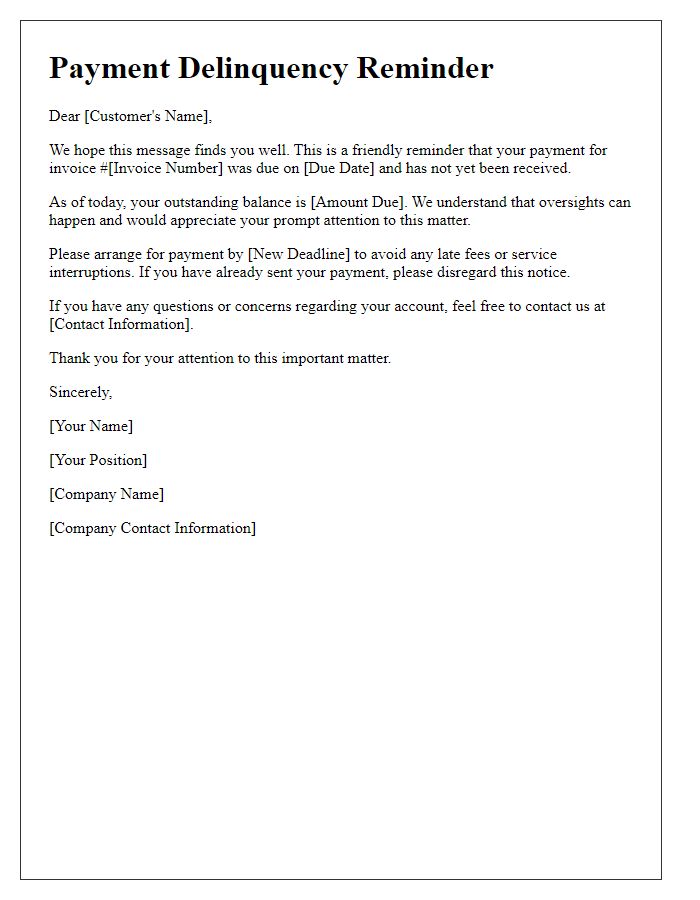

Have you ever found yourself in a situation where you need to gently remind someone about an unpaid balance? It can be a tricky conversation to navigate, but a well-crafted letter can make all the difference. In this article, we'll explore effective templates you can use to address unpaid balances while maintaining a professional tone. So, let's dive in and discover the best ways to communicate this important message!

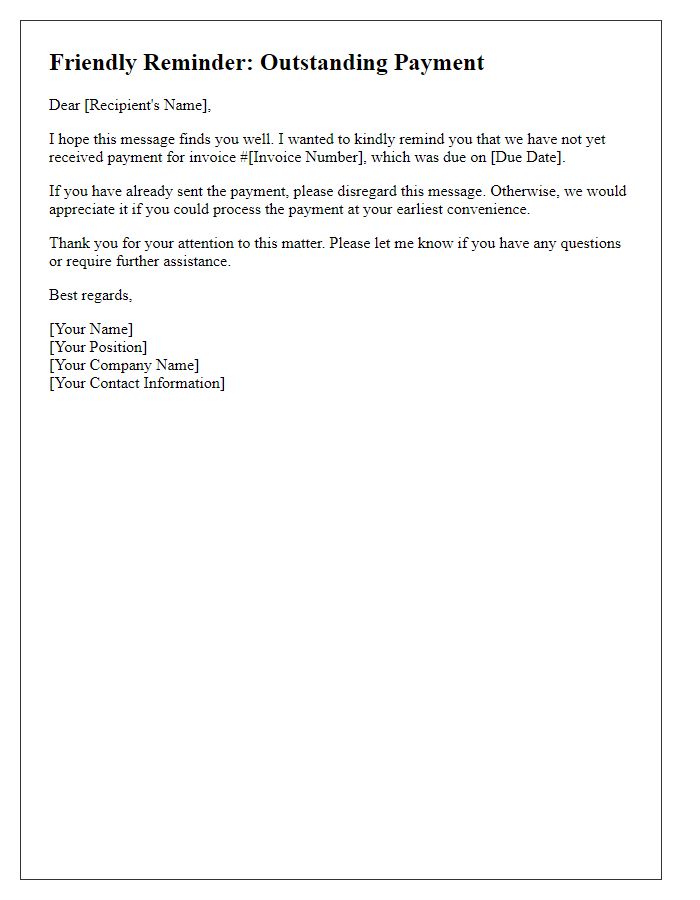

Polite and professional tone.

Unpaid balance reminders can play a crucial role in maintaining cash flow for businesses. Consistent follow-ups via email or letter can help remind clients of their outstanding balances, ensuring they remain aware of their financial obligations. Including specific details like invoice numbers, due dates, and amounts owed can enhance clarity and urgency. A gentle yet firm approach is effective to encourage timely payments while preserving professional relationships. Additionally, providing contact information for inquiries can facilitate communication and resolution of any potential disputes.

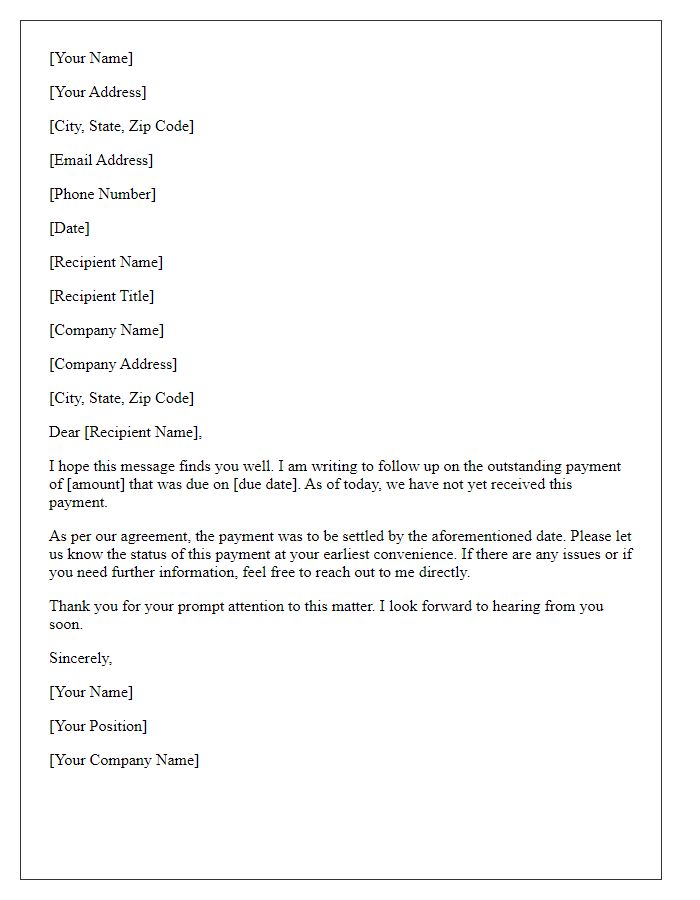

Clear mention of outstanding amount.

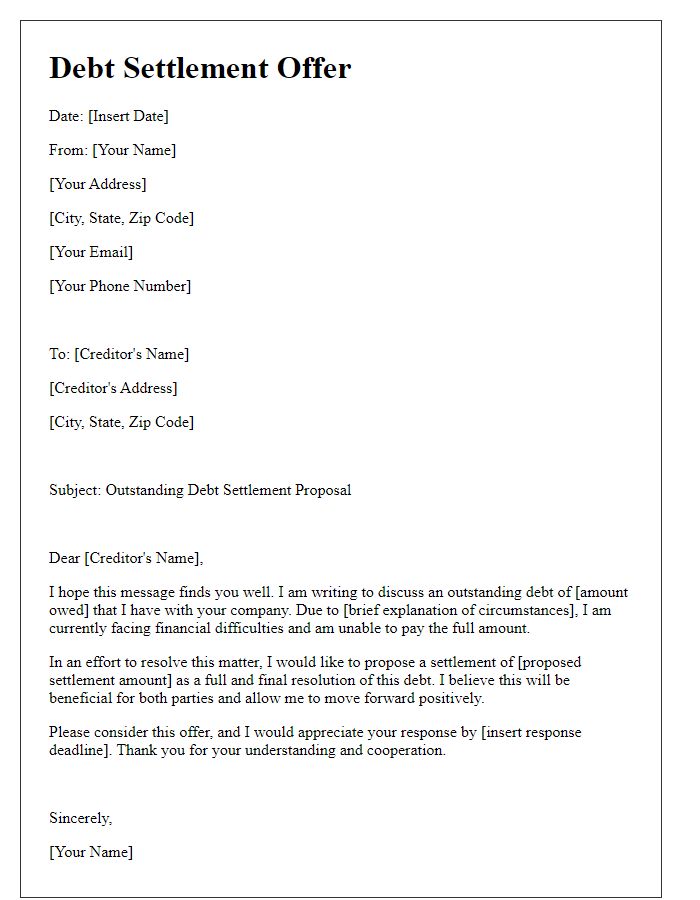

Unpaid balances can significantly impact financial stability, especially for individuals or businesses. A typical outstanding amount might range from $100 - $10,000 depending on the service or product acquired. When a payment is overdue by 30 days or more, implications include late fees or potential interest charges, which can amplify the financial burden. Furthermore, businesses, such as local service providers, may initiate collection activities, which could affect credit ratings and future borrowing capacity. Regular reminders serve as crucial communication tools to prompt timely settlements and maintain healthy financial relationships.

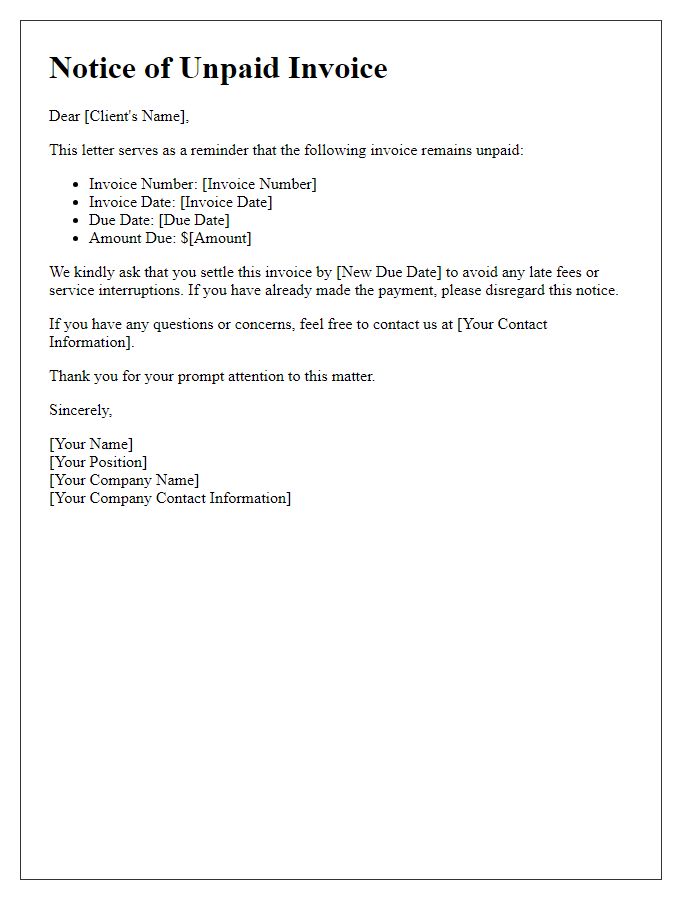

Specific payment due date.

Outstanding unpaid balances, typically on credit accounts or service contracts, can cause significant financial distress for individuals and businesses. Specific payment due dates, often set by the creditor, play a crucial role in maintaining financial health. For instance, a monthly due date of the 15th for a credit card bill requires borrowers to manage their finances effectively to avoid late fees. Consistent reminders about these due dates help ensure that customers are informed about balances due, encouraging timely payments to prevent collections or further interest accrual. Detailed statements, including the outstanding amount, payment methods, and contact information for support, enhance clarity, facilitating the settlement process and fostering positive customer relationships.

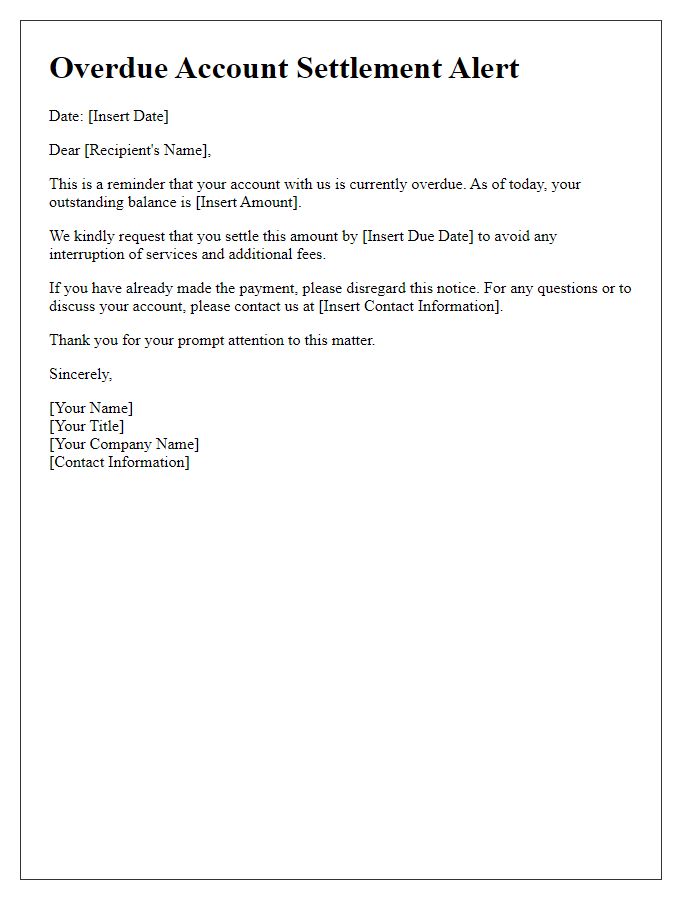

Contact information for queries.

Unpaid balance settlements require prompt attention to avoid disruptions. In 2023, many individuals and businesses face challenges with overdue accounts, often exceeding 30 days past due. Maintaining clarity in financial communications is vital. Ensure contact details are included for queries, such as a dedicated phone number and email address, facilitating easy resolution. Utilizing systems like automated reminders may enhance response rates. Highlighting specific date markers for payment deadlines can create a sense of urgency. Providing a link to an online payment portal can streamline the settlement process, reducing friction and improving cash flow.

Consequences of non-payment.

Failure to address unpaid balances can lead to significant repercussions in financial obligations. For instance, a remaining amount of $500 overdue for more than 30 days can result in late fees, often accumulating at a rate of 1.5% monthly. Continuous delinquency can negatively impact credit scores, with potential declines of 50 to 150 points based on outstanding debt levels and payment history. Legal actions may commence after 90 days, including collections procedures initiated by agencies, further exacerbating financial strain. Additionally, a court judgment could result, leading to wage garnishment or bank account levies to recover the owed amounts, underscoring the importance of timely payment.

Comments