Are you feeling the pressure of an upcoming payment deadline? It's completely normal to encounter unexpected challenges that could hinder your ability to meet financial obligations on time. In this article, we'll walk you through a well-crafted letter template that you can use to request an extension for your payment deadline. Stay tuned to learn how to effectively communicate your situation and increase your chances of getting that extension!

Clear and respectful tone

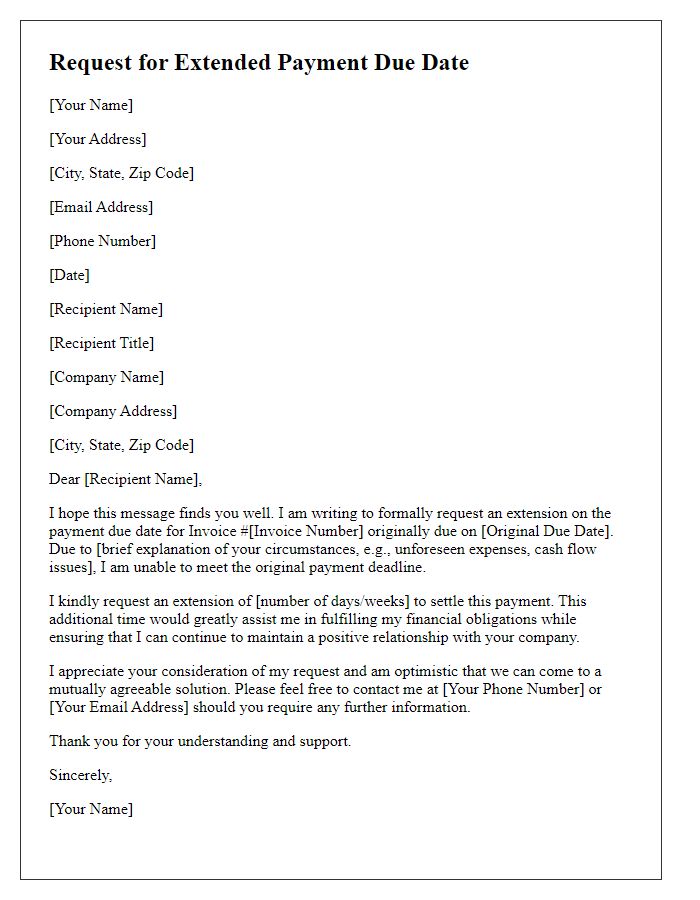

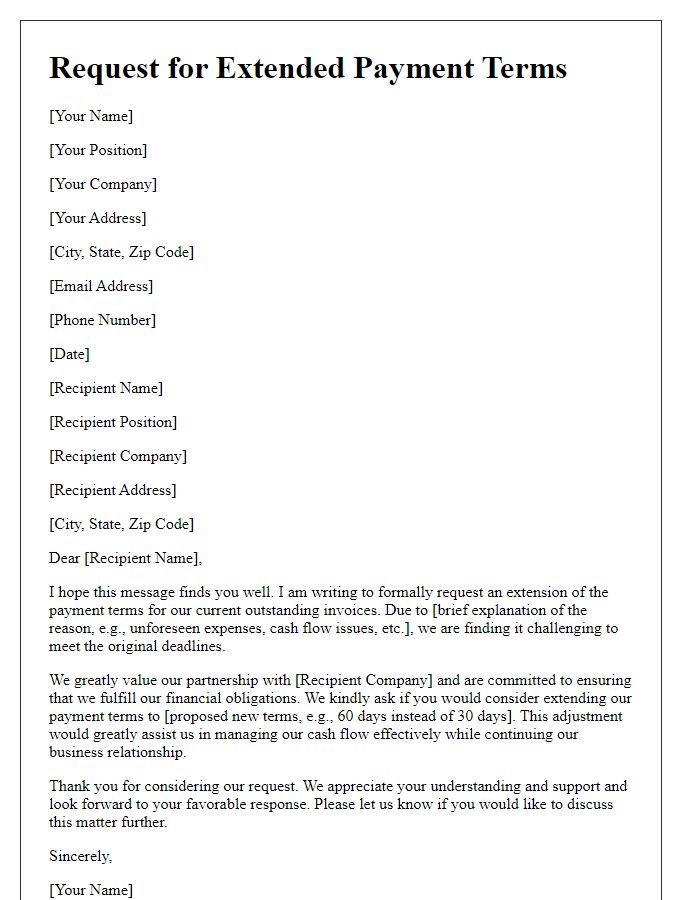

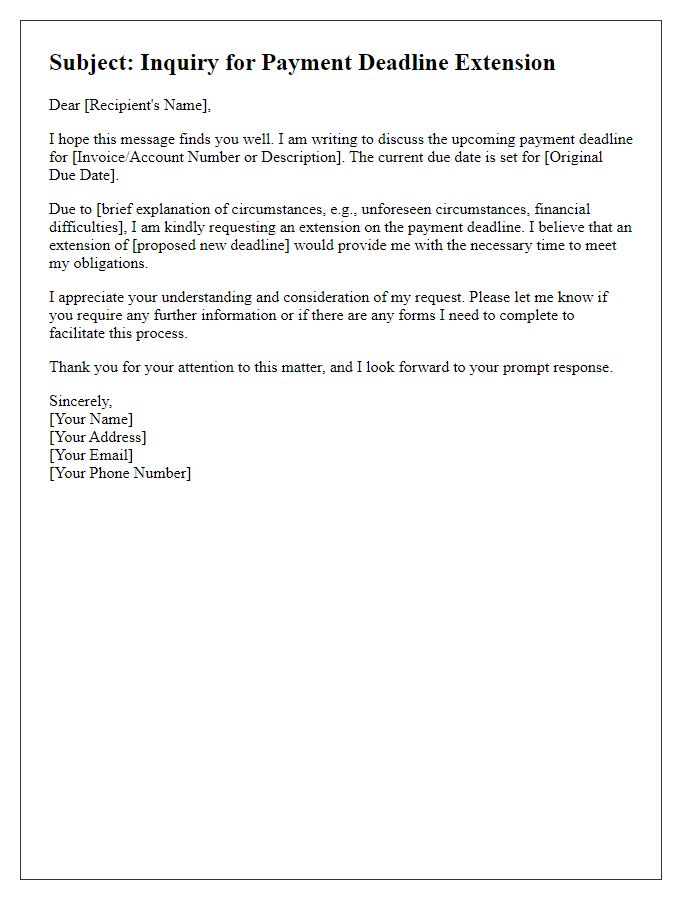

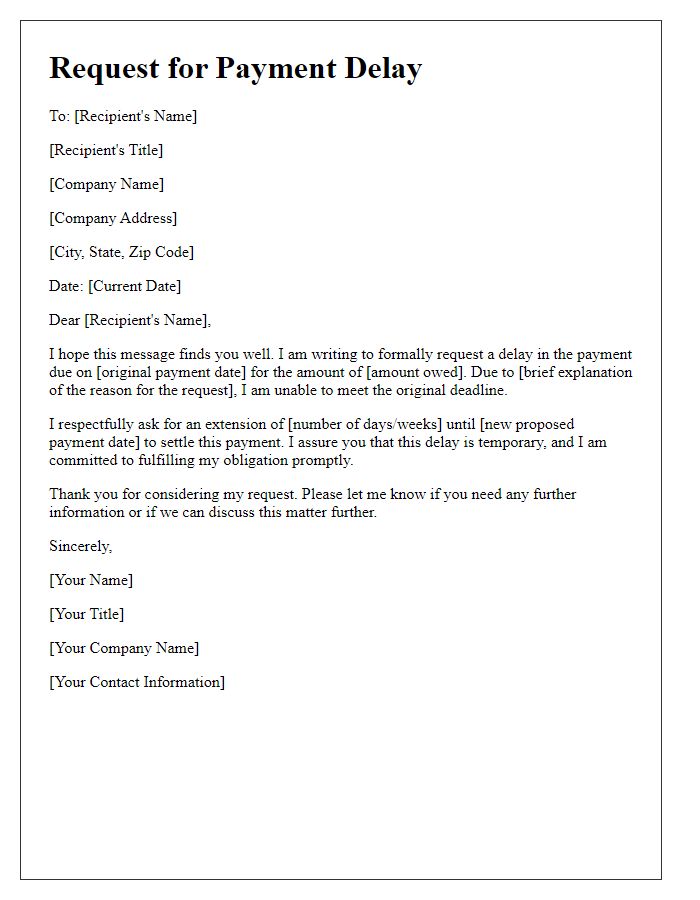

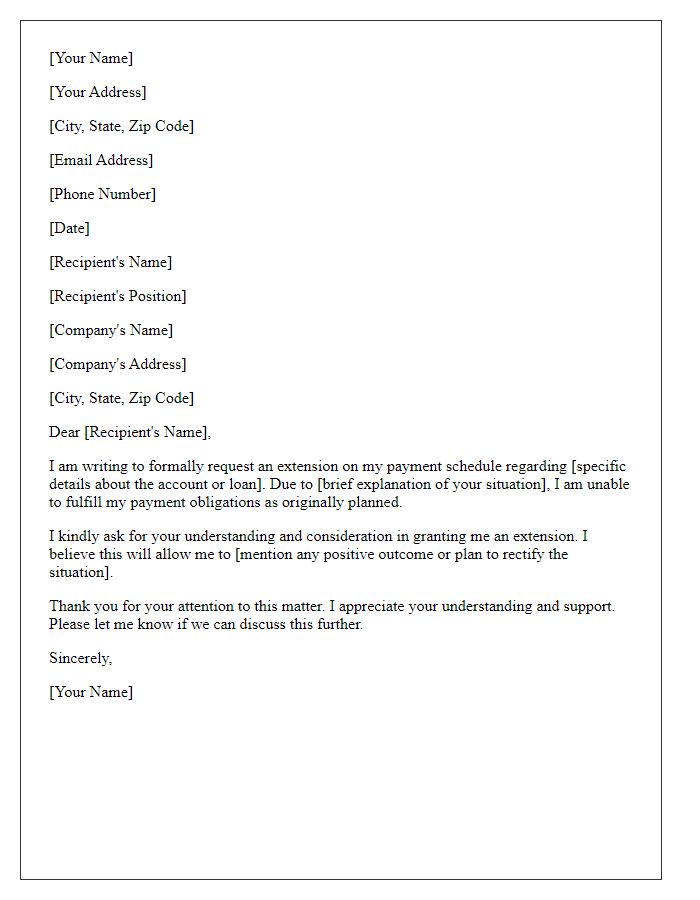

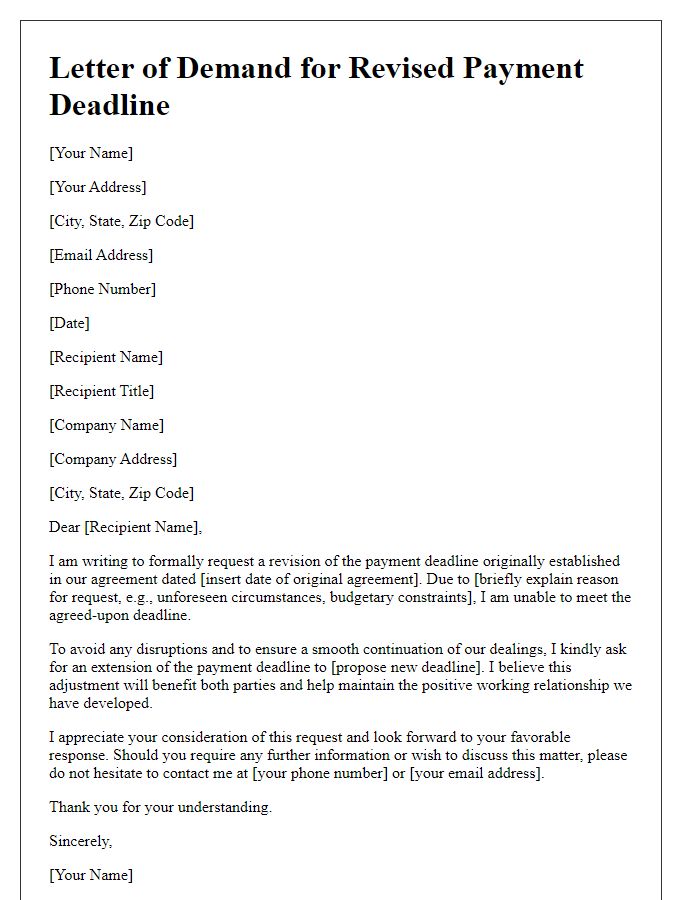

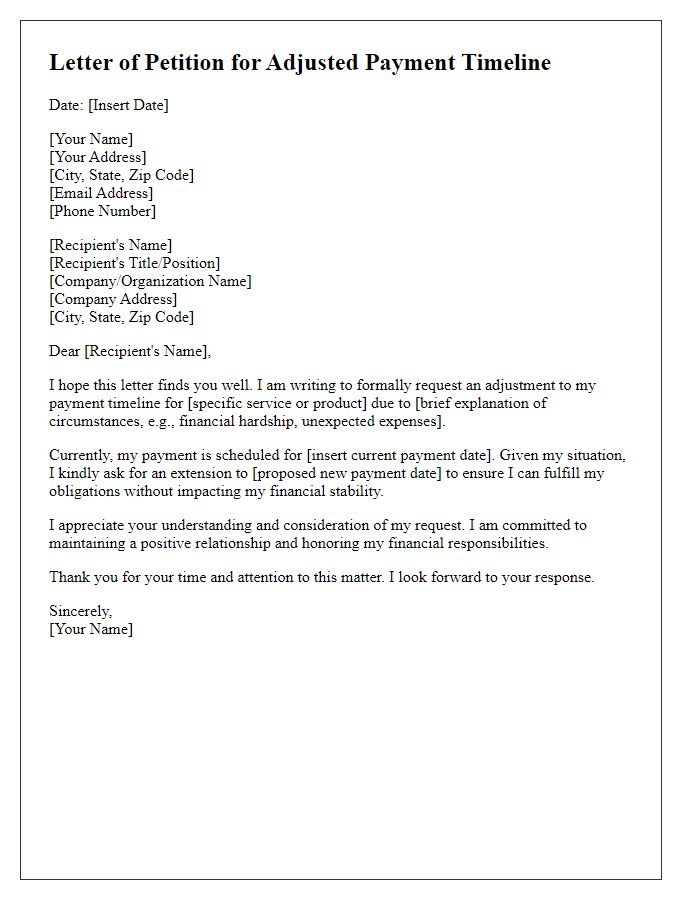

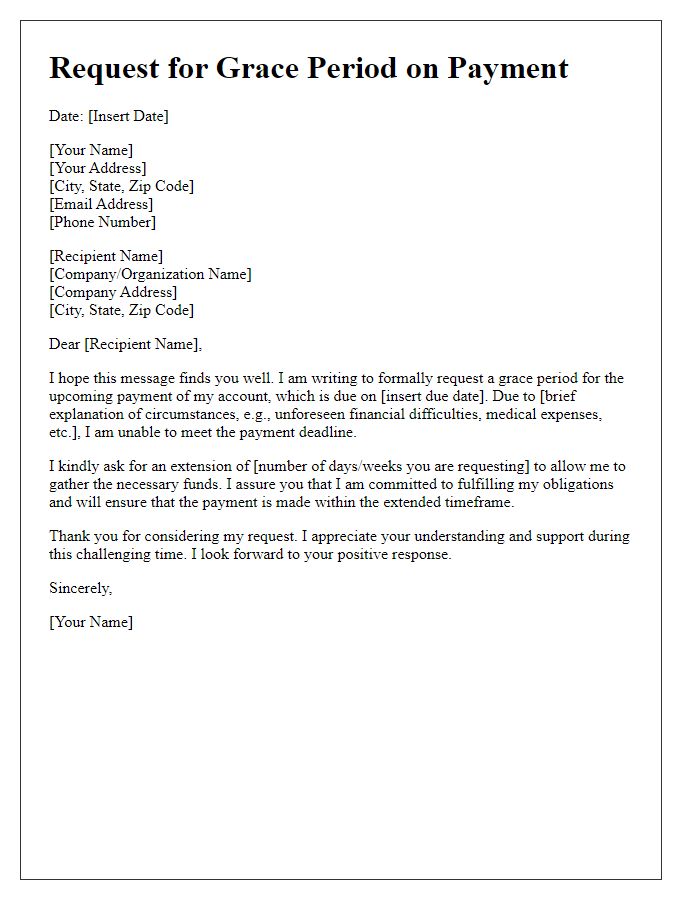

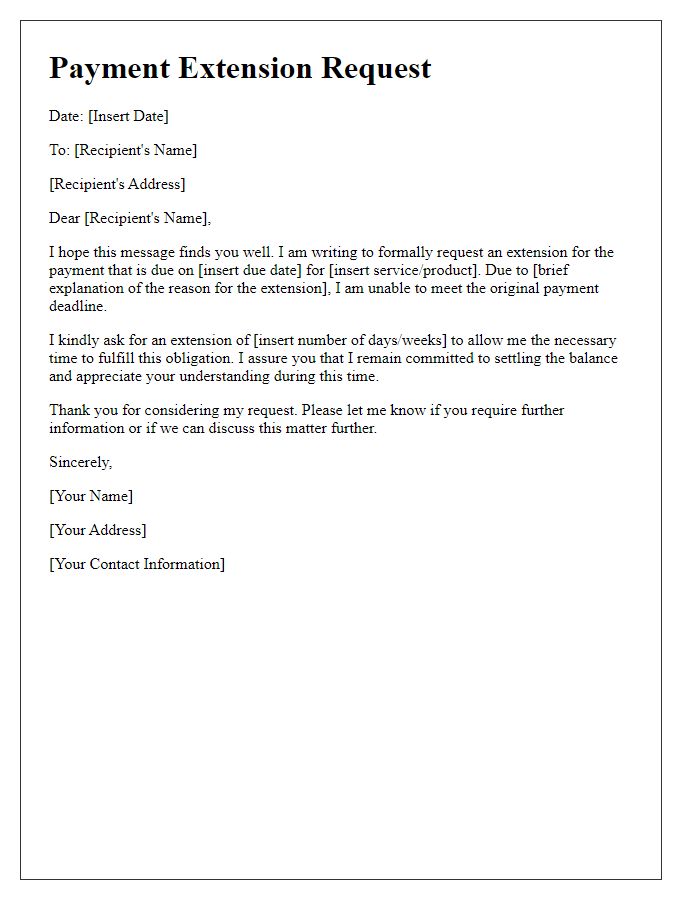

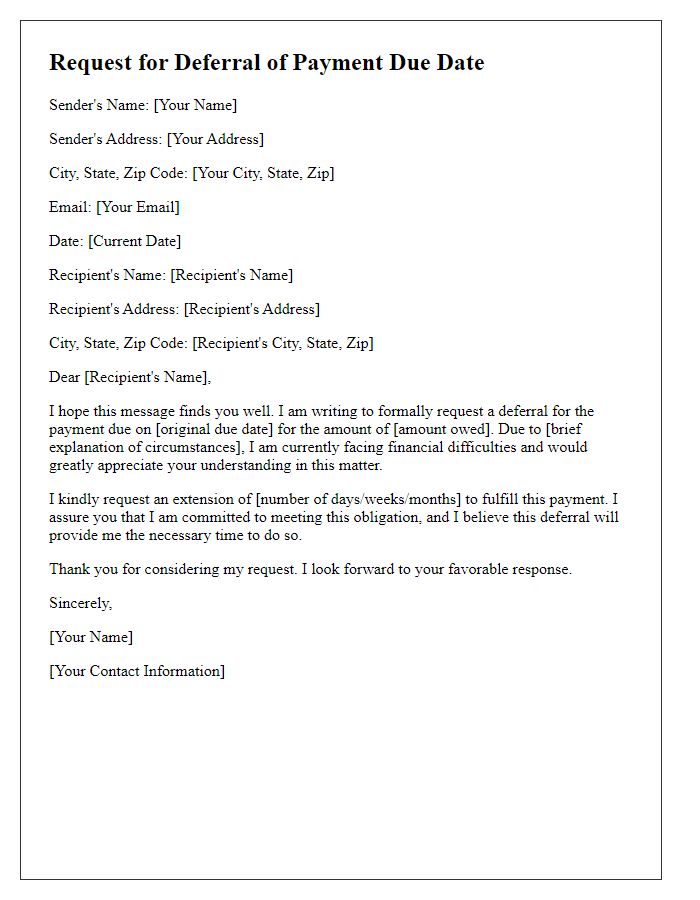

A request for a payment deadline extension due to unforeseen circumstances can benefit from clarity and respectfulness. When crafting this communication, consider detailing your specific situation, such as unexpected expenses or delays in income. Make sure to state the desired new deadline, whether it's an additional week or a month. Express gratitude for their understanding and willingness to accommodate your request. Reiterate your commitment to fulfilling your financial obligation and maintaining a positive relationship. This approach creates an atmosphere of cooperation and fosters goodwill.

Specific reason for extension

Small businesses often face financial challenges, such as unexpected expenses or cash flow issues, leading to the need for a payment deadline extension. A common scenario involves a freelance graphic designer, whose client has experienced delays in project completion. The designer may request an extension of 30 days to submit an invoice, allowing time for the client to secure the necessary funds. By providing context around the project's importance and the designer's intention to maintain a positive professional relationship, the request remains reasonable and considerate. Such adjustments can prevent further complications and foster trust between the parties involved.

Proposed new deadline

A request for an extension on a payment deadline is often necessary in financial negotiations. Businesses, such as small enterprises or large corporations, occasionally encounter unforeseen circumstances that impede timely payments. For instance, a proposed new deadline requiring an additional 30 days (from a duly agreed upon date) can facilitate smooth cash flow management amid challenges such as economic fluctuations or unexpected expenses. This extension allows the concerned party to address any potential financial shortfalls while maintaining a good business relationship, ensuring that obligations are met without incurring penalties or disrupting service agreements.

Assurance of payment

Businesses often face unexpected cash flow issues, which can necessitate requesting an extension on payment deadlines. A well-formulated request can help maintain positive relationships with suppliers or creditors. Providing specific details about the situation, such as the invoice number, original payment due date, and reasons for the delay, can strengthen the request. It is beneficial to assure the party of commitment to settle the outstanding amount promptly, possibly offering a revised payment timeline, which can solidify trust. Including a personal touch by expressing appreciation for their understanding can also enhance the likelihood of a favorable response.

Contact information

A payment deadline extension request typically involves specific elements. The first crucial element is the contact information which includes the name of the individual or business making the request, such as John Smith or ABC Enterprises. The next aspect is the recipient's details, including their name, company name, and address, like Jane Doe, Acme Corp., 123 Main St, City, State, Zip Code. The subject line should clearly indicate the purpose, for example, "Request for Payment Deadline Extension." Within the main body, it's important to specify the original payment due date and the reasons for the request for an extension, such as unforeseen circumstances or cash flow issues. Finally, a proposed new deadline is also necessary to facilitate a response.

Comments