Are you struggling to keep track of late payments from your retail clients? Sending a gentle reminder can help maintain healthy business relationships while ensuring your cash flow remains intact. In this article, we'll provide you with a simple and effective letter template designed specifically for late payment reminders. So, let's dive in and explore how you can communicate with your clients professionallyâread on to discover the perfect approach!

Clear Subject Line

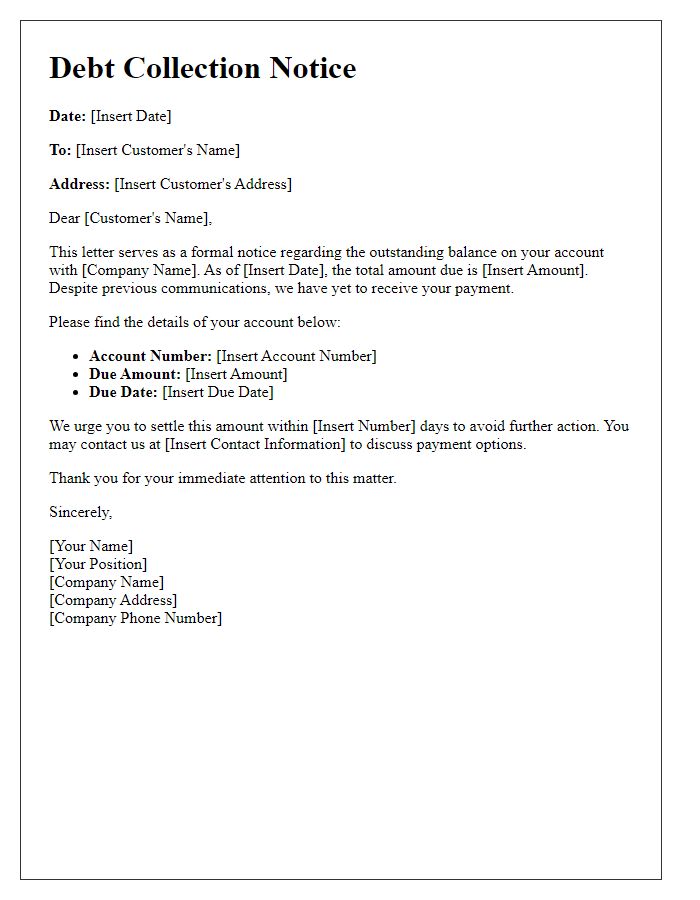

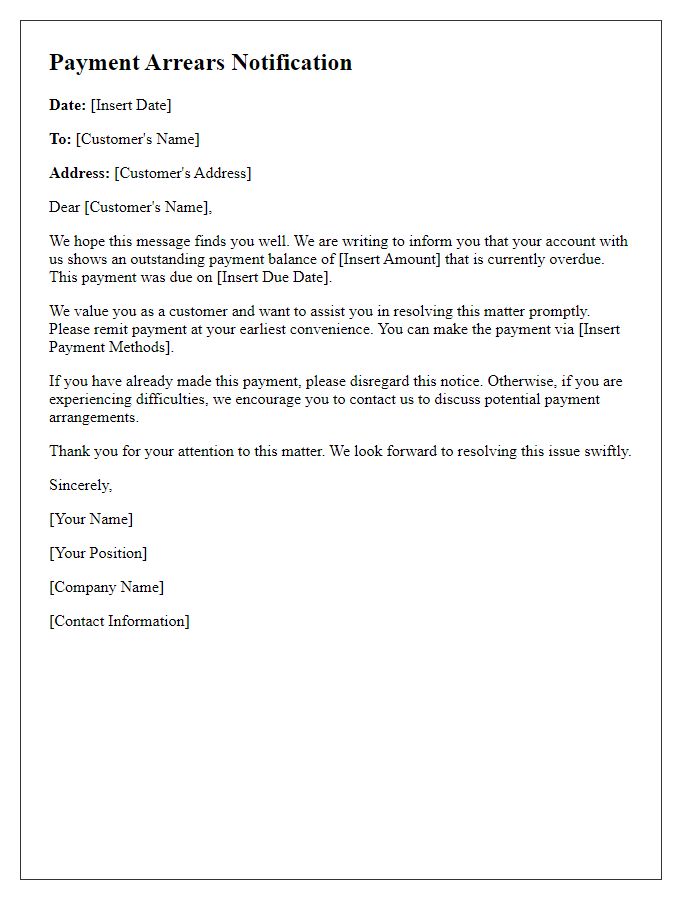

Retail late payment notices serve as essential reminders for outstanding debts, such as invoices. These communications should include the retail store's name, the customer's account number, and the total amount due. Specific due dates highlighted in bold can help emphasize urgency. Detailing payment methods accepted (credit card, bank transfer) fosters ease of transaction for customers. Additionally, providing a late fee percentage applicable after a certain period (e.g., 30 days) encourages prompt payment compliance. Including contact information (phone number, email) offers a channel for customers to clarify any questions regarding the notice or payment options.

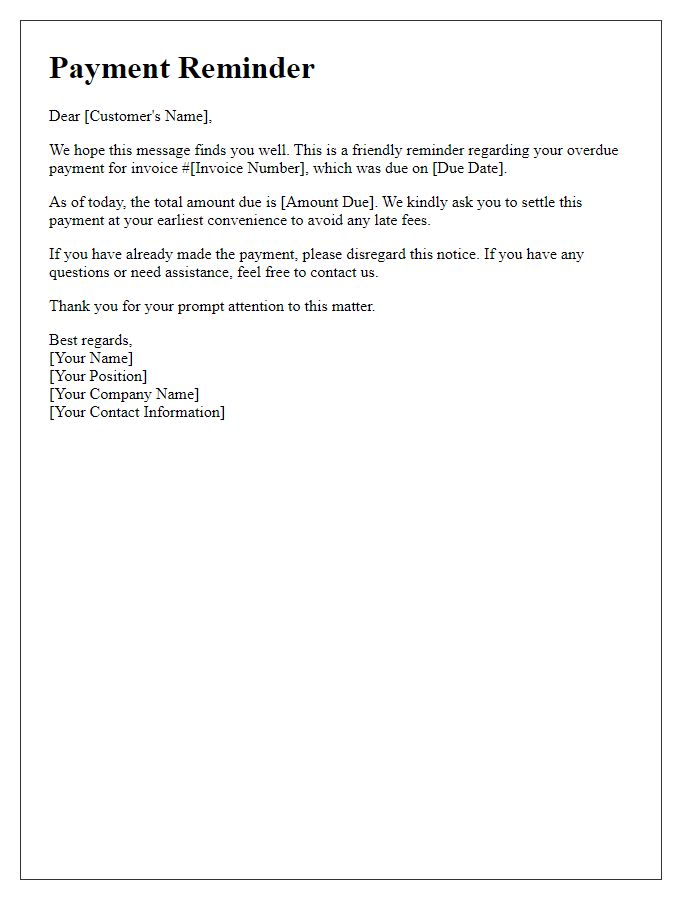

Professional Tone

Retail late payment reminders are essential for maintaining cash flow and customer relationships. A professional notice emphasizes the importance of timely payments, clearly states the overdue amount, and highlights the due date. Customers may appreciate a courteous tone while being reminded of the specifics, such as invoice numbers and payment methods. Polite language fosters goodwill, encourages immediate action, and maintains a strong business rapport. Including payment options and potential late fees can motivate prompt responses, ensuring that financial responsibilities are met while preserving the professional integrity of the retailer.

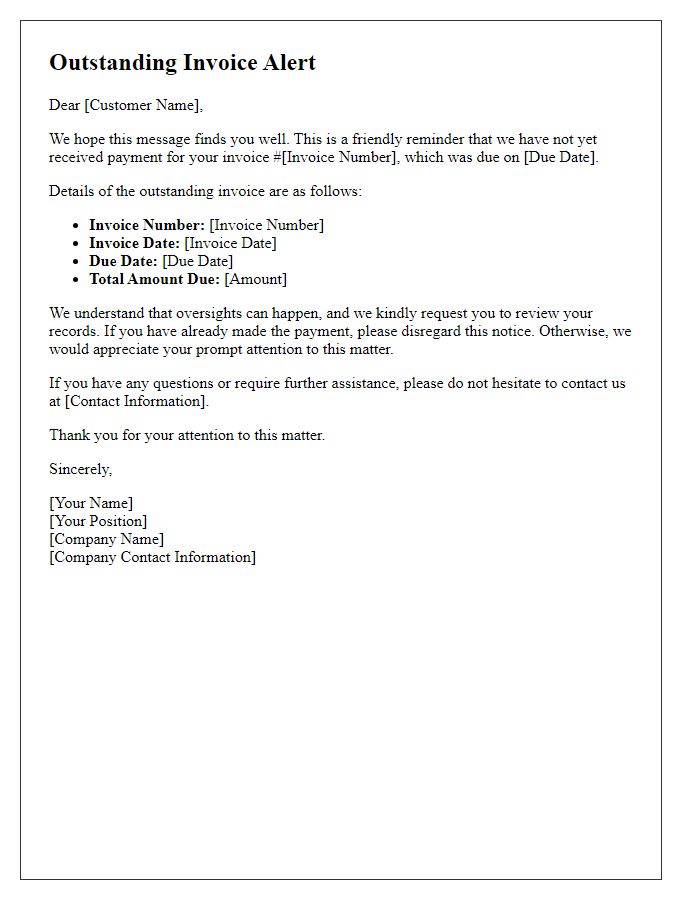

Invoice Details

Retail late payment reminders serve as essential notices to customers regarding outstanding balances on their invoices. These invoices typically feature unique identifiers such as the invoice number (a specific reference to track payment), invoice date (the date the invoice was issued), and due date (the deadline for payment). In retail transactions, amounts owed can vary, often ranging from small purchases to larger transactions exceeding thousands of dollars. Additionally, reminders may include details about payment methods accepted, such as credit cards or electronic transfers, and may highlight the potential for late fees, typically a percentage of the outstanding amount, if payments are not received by the outlined due date. This notification aims to encourage prompt payment while maintaining positive customer relations.

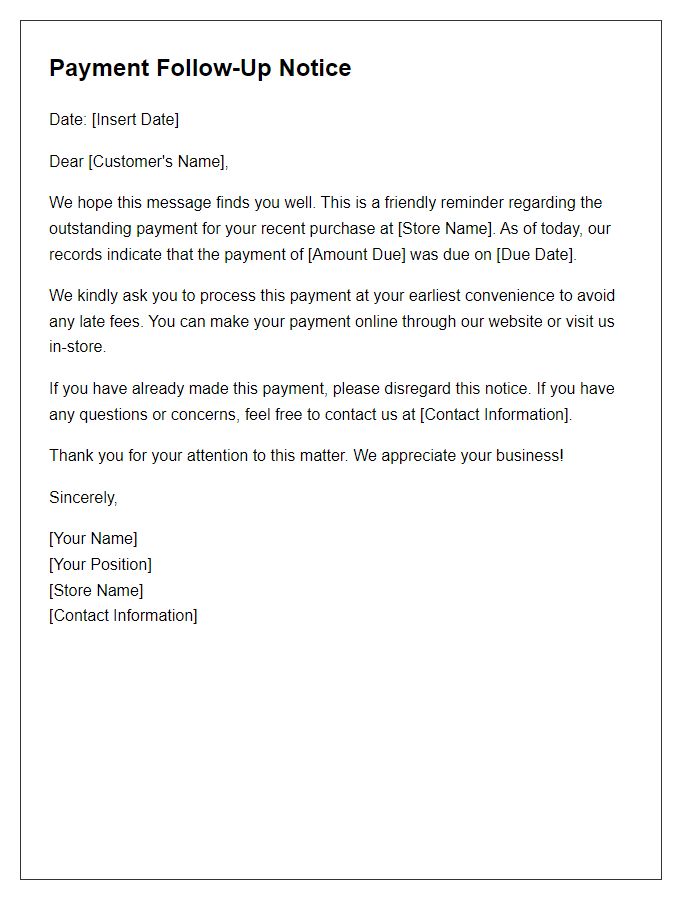

Payment Instructions

Late payment reminders are crucial for maintaining cash flow in retail businesses. Timely reminders, often sent after a grace period of 30 days post-due date, emphasize the importance of payment. Instructions should clearly outline acceptable payment methods, such as bank transfers to specific accounts, use of credit cards, and online payment platforms like PayPal for convenience. As a best practice, including invoice numbers ensures accurate referencing of transactions. Additionally, setting a final payment deadline--suggested within 15 days of the reminder--can motivate prompt action. Clear communication of potential late fees, typically 1.5% per month, helps convey urgency. Reminder templates should be professional, reflecting the brand's identity while maintaining a courteous tone to foster ongoing customer relationships.

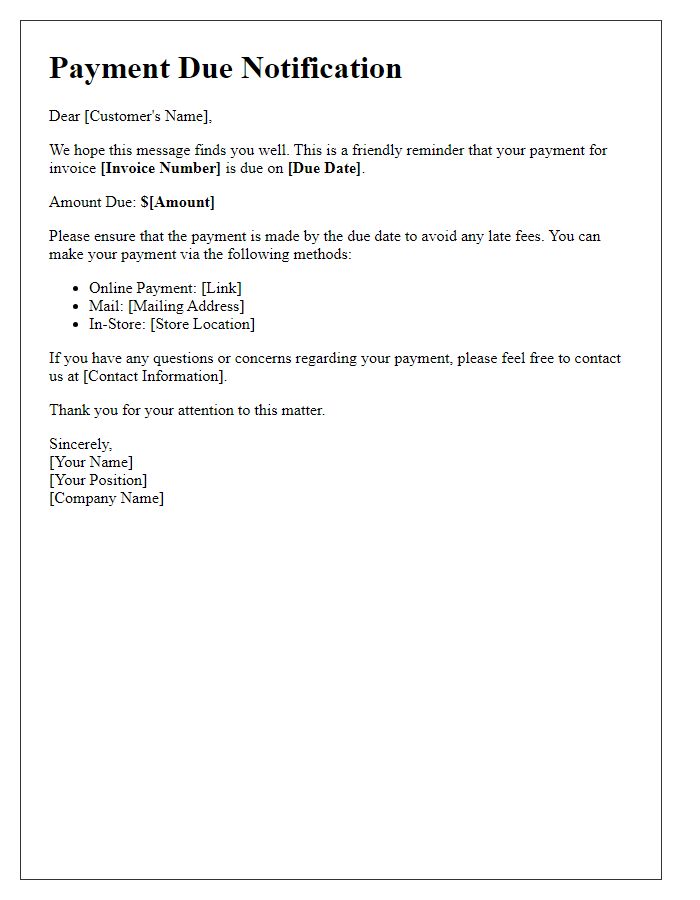

Contact Information

Retail businesses often face challenges with late payments from customers, impacting cash flow and operations. Late payment notices serve as important communications, prompting customers to settle their outstanding balances. Typical components include the retailer's name, contact number, and email address, ensuring customers can easily reach out for clarification. Payment terms specify the due date and interest penalties for delays, fostering a sense of urgency. Including a clear itemization of overdue amounts enhances transparency and reinforces the need for prompt action. Not only do these notices aid in maintaining financial stability, but they also foster accountability among customers, strengthening business relationships in the long term.

Comments