Hey there! We all know that life can get busy, and sometimes, payment deadlines can slip through the cracks. That's why we want to gently remind you about your outstanding balance and the associated late payment penalty that may apply. Understanding these details can help you avoid any unnecessary fees and keep everything running smoothly. Curious to learn more about your options and what to do next?

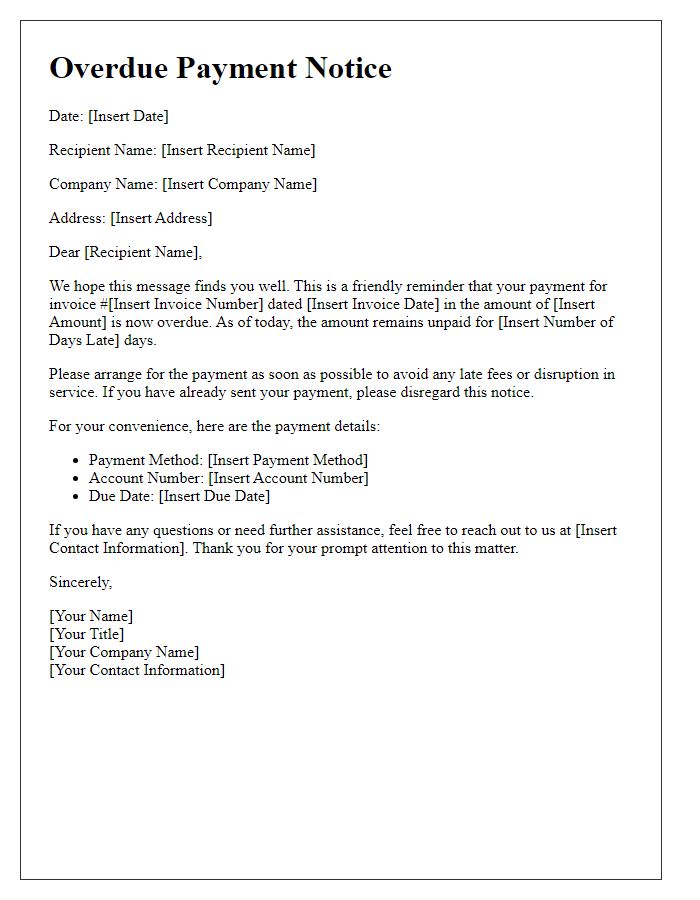

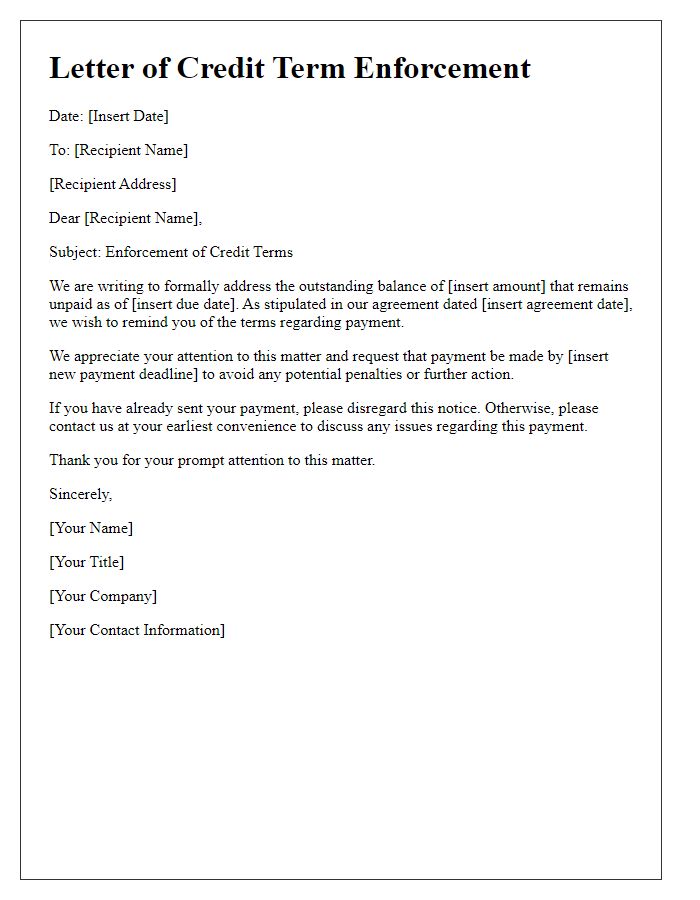

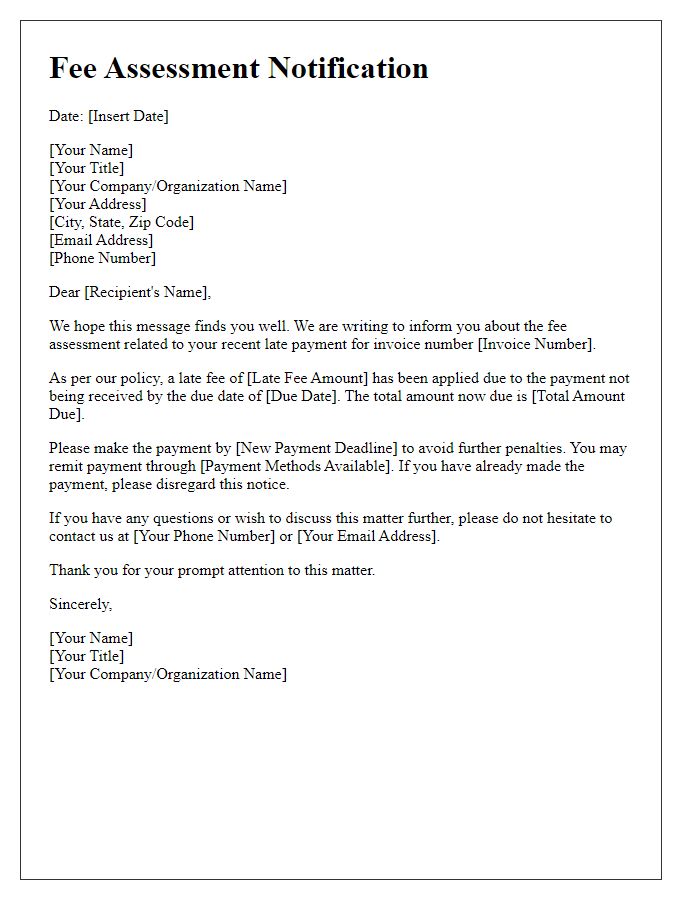

Clear subject line

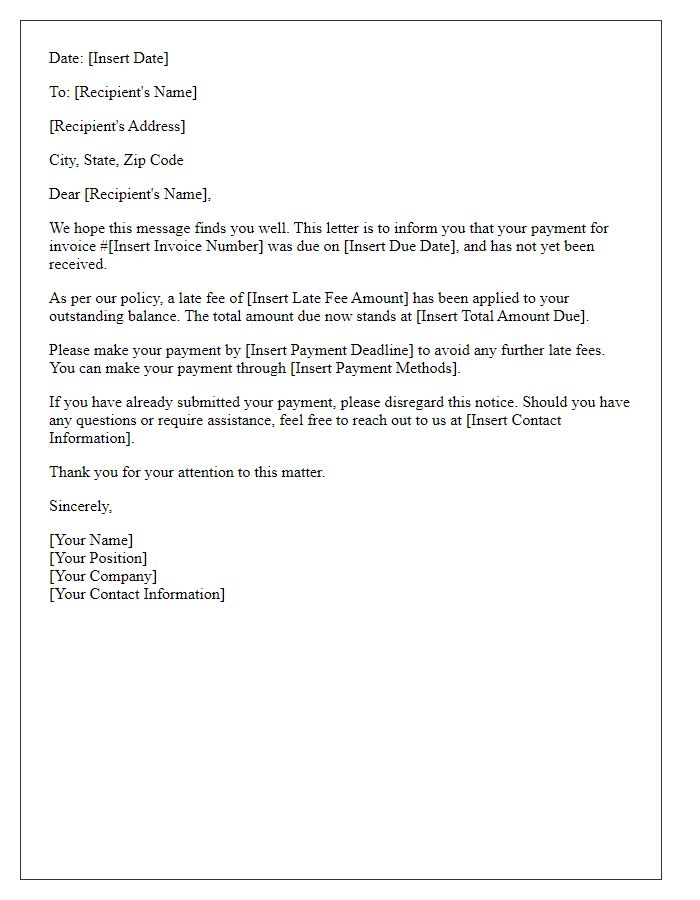

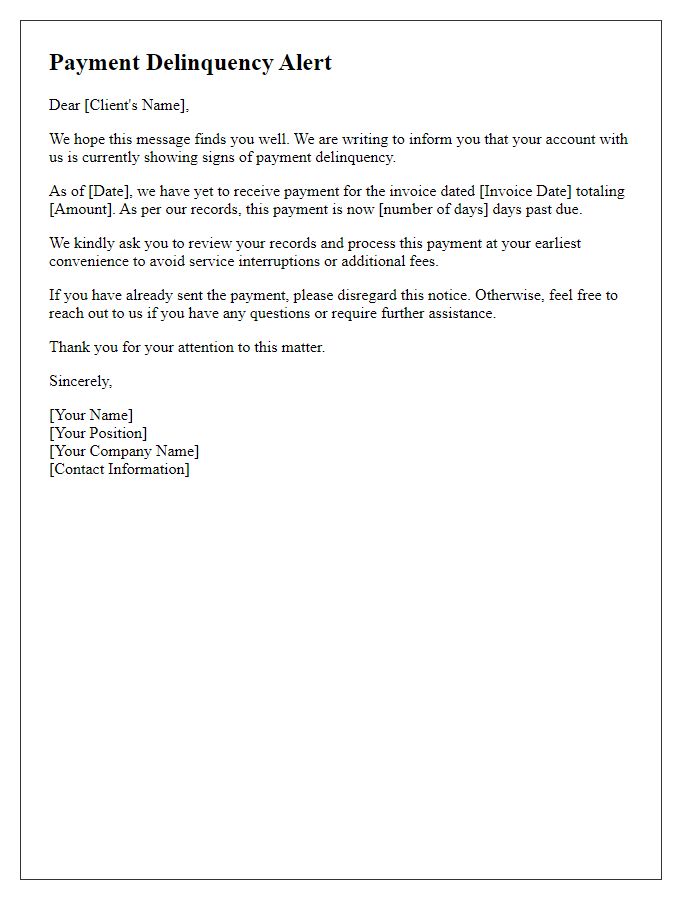

A late payment penalty reminder serves as an important notification to clients regarding overdue payments. Timely communication is crucial in maintaining healthy business relationships and ensuring cash flow. For example, invoices dated July 15, 2023, with a payment due date of August 15, 2023, can incur a penalty of 1.5% of the outstanding amount for each month delayed beyond the due date. Clients should be reminded that consistent late payments can lead to additional fees and impact future service agreements. Transparency and clarity in outlining payment terms can help mitigate misunderstandings and maintain mutual respect between the service provider and client.

Polite opening statement

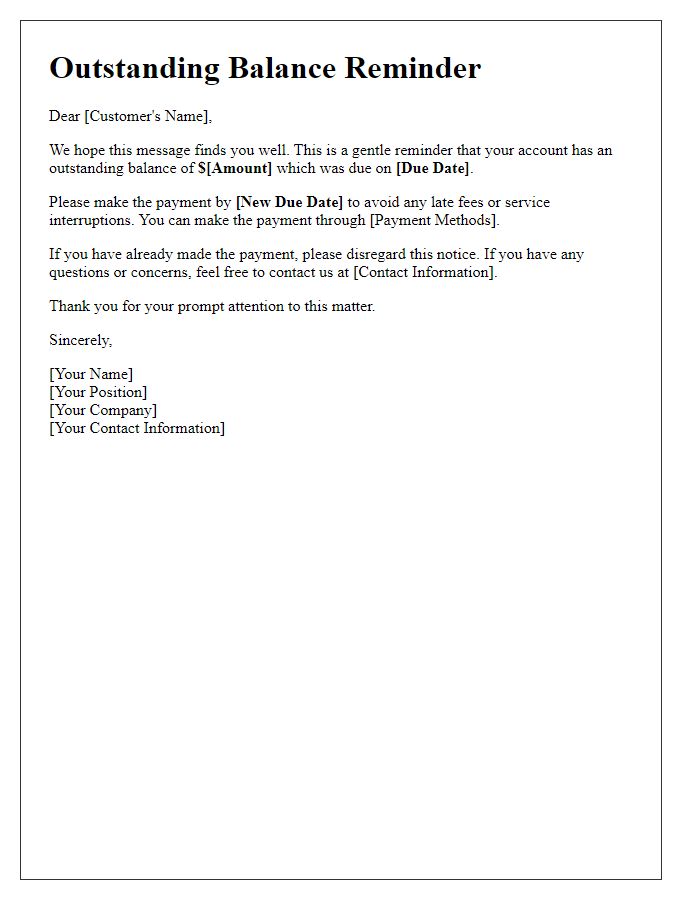

A late payment penalty can impact financial health and relationships. Timely payments help maintain trust and service continuity for businesses. Setting clear expectations in contracts reduces misunderstandings. Clear communication in reminders emphasizes importance of meeting deadlines. Friendly tone fosters positive interaction, encouraging prompt resolution.

Details of the overdue payment

A late payment penalty reminder serves as a crucial communication for outstanding financial obligations. An overdue payment, such as an invoice of $1,200 due for services rendered on September 15, 2023, can accrue a penalty of 1.5% monthly if not settled by the end of the current month. Formal reminders typically reference specific payment terms outlined in contracts, leading to potential consequences for continued delays, including suspension of services or legal proceedings. Contact information, including phone number and email for inquiries, should be provided to facilitate immediate communication regarding payment resolutions.

Consequences of non-payment

Late payment penalties can significantly impact both individuals and businesses, leading to increased financial strain. In many cases, companies enforce a late fee, typically ranging from 1% to 5% of the overdue amount, which can accumulate monthly, creating larger outstanding balances. For instance, if an invoice of $1,000 remains unpaid for three months with a 3% penalty, the total amount due can rise to $1,090. Additionally, consistent non-payment can result in suspension of services or products until the account is brought current, affecting operations or access for customers. In severe instances, it may lead to the involvement of collection agencies which can damage credit ratings and result in further legal consequences, stressing the importance of timely payments to avoid such scenarios.

Contact information for resolution

Late payment penalties can significantly impact business cash flow, particularly for companies like XYZ Corp. Late payment fees, typically starting at 1.5% per month or part thereof, accumulate quickly. This penalty applies to overdue invoices dated beyond the specified payment terms, often net 30 days from the invoice date. It's essential for clients to address outstanding balances promptly, as the average outstanding invoice can remain unpaid for over 45 days, leading to increased financial strain. For resolution, clients should contact the finance department of XYZ Corp at info@xyzcorp.com or call (555) 123-4567 during business hours. Quick communication can help mitigate penalties and maintain service continuity.

Comments