Hey there! We all know that life can sometimes throw us unexpected curveballs, and it's easy to fall behind on financial commitments. If you find yourself needing to explain a late payment, crafting an effective letter can help ease any tension and restore understanding. In this article, we'll provide you with a simple yet powerful template to use for your late payment explanation, ensuring you communicate your situation clearly and professionally. Stick around to learn more and get the support you need!

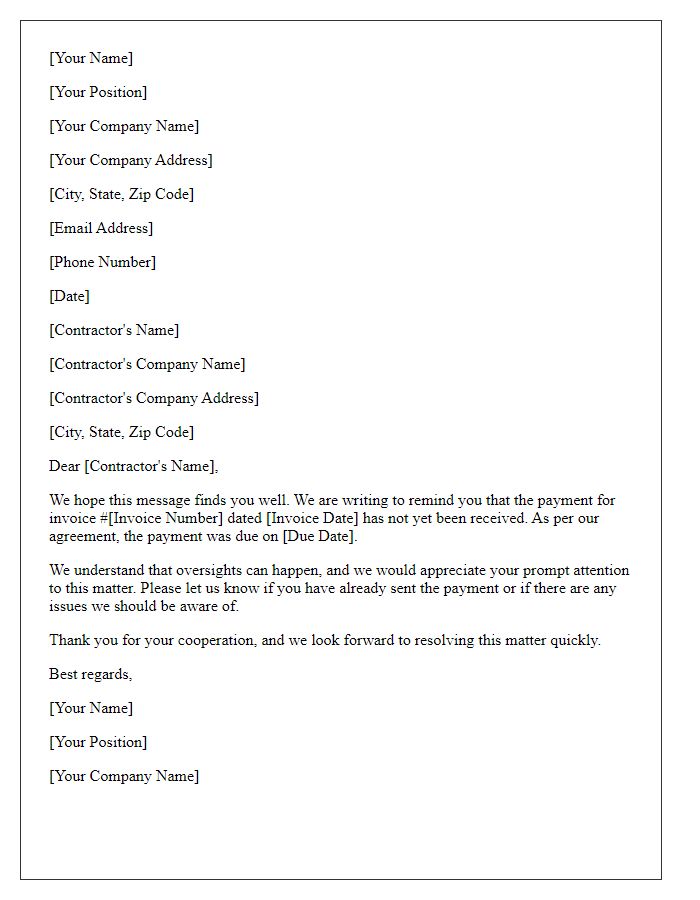

Clear subject line

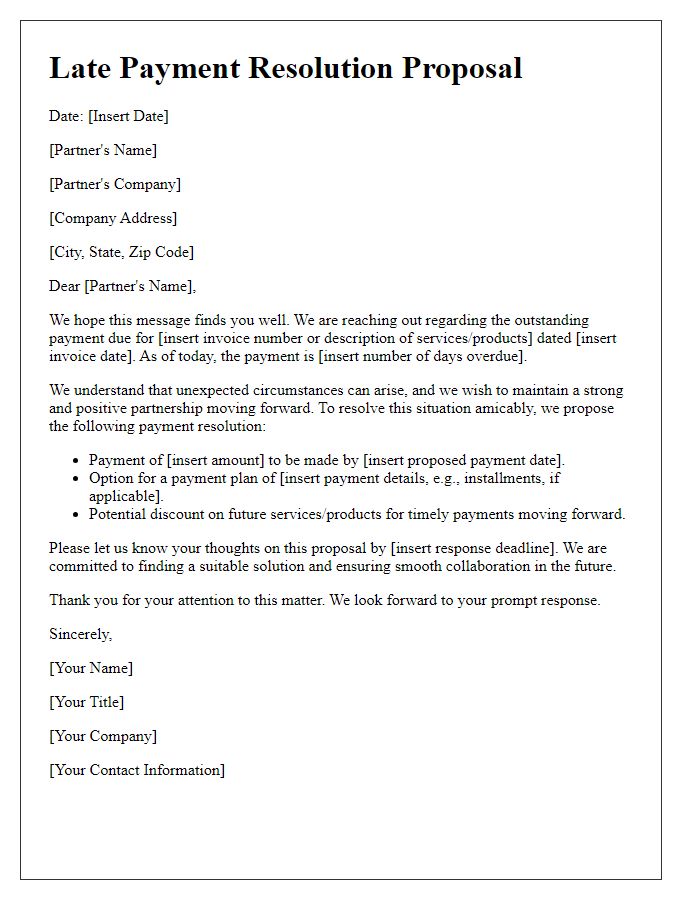

Late Payment Explanation: Details and Apology A recent invoice from Company XYZ, dated October 5, 2023, remains unpaid, causing concerns regarding account status. The reason for the delay involves unexpected financial challenges due to supply chain disruptions attributed to global events affecting material availability. Furthermore, internal accounting errors led to the oversight of payment schedules, impacting timely settlements. In response, a revised payment plan is being established to resolve the balance of $5,000 by November 15, 2023, and ensure future compliance with financial obligations. Apologies are extended for any inconvenience this may have caused to the company's operations.

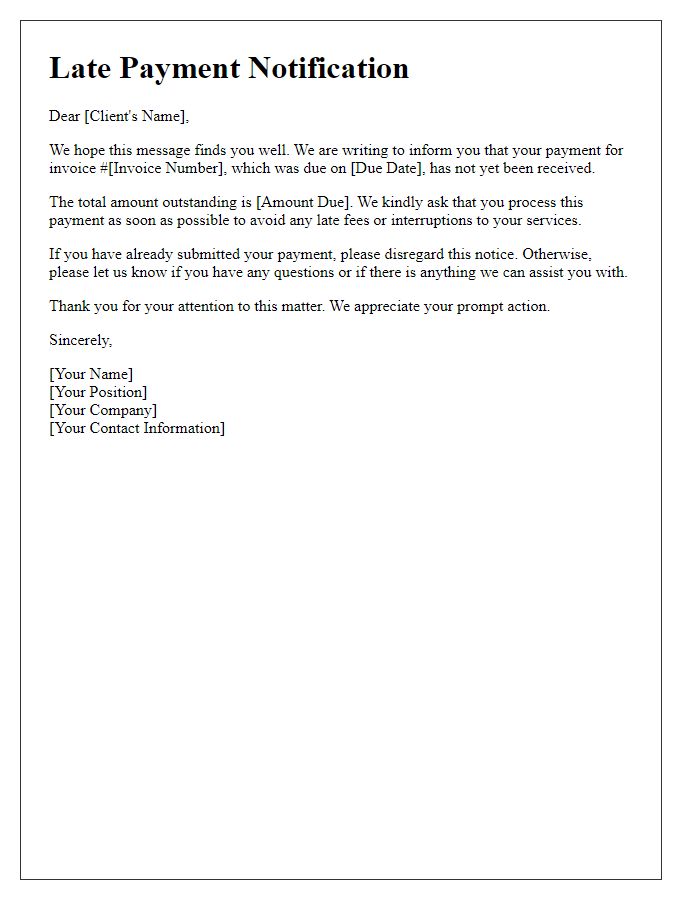

Polite greeting

Late payment can disrupt financial stability for businesses and individuals. Various reasons, such as unexpected expenses or cash flow issues, can lead to delays. For instance, medical emergencies (such as a hospital stay) or car repairs can strain personal finances. Businesses might face disruptions due to economic downturns or supply chain delays. Communication is crucial; informing creditors as soon as difficulties arise can maintain goodwill. Proposing a payment plan or timeline reassures creditors of commitment. Consistent updates on payment status can further foster trust and understanding between parties.

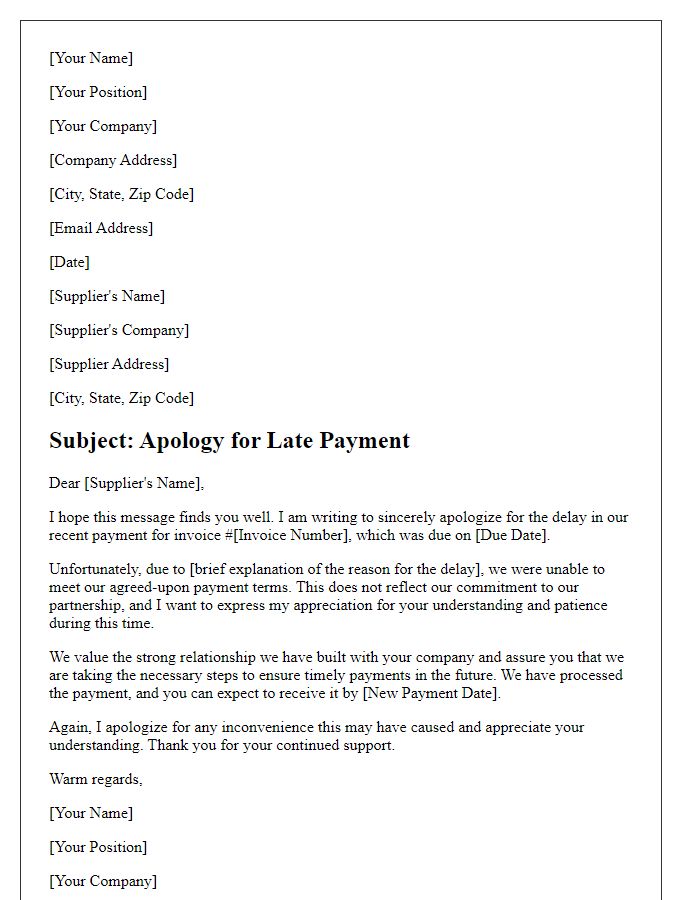

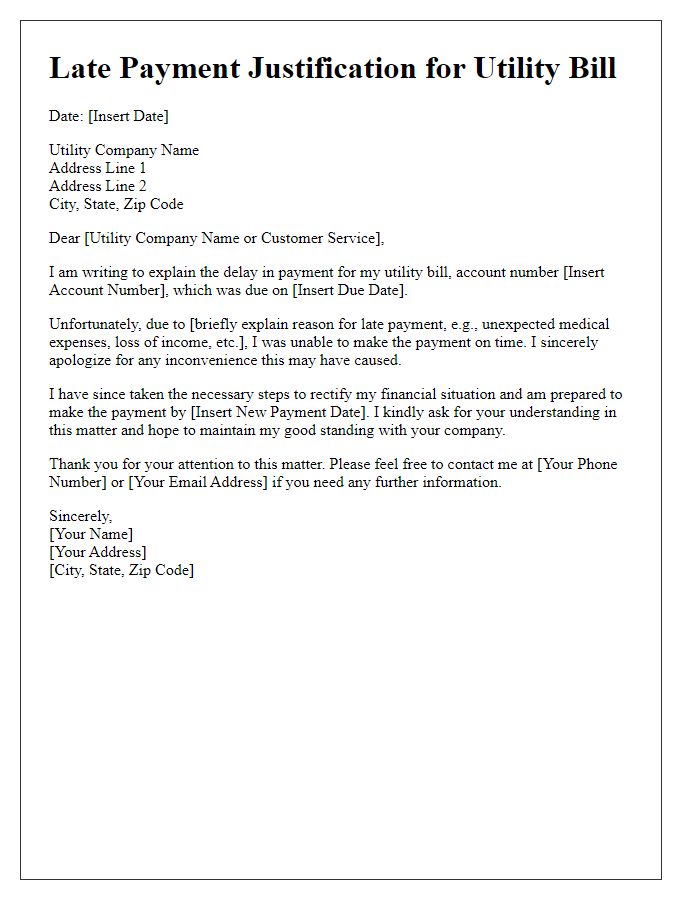

Explanation of delay

Late payments can arise from various factors affecting financial stability and transaction processing. Common reasons include unexpected medical expenses (averaging $1,000 per incident in the United States), job loss impacting income (with unemployment rates fluctuating around 4-5% in recent years), or administrative errors in billing processes (which can account for over 30% of payment delays). Additionally, cash flow issues may arise during peak spending periods, such as the holiday season, causing further delays. Understanding these challenges is essential for maintaining good relationships with creditors and ensuring timely future payments.

Apology statement

Late payments can occur due to various unforeseen circumstances. An unexpected medical emergency can arise, resulting in significant healthcare costs that disrupt personal finances. Moreover, job loss can happen suddenly, leading to a reduced income stream and cash flow challenges for obligations like rent or utility bills. Unexpected expenses related to home repairs, such as plumbing issues or electrical faults, can further strain financial resources and cause payment delays. It is crucial to communicate promptly with creditors to explain the situation and negotiate payment plans, demonstrating a commitment to resolving the outstanding balance while maintaining open lines of communication during financial hardships.

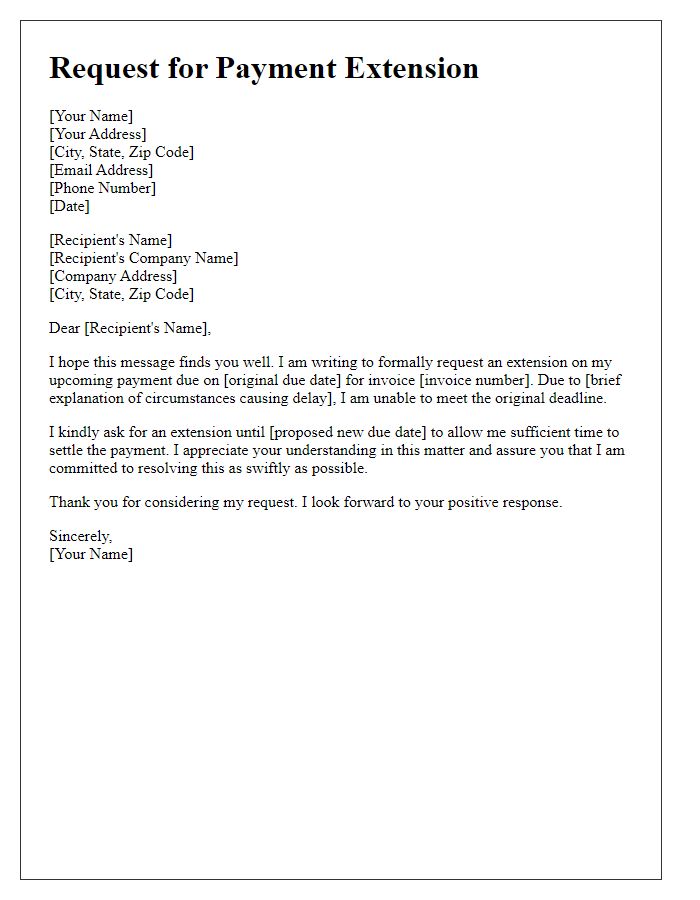

Proposed resolution or payment plan

Late payments can significantly impact the financial health of a business, such as a small enterprise struggling with cash flow issues. A proposed resolution can include setting up a structured payment plan to mitigate the financial strain. For example, an installment payment plan stipulating a monthly payment amount based on the outstanding balance can help facilitate timely payments. Notably, reaching an agreement with creditors, such as a local bank or utility company, can provide flexibility and improve relationships. Implementing a timeline for final full payment by a specific date, such as six months from the proposal, can offer clarity. This managed approach can enhance financial stability and restore trust with stakeholders while addressing overdue obligations.

Comments