Are you on the hunt for a banking position and in need of a reference? Requesting a recommendation letter can feel daunting, but it doesn't have to be! With the right approach and a friendly tone, you can craft a compelling request that clearly outlines your qualifications and the value you bring to the table. Let's dive into how to effectively ask for a reference that will enhance your job applicationâread on for expert tips!

Personal and Professional Details

A banking position reference request typically includes key personal and professional details that help validate a candidate's qualifications. Key details include the individual's full name, current job title, bank name, and years of service, which often reflect their role within a financial institution. Additionally, specific accomplishments such as successful project management, customer satisfaction ratings, and compliance with financial regulations can showcase professional competence. Personal characteristics like communication skills, adaptability in high-pressure environments, and ethical behavior also play crucial roles in assessing suitability for banking positions. Providing contact information for the reference, including phone number and email address, ensures seamless communication for verification and further inquiries.

Relationship with Candidate

The applicant for the banking position showcased exceptional skills during their internship at XYZ Bank from June 2022 to August 2022 (Summer Internship Program). Throughout this period, they demonstrated a strong understanding of financial analysis, including proficiency in Excel for data modeling and forecasting. The candidate consistently collaborated with teams on various projects, including risk assessment analysis, enhancing the bank's investment strategies. Their ability to communicate effectively and build rapport with clients resulted in a significant increase in customer satisfaction ratings, highlighting their potential for success in client-facing roles within the banking sector.

Specific Skills and Competencies

A banking position requires a unique set of skills and competencies that ensure effective financial management, customer service, and risk assessment. Proficiency in financial analysis tools, including Excel and financial modeling software, enhances decision-making capabilities. Strong communication skills are vital, enabling clear interaction with clients and team members, particularly in fast-paced environments such as urban financial districts like Wall Street in New York City. Knowledge of regulatory compliance and risk management practices safeguards the institution against potential financial irregularities. Additionally, a customer-centric approach fosters relationships within diverse client demographics, contributing to overall bank performance. Attention to detail is critical in managing transactions and maintaining accurate records, while teamwork underscores the importance of collaboration in achieving organizational goals.

Relevant Achievements and Contributions

A reference request for a banking position should highlight specific relevant achievements and contributions that demonstrate the candidate's skills and success in the financial sector. For instance, achieving a 20% increase in quarterly sales through strategic client engagement in a retail bank, or successfully leading a project that reduced operational costs by 15% through process optimization in a commercial banking environment. Additionally, articulating contributions such as developing customer loyalty programs that increased client retention rates by 30%, or implementing risk management strategies that resulted in maintaining compliance during stringent regulatory audits can further strengthen the request. Recognizing accomplishments like managing a portfolio exceeding $10 million, coupled with accolades such as 'Employee of the Year' at a reputable financial institution, paints a comprehensive picture of the candidate's impact and professional competence in the banking industry.

Contact Information

When seeking a reference for a banking position, it's important to reach out to individuals who can speak to your qualifications and professionalism in financial contexts. Begin by identifying potential referees, such as former supervisors from recognized financial institutions like JPMorgan Chase or Bank of America. Next, craft a clear and concise message, including your full name, the position you are applying for, and specific skills or experiences you would like them to highlight, such as expertise in risk management or proficiency with financial regulatory compliance. Provide your contact information in the form of a phone number and professional email address, ensuring all details are accurate for easy follow-up. Highlight the importance of their reference in assisting your career advancement, emphasizing the value of their endorsement in competitive banking roles.

Letter Template For Banking Position Reference Request Samples

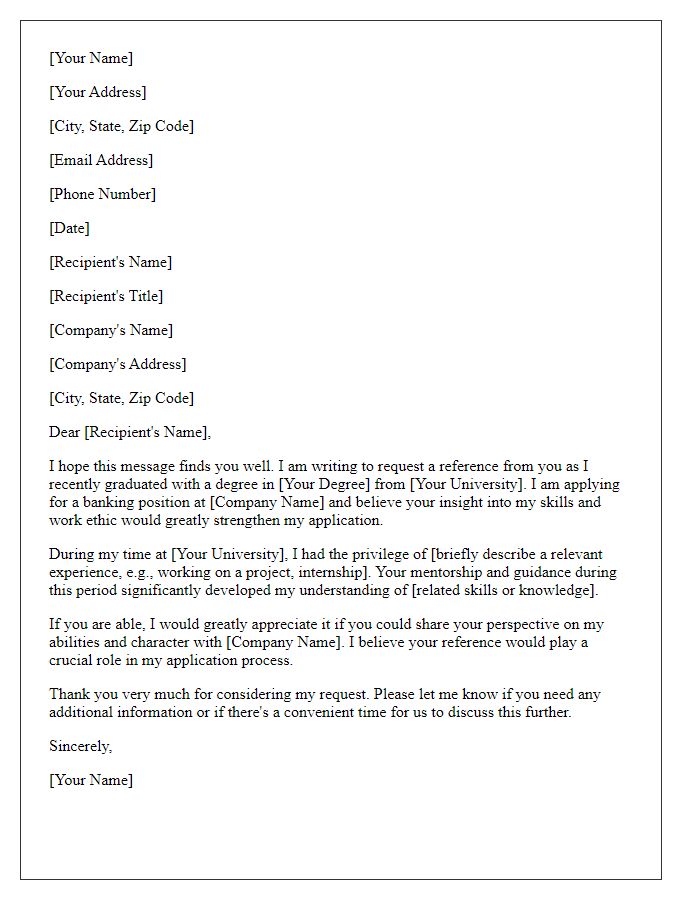

Letter template of banking position reference request for a recent graduate

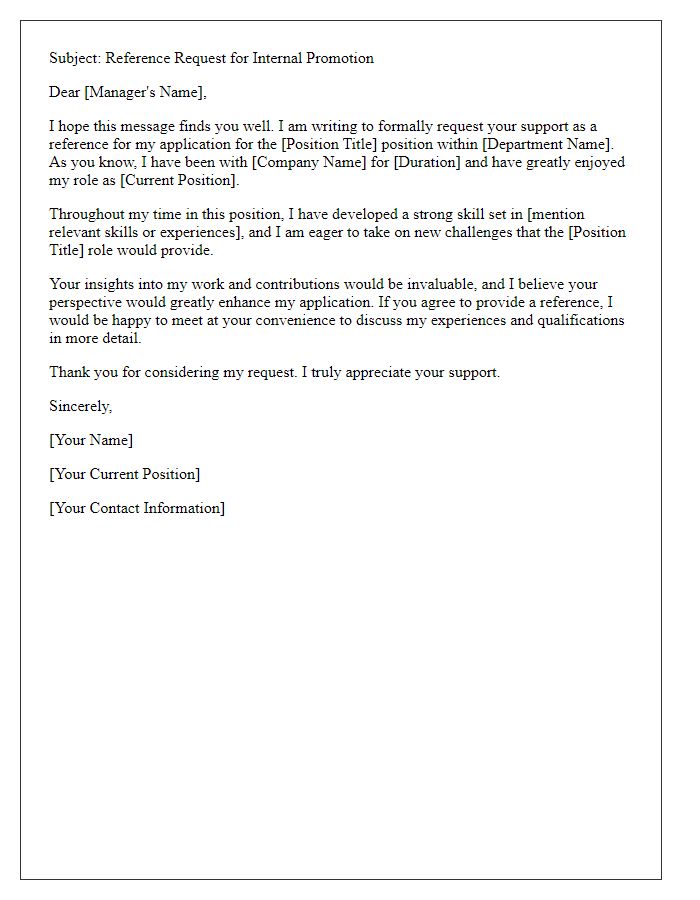

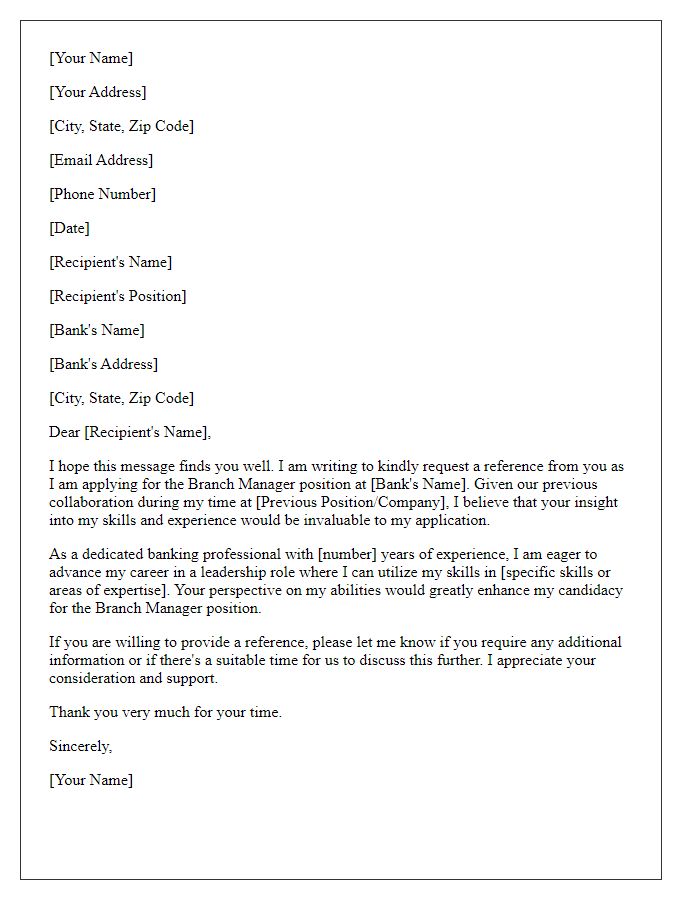

Letter template of banking position reference request for an internal promotion

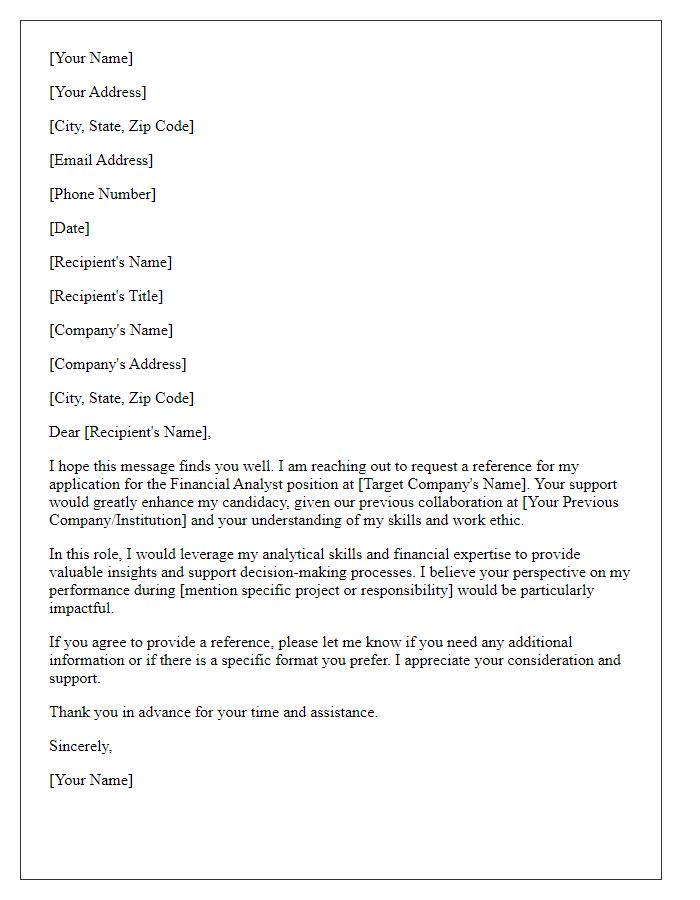

Letter template of banking position reference request for a financial analyst role

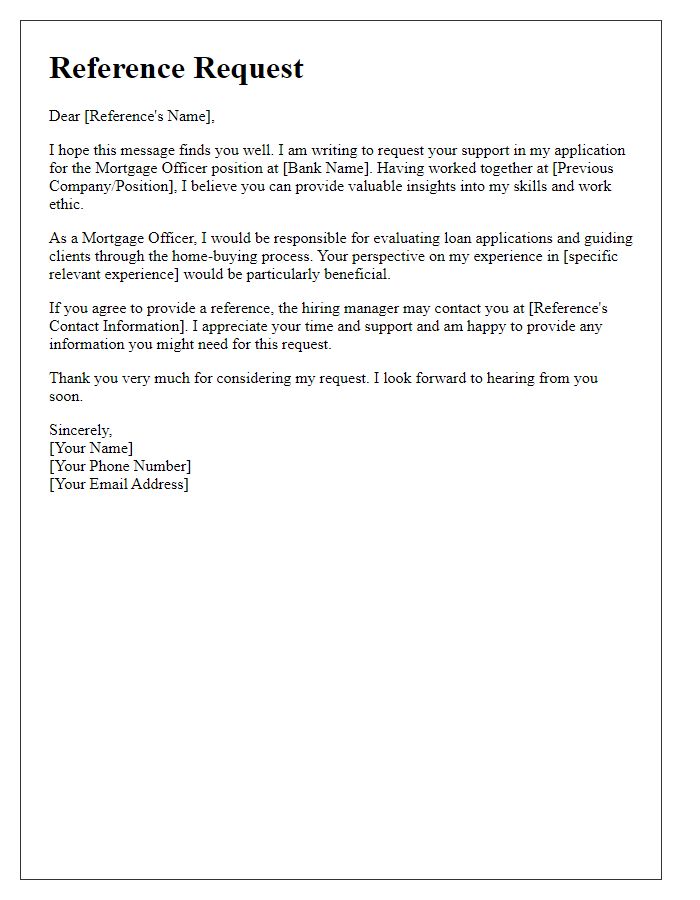

Letter template of banking position reference request for a mortgage officer position

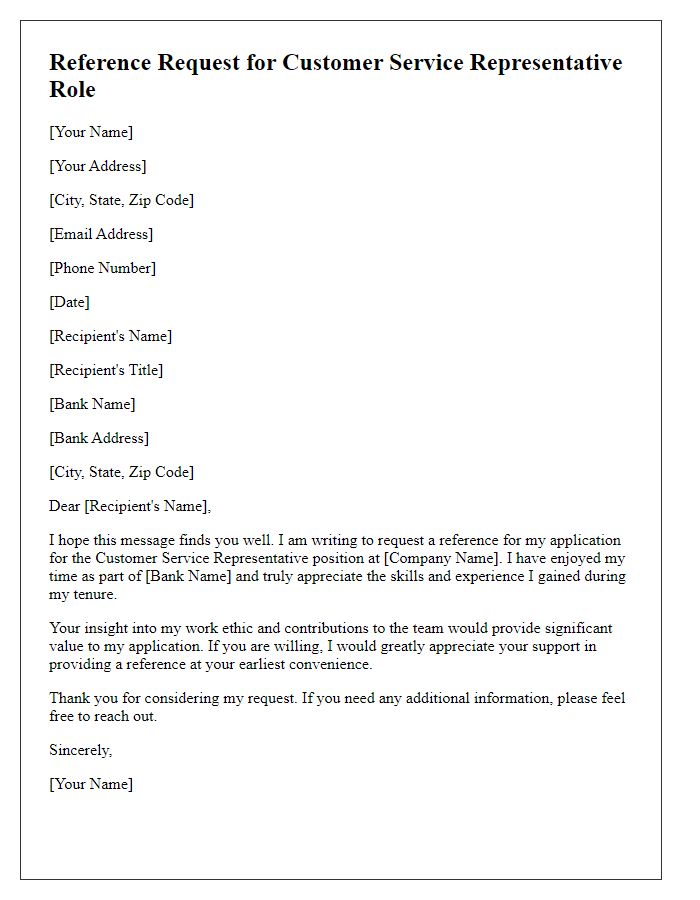

Letter template of banking position reference request for a customer service representative role

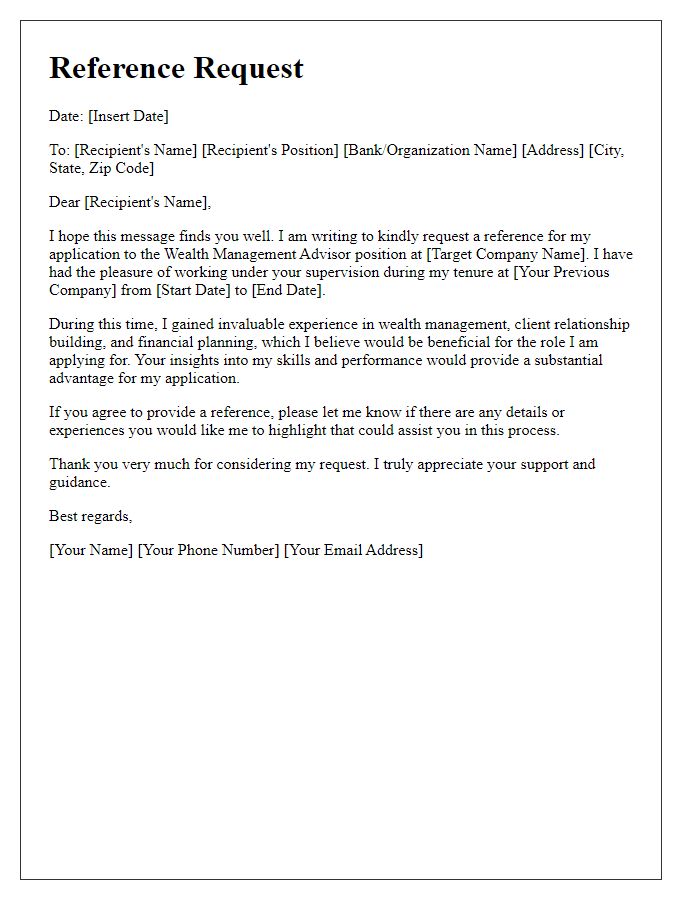

Letter template of banking position reference request for a wealth management advisor

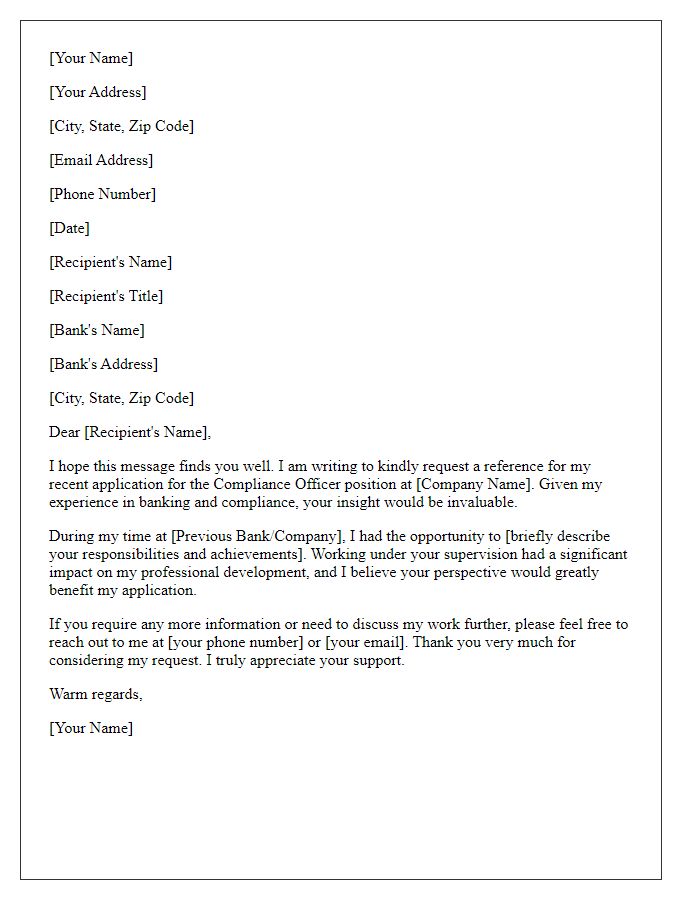

Letter template of banking position reference request for a compliance officer

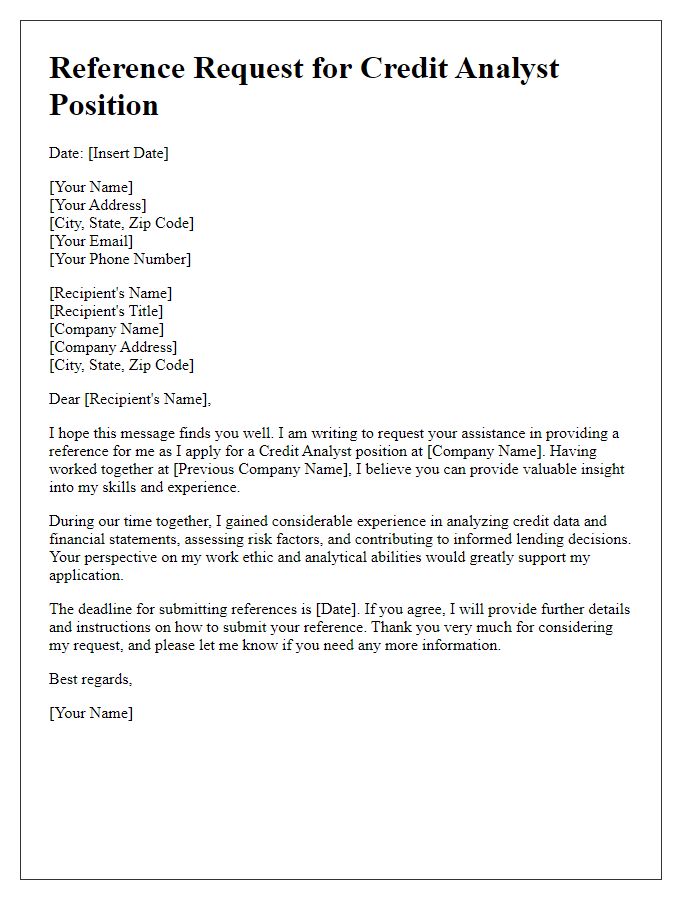

Letter template of banking position reference request for a credit analyst position

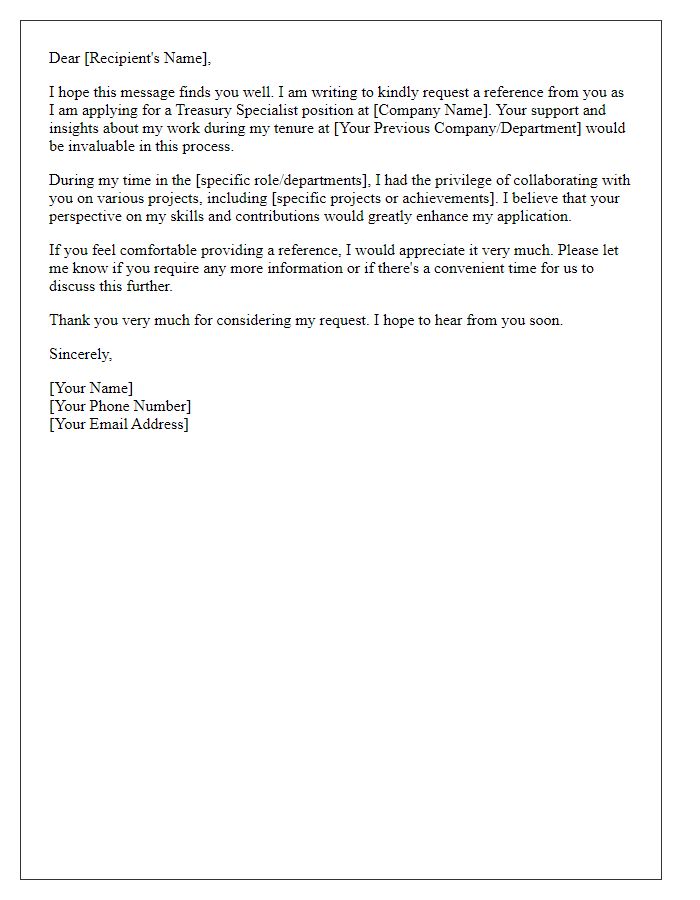

Letter template of banking position reference request for a treasury specialist role

Comments