Creating a will is a crucial step in ensuring that your wishes are honored after you're gone. It can be a daunting task, but with the right guidance, it becomes manageable and even empowering. In this article, we'll explore the essential components of a will, the registration process, and how to make your testament legally binding. So, if you're ready to take control of your legacy, read on to discover the steps you need to follow!

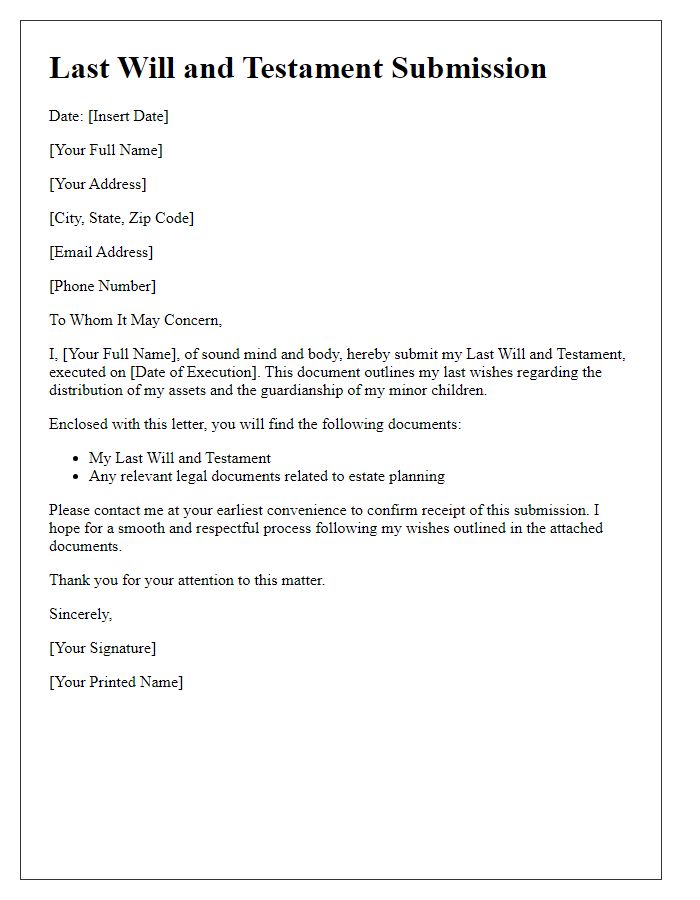

Personal Information

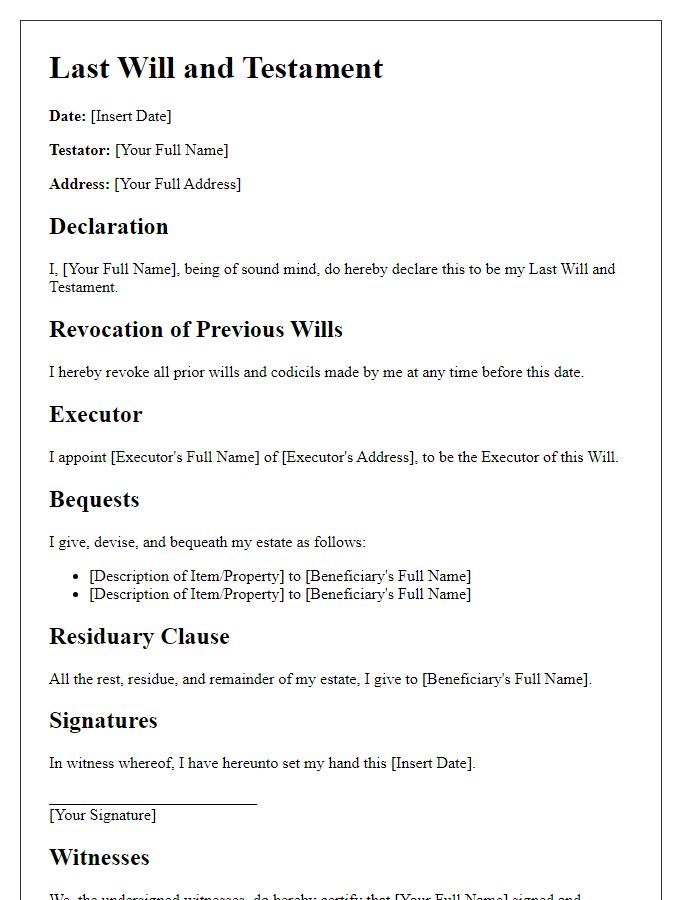

Creating a will and testament involves the collection of personal information to ensure legal validity and clarity regarding the distribution of assets. Required details include full legal name, commonly known name, and date of birth, which are crucial for identity verification. The address, including street number, city, state, and ZIP code, establishes residency, influencing jurisdiction for legal matters. Additionally, details on marital status, including spouse's name (if applicable), along with information about children, such as names and dates of birth, help outline beneficiaries. Professional affiliations and specific asset descriptions, including bank accounts, real estate locations, and personal property (furniture or collectibles), are essential for the effective allocation of assets in accordance with the testator's wishes.

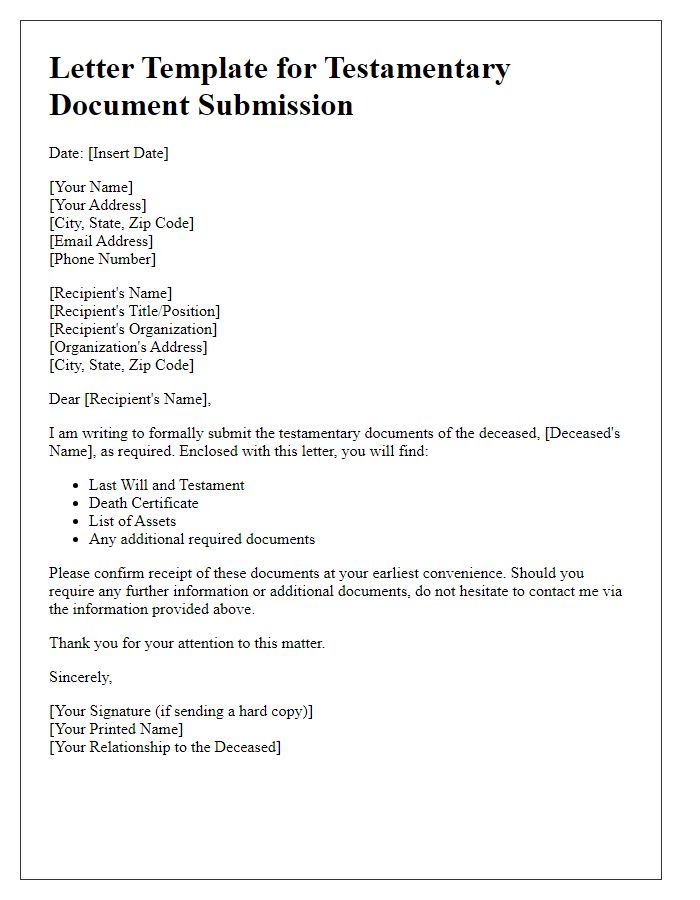

Executor Details

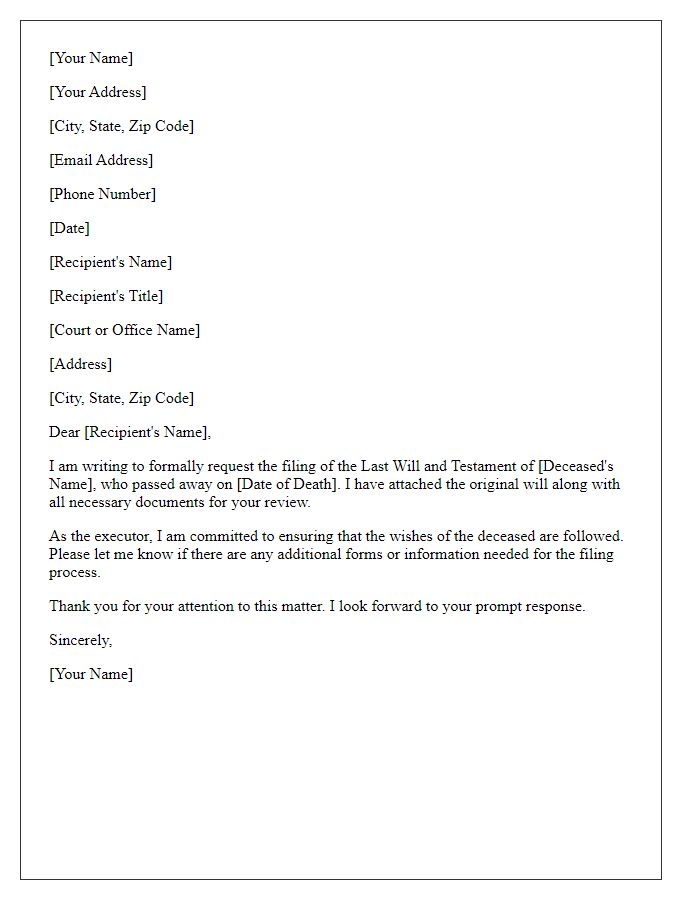

An executor, appointed for the administration of a Last Will and Testament, carries significant responsibilities and must be carefully selected. This individual, often a trusted family member or a close friend, assumes the role of ensuring the decedent's wishes are honored, managing estate assets in locations such as residential properties in California, bank accounts across major financial institutions, and personal belongings. Executors should be aware of their duties, which include filing legal documents with probate courts, settling debts, and distributing assets to beneficiaries, as outlined by the decedent's wishes. Furthermore, they may require additional support from legal professionals or accountants, especially in cases involving complex estates or disputes among beneficiaries. A well-recorded executor's information is crucial for efficient estate administration and to avoid delays during the probate process.

Beneficiary Designations

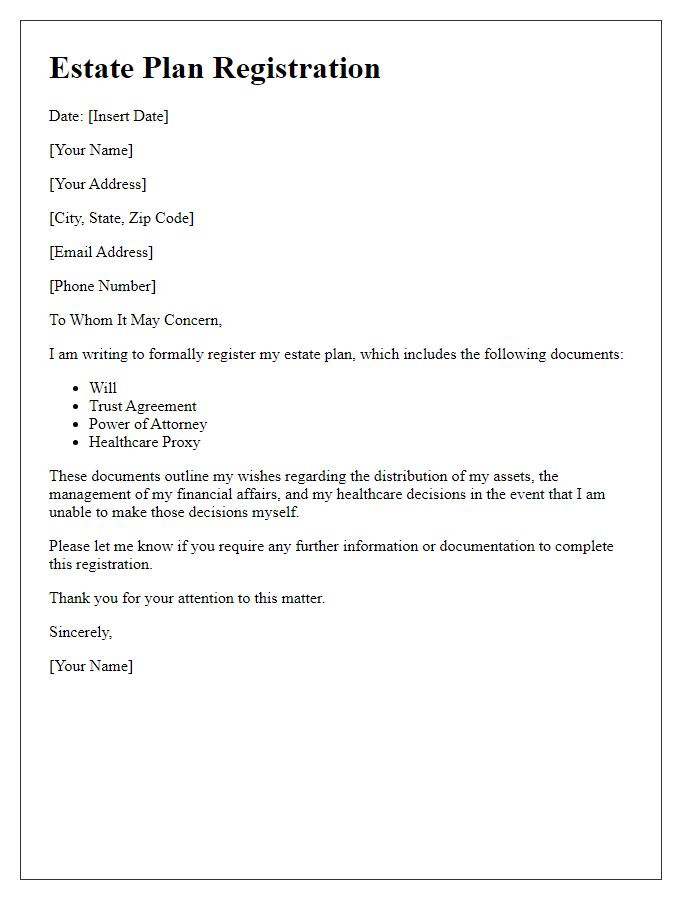

Creating a will and testament ensures that your assets are distributed according to your wishes upon passing. Designating beneficiaries clearly outlines who will inherit specific assets, such as real estate (homes, land), personal property (vehicles, jewelry), and financial accounts (bank accounts, investment portfolios). It's crucial to have accurate information regarding beneficiary names, relationships, and Social Security numbers, which helps to prevent disputes. Specifics about the percentages or shares of each asset can also be included. Documentation may need to comply with laws of the state you're residing in, ensuring a legal and binding process during registration. Properly executed beneficiary designations can streamline the transfer of assets and minimize the burden on loved ones during a challenging time.

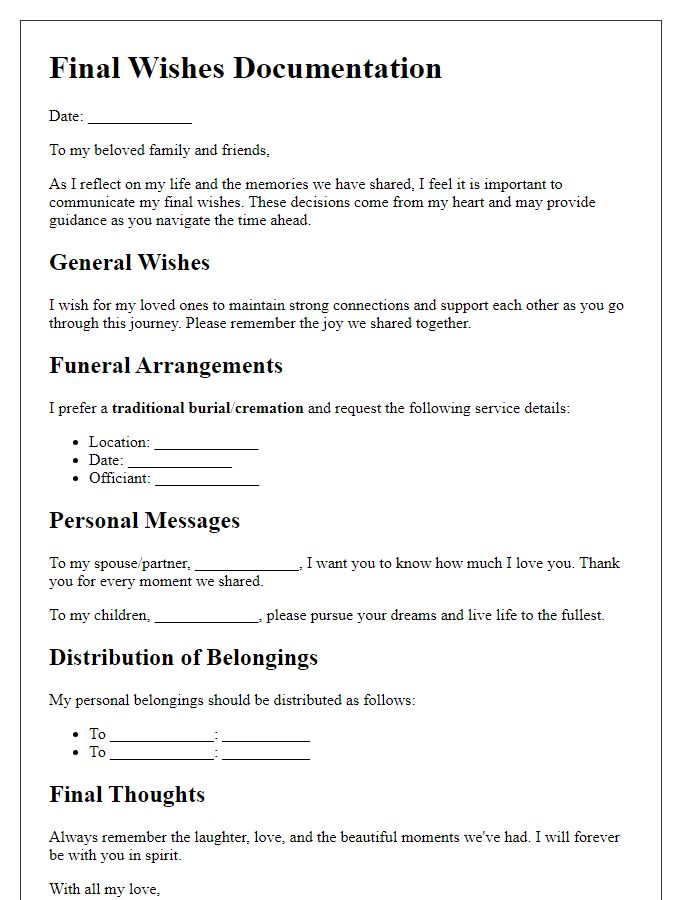

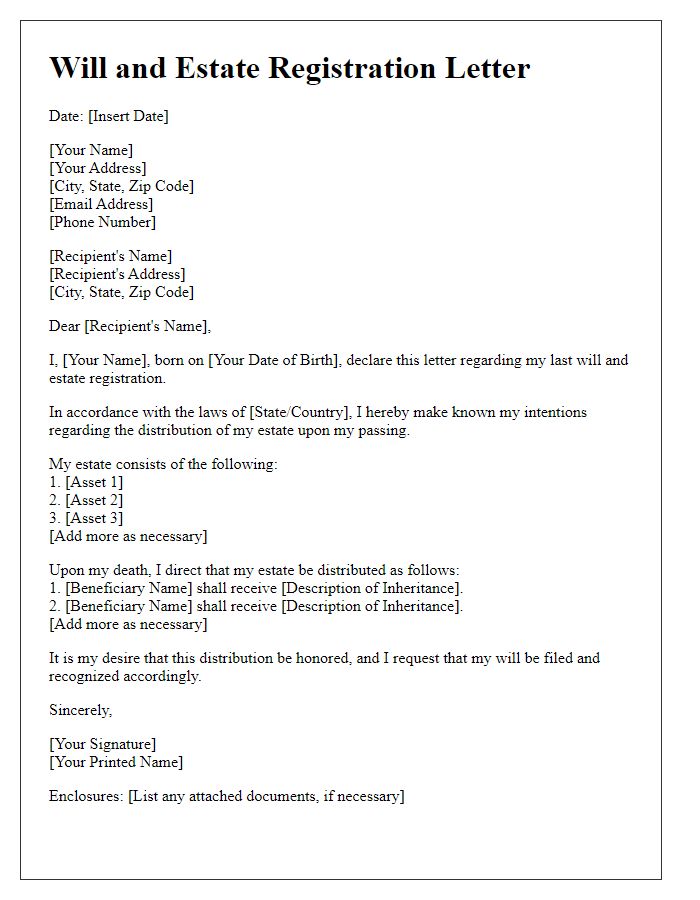

Asset Distribution

Creating a will and testament involves a detailed asset distribution plan to ensure that personal belongings, property, and financial assets are allocated according to the individual's wishes after their passing. A well-structured document includes specifics about each asset type, such as real estate properties (including homes valued at market rates), bank accounts (like checking and savings accounts with specific financial institutions), personal belongings (such as vehicles, jewelry, and treasured family heirlooms), and investments (including stocks or bonds listed under brokerage firms). Each beneficiary should be clearly identified by name, relationship, and, if possible, their addresses, alongside any contingencies outlined for scenarios where a beneficiary is no longer living. Additionally, the will should detail an executor, a trusted individual appointed to oversee the distribution process according to the legal frameworks of jurisdiction (such as probate law). Proper execution, including witnessing signatures and notarization, adds legal validity, reducing potential disputes among heirs and ensuring a smooth transition of assets.

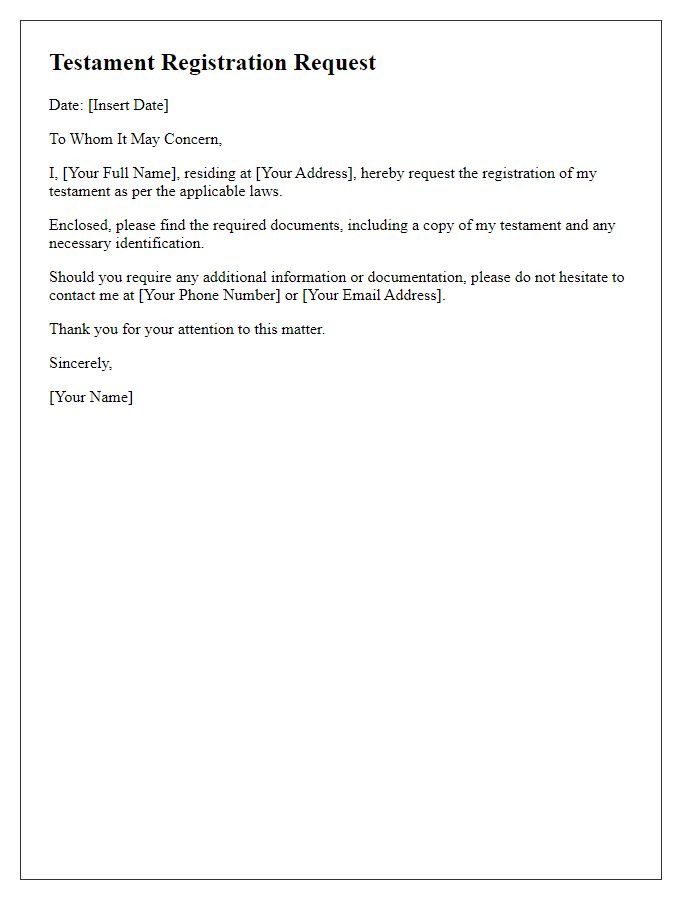

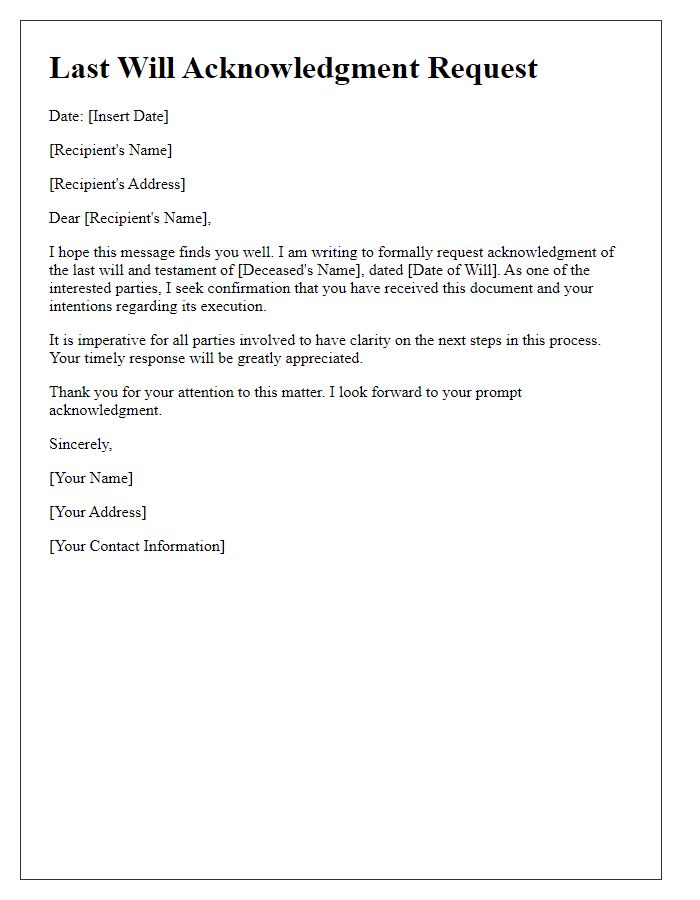

Legal Provisions

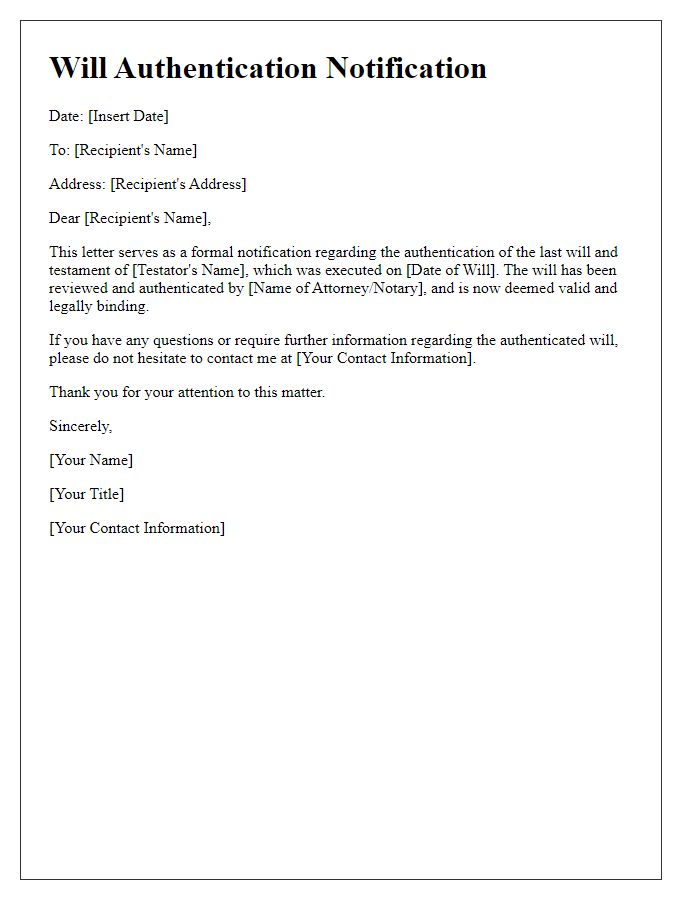

Creating a will and testament involves several legal provisions that ensure its validity and enforceability. Each jurisdiction has unique requirements; generally, a will must be in writing and signed by the testator, the person creating the will. Witnesses are often required; typically, two witnesses must observe the signing, ensuring impartiality and legal authenticity. Specific legal languages and exclusions for certain assets, such as life insurance policies and retirement accounts, are critical considerations. Probate court (the legal process of validating a will) may involve filing documents like the death certificate and the will itself, which must be executed according to state laws (varying across the United States). Additionally, any conditions or bequests outlined in the will must adhere to principles of legality and public policy, preventing issues such as enforceability in the case of illegal actions or undue influence claims. Proper registration can help mitigate disputes among heirs, ensuring a smooth transition of estate assets.

Comments