Are you feeling overwhelmed by the idea of making a big purchase all at once? You're not aloneâmany people prefer the comfort of manageable payment plans that fit their budgets. By spreading out the total cost, you can enjoy what you love without the stress of a lump sum payment. If you're curious about how our flexible payment options can work for you, read on to discover more!

Clarity in Terms and Conditions

Understanding the clarity of terms and conditions is crucial for consumers considering payment plan options, especially in financial agreements. Clear documentation ensures that individuals grasp important aspects such as interest rates, payment quantities, and due dates. Misunderstandings can lead to issues like late fees in the United States, which average $35 per instance. Transparent terms help mitigate confusion regarding cancellation policies or penalties for early repayment, fostering trust between the consumer and the lender. Disclosure of all potential charges upfront is essential in maintaining a positive financial relationship and avoiding disputes. Educating consumers on the significance of straightforward terms can empower informed decisions about their financial commitments.

Persuasive Language and Tone

Explore flexible payment plan options designed to ease your financial burden. Our customized plans cater to diverse budgets and preferences, offering manageable installments spread over convenient timeframes. These options allow customers to acquire quality products or services without overwhelming upfront costs. Recent studies indicate that consumers prefer payment flexibility, which can enhance satisfaction and loyalty. By choosing our payment plans, you unlock the opportunity to invest in essential purchases while maintaining financial stability. Embrace the freedom of scheduling your payments according to your lifestyle, ensuring a stress-free experience.

Concise and Direct Structure

Our flexible payment plans provide a convenient solution for managing expenses. Choose from various options tailored to fit your budget, ensuring affordability without compromising quality. Monthly installments can ease financial stress, making it easier to manage larger purchases. Whether you're considering an essential item or a luxury purchase, our payment options are designed to accommodate diverse financial needs, allowing you to enjoy your selections while maintaining financial stability.

Highlight Benefits and Flexibility

Discover flexible payment plan options designed to accommodate diverse financial needs. With plans tailored for various budgets, users enjoy the ease of spreading costs over manageable monthly installments, making high-value purchases, such as electronics or home appliances, more accessible. These payment options often come with low or no interest rates, ensuring affordability while maintaining consumer purchasing power. Furthermore, personalized payment schedules allow customers to select timelines that fit their unique financial situations, promoting financial freedom and reducing stress associated with lump-sum payments. Embrace the convenience and flexibility that modern payment plans offer to enhance your shopping experience.

Call-to-Action

Flexible payment plans provide convenience for customers looking to manage expenses effectively. For instance, monthly installment options, often spanning 12 to 24 months, allow for budget-friendly purchasing. Financing plans can cater to various credit scores, ensuring accessibility for a wider range of consumers. Promotional interest rates, such as 0% for the first six months, incentivize early adoption. Clear terms and conditions enhance transparency, building trust with clients. Accessible support through customer service channels assists individuals throughout their payment schedule, ensuring a smooth experience.

Letter Template For Promoting Payment Plan Options Samples

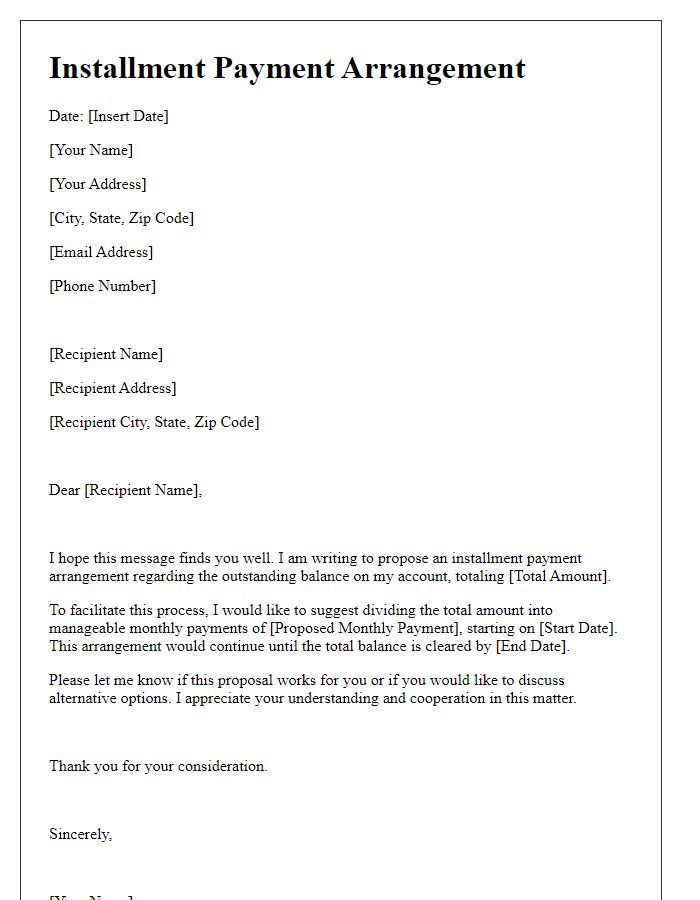

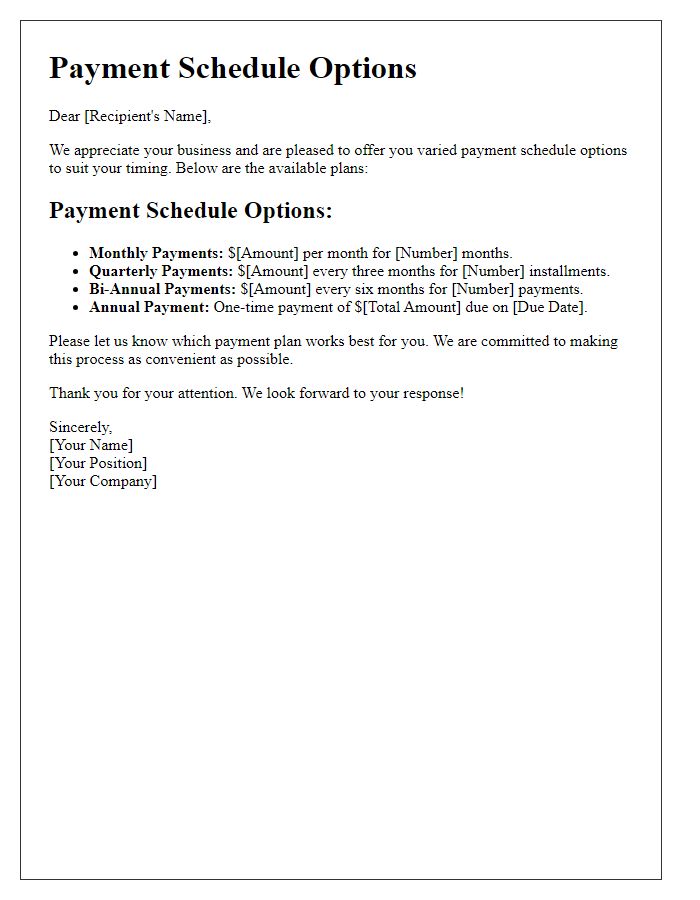

Letter template of installment payment arrangements for your convenience.

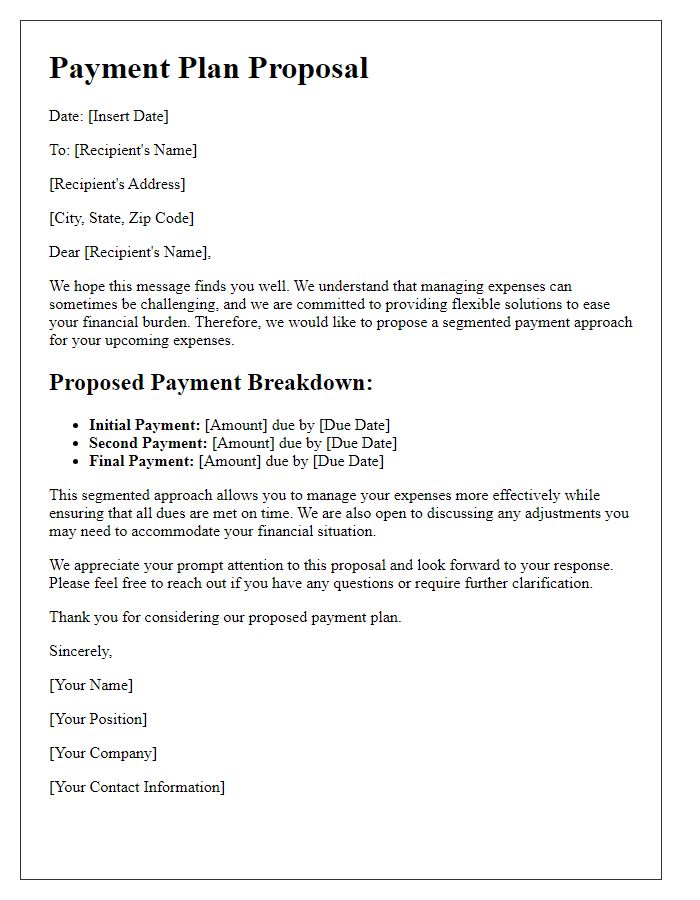

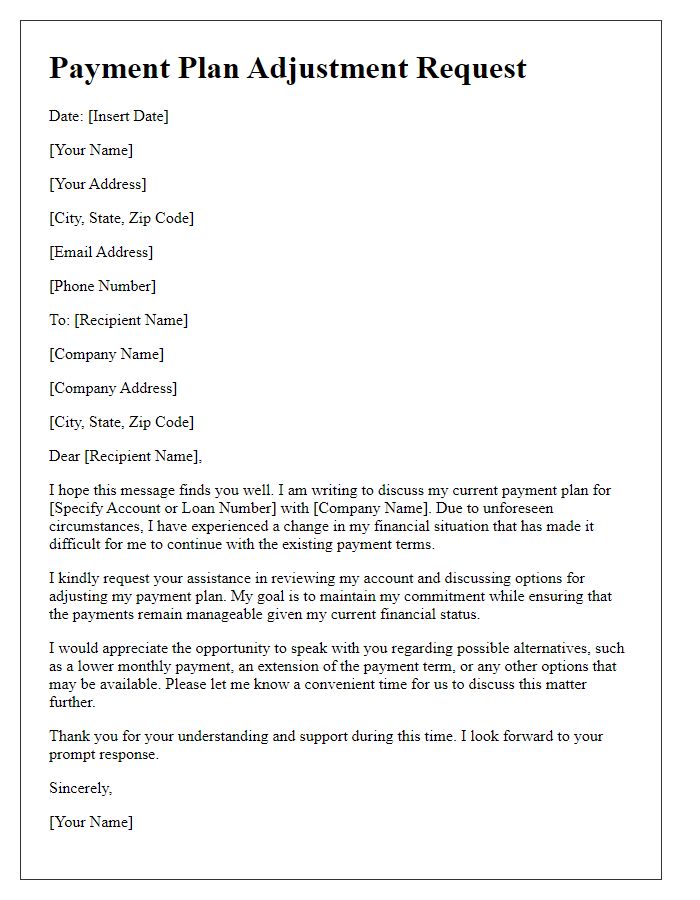

Letter template of segmented payment approaches for manageable expenses.

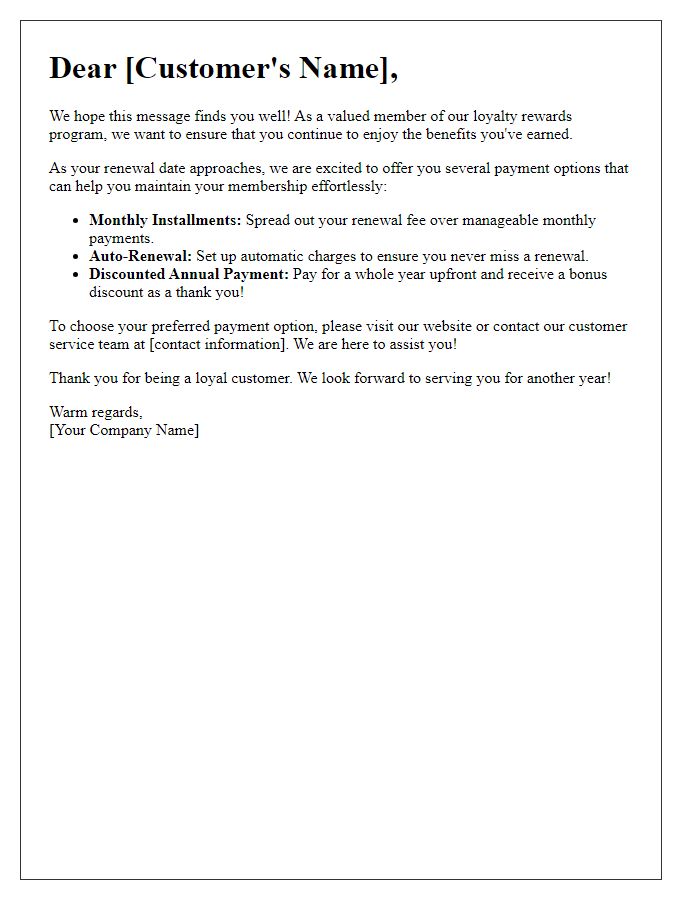

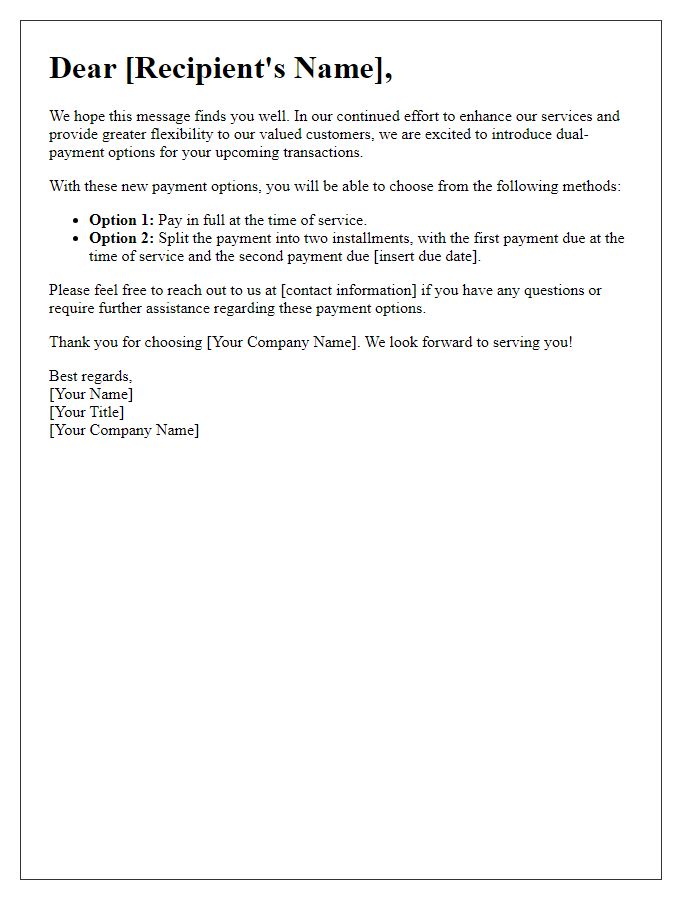

Letter template of renewal-friendly payment options for loyalty rewards.

Comments