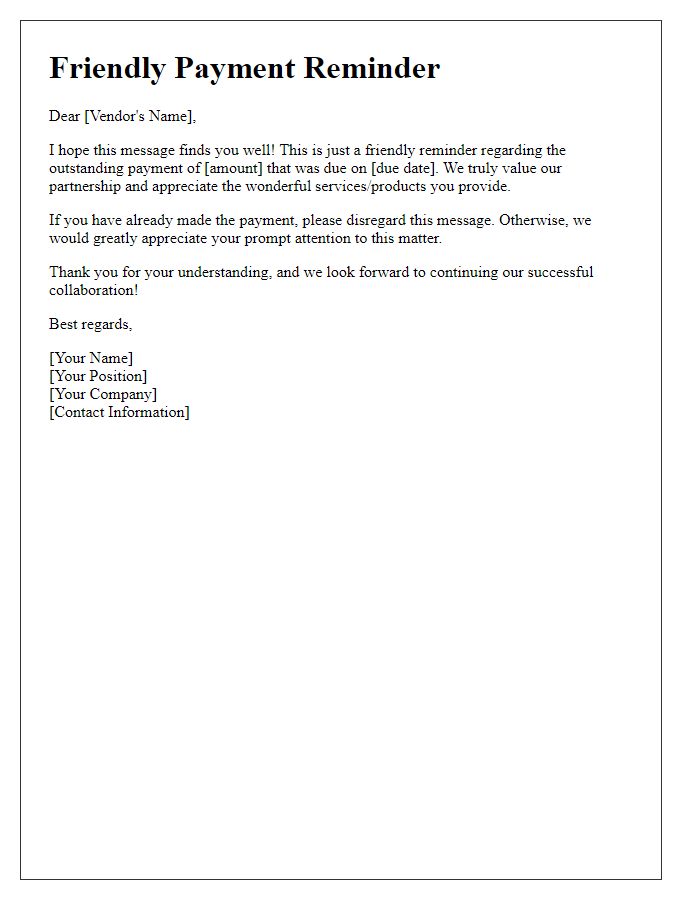

Hey there! If you're managing a retail business, you know how crucial it is to stay on top of your payments. A gentle reminder can be just what your vendors need to keep things running smoothly. In this article, we'll explore the best practices for crafting an effective payment reminder letter that maintains good relationships while ensuring timely payments. So, grab a cup of coffee and let's dive in!

Recipient Details and Account Information

A retail vendor payment reminder serves a critical role in maintaining the financial health of a business relationship. This communication usually includes essential recipient details such as the vendor's name, address, and contact information, ensuring clarity regarding the party involved. Account information might encompass details like the account number, invoice numbers, and outstanding balance, often specifying payment terms (such as net 30 days from invoice date) for reference. By highlighting the invoice date and the specific product or service rendered, the reminder reinforces the context of the payment due. Timely reminders, particularly within 30 days of the due date, can help prevent misunderstandings and encourage prompt settlement of accounts.

Clear Statement of Outstanding Balance

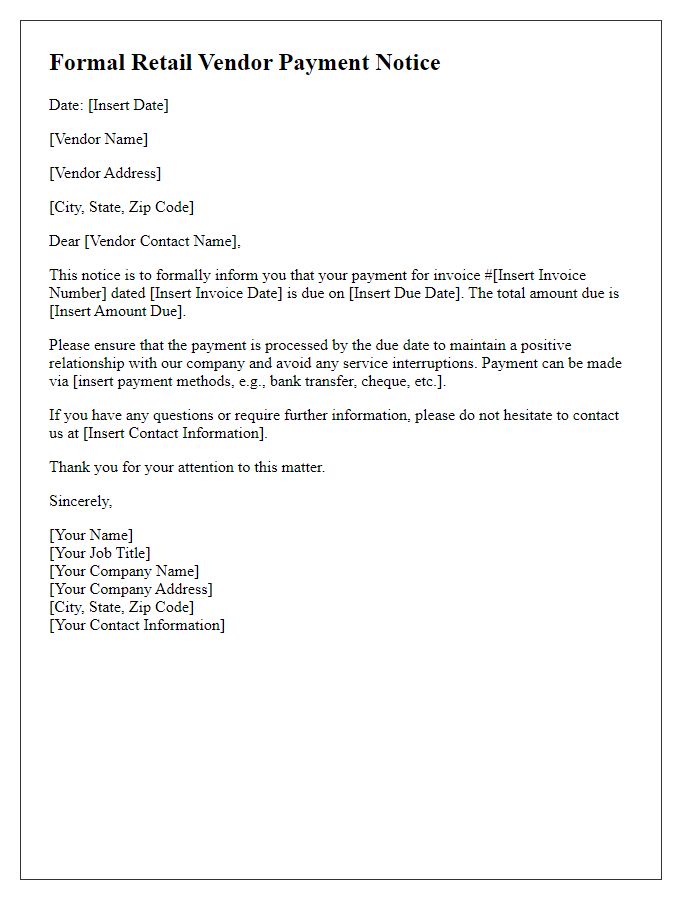

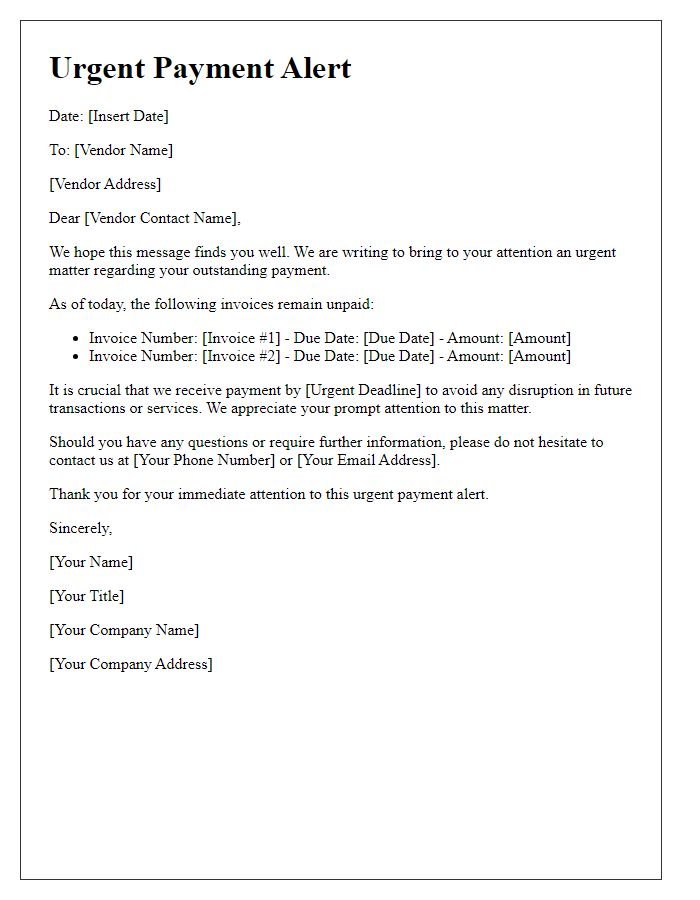

Retail vendors often experience outstanding balances that require timely resolution to maintain cash flow and business relationships. A clear statement detailing the outstanding balance, including specific invoice numbers and due dates, ensures transparency. For example, an invoice dated September 15, 2023, with a balance of $1,500, may indicate a payment due date of October 15, 2023. Communication regarding these matters should emphasize the importance of prompt payment to avoid late fees, which could be as much as 1.5% monthly on overdue amounts. Vendors should also highlight their payment methods, such as direct bank transfers or checks, to facilitate smooth transactions.

Payment Due Date and Terms

Retail vendors often face challenges regarding timely payments for goods and services provided. A payment reminder highlights critical information, including due dates, payment terms, and invoice references. Clear communication ensures vendors maintain healthy cash flow and operational efficiency. For example, a vendor may require payment within 30 days of invoice date, with penalties for late payments, to encourage prompt settlement. Providing specific details, such as invoice number, total amount due, and previous payment history, can facilitate a smoother reminder process, ensuring the financial relationship remains positive.

Accepted Payment Methods and Instructions

Retail vendors often encounter challenges in receiving timely payments for their products and services. Regularly collaborating with distributors requires clear communication regarding payment terms. Accepted payment methods include wire transfers, credit card payments, and checks, ensuring flexibility for vendors. Payment instructions typically outline necessary details like bank account information for electronic transfers or payee name and address for check payments. It is essential for vendors to keep track of invoice dates, maintaining accurate records to avoid potential delays or disputes over payments. Reminders can enhance cash flow management and strengthen relationships between vendors and their clients.

Contact Information for Queries and Assistance

Retail vendors often require timely payments to maintain smooth operations and cash flow. Payment reminders can serve as crucial communication tools. Contact information should include the vendor's name, phone number, and email address, ensuring easy accessibility for queries or assistance. Detailed payment instructions should accompany the reminder, specifying invoice numbers, due dates, and accepted payment methods. It's also beneficial to highlight any late fees or penalties that may apply, emphasizing the importance of adhering to payment schedules. This approach not only fosters a professional relationship but also ensures both parties remain aligned on financial expectations.

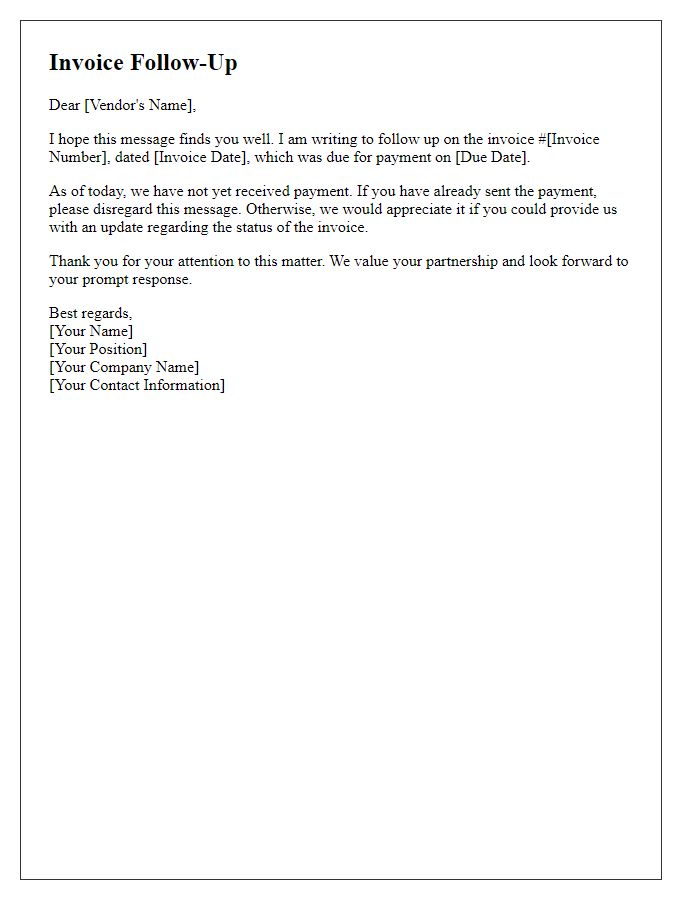

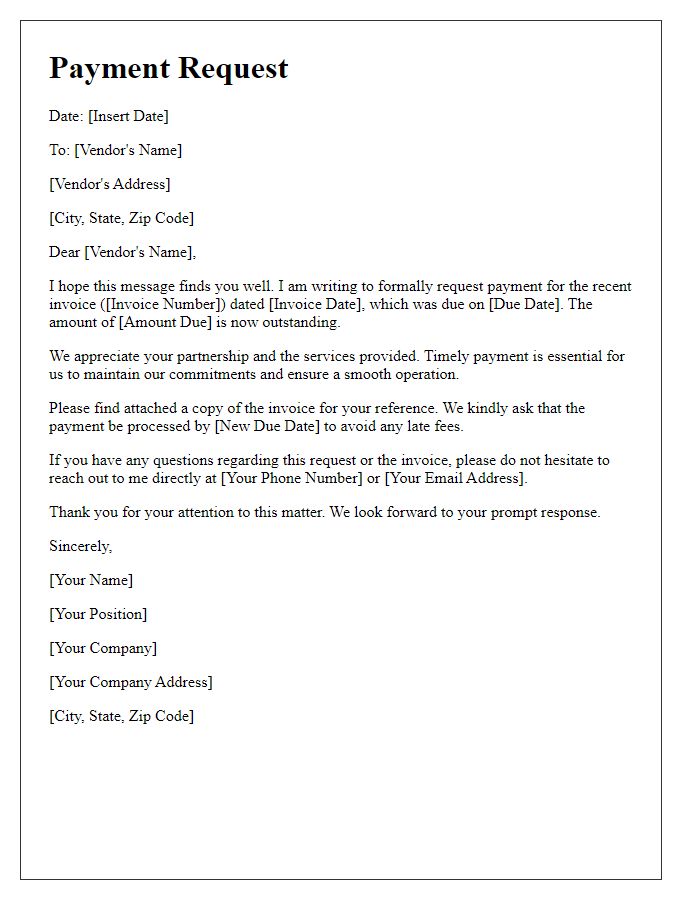

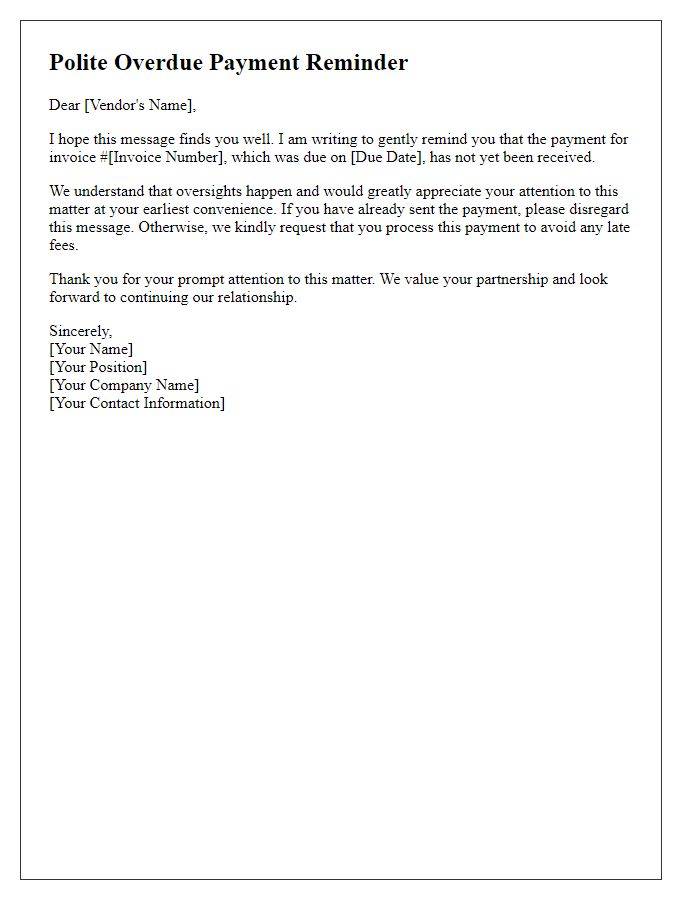

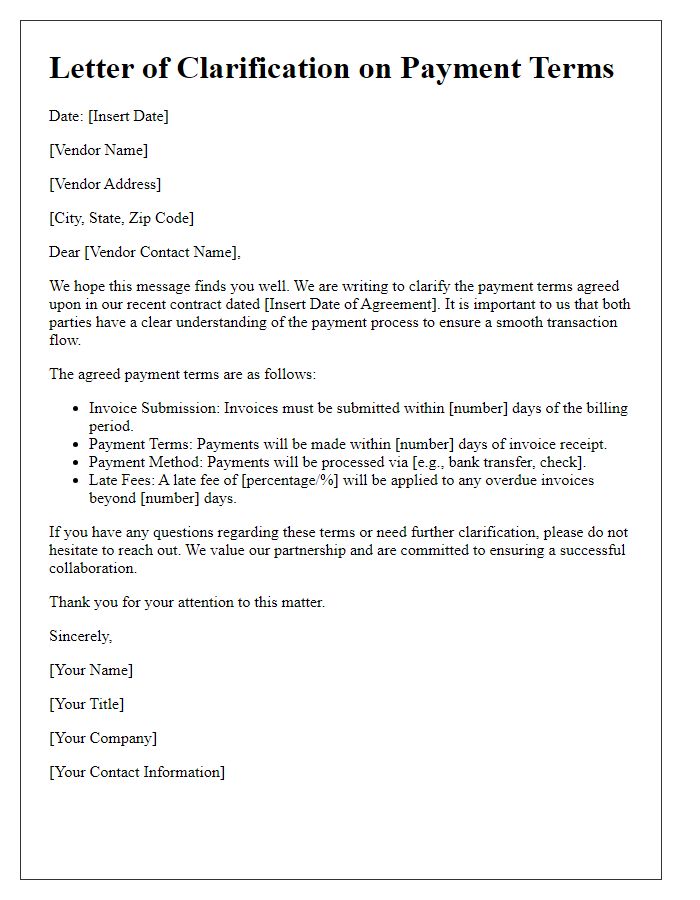

Letter Template For Retail Vendor Payment Reminder Samples

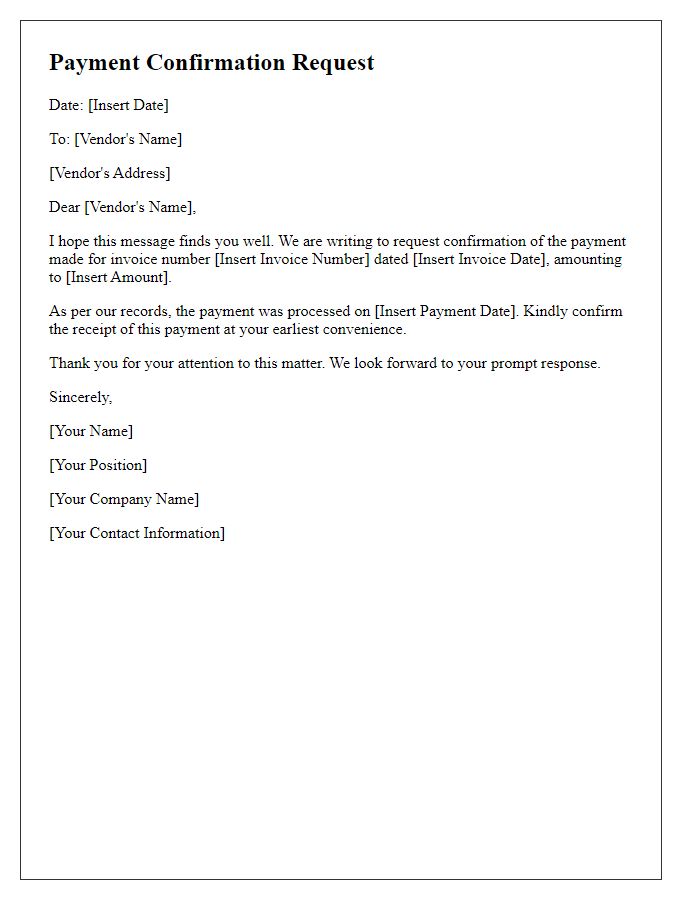

Letter template of straightforward retail vendor payment confirmation request

Comments