Hey there! We've all been there when an invoice doesn't quite match up, right? Whether it's a mix-up with numbers or just a miscommunication, sorting out discrepancies can feel daunting. In this article, we'll break down a simple template to address those issues effectively and professionally. So, let's dive in and make invoice clarity a breeze!

Subject line clarity

Subject lines should be clear and direct to facilitate understanding and ensure quicker responses. An effective subject line for an invoice discrepancy clarification could include specific details such as invoice number, date, and issue type. For example, "Clarification Request: Invoice #12345 Discrepancy Dated October 5, 2023." This provides immediate context to the recipient, enabling them to quickly identify the nature of the inquiry and prioritize their response accordingly. Additional identifiers, such as the related purchase order number or service description, can enhance specificity and assist in swift resolution.

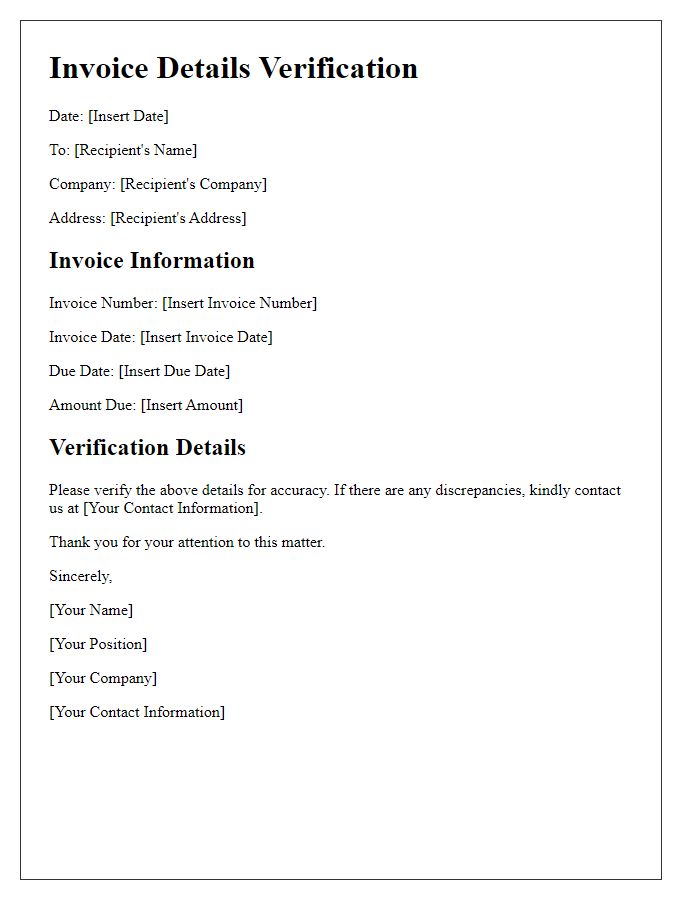

Detailed invoice reference

Inaccurate invoices can arise from various factors, such as miscalculations or incorrect data entry. Discrepancies often relate to quantity (for example, 100 units of a product versus the billed 120), pricing (e.g., $50 per unit instead of the agreed $45), or missing items (like an overlooked service in the total). These errors not only complicate the financial reconciliation process but can also impact business-client relationships. Addressing these discrepancies promptly, with reference to the specific invoice number (for instance, INV-2023-042), ensures a smoother resolution and maintains transparency in transactions. Detailed explanations of each line item on the invoice provide clarity and promote trust between parties involved in financial exchanges.

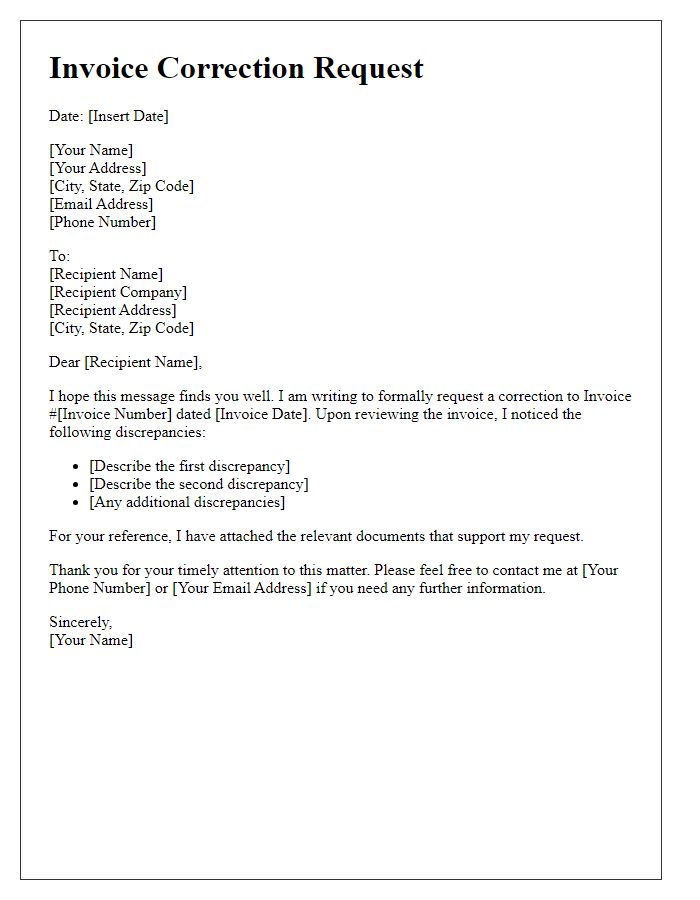

Specific discrepancy description

An invoice discrepancy often occurs when there are differences between the billed amount and the expected payment. A common issue includes overcharges where the billed amount exceeds the agreed price on the purchase order by an average of 10%-15%. Another prevalent discrepancy could involve incorrect service or product descriptions, leading to potential billing for items not received, creating confusion for clients. For instance, a customer may receive a shipment of 50 units but the invoice lists 60 units. Additionally, discrepancies may arise from unauthorized additions of fees such as shipping costs, which can range from $15-$50 depending on the carrier used. Timely clarification of these issues is crucial to maintaining positive business relationships and ensuring accurate financial records.

Supporting documents attachment

Invoices often contain discrepancies that require clarification, particularly in business transactions. Supporting documents, such as purchase orders, delivery receipts, and previous correspondence, serve as crucial evidence during this clarification process. Accurate records of quantity received, expected prices, and agreed terms are essential for resolving issues efficiently. Clear documentation can expedite resolution and ensure both parties maintain a transparent audit trail, preventing future misunderstandings. Timely communication regarding discrepancies can foster good business relationships and uphold trust between involved entities.

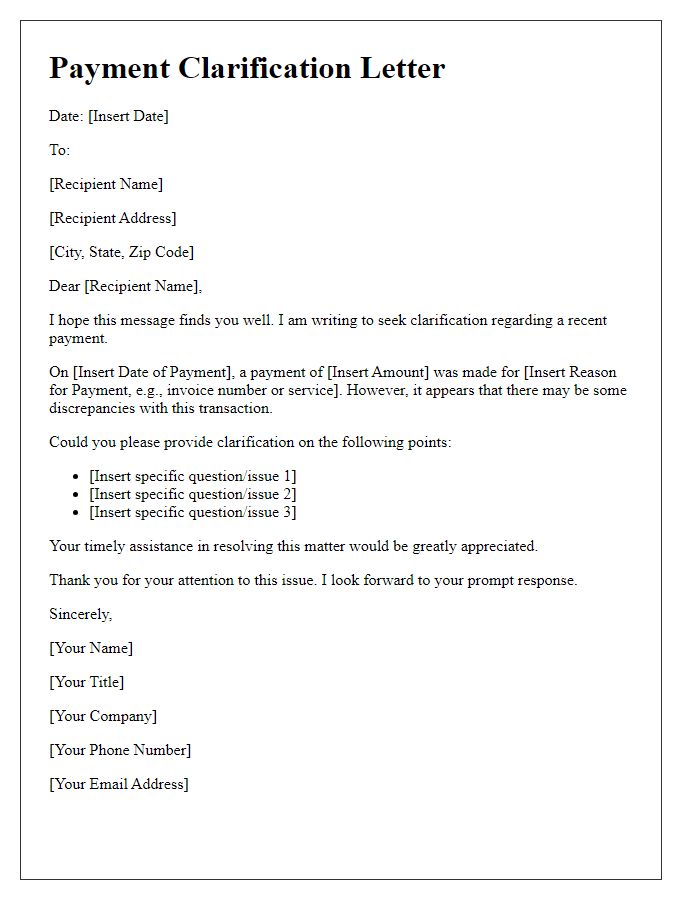

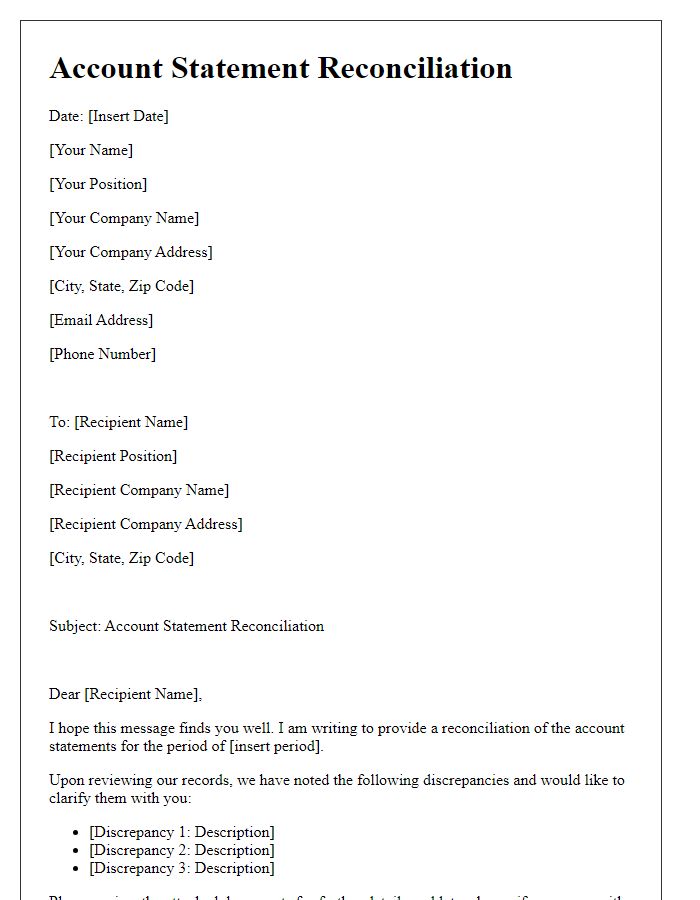

Contact information for follow-up

Invoice discrepancies can arise due to various reasons, such as incorrect line item pricing or taxes, payment terms not aligning with agreed-upon conditions, or miscommunication regarding services rendered. Key contacts for follow-up include the accounts receivable department (often reachable at a dedicated phone number or email address), the sales representative who managed the transaction, and a billing supervisor for escalated queries. Prompt communication is essential to resolve issues swiftly, maintaining strong relationships between businesses. Documentation such as previous correspondence and the original invoice (numbered for reference) should be gathered to facilitate accurate clarification of any misunderstandings.

Comments