Are you ready to take your tech startup to the next level? Securing investment can be a game-changer, and having the right letter template can make all the difference. Crafting a compelling letter not only captures the attention of potential investors but also showcases your unique vision and the potential for high returns. To dive deeper into how to create an impactful investment letter, read on for expert tips and templates designed specifically for tech startups.

Clear Introduction

In the rapidly evolving landscape of technology startups, innovative companies like [Startup Name], located in [City/Region], are poised to disrupt traditional industries. Founded in [Year], [Startup Name] specializes in [specific technology or service], targeting a growing market worth [Market Size]. With a dedicated team of [number of employees] passionate individuals, the startup aims to address significant pain points in [specific problem or industry], leveraging cutting-edge solutions such as [specific technology or approach]. Recent milestones include [mention any awards, recognitions, or achievements], demonstrating the potential for scalable growth and investment opportunities within the [specific sector or industry].

Unique Value Proposition

Tech startups often emphasize unique value propositions (UVPs) that differentiate them in highly competitive markets. A compelling UVP clearly articulates how a product or service addresses specific problems faced by target customers, offering superior benefits compared to competitors. For instance, a startup may focus on AI-driven solutions, enhancing efficiency in industries like healthcare and finance, where traditional processes are often slow and cumbersome. Highlighting case studies that demonstrate cost savings, time efficiency, or improved customer satisfaction can further strengthen this value proposition. Additionally, quantifying the impact through metrics, such as a 30% reduction in processing time or a 50% increase in user engagement, adds credibility. Emphasizing innovative technology, like blockchain for security or machine learning for personalized user experiences, can capture investor interest, showcasing not only the startup's potential market impact but also its alignment with current technological trends.

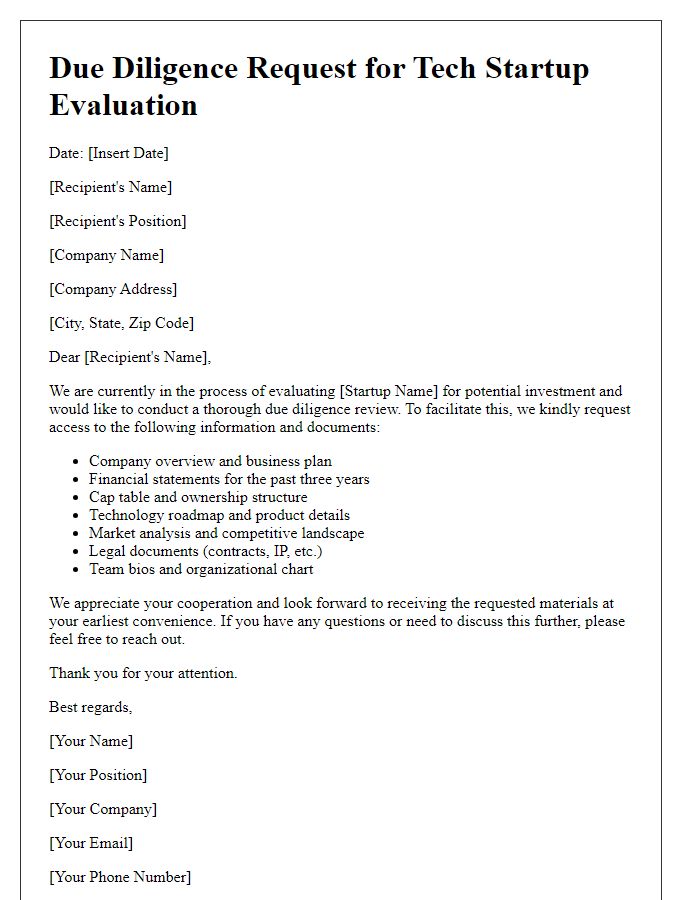

Market Analysis

The tech startup landscape is characterized by rapid growth and dynamic shifts, particularly in sectors like artificial intelligence and blockchain technology. As of 2023, the artificial intelligence market is projected to reach a valuation of approximately $1.5 trillion by 2030. Major players like OpenAI in San Francisco and DeepMind in London demonstrate the intense competition and innovation driving this sector. Blockchain technology, with a market size expected to exceed $67 billion by 2026, is witnessing increased adoption across industries, from finance to supply chain management. Regions such as Silicon Valley and Shenzhen are emerging as global hubs, attracting significant venture capital aimed at nurturing disruptive innovations. Key demographics, including millennials, are driving demand for tech solutions that enhance efficiency and security, creating a fertile ground for startups focused on these areas. The convergence of IoT (Internet of Things) and AI is opening new avenues for investment, as businesses seek to leverage data for smarter decision-making. Understanding these trends is essential for identifying upcoming opportunities in the technology ecosystem.

Funding Request and Use

A tech startup seeking investment typically outlines its funding request to launch innovative technologies. The company might aim for $500,000 in seed funding to develop a mobile application software solution designed to improve user engagement in e-commerce. The funding allocation could include $200,000 for product development, ensuring a user-friendly interface and robust back-end infrastructure. An additional $150,000 may focus on marketing strategies, helping to reach target demographics through social media campaigns and influencer partnerships. The remaining $150,000 could support operational costs, including hiring key personnel with expertise in software engineering and marketing analytics to drive growth. By clearly delineating the purpose of the funding, the startup sets expectations for investors regarding project timelines and return on investment.

Closing Statement

A compelling closing statement for a tech startup investment pitch clearly articulates the unique value proposition, solid financial forecasts, and commitment to innovation. Highlight potential market size, emphasizing growth trends in the technology sector (projected at 12% CAGR from 2021 to 2027). Summarize key achievements, such as proprietary technology (patents filed in 2022) and strategic partnerships (collaboration with industry leaders like Google and Microsoft). Reinforce the investment opportunity, detailing funding requirements ($500,000 for product development and marketing) and anticipated ROI (30% within 3 years). Convey strong passion for transforming the tech landscape while inviting investors to join a visionary journey filled with potential and profitability.

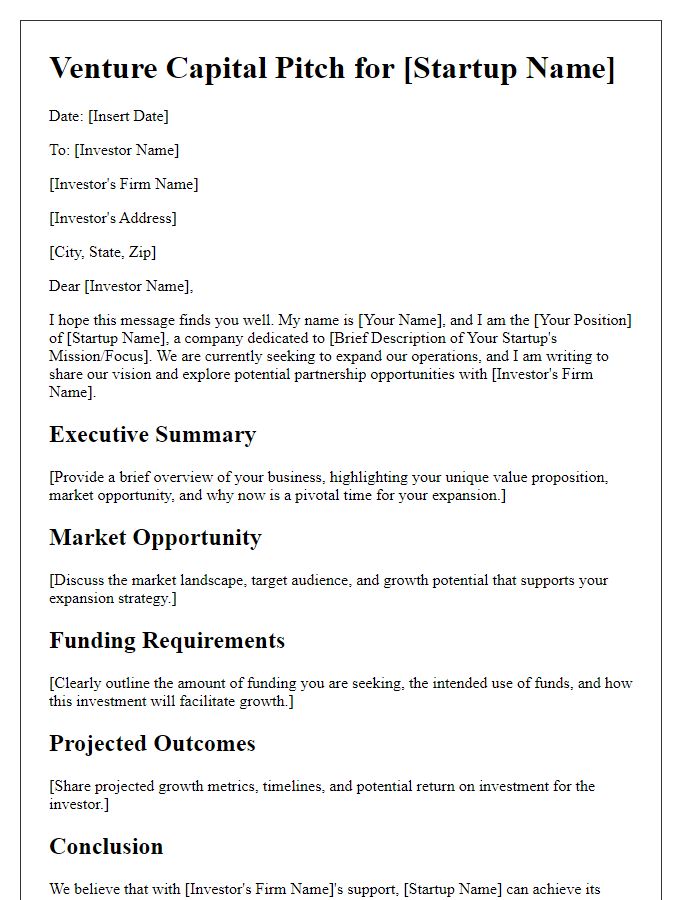

Letter Template For Tech Startup Investment Samples

Letter template of partnership inquiry for tech entrepreneurial ventures

Comments