Are you considering expanding your reseller business but unsure about how to apply for credit? Navigating the application process can feel overwhelming, but having the right resources can make it easier. In this article, we'll break down the essential components of a letter template specifically designed for reseller business credit applications. Join us as we explore tips and examples that will help you craft a compelling request for credit!

Business Information

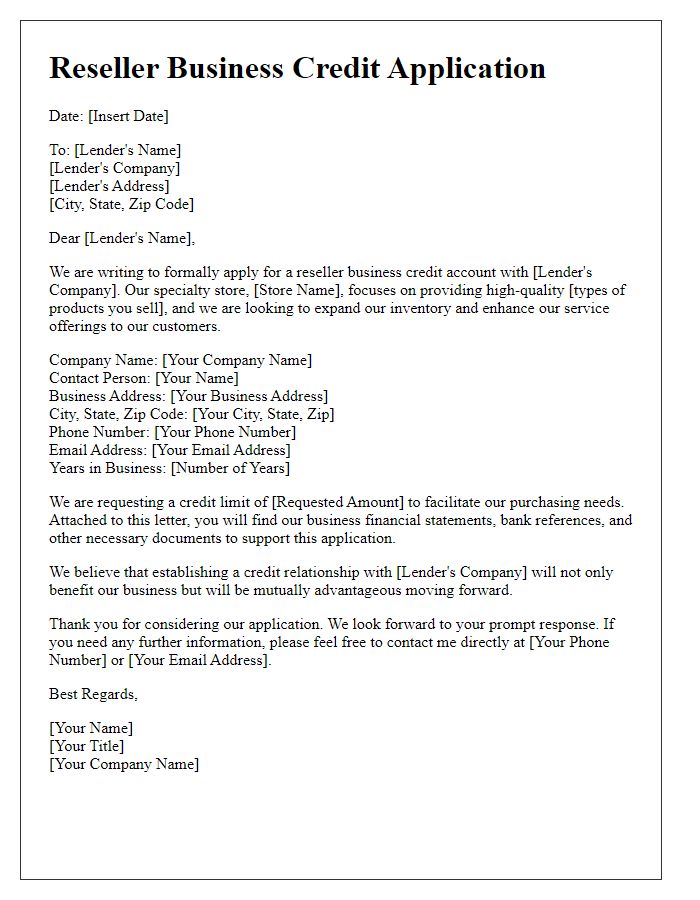

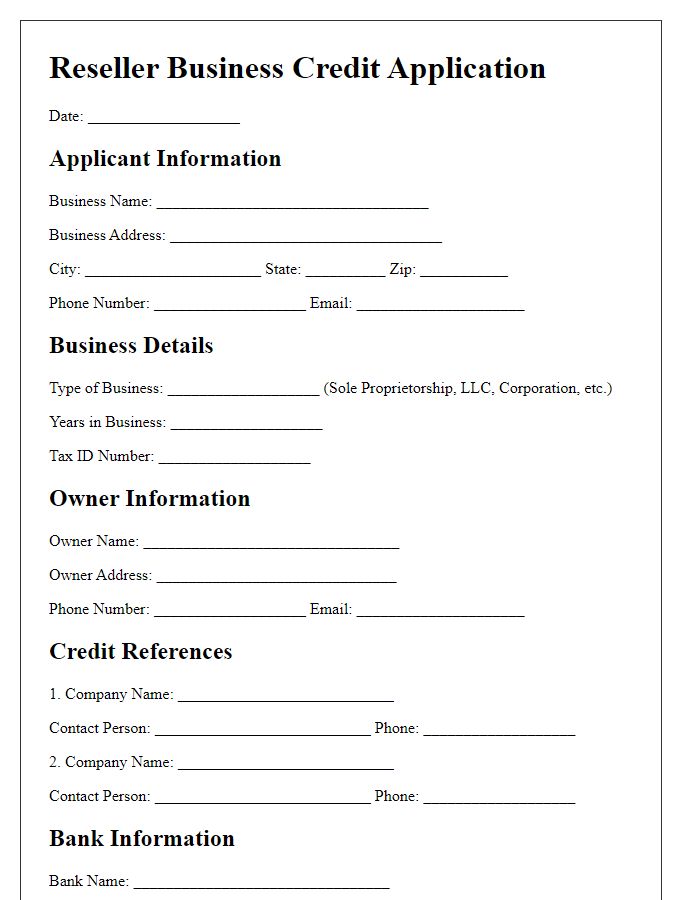

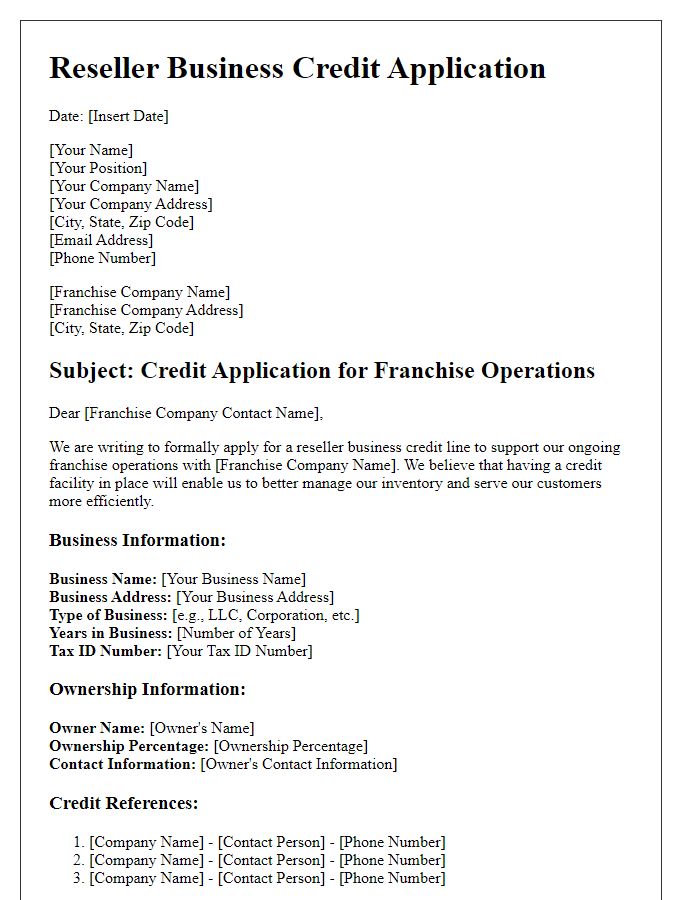

A reseller business credit application includes essential details vital for evaluating creditworthiness. Business name, such as "Innovative Gadgets LLC," must be provided. Incorporating the business registration number aids in verifying legitimacy. Address details, including street, city, state, and zip code, offer a geographic context. Key contact information, comprising a primary phone number (e.g., (555) 123-4567) and email address (e.g., info@innovativegadgets.com), facilitates smooth communication. The type of business entity, whether an LLC, corporation, or sole proprietorship, plays a significant role in assessing structure and liability. Tax ID number, essential for tax purposes, should also be included. Additionally, the total years in business (e.g., 5 years) conveys stability and experience in the market. Finally, listing anticipated credit limit requests (such as $10,000) sets expectations for financial engagement.

Reseller's Financial History

A reseller's financial history is a crucial aspect of securing credit for business operations. Factors considered include annual revenue figures, which typically range from tens of thousands to millions of dollars, helping lenders gauge the financial viability of the reseller. Furthermore, credit scores, often monitored by agencies such as Experian or Dun & Bradstreet, reflect the reseller's payment history and creditworthiness. Payment terms with suppliers, such as net 30 or net 60, reveal the reseller's cash flow management and ability to honor financial obligations. Additionally, any outstanding debts or liens, which can emerge from federal tax obligations or unpaid invoices, play a significant role in evaluating the risk associated with granting credit. Economic fluctuations, such as those caused by events like the COVID-19 pandemic, highlight the need for resellers to maintain a robust financial strategy to navigate uncertainties. Overall, this financial history is instrumental in providing potential creditors with a clear picture of the reseller's capabilities and reliability.

Credit References

A reseller business credit application requires specific information for credit references to establish financial reliability and partnership potential. Include at least three business references, providing the company name, business address, and contact person's name and position. Clearly indicate the credit limit with each reference, requesting details of payment history over the past one year, duration of business relationship, and frequency of transactions. Relevant industries may include wholesale distribution, electronics sales, or retail services. This data serves to verify the applicant's payment practices and is essential for assessing creditworthiness in the reseller market.

Terms and Conditions Agreement

Reseller businesses often seek to establish credit terms with suppliers to enhance inventory management and cash flow. A Terms and Conditions Agreement outlines the responsibilities and expectations between the reseller and the supplier. Essential components include payment terms (30 days net, for example), interest rates on overdue balances (typically ranging from 1%-2% per month), and consequences of default (such as suspension of credit). Additionally, important clauses regarding product returns, warranty conditions, and governing law (often the jurisdiction of the supplier's headquarters, such as California) provide clarity. A well-structured agreement fosters trust and smooth transactions, ultimately benefiting both parties.

Authorization and Signature Section

The Authorization and Signature section serves as a crucial component in the reseller business credit application process, distinguishing the official agreement between the business entity and the credit provider. This section typically includes essential details such as the name of the individual authorized to sign on behalf of the business (usually an owner or officer), a designated title like "Owner" or "CEO," and the date of signing. It also demands an original signature, validating the authenticity of the application and affirming the information provided is truthful and complete. The inclusion of a statement regarding the understanding of the terms of credit, repayment obligations, and potential consequences of default adds legal weight. By signing, the applicant agrees to the credit provider's policies, contributing to a clear, formal acknowledgment of commitment to the terms established.

Letter Template For Reseller Business Credit Application Samples

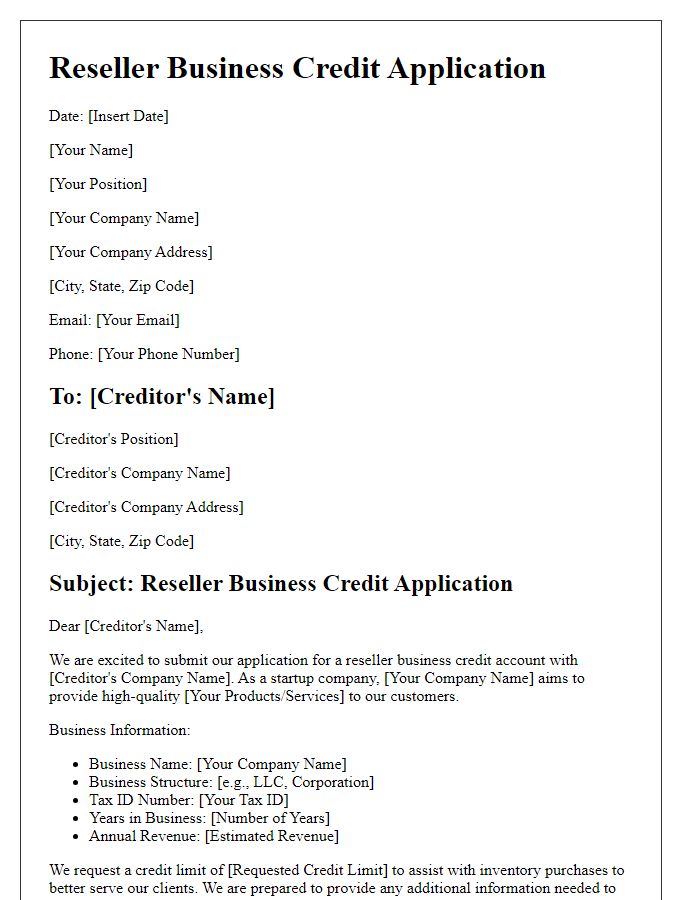

Letter template of reseller business credit application for startup companies.

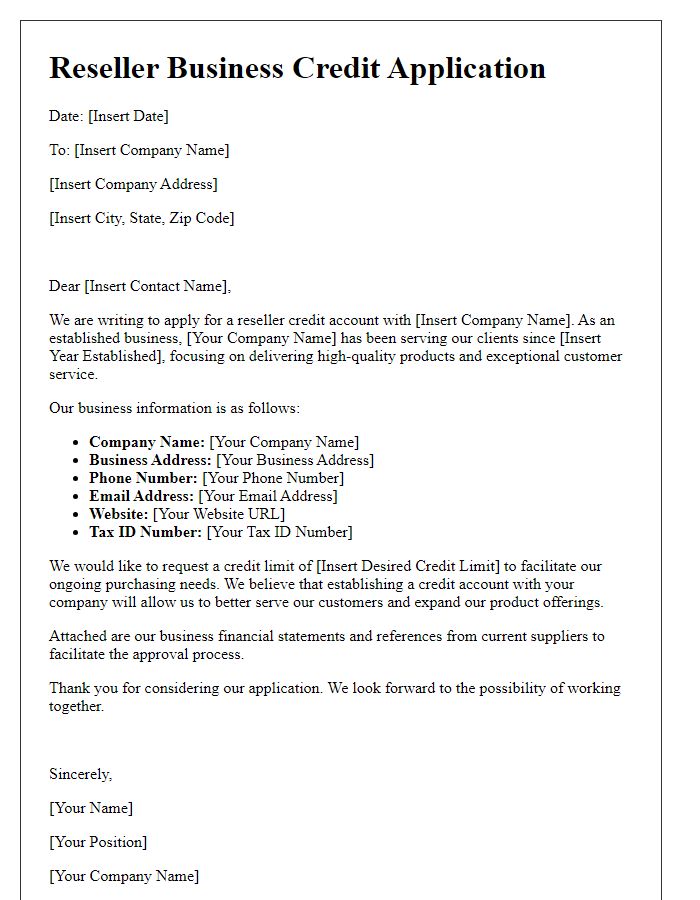

Letter template of reseller business credit application for established businesses.

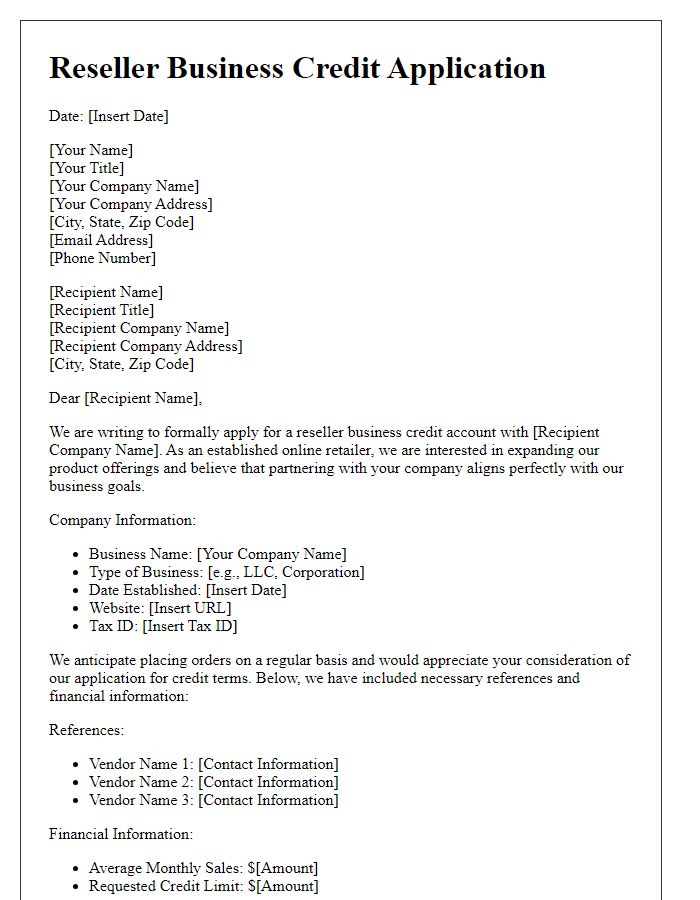

Letter template of reseller business credit application for online retailers.

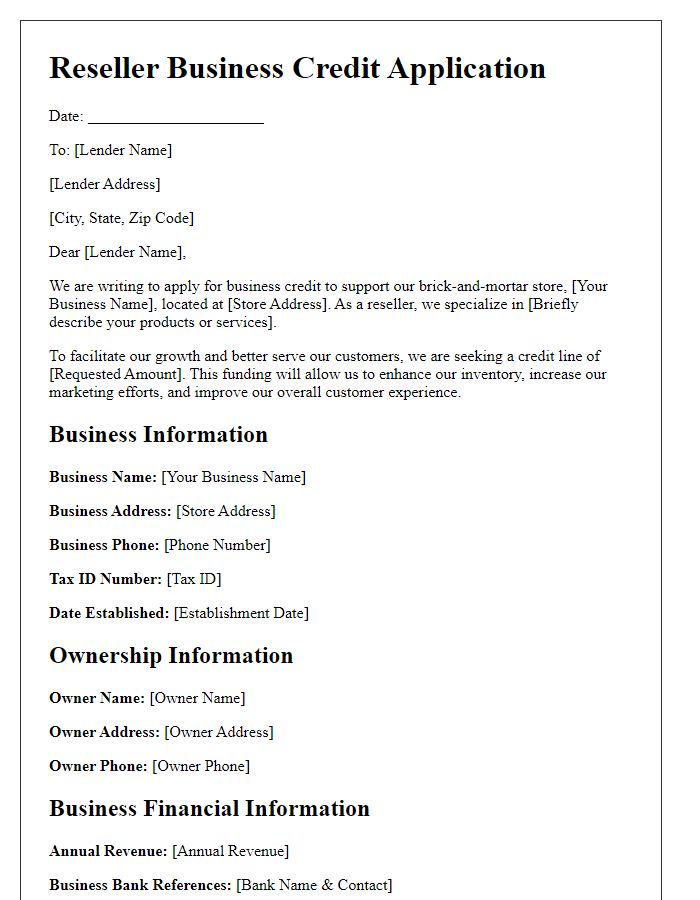

Letter template of reseller business credit application for brick-and-mortar stores.

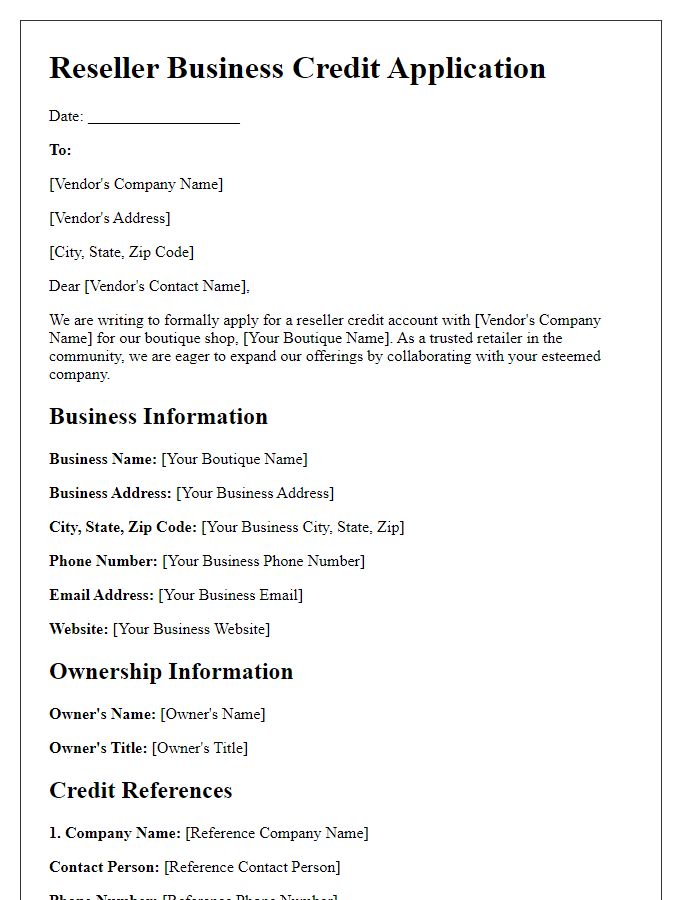

Letter template of reseller business credit application for boutique shops.

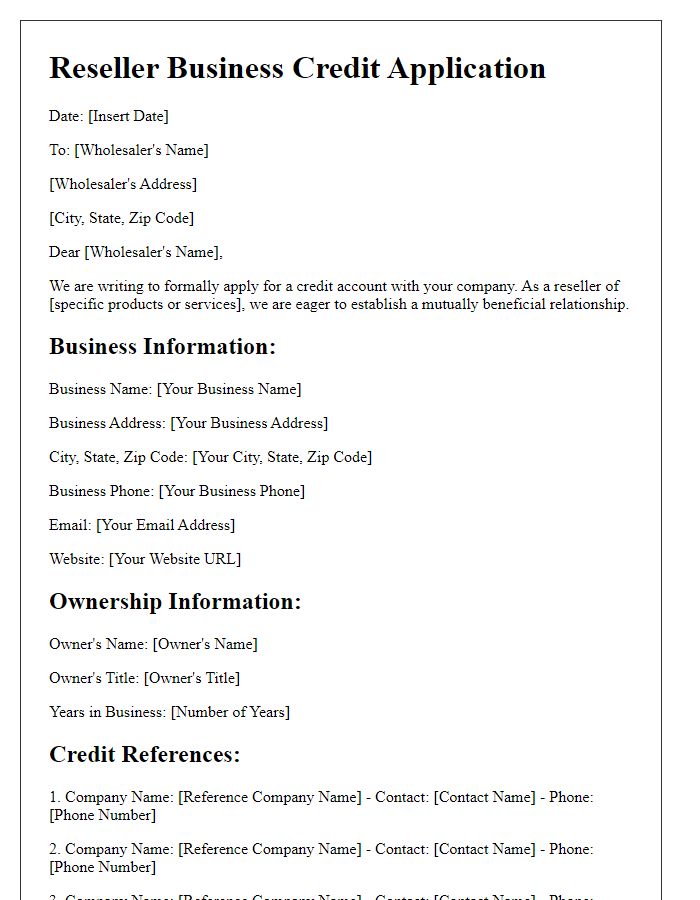

Letter template of reseller business credit application for wholesalers.

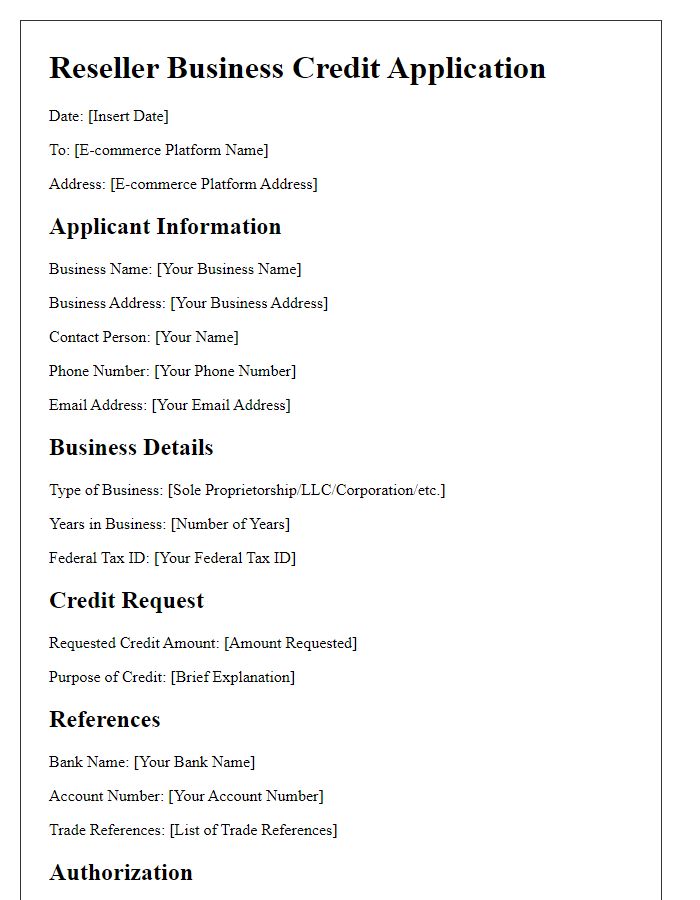

Letter template of reseller business credit application for e-commerce platforms.

Letter template of reseller business credit application for specialty stores.

Letter template of reseller business credit application for service-based businesses.

Comments