Are you looking to secure a financial endorsement guarantee but don't know where to start? Crafting the perfect letter can make all the difference in communicating your needs and ensuring a smooth process. In this article, we'll guide you through essential elements to include in your letter, helping you present your case effectively. Let's dive into the details and empower your financial journey!

Clear identification of parties involved.

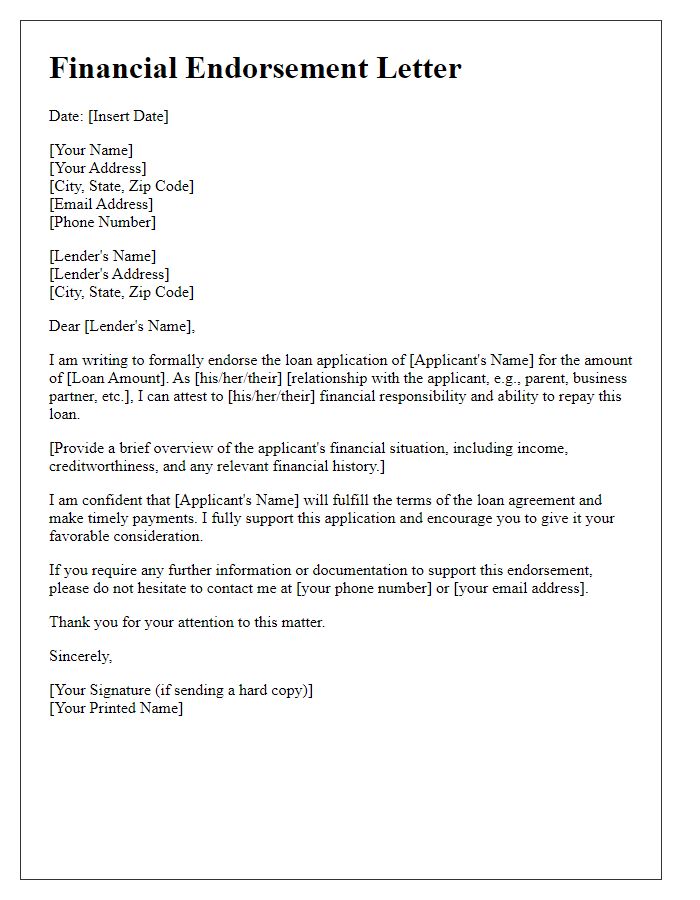

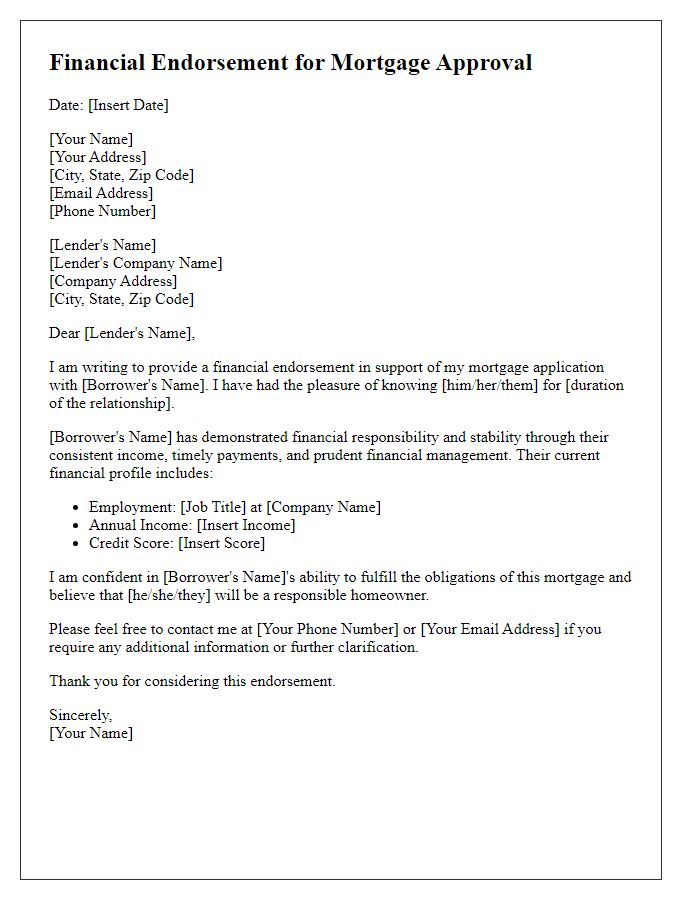

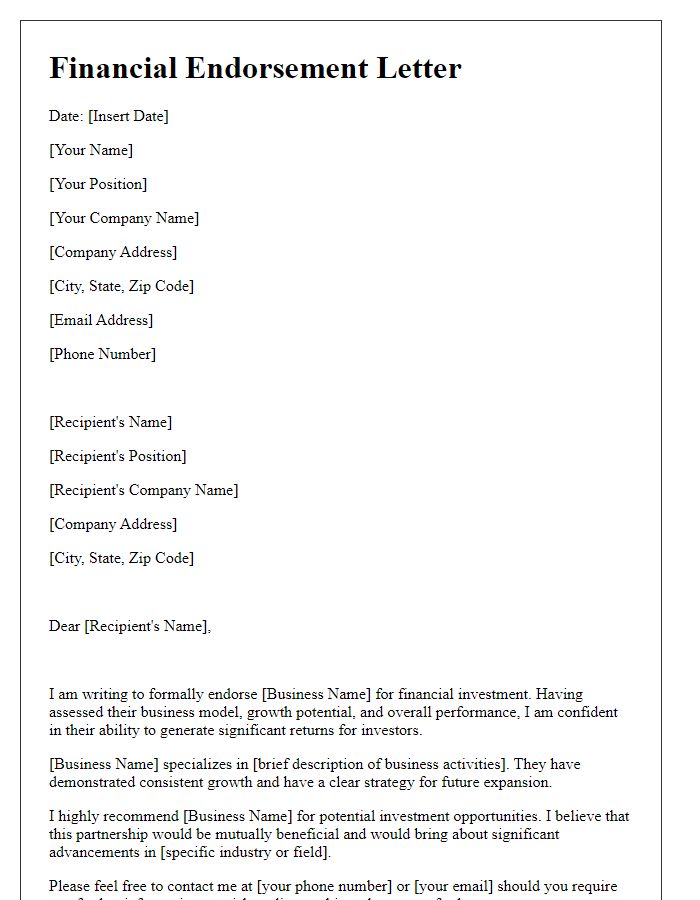

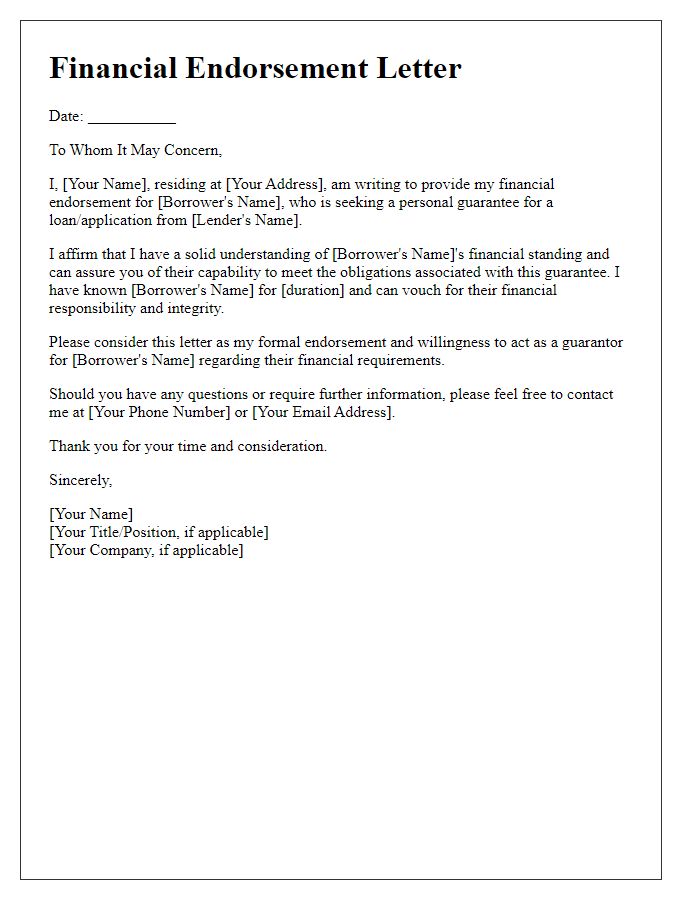

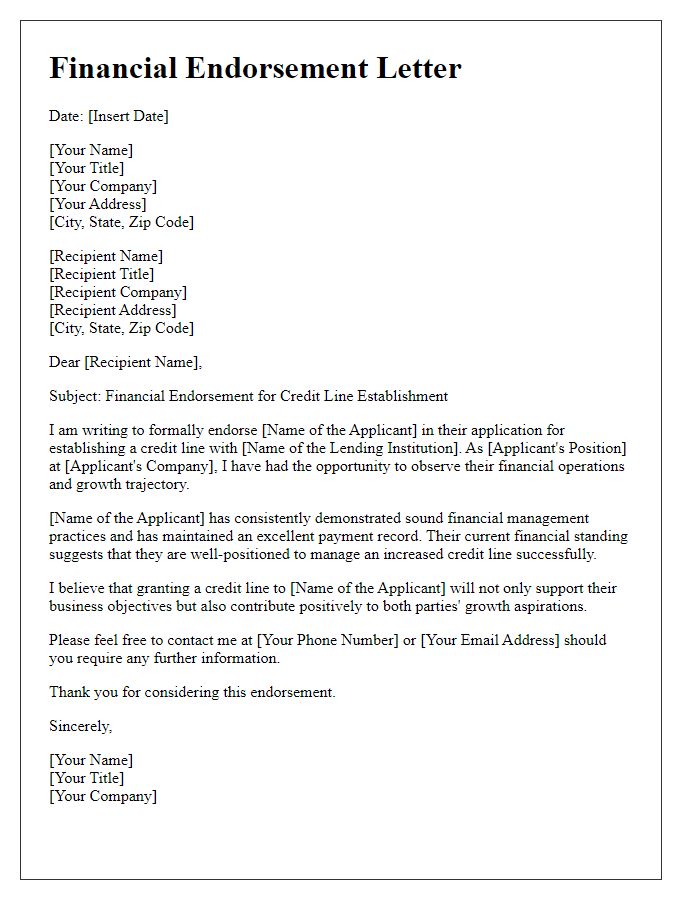

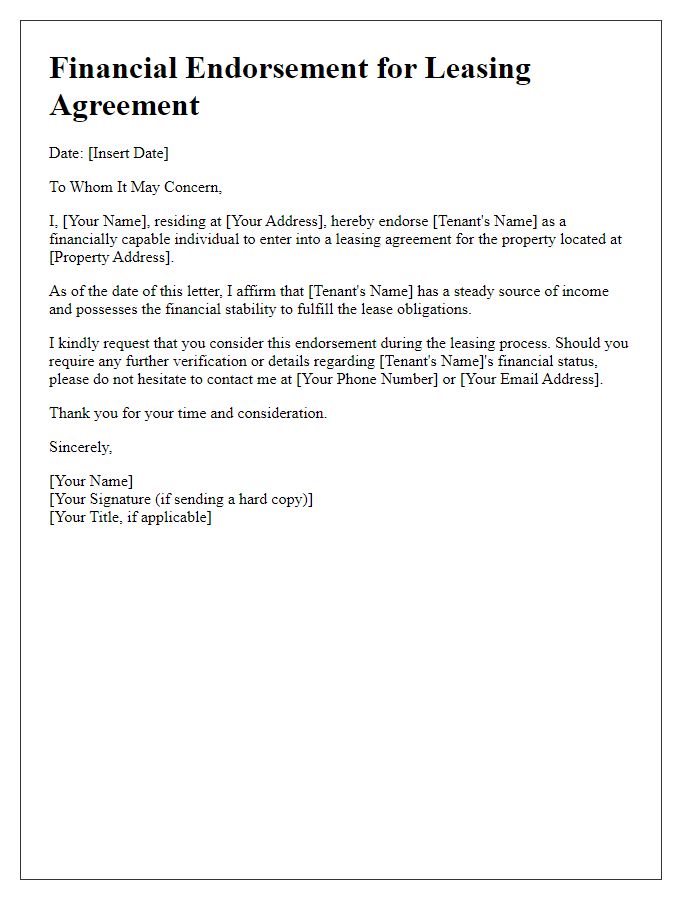

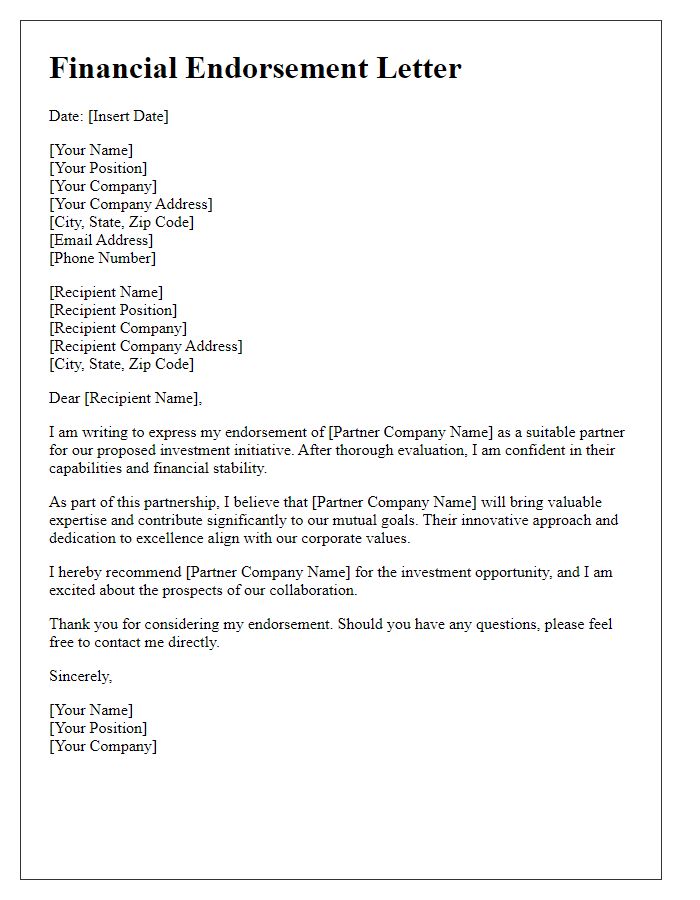

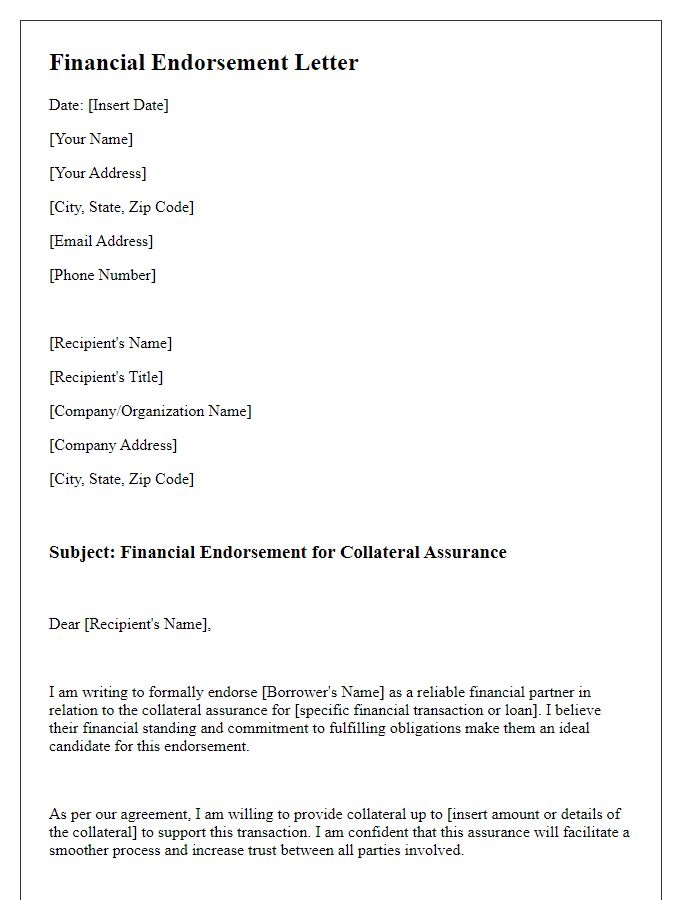

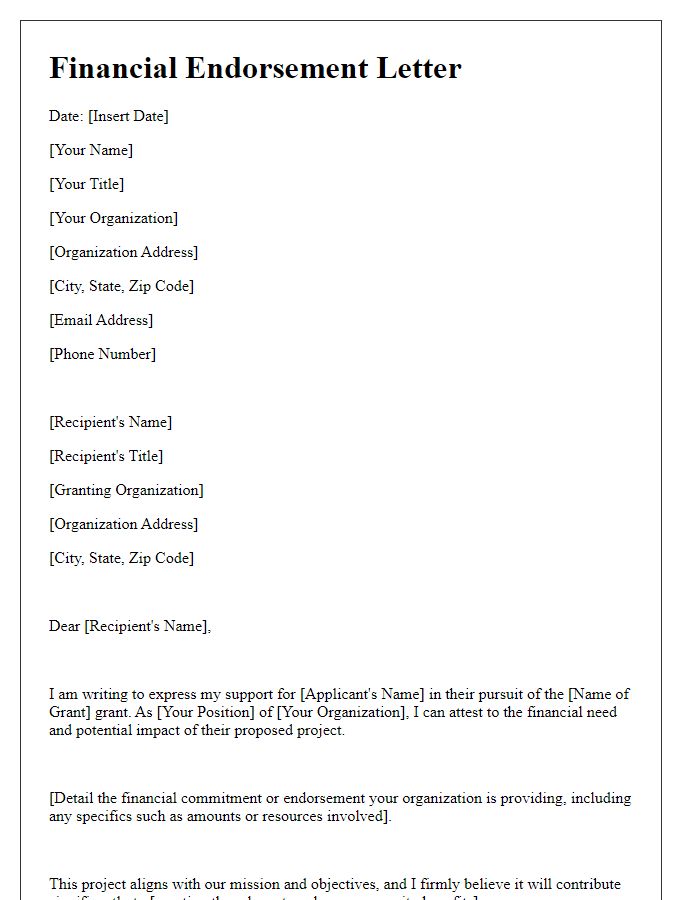

A financial endorsement guarantee involves a clear identification of parties such as the guarantor, the beneficiary, and the principal debtor. The guarantor, often an individual or an organization, offers a promise to cover the loan or obligation if the principal debtor defaults. The beneficiary, typically the lender or creditor, is the entity entitled to receive the guaranteed payment. Additionally, the principal debtor is the party responsible for fulfilling the debt obligations. This document should include specific details like names, addresses, contact information, and legal identification numbers to ensure proper identification of all involved entities. Clear terms of the guarantee, such as the amount covered and any conditions for invoking the guarantee, are crucial for legal binding.

Specific terms of guarantee and financial coverage.

A financial endorsement guarantee provides assurance to parties involved in a transaction, particularly in the realm of loans or contractual agreements. This guarantee typically specifies the terms, such as coverage amount (for example, $500,000) and duration (often ranging from one to five years). The entity providing the guarantee, such as a bank or insurance company, ensures payment obligations are met, mitigating the risk for lenders or service providers. Under specific circumstances, like default on payments, the guarantor assumes liability, offering protection against financial loss. Additionally, conditions may include assessment of creditworthiness and stipulations for timely reporting of financial changes, fostering transparency and accountability.

Conditions of endorsement and obligations.

A financial endorsement guarantee involves a series of conditions and obligations that ensure the security of a financial transaction. The endorser (individual or entity providing the guarantee) must possess sufficient assets or creditworthiness, validated by financial metrics such as credit scores, income statements, or net worth assessments. The guarantee's effectiveness typically depends on a formal agreement including specific terms, which may involve the payment of fees or interest rates, outlined in a written document. Obligations may also include the timely notification of defaults by the primary borrower, as well as full disclosure of any relevant financial changes that could impact the guarantee's validity. Legal jurisdictions governing the endorsement may establish further requirements, ensuring compliance with local laws and regulations, such as the Uniform Commercial Code (UCC) in the United States, which governs commercial transactions.

Duration and termination clauses.

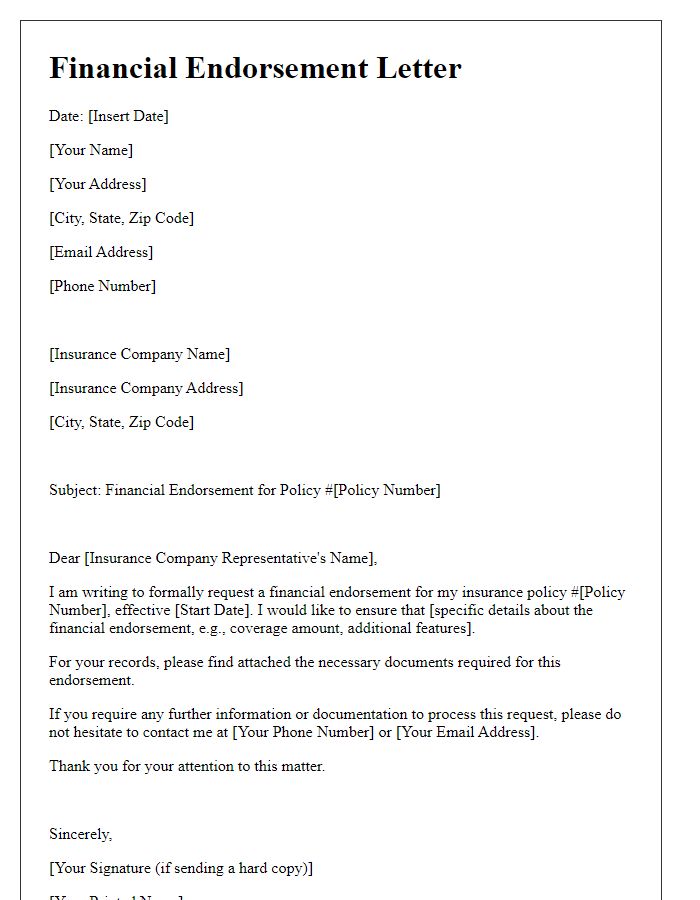

Financial endorsement guarantees often include specific clauses detailing duration and termination to ensure clarity and protection for all parties involved. Typically, the duration clause specifies the length of time the guarantee remains valid, which can range from a few months to several years, depending on the agreement's specifics. For instance, a common duration might be set for three years from the date of signing or until a certain financial milestone is reached. The termination clause outlines conditions under which the guarantee may be nullified prior to the agreed expiration. For example, a party may terminate the agreement if obligations are fulfilled, a breach occurs, or through mutual consent. Detailed notice requirements and potential penalties for premature termination may also be specified, ensuring all parties understand their rights and responsibilities.

Contact information for further communication.

Financial endorsement guarantees provide security in lending and financial transactions, ensuring that the lender is protected in case of default. A financial endorsement, specifically a guarantee, typically involves a third party agreeing to take responsibility for a loan or obligation if the borrower fails to meet their commitments. Contact information, ideally including names, emails, and phone numbers, is crucial for maintaining open lines of communication between all involved parties and ensuring prompt resolution of any issues. In addition, providing physical addresses can be important for formal documentation and correspondence regarding agreements and contractual obligations.

Comments