Navigating tax audits can feel overwhelming, but it doesn't have to be! Whether you're facing an audit for the first time or you're a seasoned veteran, understanding how to prepare for your appointment can make a world of difference. In this article, we'll walk you through a simple and effective letter template to request your tax audit appointment, making the process smoother and less stressful. So, let's dive in and get you on the right trackâread on to discover all the helpful details!

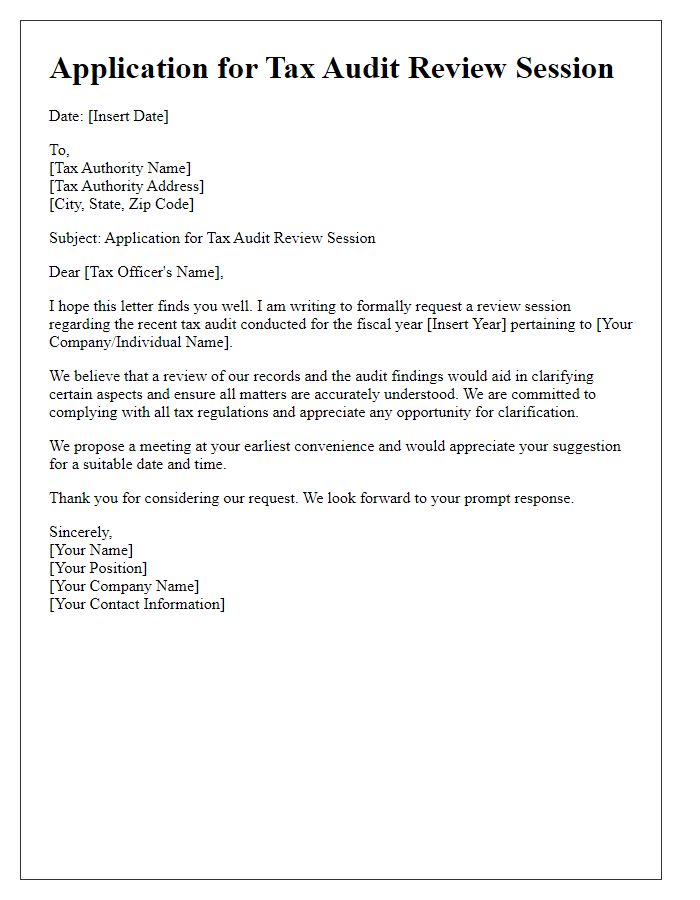

Clear subject line

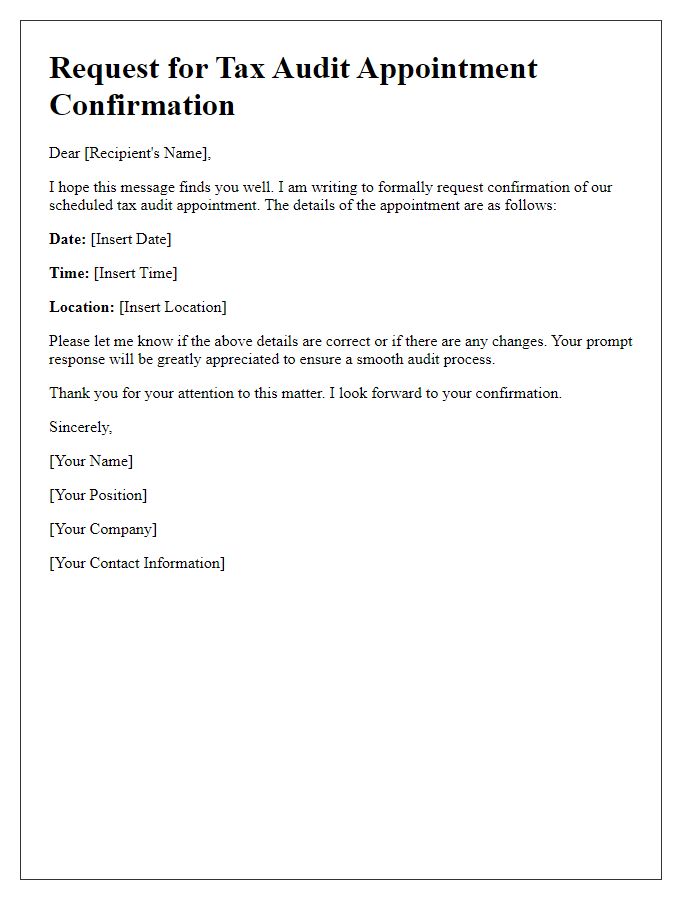

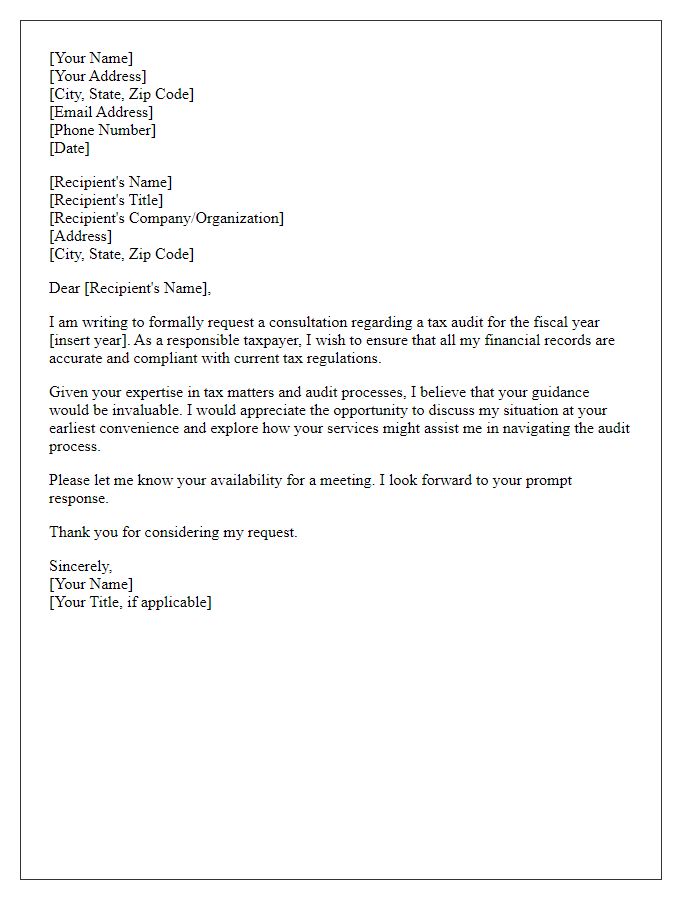

Tax audit appointment requests should clearly state the purpose and desired action. A subject line such as "Request for Tax Audit Appointment" provides immediate clarity. Detailed information regarding the tax year in question, taxpayer identification number, and preferred dates/times for the appointment can enhance communication. Including specific contact information, such as a phone number and email address, facilitates prompt responses. Maintaining a polite and professional tone throughout the request emphasizes the importance of the appointment.

Formal salutation

High levels of air pollution can lead to significant health issues in urban areas, particularly in cities like Los Angeles and Beijing. Particulate matter (PM2.5) concentrations, often exceeding 35 micrograms per cubic meter, are linked to respiratory diseases and heart problems. Vulnerable populations, including children and the elderly, face increased risks due to long-term exposure. Strict regulations on emissions, such as the Clean Air Act in the United States, aim to mitigate these dangerous pollutants, but challenges remain in enforcement and compliance. Regular air quality monitoring in these densely populated regions is crucial for public health initiatives.

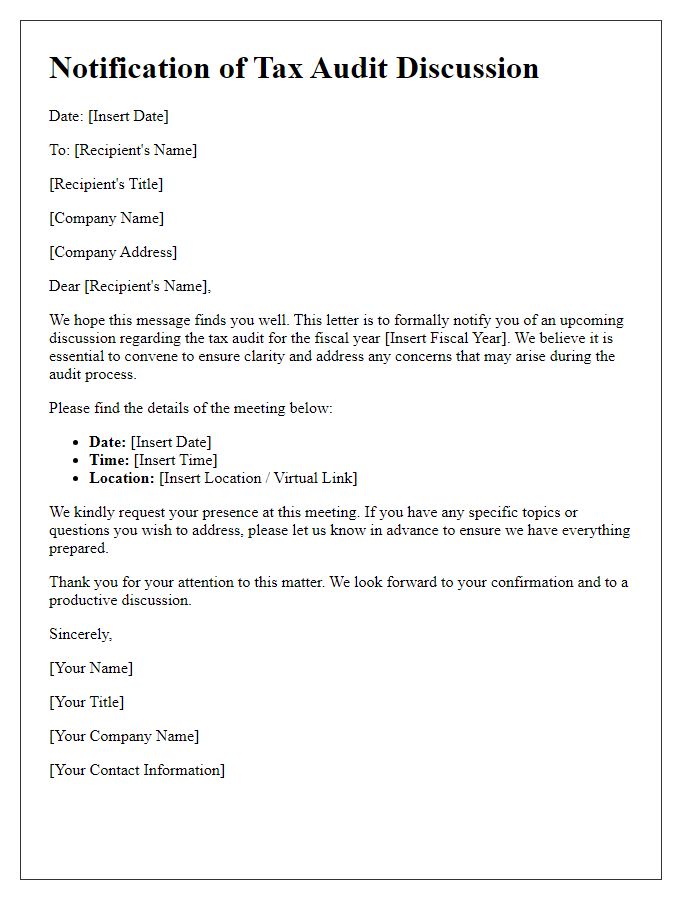

Purpose of visit

Tax audits, conducted by the Internal Revenue Service (IRS), require meticulous attention to detail and adherence to regulations. The purpose of the visit pertains to verification of tax return accuracy for the fiscal year 2022, encompassing income, deductions, and credits reported. The meeting will take place at the local IRS office located at 123 Federal Way, Washington, D.C., known for overseeing regional tax compliance. Key individuals, including the designated tax advisor and the auditor, will be present to clarify discrepancies and provide necessary documentation. Emphasis will be placed on ensuring full transparency and compliance with IRS guidelines to facilitate the audit process.

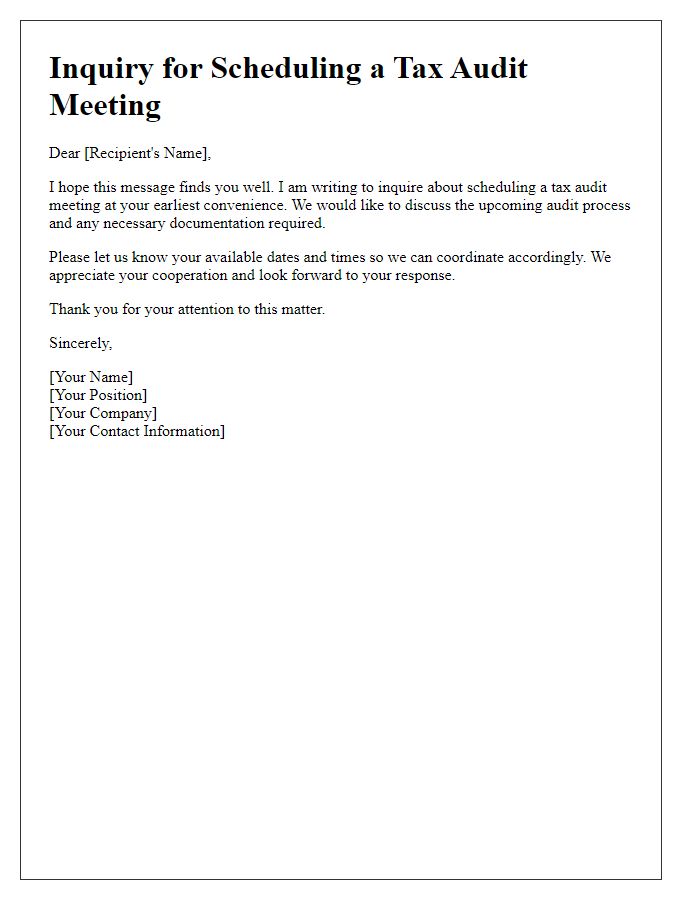

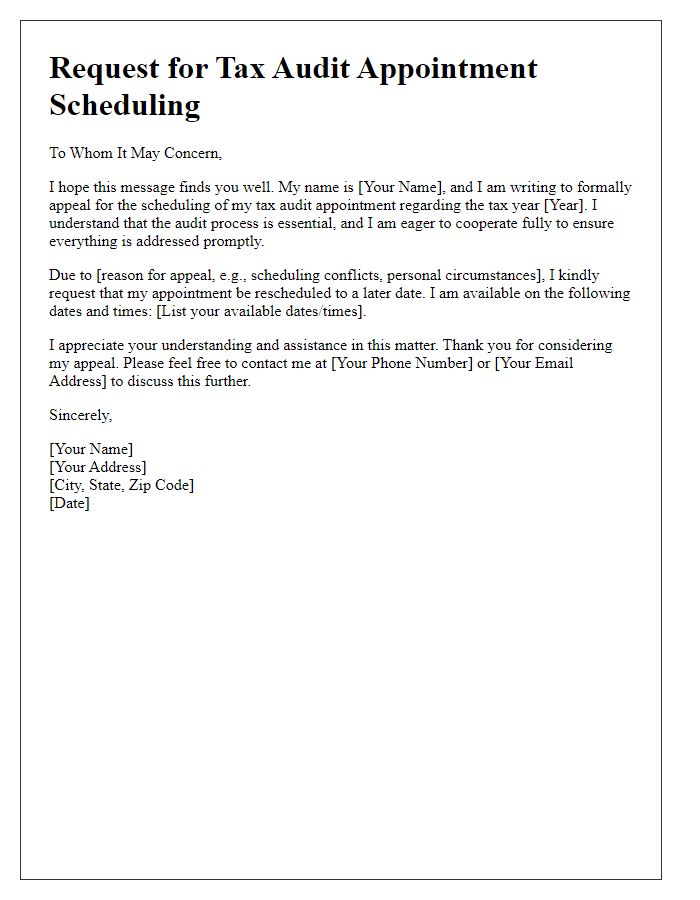

Preferred date and time

A tax audit appointment request should include specific details regarding the preferred date and time for the meeting. Tax professionals recommend specifying a timeframe for the appointment, ideally within the next two weeks to facilitate timely coordination. For example, targeting mid-October 2023, between 10:00 AM and 3:00 PM on weekdays, is advisable for optimal scheduling. Additionally, contacting the appropriate tax authority office, such as the IRS or a local tax agency, ensures compliance with regulations. Clear communication of essential information (such as taxpayer identification numbers, contact details) aids in efficient processing and confirmation of the audit appointment.

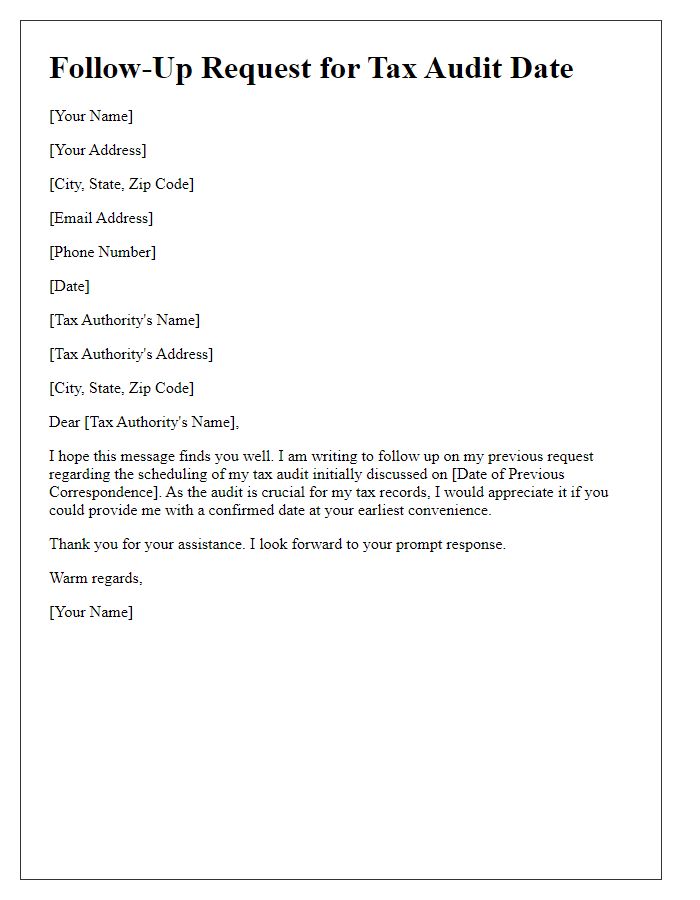

Contact information

Setting up an appointment for a tax audit involves important details. Taxpayers should provide their contact information, including full name, current address (street, city, state, ZIP code) to ensure accurate identification during the audit process. Phone numbers (both mobile and home) facilitate direct communication and scheduling. An email address can expedite correspondence and required documentation delivery. Additionally, including a preferred method of contact for prompt responses enhances clarity and efficiency in setting the appointment with tax authorities or auditors. Proper organization and complete details can lead to a smoother audit experience.

Comments