Are you navigating the world of rental applications and find yourself needing to explain your credit history? You're not aloneâmany applicants face similar challenges and want to present their circumstances in the best light possible. Crafting a thoughtful letter can make a significant difference in how landlords perceive your application, helping to clarify any misunderstandings regarding your credit status. Dive in to discover effective strategies to write a compelling credit explanation letter that will boost your chances of securing your next rental!

Clear Introduction

A rental application credit explanation should provide clarity regarding financial history. Many landlords consider credit scores, which often reflect payment behavior and financial responsibility. A person with a lower credit score due to previous financial hardships, such as medical debts incurred in 2020 or a temporary job loss, may wish to explain these circumstances. Highlighting a stable income from employment at a reputable company, such as a local hospital or government agency, as well as consistent payment of recent rent and bills adds credibility. Emphasizing commitment to timely payments and a desire for open communication reassures landlords of reliability as a potential tenant.

Reason for Credit Issues

Credit issues arise from various factors affecting an individual's financial history and credit score. Common reasons include medical emergencies, job loss leading to missed payments, or high credit utilization rates. For instance, a significant medical bill might result in delayed payments, impacting overall creditworthiness. In addition, unexpected layoffs, particularly in high-stakes industries like technology or manufacturing, can lead to prolonged periods of unemployment, further straining financial stability. Another factor involves excessive reliance on credit cards that exceed 30% utilization, which is a critical threshold for lenders. Rebuilding credit typically requires time, consistent payments, and a strategic approach to managing existing debt while avoiding new credit inquiries that can further impact scores negatively.

Steps Taken to Improve Credit

Improving credit scores involves several strategic steps aimed at enhancing financial health. Regularly checking credit reports from agencies like Experian, Equifax, and TransUnion allows individuals to identify inaccuracies, which can negatively impact credit scores. Paying down high credit card balances reduces credit utilization ratios; ideally keeping them below 30% of total credit limits. Timely payments on existing debts, including personal loans and mortgages, contribute positively to payment history, which accounts for 35% of the credit score calculation. Establishing a mixed credit portfolio, with a healthy balance of revolving and installment lines of credit, demonstrates creditworthiness. Additionally, seeking credit counseling services can provide professional guidance tailored to individual circumstances, ensuring continuous improvement in credit standing over time.

Relevant Supporting Documents

When submitting a rental application, providing relevant supporting documents enhances credibility and transparency. Clean credit history reports reveal payment patterns while bank statements (most recent two months) showcase financial stability. Pay stubs from current employment (last two to three) demonstrate consistent income levels. Tax returns from previous year reflect overall financial health and any additional income sources. Reference letters from previous landlords assist in showcasing responsible tenancy. Identification documents, such as a driver's license or passport, verify identity and assist in background checks. A comprehensive collection of these documents strengthens the application and builds trust with potential landlords.

Contact Information for Follow-up

Potential tenants may need to provide detailed contact information for follow-up inquiries regarding their rental application. Essential details may include phone numbers, preferably a primary number (such as a mobile number) allowing for immediate communication and a secondary number for alternative access. Email addresses must be current and actively monitored to facilitate prompt responses from property managers. Additionally, including a mailing address is beneficial for formal communications related to the application process. Timely follow-up could enhance the likelihood of rental approval, especially in competitive real estate markets such as New York City or Los Angeles.

Letter Template For Rental Application Credit Explanation Samples

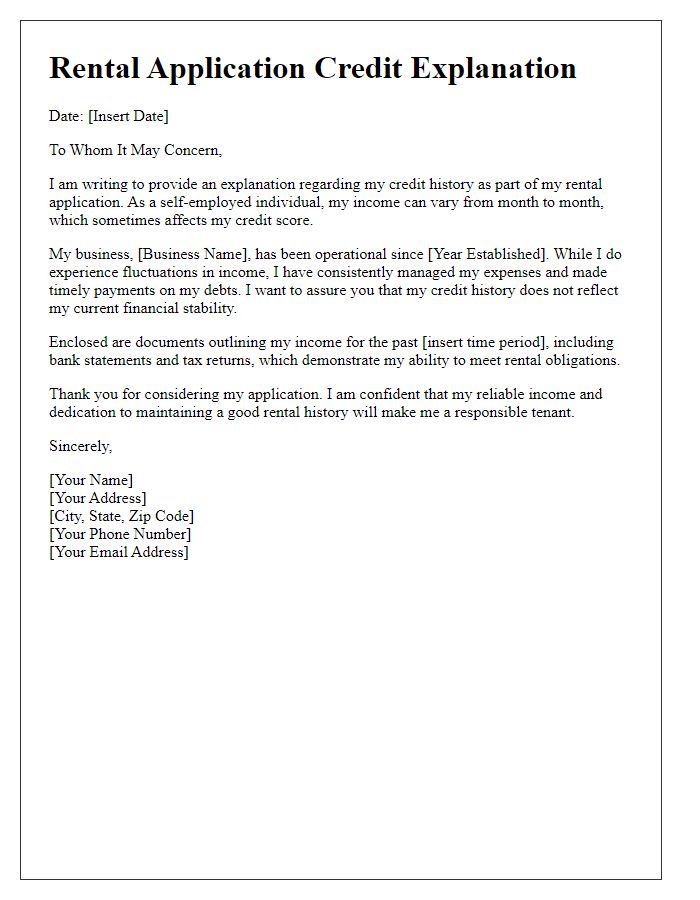

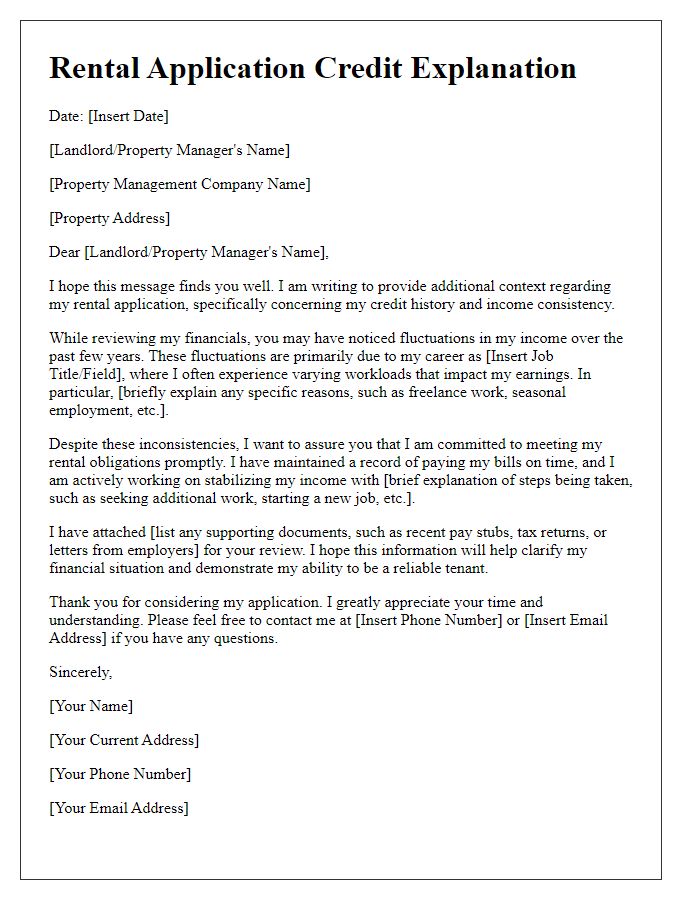

Letter template of rental application credit explanation for self-employed individuals.

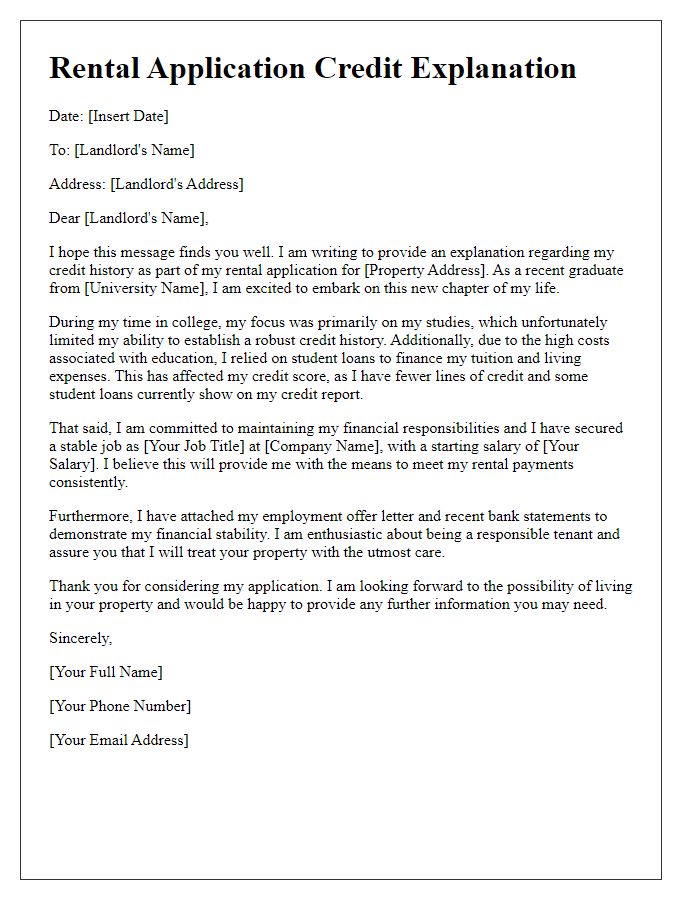

Letter template of rental application credit explanation for recent graduates.

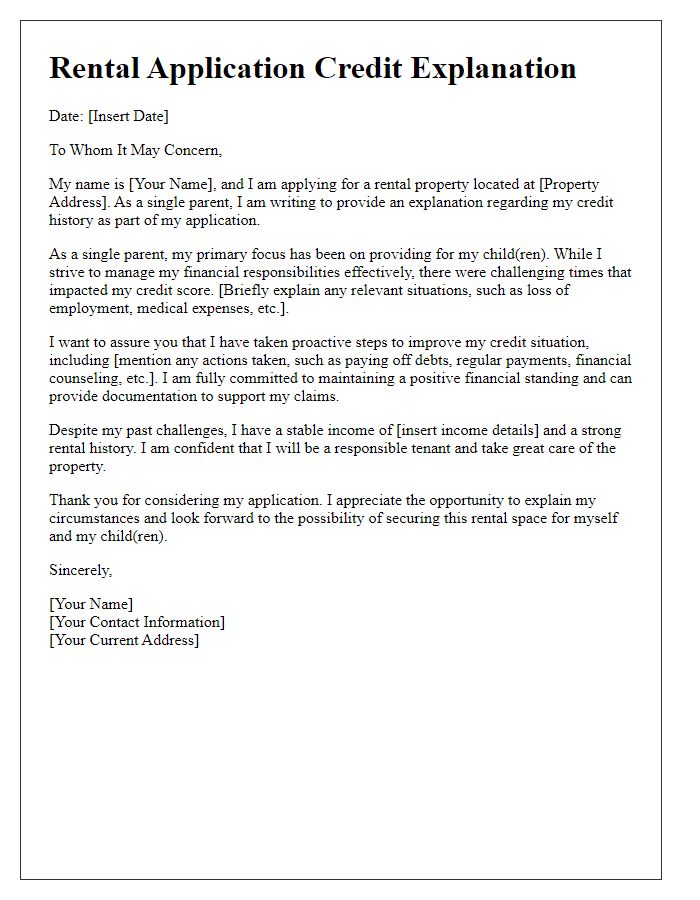

Letter template of rental application credit explanation for single parents.

Letter template of rental application credit explanation for individuals recovering from bankruptcy.

Letter template of rental application credit explanation for first-time renters.

Letter template of rental application credit explanation for students with limited credit history.

Letter template of rental application credit explanation for those with medical debt.

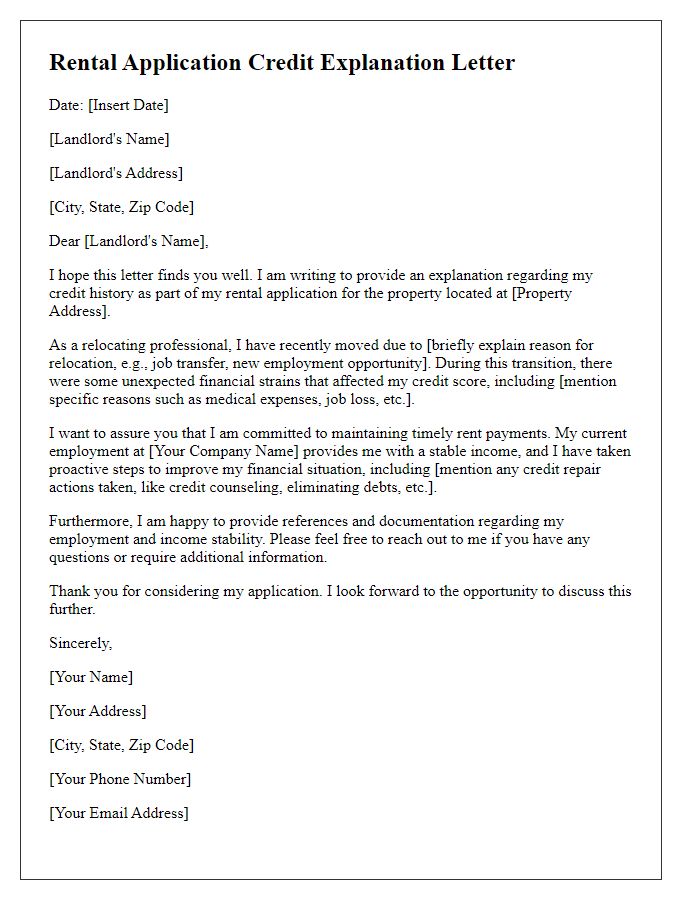

Letter template of rental application credit explanation for relocating professionals.

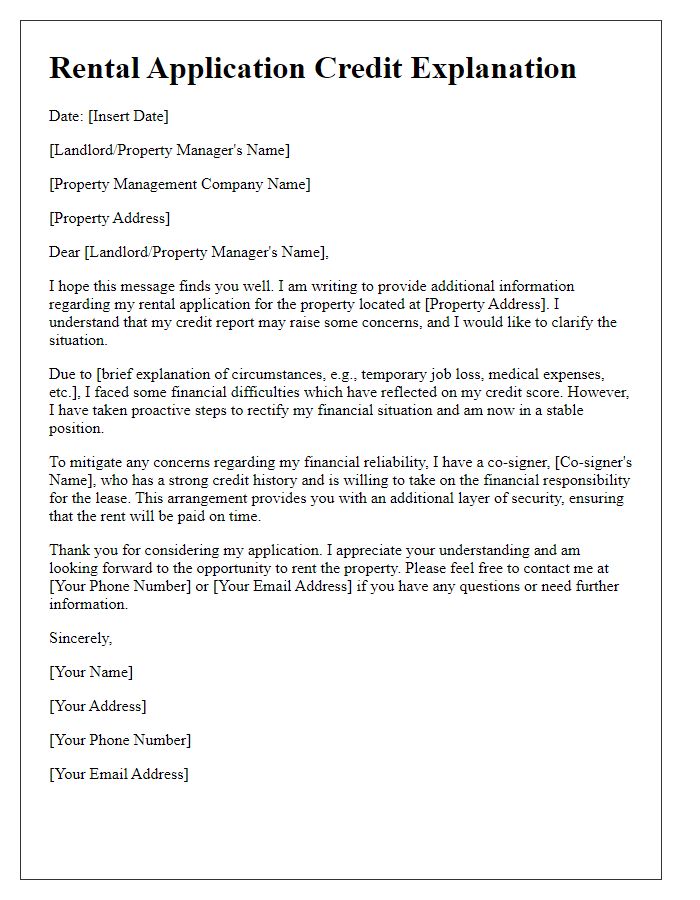

Letter template of rental application credit explanation for individuals with a co-signer.

Comments