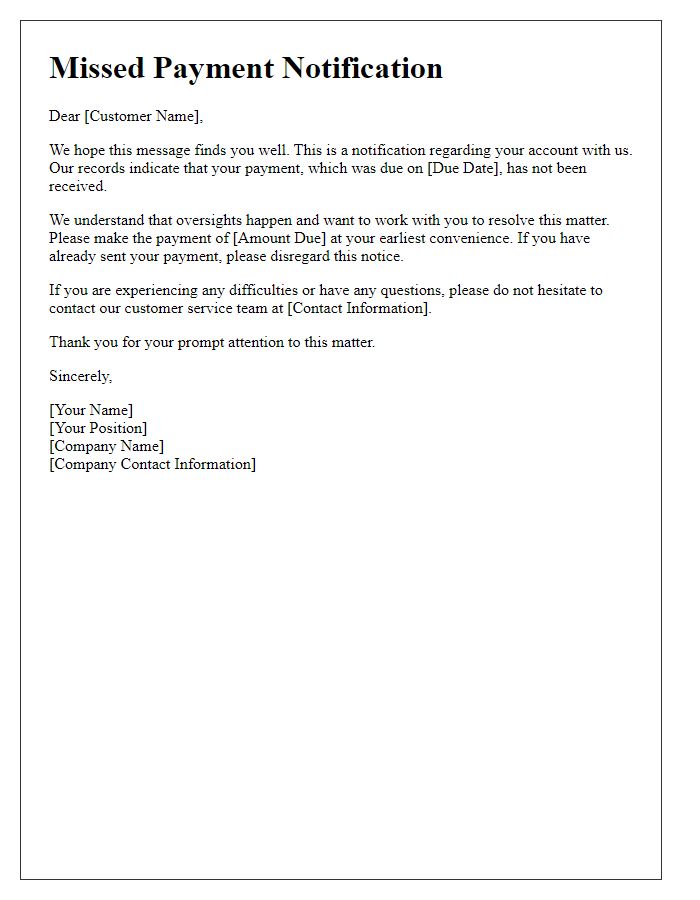

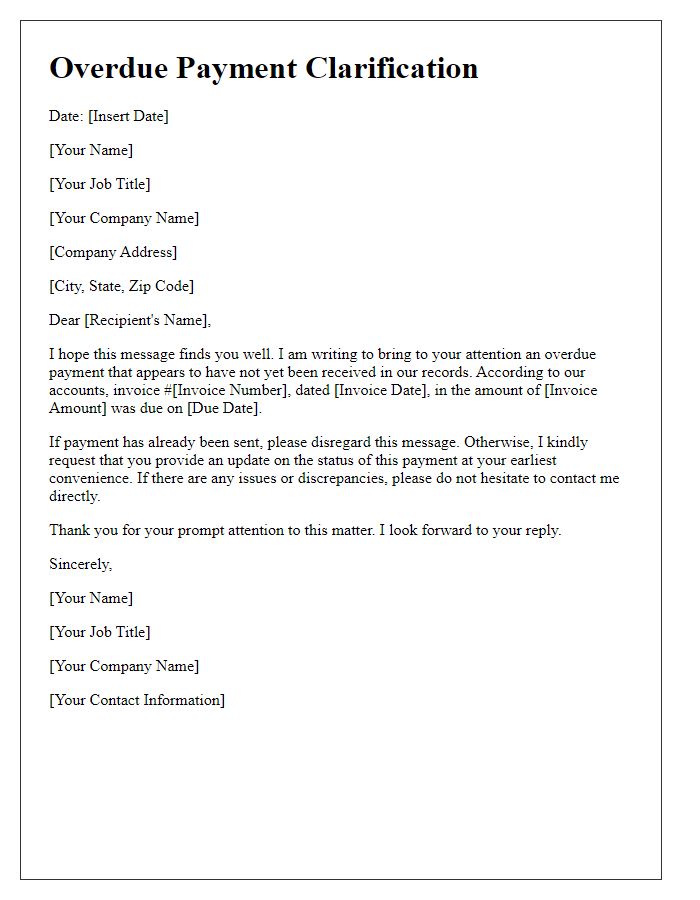

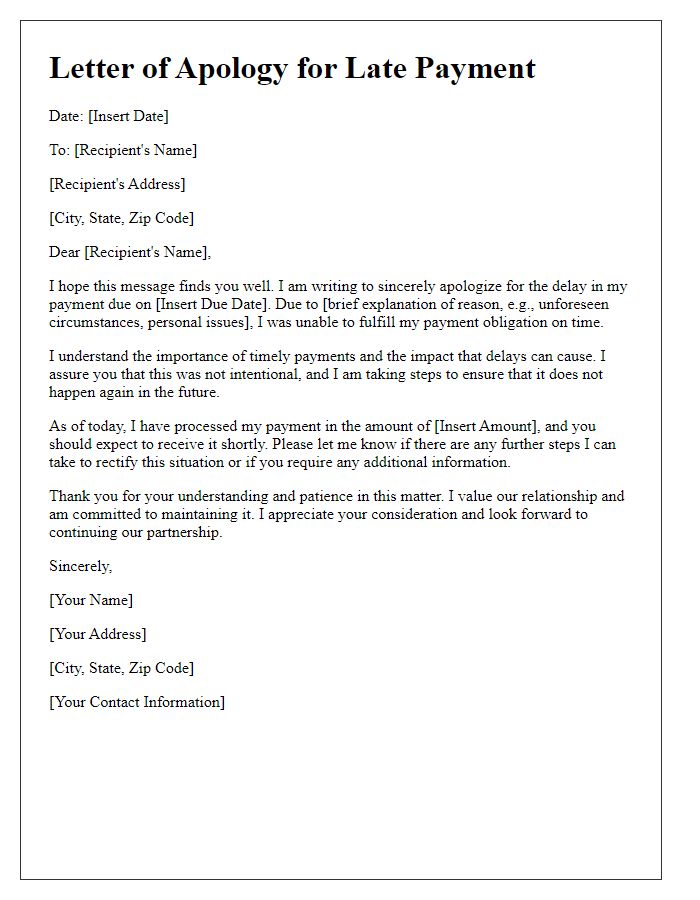

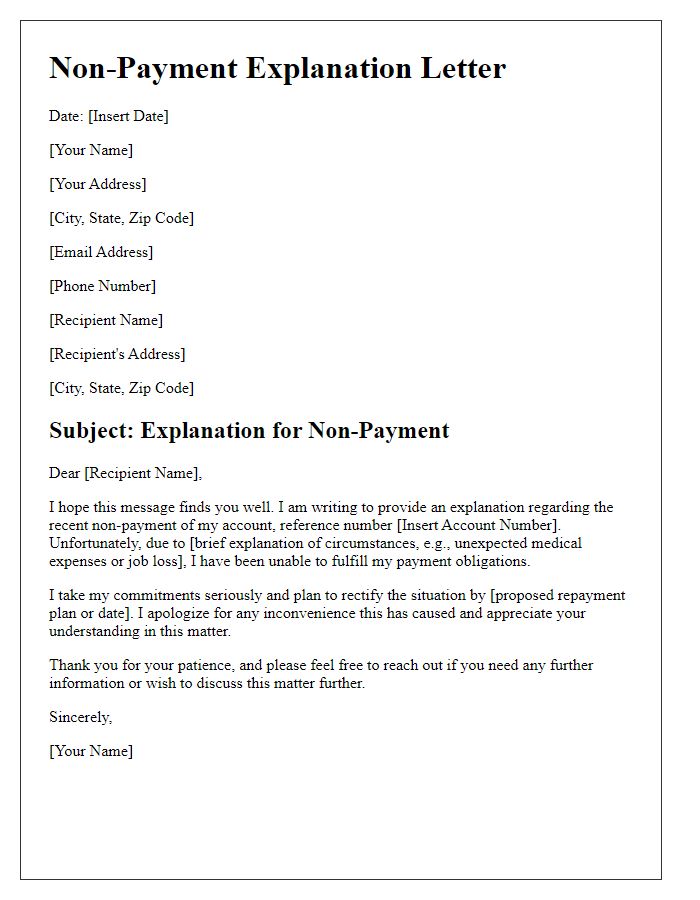

Have you ever found yourself in a situation where a missed payment leaves you feeling anxious and uncertain? It's completely understandableâlife can throw unexpected challenges your way, making it tough to keep track of everything. In this article, we'll explore a simple and effective letter template you can use to explain your missed payment and express your commitment to resolving any issues. So, if you're ready to regain control of your finances, come along as we dive deeper into this helpful guide!

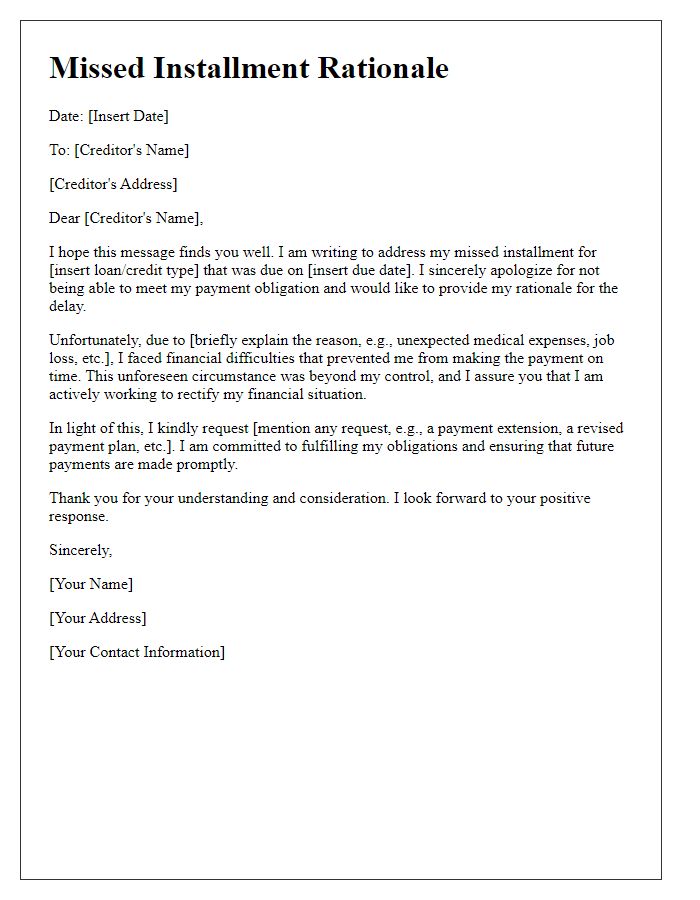

Apology for oversight

An oversight in payment processing caused a delay in settling an overdue invoice, which was due on September 15, 2023. The affected amount of $500 pertained to services rendered by Creative Solutions, Inc. on August 10, 2023. This lapse occurred amidst an increased workload, leading to difficulties in tracking various billing cycles. The account, previously maintained in good standing, has been promptly addressed with the payment cleared on September 25, 2023. Assurance is provided that robust measures are being implemented to prevent further occurrences of this nature.

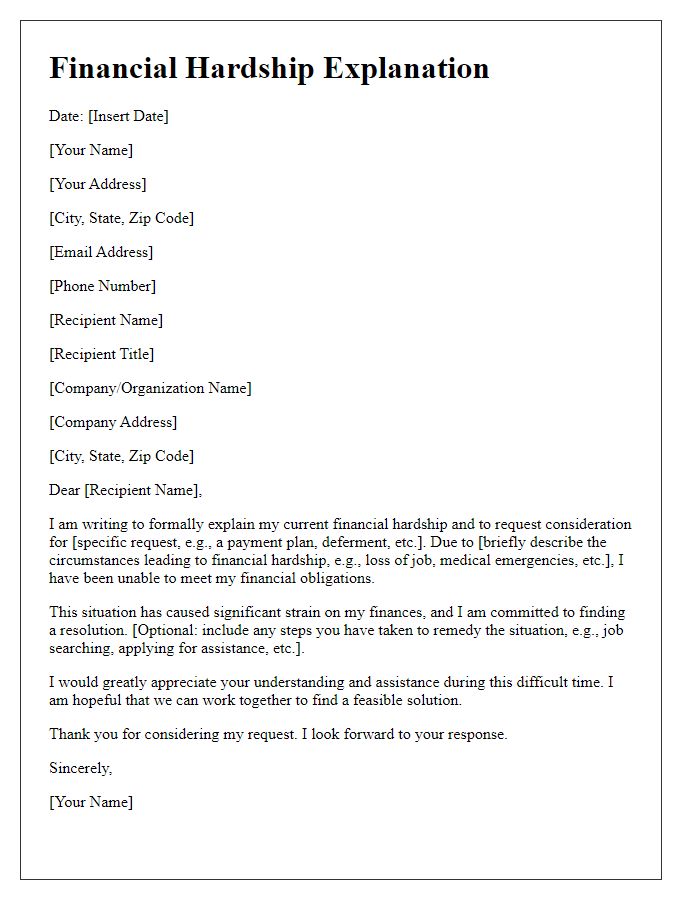

Explanation of circumstances

Missed payments can arise from various unexpected circumstances, such as medical emergencies, loss of employment, or unforeseen expenses. For instance, an unexpected medical bill of $5,000 due to a sudden illness can severely impact monthly budgets. Additionally, a layoff from a job that had a salary of $60,000 can disrupt regular income streams, making it challenging to meet financial obligations. Furthermore, other financial commitments like housing costs in metropolitan areas (where rent can exceed $2,500 per month) can add pressure to manage cash flow effectively. Understanding these factors is crucial for lenders and service providers when considering the implications of missed payments.

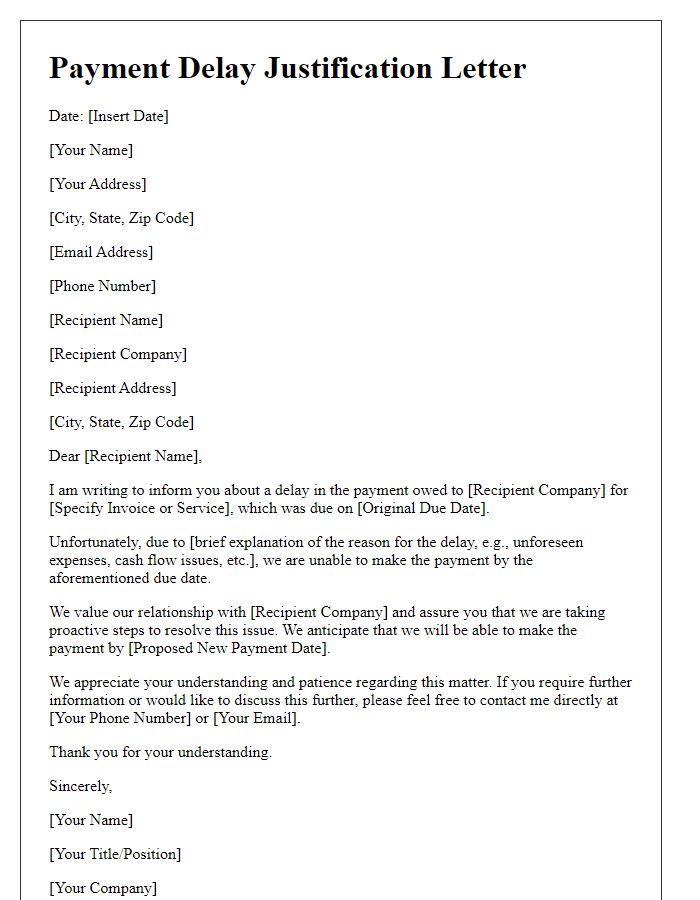

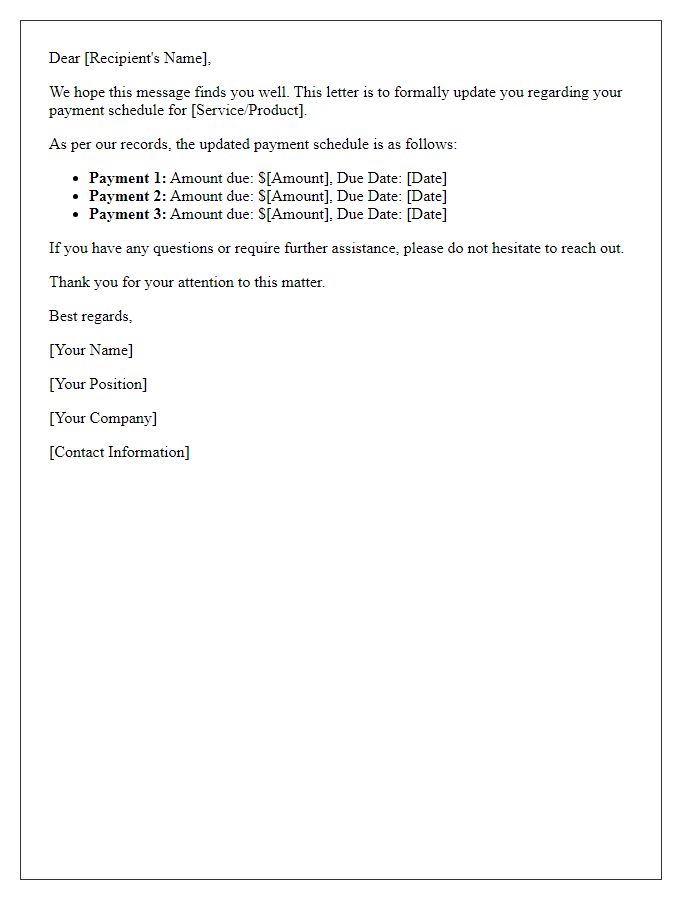

Commitment to resolution

Missed payments often arise from unexpected circumstances, such as job loss or medical emergencies. These situations can lead to financial distress, making it difficult for individuals to meet their obligations. In attempting resolution, one can reach out to creditors to explain the situation and express a commitment to resume payments. Financial institutions may offer options, such as payment plans or temporary deferments, to assist individuals facing hardships. Documenting the conversation and establishing a timeline for resumption of payments can reinforce intention and facilitate a positive response from creditors. Maintaining open lines of communication is essential in navigating these challenges.

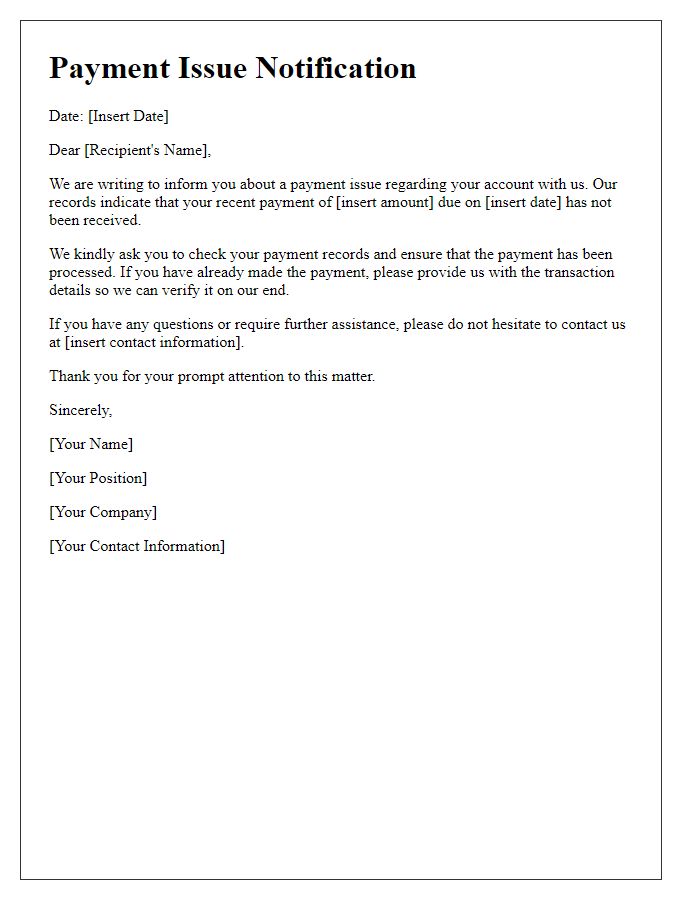

Assurance of future compliance

A missed payment can lead to significant penalties and negatively impact financial standing. Factors such as unexpected medical expenses or job loss can contribute to payment issues. It is crucial to communicate with the lender immediately, outlining the reasons for the oversight. A promise for future compliance can help restore trust. Setting up automatic payments or reminders can prevent future lapses. Demonstrating financial stability through a detailed budget may further reassure creditors of commitment to future payments. Maintaining open channels of communication is essential for resolving issues proactively, ensuring a positive relationship moving forward.

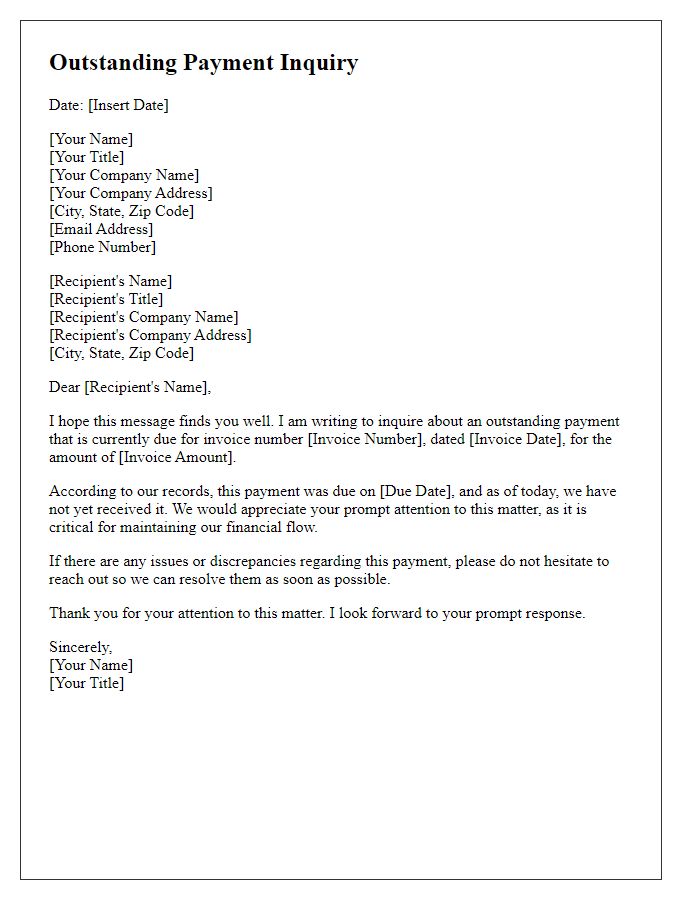

Contact information for further communication

Missed payment scenarios can result from various factors, including unexpected financial difficulties and changes in income. Individuals or businesses may encounter situations that prevent timely payments, such as medical emergencies or job loss. It's essential to maintain open communication with creditors or service providers, providing detailed explanations during the discussion. Clear contact information ensures that both parties can engage in further discussions, making resolution easier. Consider including specific numbers, such as account numbers for reference, and appropriate names, like customer service representatives, to facilitate smoother interactions. Providing a direct phone number or email aligns with best practices for ongoing communication, fostering trust and understanding while resolving any financial obligations.

Comments