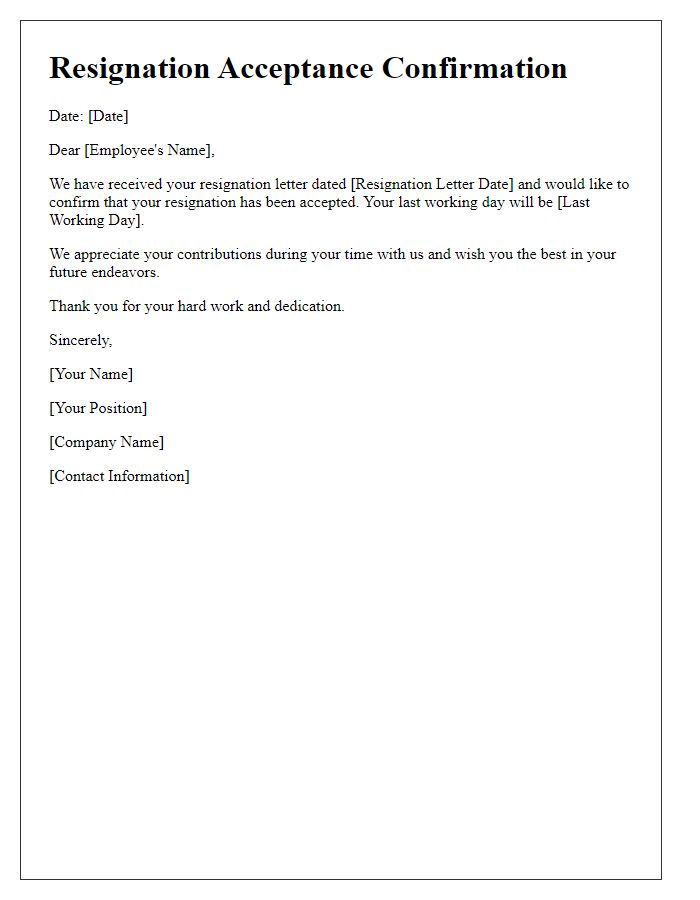

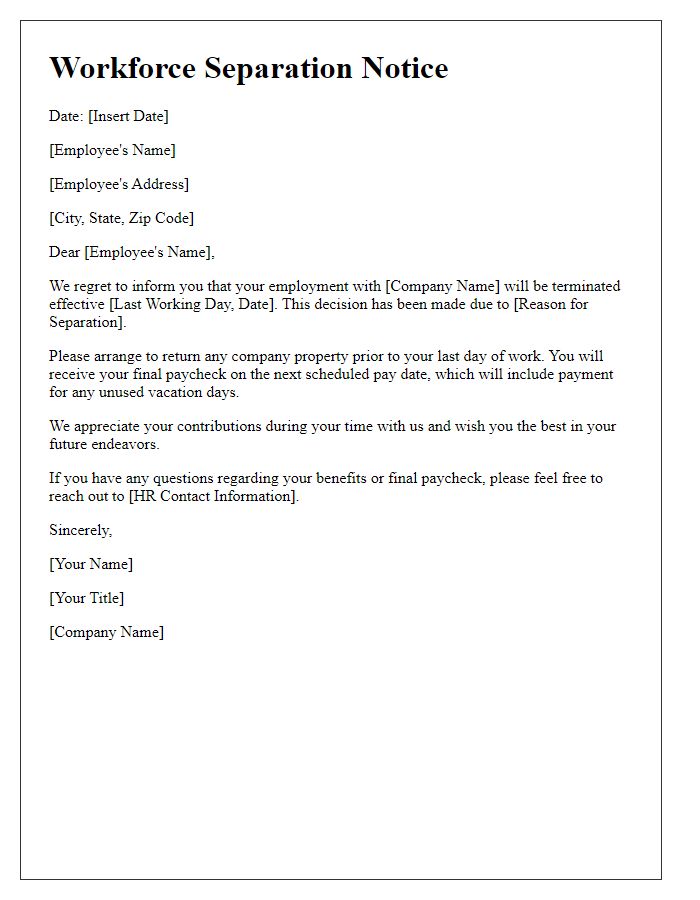

Final Settlement and Entitlements Information

The end-of-service confirmation notice provides crucial details regarding the final settlement and entitlements for employees transitioning out of the organization. This document typically includes important financial information, such as total accrued leave balance, severance pay calculations, and any outstanding reimbursements. Additionally, it outlines eligible benefits, including insurance continuation options and pension contributions, if applicable. Employees should expect a breakdown of deductions, like tax withholdings for the final payout, ensuring clarity on the total amount disbursed. The mention of specific dates, such as the employee's last working day, serves to contextualize the timeline for processing these entitlements, essential for both planning and financial management.

Comments