Are you considering applying for a bank loan but unsure how to start? Crafting the perfect letter can make all the difference in presenting your case to your potential lender. A well-structured application not only outlines your request but also conveys your understanding of the loan terms and your ability to repay. If you're ready to dive deeper into this essential process and learn how to create a compelling loan application letter, read more!

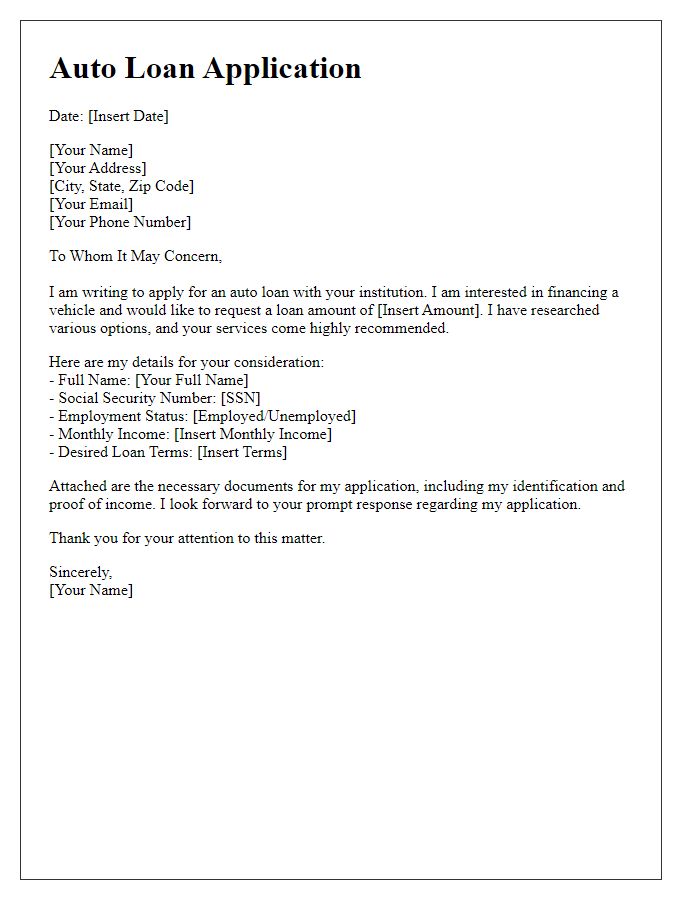

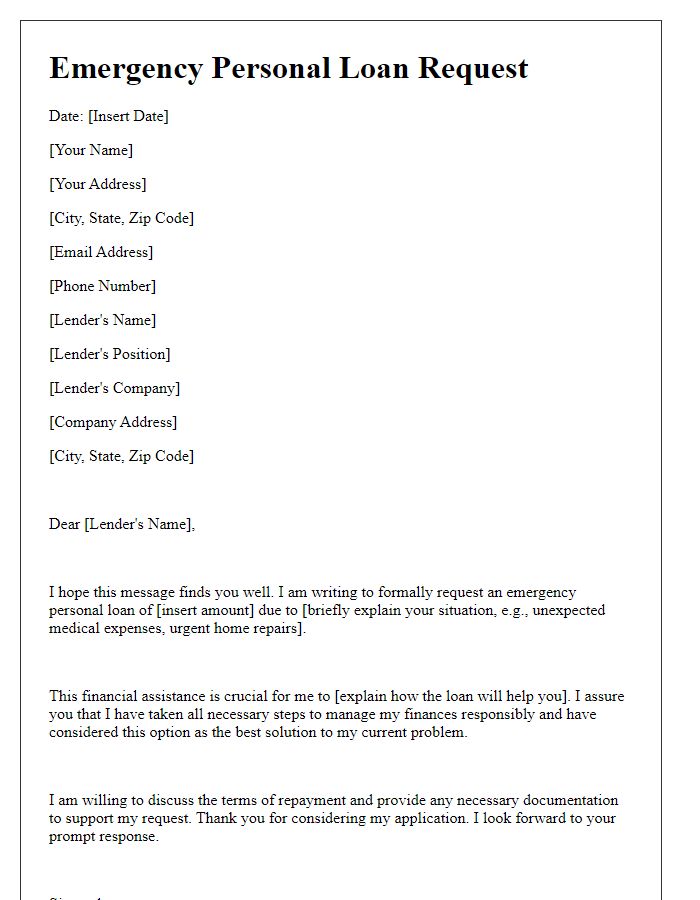

Personal Information

A bank loan application requires personal information to assess eligibility and risk. Key details typically include full name (individual's legal identity), residential address (including zip code for geographic accuracy), contact number (for direct communication), email address (for electronic correspondence), date of birth (to verify age requirements), and Social Security Number (to confirm identity and credit history). Additionally, information on employment status (including job title and employer's name), annual income (salary details to evaluate repayment capacity), and financial obligations (current debts, loans, and monthly expenses) are crucial for the bank's analysis. This comprehensive data helps in determining the applicant's creditworthiness and potential loan terms.

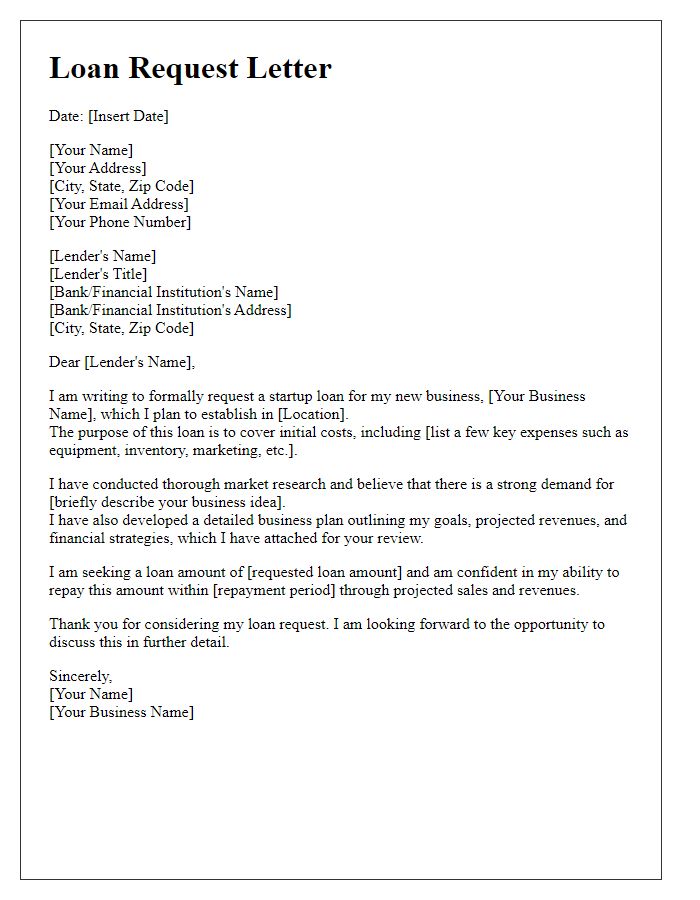

Loan Details

A bank loan application requires specific details to ensure a smooth approval process. Loan amount typically ranges from $5,000 to $500,000 or more, depending on the borrower's needs and financial status. Interest rates may vary, often between 3% to 12%, impacted by factors like credit score and loan term. Loan term refers to the repayment duration, commonly set between 1 to 30 years. Additionally, collateral may be necessary for secured loans, which could include assets like property or vehicles. Personal information, including employment history, annual income (often starting around $30,000), and existing debt obligations, are crucial for assessing eligibility and risk.

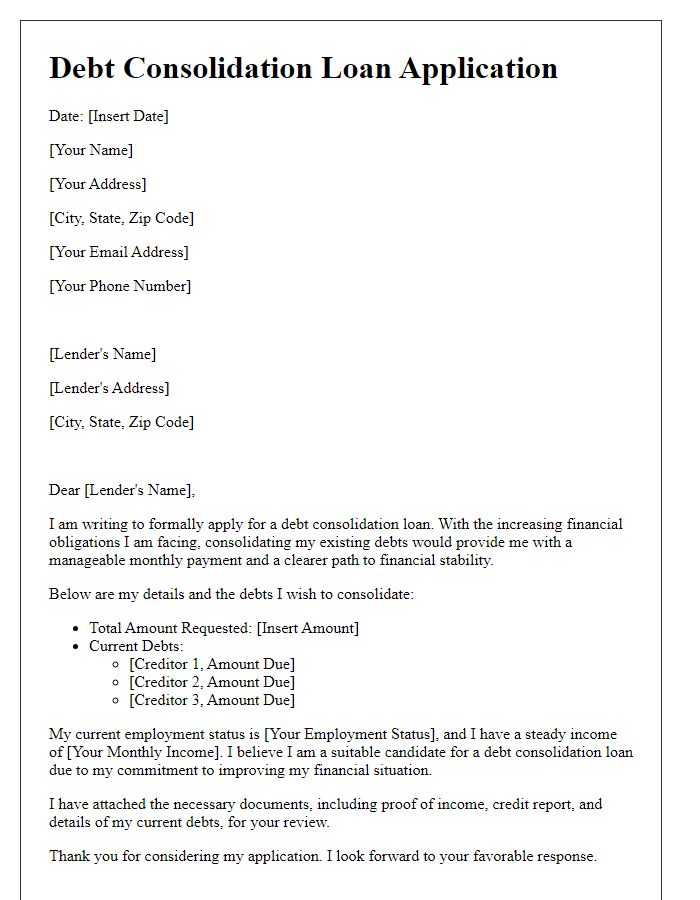

Financial Background

A bank loan application typically requires a detailed financial background to assess creditworthiness. Applicants should include specific income sources, such as salaries from full-time jobs or income from side businesses, detailing the average monthly income. Additionally, assets like savings accounts, real estate, and investments should be outlined, quantifying their current market value, especially for properties in high-demand locations like New York or San Francisco. A comprehensive overview of existing liabilities, including mortgages, credit card debts, and personal loans, is essential to demonstrate financial obligations, pinpointing the total debt-to-income ratio. Furthermore, providing information on financial behaviors, such as history of timely payments, along with any previous bankruptcies or defaults, can influence lending decisions significantly.

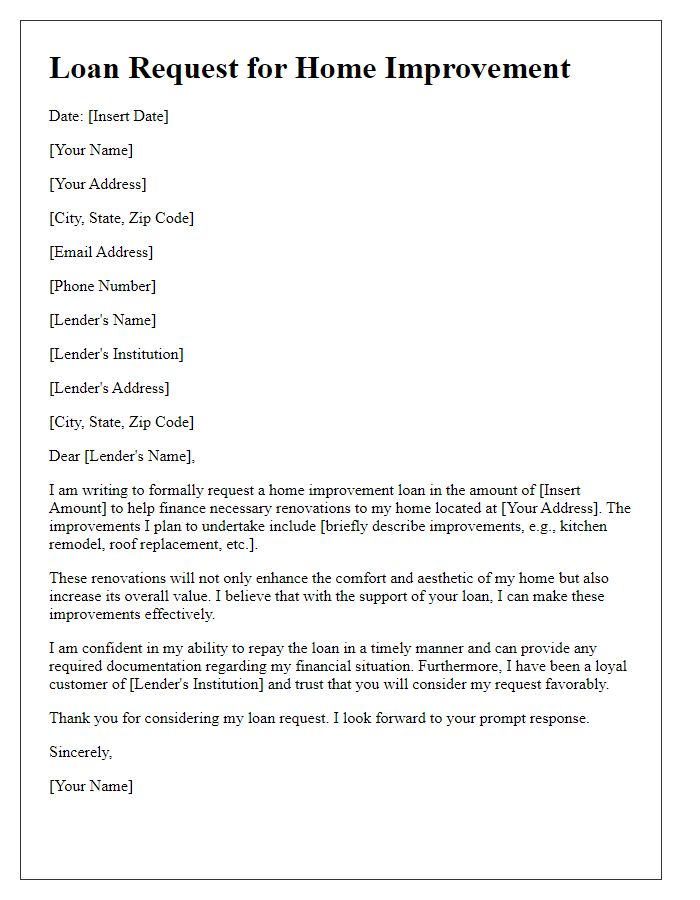

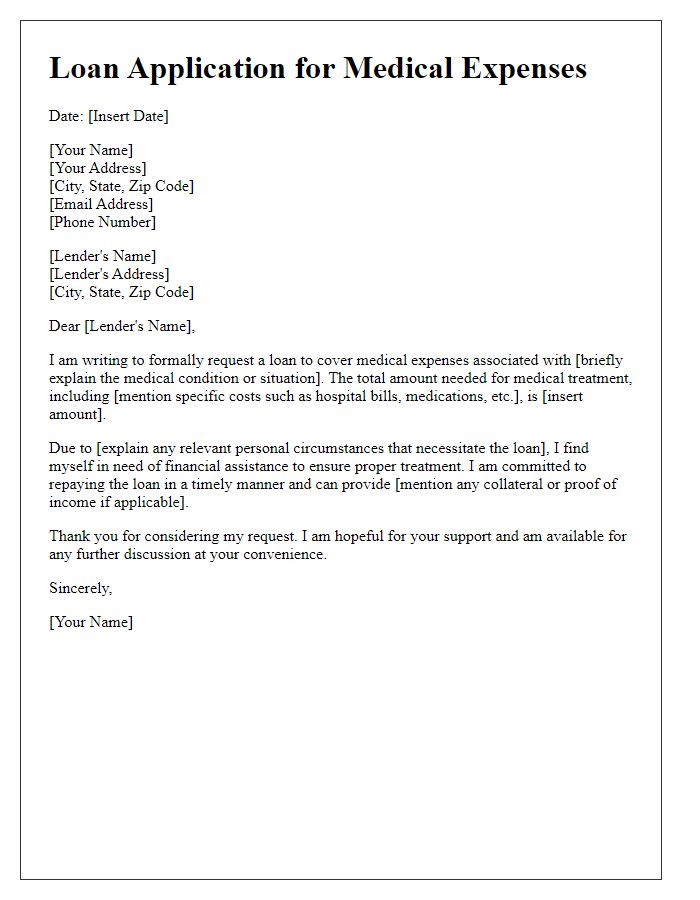

Purpose of Loan

Banks often require a detailed explanation of the purpose of a loan, ensuring applicants clearly outline their intentions. Common purposes include home renovations, which may increase property value, education expenses for tuition fees at institutions like Harvard University or Stanford University, and business expansion requiring funds for equipment or inventory. Other reasons may involve medical emergencies, covering unexpected health care expenses, or debt consolidation aimed at lowering interest rates on existing debts. Providing a precise and thorough explanation can improve the chances of loan approval, highlighting both short-term needs and long-term financial goals.

Contact Information

Contact information for a bank loan application includes essential details that streamline the communication process. Applicants should provide their full name, ensuring accuracy with no abbreviations. The address should include the street number, street name, city, state, and zip code, giving a complete location for verification purposes. A primary phone number is crucial, typically including the area code, for direct and efficient contact regarding the loan. An email address is also important for formal correspondence, ideally using a professional domain. Including employment information such as the employer's name, position, and work address can provide the bank with a more comprehensive profile of the applicant's financial stability and reliability.

Comments